The US Should Embrace India

The US Should Embrace India

India opened up to the western world in the 1980s and 90s. The US-India relations began to change in the Clinton era, benefitting under...

Our History

Our History

Quantum Advisors was founded by Ajit Dayal as India’s first institutional equity research house in January 1990.

New FM, Same Old Song?

New FM, Same Old Song?

When you tune in to a new FM station, you hope to hear a different song. The new FM offers little change.

Signs of Hope – but not for the Crony Capitalists?

Signs of Hope – but not for the Crony Capitalists?

We are not India bears. We are India bulls. So what will the true economic growth be like during 5 years of Modi’s rule?

Great Expectations and a New Reality

Great Expectations and a New Reality

Market expectations for the new government offers new realities and challenges to value investors.

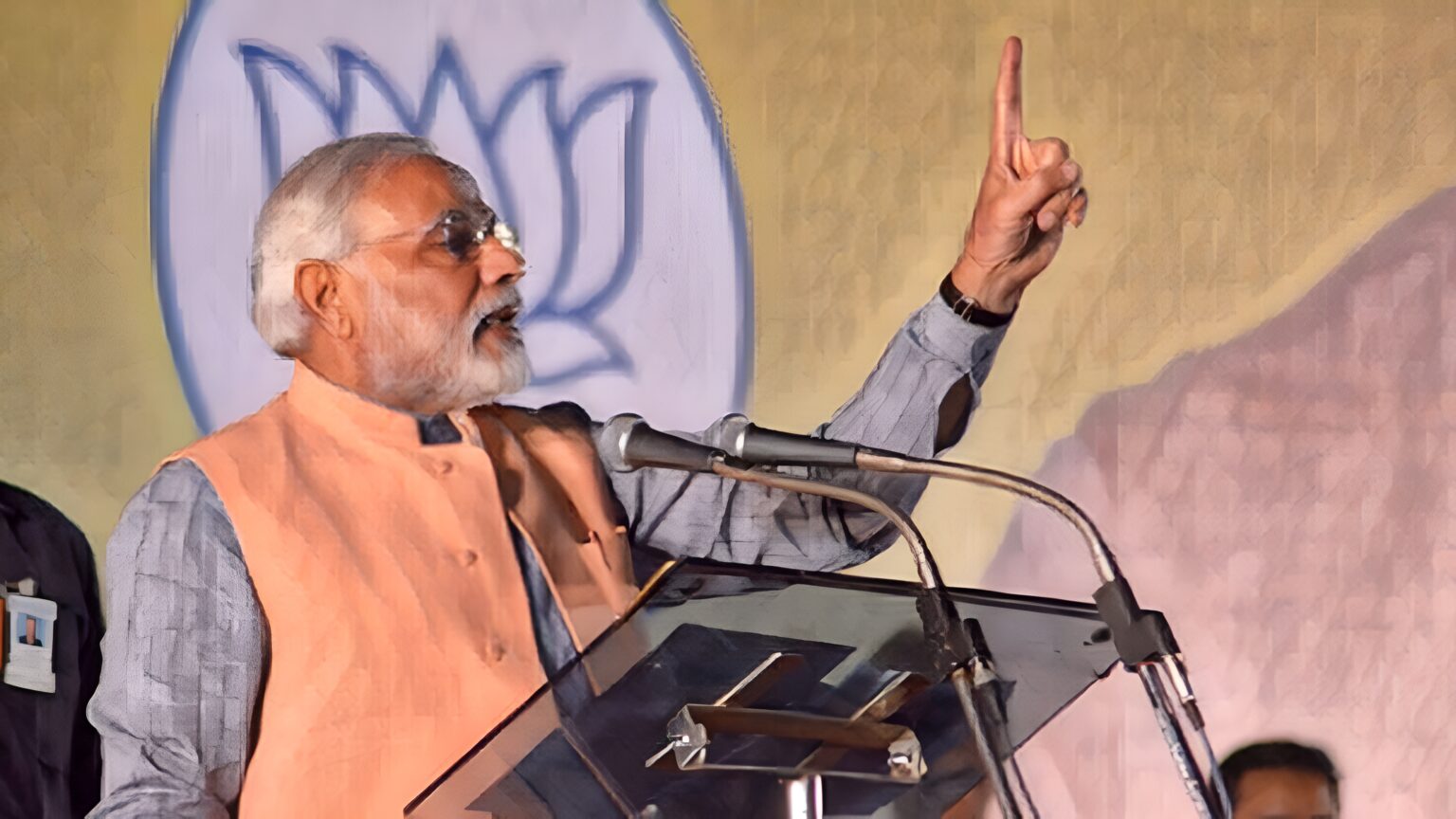

A Decisive Mandate

A Decisive Mandate

Not since 1984, has India voted so decisively in favor of a single party.

The Great Fat Indian Election

The Great Fat Indian Election

Through this cycle of expectations and disappointment, opportunities exist for those tempted by near-term events.

Has India Got its Funk Back?

Has India Got its Funk Back?

The irrational exuberance of the go-go years of the BRIC fairy tale has given way to irrational dejection.

Are Emerging Markets Dead as an Asset Class?

Are Emerging Markets Dead as an Asset Class?

The case for investing in EM – or in India - rests on more realistic expectations of emerging market governance.

India's INR Crisis

India's INR Crisis

While not in a crisis mode, a fidgety global environment and net imports are not conducive to a stable currency.

India's Infrastructure outshines China? Religion and Infrastructure

India's Infrastructure outshines China? Religion and Infrastructure

When Religion and Politics come together to deliver corruption free infrastructure.

India – FDI in Retail – A Silver Bullet?

India – FDI in Retail – A Silver Bullet?

The Indian government thinks it has a silver bullet in its new FDI retail policy - to solve the country's macro challenges.

The Advantage of a Million Mutinies

The Advantage of a Million Mutinies

The India Story remains one of quality product sold at affordable prices to the nameless mutineers going about their daily grind.

A Value Manager in India?

A Value Manager in India?

India's back on investor's radar as a growth story, however our challenge remains to understand and analyze businesses and their leaders.

Indian Economy and Business Through Phases

Indian Economy and Business Through Phases

We explore the Indian economy's trajectory comprising of 3 orbits - crony capitalism, production and infrastructure.

India Investing: From a complicated 2025 to a Simpler 2026?

India Investing: From a complicated 2025 to a Simpler 2026?

The simple India investing story of double-digit nominal GDP growth reflecting in stock market returns even in dollar terms has faced some headwinds in 2024/2025. Are these headwinds structural? What should investors expect in 2026?

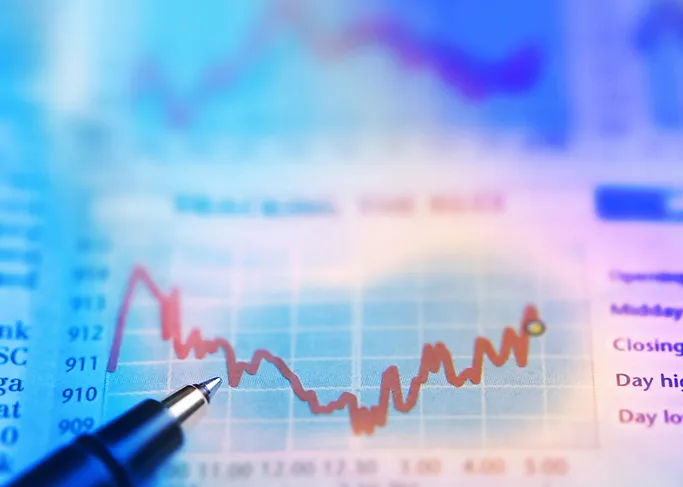

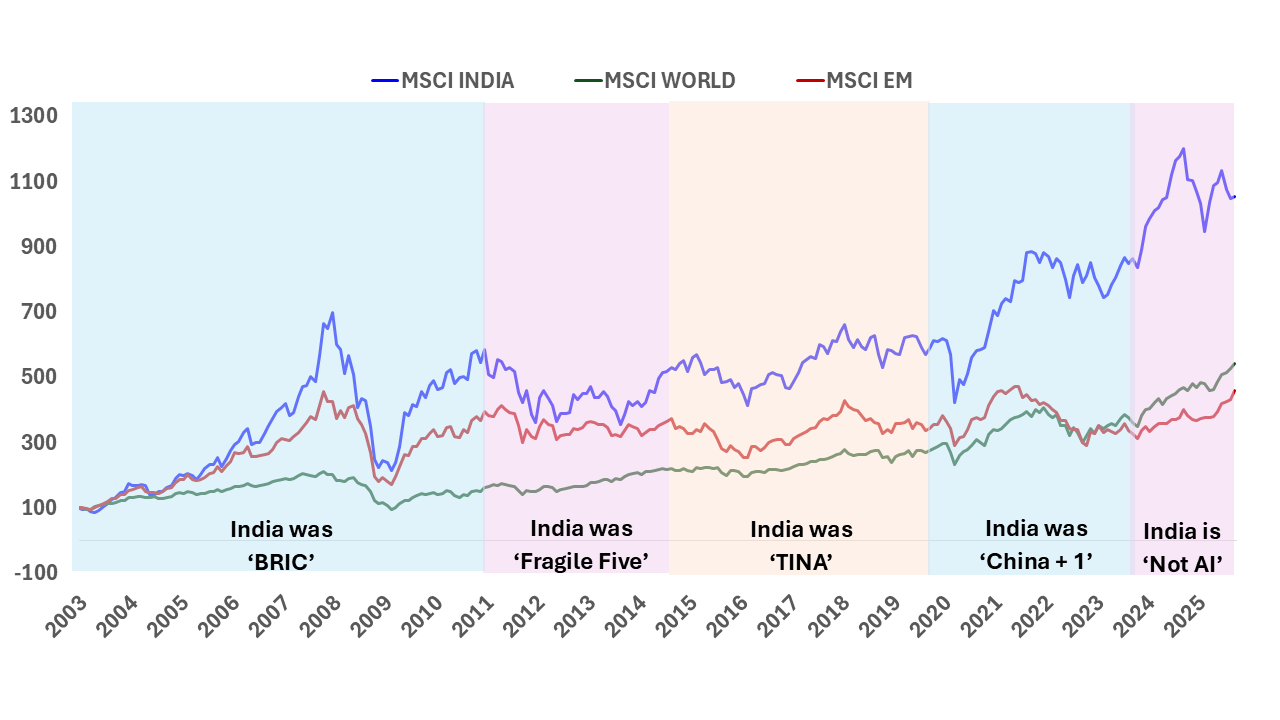

India Investing Under Global Mood Swings

India Investing Under Global Mood Swings

The narrative around global investing is often built around stories. Investors weave these stories around cycles, themes, and opportunities to justify and support their investment rationale.

The Great India Under-Allocation

The Great India Under-Allocation

The most common response to our reach outs to prospective Global Investors to get them interested in Indian Equities is ‘NO’ response.

A Permanent Headache

A Permanent Headache

Look at the map of India. History and Geography haven’t been kind to India.

On its North-East border, it shares a ~3,400 km (2,111 mile) border with China.

On its North-West border, India shares an almost similar ~3,200 km border with Pakistan.

India Outlook: Growth and Valuation

India Outlook: Growth and Valuation

India needs sustained long-term growth to pull people out of poverty, create jobs for the young, and boost incomes to widen the consumption base.

Will India Be Trumped?

Will India Be Trumped?

If you are a CEO of a global Multinational Corporation or a Chief Investment Officer of a large global pension fund, sovereign wealth fund, insurance company or asset manager with a high allocation to Emerging Markets, India should be least of your concerns for now.

A #SaveMyWorld Asset Allocation

A #SaveMyWorld Asset Allocation

Quantum Advisors was founded by Ajit Dayal in January 1990, eighteen months before the first significant set of economic reforms in India were announced in July 1991.

The Inflation Tantrum: Q India Asset Allocation Insights

The Inflation Tantrum: Q India Asset Allocation Insights

A macro look at global investor allocation to Indian asset markets as the world frets over Inflation.

Modi Sheds His Fiscal Conservatism: India 2021 Budget Outlook

Modi Sheds His Fiscal Conservatism: India 2021 Budget Outlook

The government has shocked the bond markets and cheered the equity markets with its new budget - will increased spending spur growth?

Investing Insights 2021: Themes and Trends

Investing Insights 2021: Themes and Trends

2020 has been a year of facing, learning and adapting to the unknown. We look to the year ahead and what is to come.

2019: RBI’s Year Of Adventures

2019: RBI’s Year Of Adventures

The year gone by for the Reserve Bank of India has been anything but boring, uneventful, staid and apolitical.

India Deserves a Dedicated Investment Mandate

India Deserves a Dedicated Investment Mandate

Global wealth is estimated at over USD 250 trillion. Long term investors like Public Pension Funds and Sovereign Wealth Funds account for over USD 50 trillion in assets. The other [...]

Can India benefit out of US Single country allocation risk

Can India benefit out of US Single country allocation risk

We have been on the road since 1990, singing praises of investing in India’s growing economy via allocations to the Indian stock markets – and citing dangers of bouts of hyperbolic euphoria that seem to periodically rule passionate hearts and override rationality.

India@75, Next25: Will India allocation reflect share in global GDP?

India@75, Next25: Will India allocation reflect share in global GDP?

Over the next decade, India is slated to overtake Germany and Japan to become the third largest economy in nominal terms. It is already the third largest in PPP (Purchasing Power Parity) terms. Of course, on an annual per-capita income basis, India at ~USD 2,600 is well below most Asian countries and a few African economies.

Trump and Tarrifs - From Optimism to Tension

Trump and Tarrifs - From Optimism to Tension

On 30th July, Donald Trump slapped a 25% tariff on Indian exports to US, effective from August 7th, citing unhappiness over the trade negotiations and warned of a penalty rate for India’s continued purchase of Russian crude oil.

Waltz with India Directly, Don’t Dance through GEM

Waltz with India Directly, Don’t Dance through GEM

A recent shift in public equity allocation strategies is driving investors away from China and towards other Emerging Markets, notably...

Global MNCs flourish in India, Their Pension Funds are missing out

Global MNCs flourish in India, Their Pension Funds are missing out

India's engagement with global trade and investment stretches back through various civilizations, marking a significant presence in the world economy. The East India Company, often regarded as the first multinational corporation (MNC), was established for commerce within the Indian Ocean territory, including the East Indies, South Asia, and India itself. This entity eventually extended its influence to colonize extensive regions of present-day India

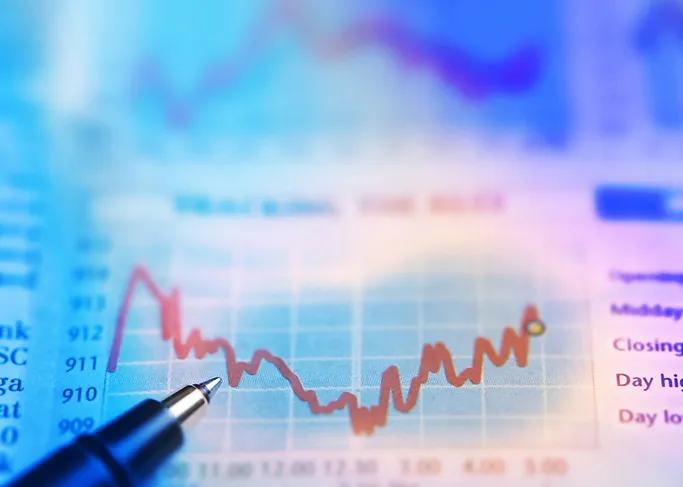

India’s Economic Growth Fuels Stock Market Returns

India’s Economic Growth Fuels Stock Market Returns

India's soaring GDP growth powers double-digit stock market returns. Broad economy and corporate growth drive markets.

Why Does India Not Grow at 8%?

Why Does India Not Grow at 8%?

What is India’s potential GDP growth rate? The answer to this proverbial question on depends on the period in which the question was asked:

China Tactical, India Strategic

China Tactical, India Strategic

Mesmerized by the Chinese dragon many investors have been comfortable leaving India in a generalist “emerging market” bucket in their...

India: Opportunity, Valuation, and Governance

India: Opportunity, Valuation, and Governance

In a dynamic geopolitical environment, global investor interest in India remains robust. With India’s GDP growth projected to continue at twice the global rate, the country warrants a “GEM + India” allocation strategy.

‘INDIA to TINA’: Private Assets – Is the Over-allocation Justified?

‘INDIA to TINA’: Private Assets – Is the Over-allocation Justified?

An in-depth analysis of foreign investment trends in India's private and public markets over the past two decades highlights the shift in...

India – Hype, Hope, and Reality

India – Hype, Hope, and Reality

In February 1990, our Founder Ajit Dayal wrote an article in the Asian Wall Street Journal ‘Loosen the Reins on India’s Bull Market’....

Are Corporate Pension CIOs heeding their Corporate CEOs?

Are Corporate Pension CIOs heeding their Corporate CEOs?

US corporations are increasingly investing in India, but their corporate pension funds have not followed suit. With over $6 trillion in...

India allocation: Ignore governance at your own reputational risk

India allocation: Ignore governance at your own reputational risk

Global institutional investors ignore risk when they invest in India. The recent bribery allegation against the Indian conglomerate and its founder along with employees of institutional investors, illustrates the governance challenges of investing in illiquid private assets in India.

Will Foreign Investors finally ‘Bond with India’ July 2, 2024 Quantum Advisors India

Will Foreign Investors finally ‘Bond with India’ July 2, 2024 Quantum Advisors India

A big milestone for Indian debt markets, opening access for index-tracking foreign capital flows.

Shake Hands and Get Five Fingers Back

Shake Hands and Get Five Fingers Back

Good governance protects long-term returns. In India's complex markets, screening for transparency proves crucial.

Our Engagements in Indian Corporate Governance

Our Engagements in Indian Corporate Governance

Corporate governance has been an integral part of our investment management process since 1996. As an actively engaged shareholder, here are some notable examples of our experiences with management.

Why Adani demonstrates the G should come first in ESG at least in India

Why Adani demonstrates the G should come first in ESG at least in India

The Adani situation and its potential impact on India's reputation and financial system.

Eyewash, Hogwash and Greenwash (EHG) – The Trilemma of ESG Investing

Eyewash, Hogwash and Greenwash (EHG) – The Trilemma of ESG Investing

We examine a growing trend amongst corporations: a diminishing focus on Environmental, Social, and Governance (ESG) initiatives. A recent...

Engagement Is the Key to ESG Success

Engagement Is the Key to ESG Success

Placing stewardship and investor interaction with management at the centre of our ESG approach is crucial to investment and risk management.

India Inc. Workforce Gender Diversity

India Inc. Workforce Gender Diversity

Our own standards of inclusiveness, equity and diversity - and those of our investee companies - require continuous evaluation & engagement

Workforce Disclosures at Quantum Advisors

Workforce Disclosures at Quantum Advisors

These learnings help us take our experience to the portfolio companies who can meaningfully engage with WDI to improve their own workforce practices.

From E to S, India ESG Increasingly Looking at Social Concerns Too

From E to S, India ESG Increasingly Looking at Social Concerns Too

Self-assessment and proactive engagement lead our approach towards a sustainable future, underlining the harmony of 'planet and people'.

A Value Manager in a Growth Market

A Value Manager in a Growth Market

What is a ‘Value Manager’ doing in India? – In our more than 30 years of existence as a firm and more than 20 years of directly managing India dedicated [...]

2023-value-with-values

2023-value-with-values

Building your India portfolio since 1990 on a foundation of ethics, integrity & disciplined investment research process.

Meet the Team: India Value Strategy

Meet the Team: India Value Strategy

In this joint interview I. V. Subramaniam or Subbu (Managing Director, CEO & CIO) and Nilesh Shetty (Portfolio Manager) at Quantum Advisors, discuss the bottom-up research and portfolio construction process. The team also shares their experience on how the “Integrity Screen”, adopted in 1996, for evaluating Corporate Governance in India evolved into integrating ESG actively.

The Indian Goods & Services Tax is Launched

The Indian Goods & Services Tax is Launched

We are not jumping on the tables and celebrating the slam dunk of GST. We need to see the data points evolve.

Demonetization: What a Messy Economic Plan

Demonetization: What a Messy Economic Plan

Demonetization: What a Messy Economic Plan

Unleash the Indian Elephant – Two Big Ideas

Unleash the Indian Elephant – Two Big Ideas

Our two big ideas to unleash the Indian economic elephant.

Indian Elections Don't Matter to Long Term Investors

Indian Elections Don't Matter to Long Term Investors

On 17th May, 2004, the Indian stock markets hit its lower circuit, (-20%). The Bombay Stock Exchange (BSE)-30 Index, Sensex, fell by 842 points, its steepest one-day fall ever then.

India – Time for a Reality Check

India – Time for a Reality Check

Amid growing investor optimism about India, it's crucial to reality-check the narrative.

India's Demography: Dividend or Disaster?

India's Demography: Dividend or Disaster?

India can potentially become a billion-plus consumer market over the next 25 years but there are signs job creation is failing to keep up.

Many Apples a Day to Keep Unemployment at Bay

Many Apples a Day to Keep Unemployment at Bay

Tim Cook, the CEO of Apple, is India's newest celebrity. The opening of the first Apple store in India, in Mumbai and Delhi, is all the...

India @ 75 - The Next 25: Will India be Decoupled?

India @ 75 - The Next 25: Will India be Decoupled?

Over the next few months, we will look at the various aspects that we think will shape India in the coming 25 years. From now till 2047. India as a [...]

How Geo-politics Shaped India@75

How Geo-politics Shaped India@75

On 15th August 2022, India celebrated 75 years of being a free country since ending British colonial rule in 1947. Though India boasts a civilization with recorded history of over 5,000 years, India, as a modern nation state, is very young.

India: No Country for a Strong Man

India: No Country for a Strong Man

Should global investors worry about Modi being a ‘Strong Man’? Is India becoming un-democratic?

Modi More Obama Than Regan – April 2014

Modi More Obama Than Regan – April 2014

Convinced that the Congress government with its well-honed brand of crooked playing fields and “stash-the-cash” is soon to be replaced by an angelic BJP government led by Narendra Modi, corporate honchos (many of whom were the givers of cash in exchange for favours from the Congress), the financial services community, and the media are waving the “time-to-buy India” flag. With the market already having had a run up and the INR gaining ground, we are sceptical.

The Emergency: India lost its freedom 40 years ago – June 2015

The Emergency: India lost its freedom 40 years ago – June 2015

On June 25, 1975 Prime Minister Indira Gandhi – without consulting her Cabinet colleagues in the then Congress government – sent a letter to the President of India recommending the suspension of individual rights and freedom. The infamous Emergency was born with this statement: “In exercise of the powers conferred by the Clause 1 of Article 352 of the Constitution, I, Fakhruddin Ali Ahmed, President of India, by this Proclamation declare that a grave emergency exists whereby the security of India is threatened by internal disturbance”.

India Geopolitics – Pakistan & China

India Geopolitics – Pakistan & China

We consider the geopolitical macro view that forms the background to our bottom up value investing approach.

First Adani, now Silicon Valley: India Stirred but not Shaken

First Adani, now Silicon Valley: India Stirred but not Shaken

India's inherent long-term resilience has helped it recover from crises, including self-inflicted ones.

Meet the Team: ESG Governance Strategy

Meet the Team: ESG Governance Strategy

In this interview Chirag Mehta, Senior Fund Manager (ESG & Alternatives) at Quantum Asset Management talks about his experience of managing the ESG offerings at Quantum. The interview covers the ESG research process, portfolio construction, their experience of ESG engagements with portfolio companies and the steep learning curve.

ESG Ratings – Aggregate Confusion

ESG Ratings – Aggregate Confusion

The arbitrary nature of ESG ratings is exemplified by various studies that pinpoint the low correlation in ratings from various agencies.

Quantum View: A Rating for 'Growth'

Quantum View: A Rating for 'Growth'

Will India be downgraded to Junk? The key rating sensitivity is whether India will reach its growth potential.

Our ESG Scoring Process

Our ESG Scoring Process

Our ESG research framework focuses on evaluating corporate disclosures and qualitative performance that are material to operations.

Quantum Leads the Way on ESG in India

Quantum Leads the Way on ESG in India

Backed by decades of building in-house capabilities, Quantum is at the forefront of advancing ESG principles across India.

Does Growth Matter? – India Multi Asset Commentary

Does Growth Matter? – India Multi Asset Commentary

The Growth versus Markets conundrum - markets have rallied despite growth slowing and corporate earnings flat. Does growth actually matter?

2023 - Climate Evidence Will Force a Resurgence in Sustainable Investing

2023 - Climate Evidence Will Force a Resurgence in Sustainable Investing

After a challenging year for ESG investing in 2022, marked by setbacks and declining interest, the focus now shifts to 2023. The recent...

Prof. Damodaran, see the "Value" in ESG

Prof. Damodaran, see the "Value" in ESG

Professor Aswath Damodaran suggests people working in the ESG space were either ‘useful idiots’ or ‘feckless knaves’. We argue that...

Is India a Flailing State?

Is India a Flailing State?

The contradiction of a fast growing democracy with a failure to provide support during the recent surge has implications on the economy.

Two Blue Ticks Verify Our Sustainability Credentials

Two Blue Ticks Verify Our Sustainability Credentials

Our adherence to stringent ESG standards exemplifies our commitment to sustainability and transparent business practice.

India’s Fiscal Budget Thrust on Sustainability – Show Me The Money?

India’s Fiscal Budget Thrust on Sustainability – Show Me The Money?

We take an accounting of the sustainability linked hits and misses in this year's Fiscal Budget.

2022 – Year When ESG Aspiration Meet Implementation

2022 – Year When ESG Aspiration Meet Implementation

With pressures to make ESG reporting more meaningful, we take a look at the standards, quality and coverage to come, globally and in India.

Assessing companies for financial risk, sustainability and resilience

Assessing companies for financial risk, sustainability and resilience

Assessing companies for financial risk, sustainability and resilience to macro turbulence is key to our proprietary ESG investment process.

How Green is Green Energy?

How Green is Green Energy?

We look beyond the “clean” label in responsible investing to reveal stark choices for carbon intensity and footprint.

From ESG to EHG: Greenwashing Pitfalls in the March Towards Sustainability

From ESG to EHG: Greenwashing Pitfalls in the March Towards Sustainability

Investors navigating ESG greenwashing need to be aware of practices which we refer to as EHG: Eyewash, Hogwash, and Greenwash.

Progress on Indian Workplace Gender Diversity

Progress on Indian Workplace Gender Diversity

Workplace diversity contributes to better management outcomes. How has India progressed in female employee participation?

ESG Harnessing the Power of Equal Opportunity

ESG Harnessing the Power of Equal Opportunity

Gender diversity is crucial to profitability and value creation. As India ESG investors, we demand far better disclosures from companies.

ESG Indexes – A Stumbling Block for India Investors

ESG Indexes – A Stumbling Block for India Investors

ESG indexes are only as good as the underlying data used to construct them and are rightly under increasing investor scrutiny.

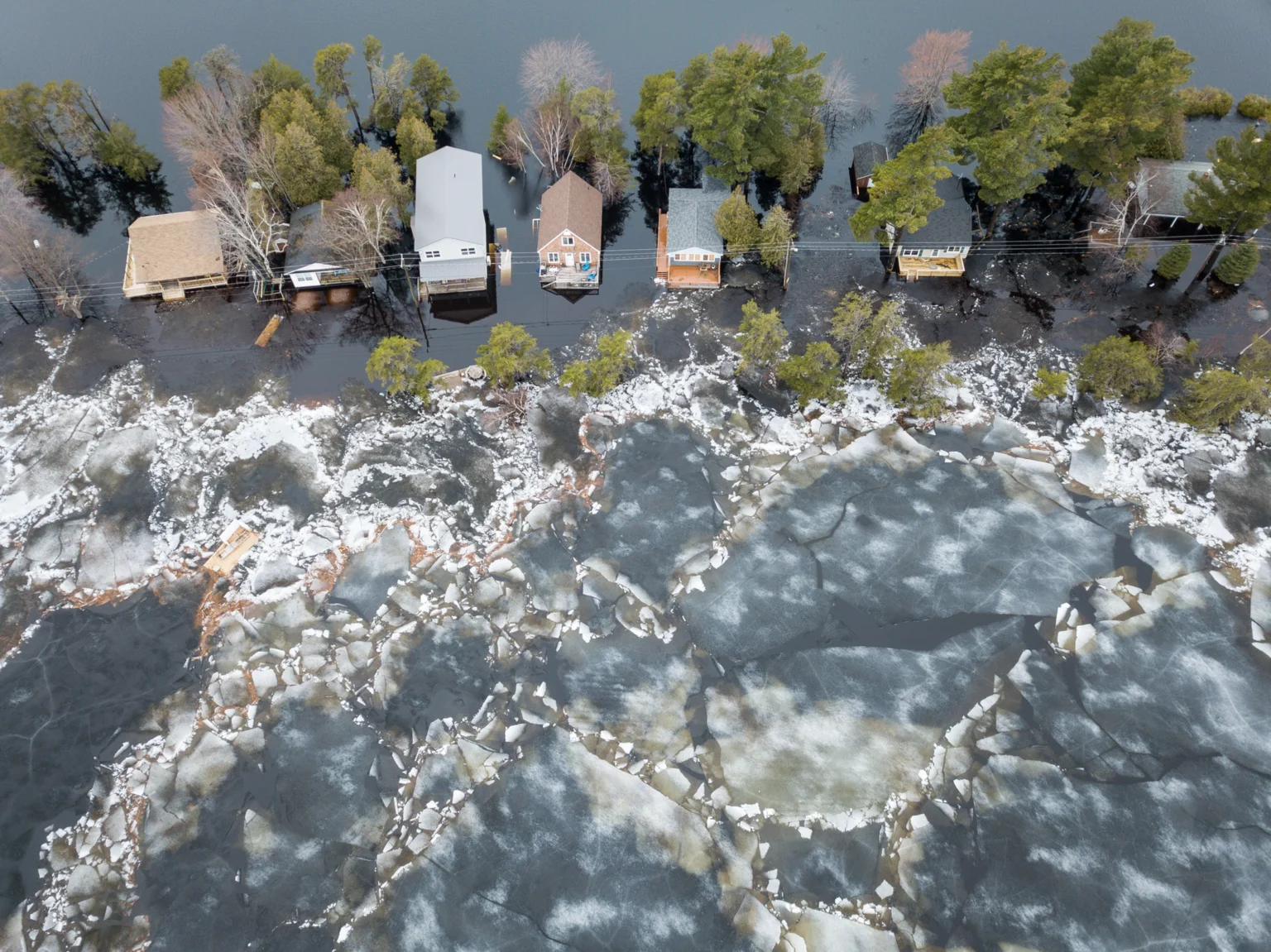

Time is Running Out For Climate Action

Time is Running Out For Climate Action

Climate mitigation to achieve Paris Agreement goals requires concerted action by global asset allocators and policy makers alike.

Why Investors Need a #SaveMyWorld Allocation

Why Investors Need a #SaveMyWorld Allocation

Who will fund the world's needed response to Climate Change? An allocation of just 1% by pension funds and SWF would avert a global crisis.

Transitioning to a Low Carbon Future

Transitioning to a Low Carbon Future

As stewards of long term capital we expect Indian corporates to lead India's transition to a low carbon future.

"Greenflation" – a Scapegoat for Today’s Inflation

"Greenflation" – a Scapegoat for Today’s Inflation

The burdens and benefits of greenflation require closer examination as the world pursues climate transition during times of inflation.