If you are a CEO of a global Multinational Corporation or a Chief Investment Officer of a large global pension fund, sovereign wealth fund, insurance company or asset manager with a high allocation to Emerging Markets, India should be least of your concerns for now. Donald Trump has won and all the scenarios that your staff planned around his potential win may probably start playing out in real time. Trump’s ‘America First’ and ‘Make America Great Again’ rhetoric and soon to be policies, may impact countries and corporations who have:

- a commodity in which US has/wants dominance (oil & gas – Middle East, Brazil, Indonesia);

- high technology at scale (chips, AI, new energy – Taiwan, South Korea, China, European Union);

- a large goods trade surplus with US (China, Mexico, Eastern EU, ASEAN) and

- dependence on US foreign policy (Russia/Ukraine, Israel/Middle East, Taiwan).

The Indian state, the Indian economy and most Indian corporations do not fall under any of these categories and hence are unlikely to be directly impacted by Trump’s policies.

India is a big net importer of Oil and Gas and can technically benefit from a supply hegemon like US. India does not have any stake in the high technology world. India does not make high end chips, has not developed its own large language models, does not even have its own 5G telecommunications protocol, and has no major technological prowess in new energy – renewable, battery, storage. India runs an overall trade deficit. India runs a small trade surplus with the US in goods and a larger trade surplus in services and we will discuss that in detail below. India is not part of any multi-lateral trade agreement and has not ‘gamed’ US free trade. We believe India is not a ‘geo-political threat’ to the US. Also, India has never been dependent on US congress’s benefactions to manage its own security interests.

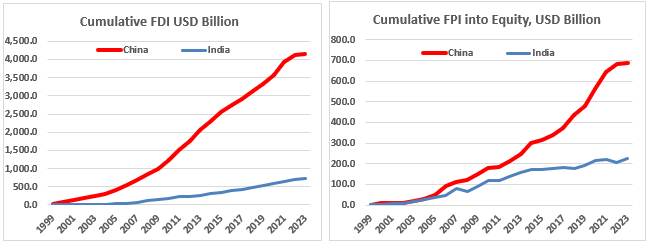

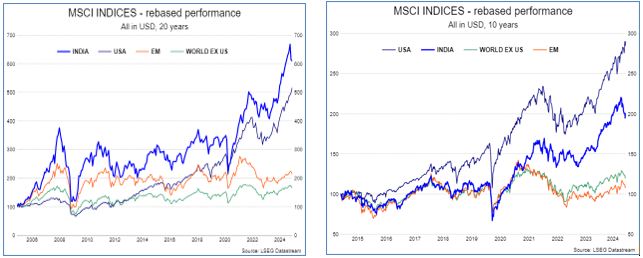

Chart 1 and 2: Global Investors and MNC are lot more invested in China than India

(Source: IMF, FDI – Foreign Direct Investments, FPI – Foreign Portfolio Investors, Annual Data till December 2023)

Although, India is now ~4% of Global GDP 1, it is yet not material enough for global corporations and investors. India is growing but for now is a light-weight in global geo-politics as well. This situation would be very different 10 years hence, however, for now, given how we have laid out the scenario above, India seems to be relatively less impacted from Trump’s stated election rhetoric.

Foreign investments into India be it Foreign Direct Investment (FDI) or Foreign Portfolio Investment (FPI) need not be upended just because of Trump’s America First policies.

Depending on the extent of the Trump rhetoric being converted to policy, it could have some serious macro shocks on economies, business models and hence on investment flows into countries listed above. India, Indian companies, and Indian investment markets from this standpoint could be a relative net beneficiary.

That is not saying, India and Indian markets will be immune from the global gyrations. India is much more correlated to US and US markets than what is generally expected. Hence, the volatility seen in US equities, rates, commodities, and currency will be well and truly felt in government fiscal accounts, corporate balance sheets and in the capital markets. Some of that volatility can be beneficial.

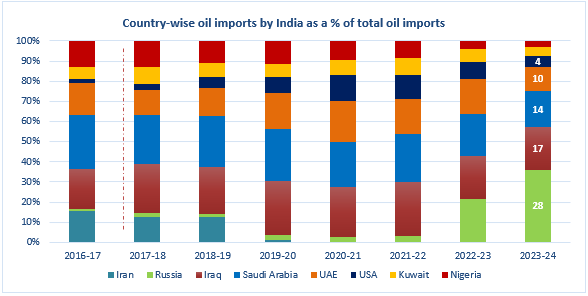

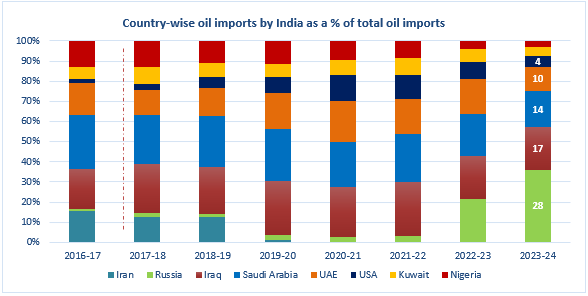

Oil Prices: The average oil price during Trump’s first term was around US$60/brl 2. His commitment on ending global wars and his ‘Drill, Baby Drill’ rhetoric, could result in lower or capped oil prices which is a net dividend for an oil importer like India. Trump loves deals. In our view, India can curry Trump’s favor by shifting a major part of its oil purchases to USA away from Russia and the Middle East.

Chart 3: India can shift its Oil purchases from Russia to the US as a trade truce

Source: CMIE, Quantum Research. Annual Data as at March 2024

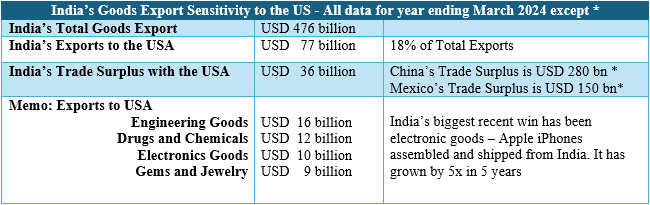

If Oil prices indeed fall to ~USD 60/brl as many seem to be claiming, it is a big net boon for India. Trade and Tariffs: Trump has labelled India ‘Tariff King’ and ‘Tariff abuser’ 3. The US Treasury had previously listed India as a potential currency manipulator 3. India will not escape Trump’s wrath on goods trade.

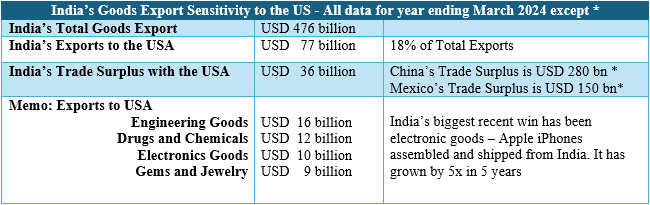

India exported only ~USD 77 bn in Exports to the USA in year ending March 2024. However it is susceptible to a tariff increase as ~18% of India’s Exports is to the US and happens to be India’s largest export region.

Table 1: India will be hit if Trump imposes unilateral tariffs on India

(Source: CMIE Economic Outlook, *- US Census.gov, Annual Data for 2023)

The other aspect to note is tariffs on India electronics exports. A high tariff on electronics exports should not make it unviable for companies like Apple to continue to export iPhone to US from India. India is seeing the nascent boom of what it means to be in global supply value chain. We believe Apple’s eco system is expanding and can spawn many other such opportunities for India. This is the only China+1 story that has played out. India should ensure tariffs don’t upend it.

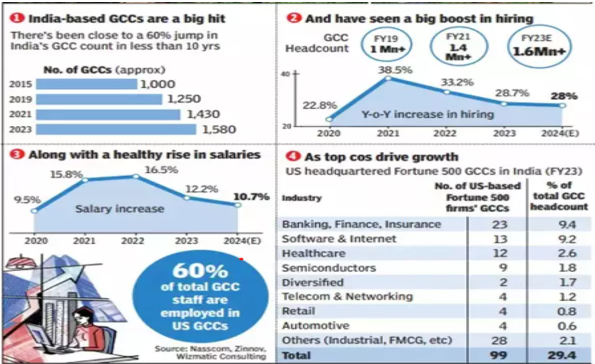

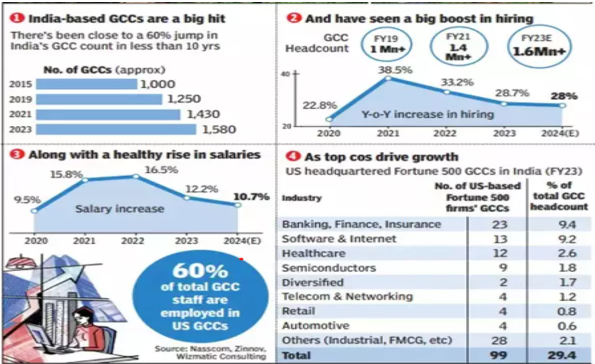

India’s biggest exports are Services. IT Services is India’s biggest economic activity, income, and growth driver. IT services, Back Office and Global Capability Centre (GCC) has over 5 million in direct employment4. Given the high wages, the indirect employment and economic impact is significant. The city of Bengaluru and National Capital Region (NCR), major IT services zones in India, have sizes of GDP rivaling certain other cities in the world. 5.

India’s trade minister thus needs to ensure that Indian service exports remain unaffected. Almost 60% of the GCC activity is catered to US firms. US corporations should be able to outsource to India and continue to be able to set up large GCCs in India. (See chart 4 below for detailed data).

What India has to manage as a relationship, is to try and keep its tariffs at a lower level than countries like China, Vietnam, Indonesia, Mexico. If that happens, then certain exports from these countries can potentially move to India.

India though will not get a better opportunity to try for a US-India trade and investment treaty. Trump and Modi seem to dislike multi-lateral trade agreements given that they walked away from TPP and RCEP respectively 6. Trump and Modi should secure a bilateral US-India trade agreement.

Chart 4: India is the Global Capability Centre of the World

(Source: Times of India Article, August 2024)

Geo-Politics and Modi-Trump relationship

Prime Minister (PM) Narendra Modi effectively endorsed Trump for a second term at the ‘Howdy Modi’ event in Texas in September 2019. In February 2020, Trump attended the ‘Namaste Trump’ event in Delhi. 7

The Indian Trade Minister alluded to this friendship and that the PM is looking forward to work with the administration. 8 The Indian government may also be hoping that Trump being in office takes the heat off on some of the recent matters between India and the US.

Two recent indictments from US Department of Justice (DOJ) have caused some consternation. The first one of a former Indian government employee being indicted for the assassination of a US national belong to the Sikh community 9 . The most recent one was of a large Indian conglomerate with investments in key national strategic sectors. 10

We will have to see how this plays out and whether Trump being in office takes the heat off on these matters.

Global Investment Flows: FDI - America First policies with the support of tariffs, lower corporate taxes and other incentives portends that US companies will continue to increase their dominance. India’s FDI flows which are driven by private equity/venture capital flows has already slowed down 11. We haven’t seen many large global corporations investing in India despite the ‘Make in India’ rhetoric. We would expect further fall in corporate FDI flows until Trump’s trade policies are announced. Under Trump, India may also struggle to attract capital from US firms to support its climate transition.

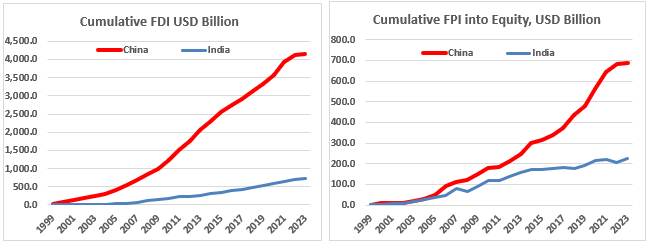

FPI - For large US and global asset allocators, the trend of buying passive US listed equities might gain further ground and would move them away from taking ‘geopolitical’ risks of investing in far-away emerging markets like India.

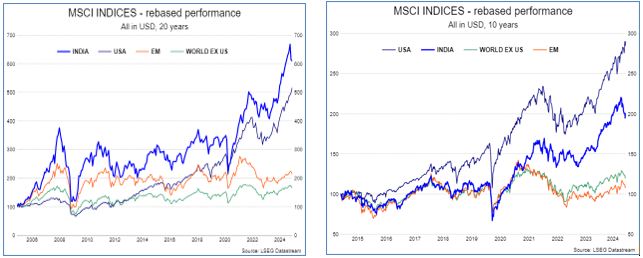

Chart 5 and 6: Will ‘America First’ continue the trend of US Equities performance negating the need for diversification?

(Source: DataStream, MSCI Indices in USD, Rebased to 100 Daily data till 25 November 2024 for the period mentioned) Past performance is not an indicator of future outcomes.

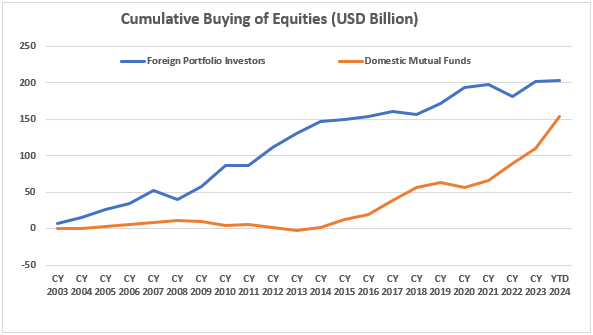

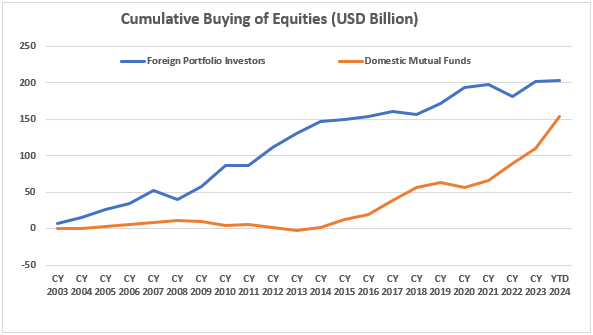

Despite, India’s public equity track record 12 over the last many years, foreign investors have not committed to as many India dedicated mandates as expected. The Indian Equity markets are of course no longer solely dependent on foreign investors. Domestic Mutual Funds have bought ~USD 150 bn of equities since 2014, Foreign Investors have invested a third of that ~USD 50 bn for a 20 year cumulative investment at cost of only ~USD 200bn.

Chart 7: Domestic Mutual Funds driven by retail flows have invested 3X more than foreign investors

(Source: NSDL, SEBI, YTD data till 31-October 2024)

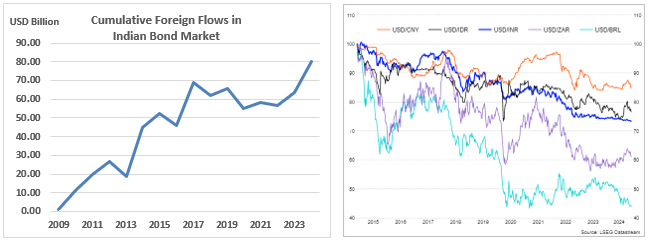

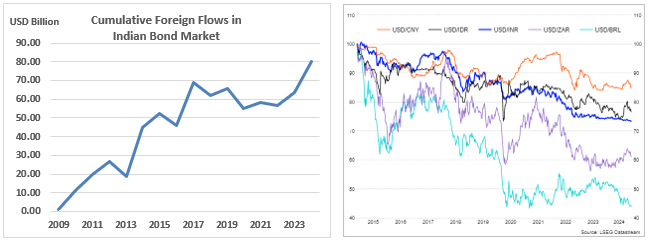

Bonds and Currency: It feels like August 2011 again. That was a pivotal time for the US dollar as the US credit rating downgrade drove a fiscal correction and led to a strong dollar which has continued till now. The dollar index was ~75 in August 2011 and is above 104 by October 2024 13. It seems like the dollar strength will continue if the Trump administration succeeds in implementing its America First Policies. This has huge significance for flows into emerging markets. Bond index inclusion saw ~USD 18 billion flows into Indian government bonds. With the spread between India and US 10 year treasuries near all-time lows, we could see outflows from India bond allocations. Many will remember that the 2013 INR currency panic was triggered by foreign ‘bond tourists’ selling. However, our relative external position and the large hoard of Foreign Exchange Reserves should ensure better management of rupee volatility on potential outflows. 14

Chart 8 and 9: Bond Index Inclusion can bring in ‘Bond Tourists’ but INR not ‘Fragile’ anymore

(Source: chart 8 - NSDL, data till October 2024; chart 9 – LSEG DataStream, rebased to 100, 10-year data till November 25, 2024, currencies against US Dollar); There is no assurance or indication that the same will be sustained in future.

India is not entirely immune to Trump’s impact on the global economy, however, India seems to have the potential to triumph out of a Trump administration rather than being Trumped.

Notes to the Article:

- S&P Global Report, 19 September 2024

- Trading economics chart on Oil prices

- Indian Express Article, 20 September 2024

- NASSCOM Report on India Technology Strategic Review, 2024

- Wikipedia page on Cities GDP ranking

- Petersen Institute on countries part of CPTPP - Comprehensive Progressive on Trans-Pacific Partnership and RCEP – Regional Comprehensive Economic Partnership,

- HT Article detailing the two events

- TOI Article quoting Piyush Goyal, India’s trade minister, Nov 29, 2024

- NBC News article on Indian involvement in assassination

- Whistleblower Network post on measures taken by US DOJ and US SEC

- India Today Article, Nov 22, 2024, on FDI squeeze

- Charles Shwab article of March 2024 comparing India and other markets

- Investing.com chart on US Dollar Index

- Reuters article on Forex Reserves

Important Disclosures & Disclaimers

Any information contained in this material shall not be deemed to constitute an advice or an offer to sell/purchase or as an invitation or solicitation to invest in any security and further Quantum Advisors Private Limited and its employees/directors shall not be liable for any direct or indirect loss, damage, liability whatsoever arising from the use of this information.

Recipients should exercise due care and caution and if necessary, obtain the professional advice prior to taking any decision based on this information

Important Notice:

This newsletter contains hyperlinks to websites operated by third parties. These linked websites are not under the control of QAPL and are provided for your convenience only. Clicking on those links or enabling those connections may allow third parties to collect or share data about you. When you click on these links, we encourage you to read the privacy notice of the website you visit. QAPL does not endorse, or guarantee products, services or advice offered by these websites.

UK related important disclosures:

• The content of this newsletter has not been approved by an authorized person within the meaning of the Financial Services and Markets Act 2000 (“FSMA 2000”). Reliance on this newsletter for the purpose of engaging in any investment activity may expose you to a significant risk of losing all of the property or other assets you invest or of incurring additional liability. This newsletter is exempt from section 21 FSMA 2000 on the grounds that it is directed only to certified sophisticated investors, high net worth companies, unincorporated associations, trusts and/or investment professionals within the meaning of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (“FPO”). The investment activity described in this newsletter is only available to these persons or entities and no other person or entity should rely on the contents of this document.

• The protections conferred by or under the Financial Services and Markets Act (FSMA) will not apply to this newsletter and any investment activity that may be engaged in as a result of this newsletter.

The applicability of any dispute resolution scheme or compensation scheme and its jurisdiction (if and where applicable) pertaining to a transaction resulting from this newsletter would be as specified in the respective client agreements.