India Investing Under Global Mood Swings

India Investing Under Global Mood Swings

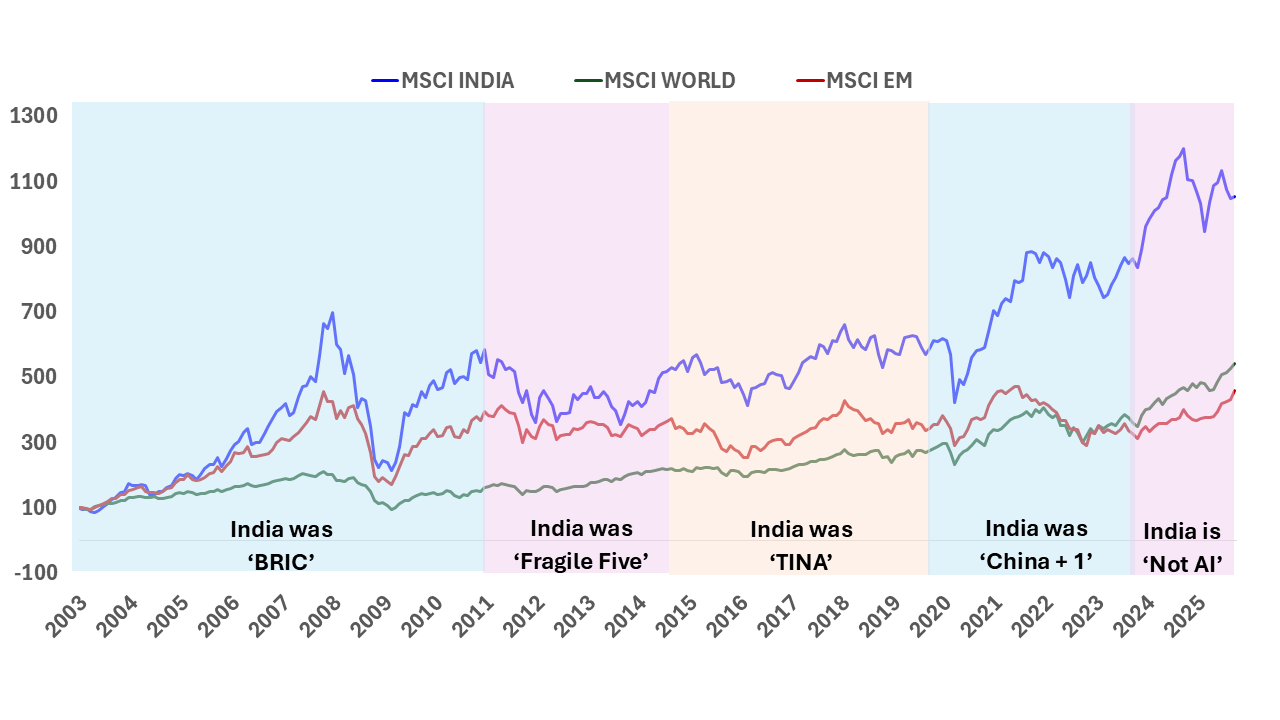

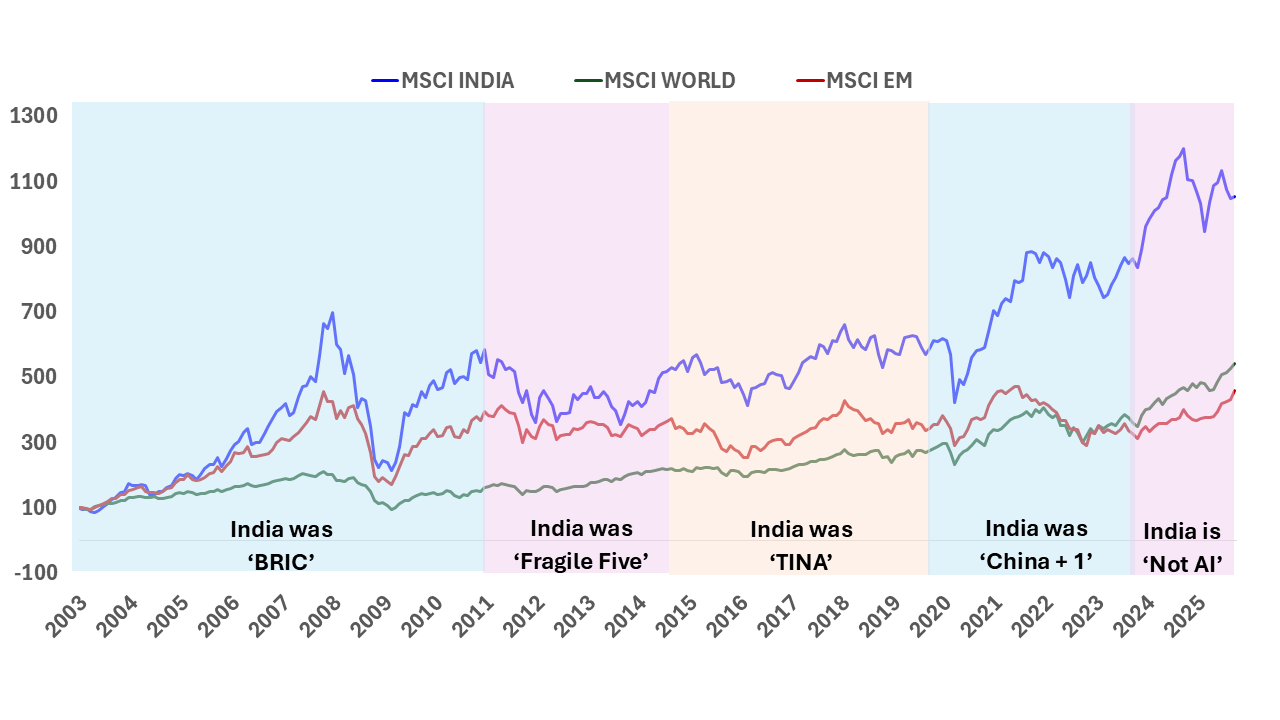

The narrative around global investing is often built around stories. Investors weave these stories around cycles, themes, and opportunities to justify and support their investment rationale.

The Great India Under-Allocation

The Great India Under-Allocation

The most common response to our reach outs to prospective Global Investors to get them interested in Indian Equities is ‘NO’ response.

EM ex-China Allocations will Disappoint

EM ex-China Allocations will Disappoint

A recent article in the Financial Times notes that investors are piling into Emerging Market (EM) funds which exclude China on the belief that an “EM ex-China” allocation will give them sufficient exposure to India and, simultaneously, deal with the China geo-political risk

India Deserves a Dedicated Investment Mandate

India Deserves a Dedicated Investment Mandate

Global wealth is estimated at over USD 250 trillion. Long term investors like Public Pension Funds and Sovereign Wealth Funds account for over USD 50 trillion in assets. The other [...]

Can India benefit out of US Single country allocation risk

Can India benefit out of US Single country allocation risk

We have been on the road since 1990, singing praises of investing in India’s growing economy via allocations to the Indian stock markets – and citing dangers of bouts of hyperbolic euphoria that seem to periodically rule passionate hearts and override rationality.

India@75, Next25: Will India allocation reflect share in global GDP?

India@75, Next25: Will India allocation reflect share in global GDP?

Over the next decade, India is slated to overtake Germany and Japan to become the third largest economy in nominal terms. It is already the third largest in PPP (Purchasing Power Parity) terms. Of course, on an annual per-capita income basis, India at ~USD 2,600 is well below most Asian countries and a few African economies.

Waltz with India Directly, Don’t Dance through GEM

Waltz with India Directly, Don’t Dance through GEM

A recent shift in public equity allocation strategies is driving investors away from China and towards other Emerging Markets, notably...

Global MNCs flourish in India, Their Pension Funds are missing out

Global MNCs flourish in India, Their Pension Funds are missing out

India's engagement with global trade and investment stretches back through various civilizations, marking a significant presence in the world economy. The East India Company, often regarded as the first multinational corporation (MNC), was established for commerce within the Indian Ocean territory, including the East Indies, South Asia, and India itself. This entity eventually extended its influence to colonize extensive regions of present-day India

India’s Economic Growth Fuels Stock Market Returns

India’s Economic Growth Fuels Stock Market Returns

India's soaring GDP growth powers double-digit stock market returns. Broad economy and corporate growth drive markets.

China Tactical, India Strategic

China Tactical, India Strategic

Mesmerized by the Chinese dragon many investors have been comfortable leaving India in a generalist “emerging market” bucket in their...

‘INDIA to TINA’: Private Assets – Is the Over-allocation Justified?

‘INDIA to TINA’: Private Assets – Is the Over-allocation Justified?

An in-depth analysis of foreign investment trends in India's private and public markets over the past two decades highlights the shift in...

Are Corporate Pension CIOs heeding their Corporate CEOs?

Are Corporate Pension CIOs heeding their Corporate CEOs?

US corporations are increasingly investing in India, but their corporate pension funds have not followed suit. With over $6 trillion in...

Will Foreign Investors finally ‘Bond with India’ July 2, 2024 Quantum Advisors India

Will Foreign Investors finally ‘Bond with India’ July 2, 2024 Quantum Advisors India

A big milestone for Indian debt markets, opening access for index-tracking foreign capital flows.