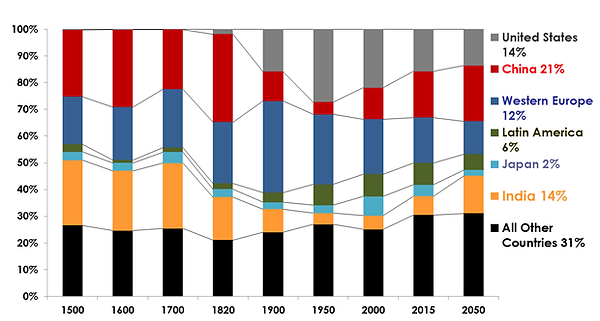

Demographic advantage: Demographic advantage: With a population of 1.2 billion and a median age of 27, India looks to have a labour cost advantage for the next several decades. Indian companies will be able to leverage that lower cost of human capital to compete in the global economy and to provide goods and services to the growing demand within India.

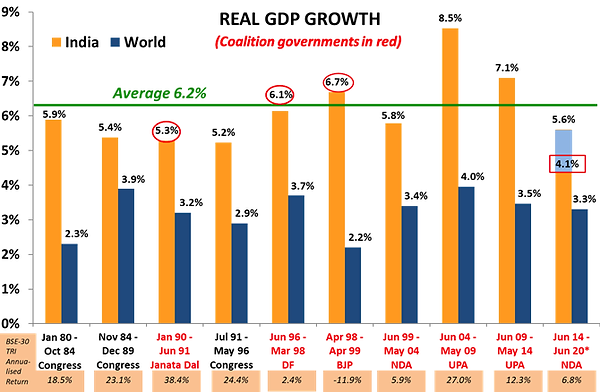

Steady growth irrespective of who’s in power: Over the past three-plus decades, despite 10 different governments (of which 7 were coalitions), India's GDP has grown at 2x the average of the global economy. This higher growth rate is expected to sustain for the next few decades, and we expect 6.5% to be a reasonable long term assumption for India’s Real GDP Growth.

Source: RBI and www.parliamentofindia.nic.in as of June 2020.

Note: The number in red rectangle is from a changed data series starting Jan 2015. While a “superior” series, there is no comparable number to equate the “New” with the “Old”. Most economists deduct 0% to 1.5% from the “New” to equate to the “Old”; therefore under Modi, the GDP has been at 5.9% at best matching the 5.6% under the BJP-led coalition government of Vajpayee that resulted in a rout for the BJP at the time of the next election in 2004!* Please note that data used for World GDP for 2017 is a median Estimate since World Bank data is not yet available and India GDP data is governments second advance estimate released at the end of May.

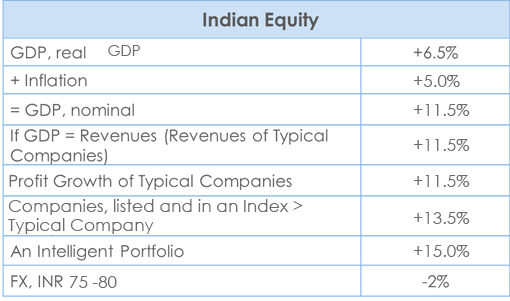

GDP growth and earnings potential of Corporate India: Quantum’s assumption of long term real GDP growth rate at 6.5% to 7% per annum ensures earnings visibility over the cycle. This superior long term earnings profile should be matched by a higher long term Price to Earnings ratio, presenting a unique opportunity for long term, patient investors in equity products. When we forecast earnings of companies, we assume real GDP growth at 6.5%, inflation at 5%, 10-year long bond yield at 7% and Rupee to appreciate/depreciate by 2%. These four anchors ultimately determine our long term normalized earnings forecast of companies in our financial models.

Disclaimer: The numbers in the above table are based on the assumptions and estimates made by Quantum Advisors Pvt Ltd. “An intelligent portfolio” mentioned above refers to a portfolio constructed by an investment manager following an active approach to investing with an appropriate research and investment process in selecting stocks. These growth rates or indicative rates of return may or may not be achieved. Past performance does not guarantee future results and future performance may be lower or higher than the data given above.

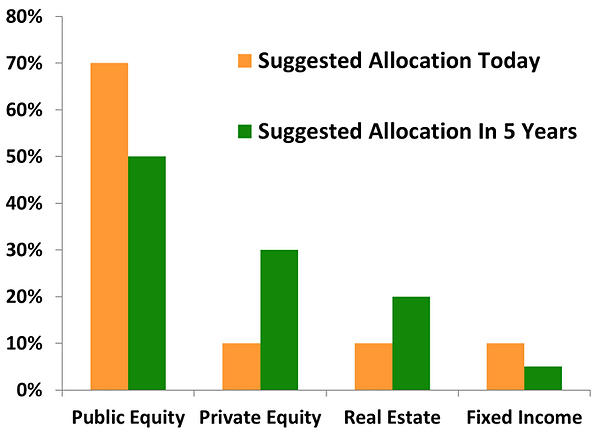

Suggested India Asset Allocation: Publicly listed equity mandates in liquid companies should be the bulk of an India allocation – investors got this wrong.