India Investing: From a complicated 2025 to a Simpler 2026?

India Investing: From a complicated 2025 to a Simpler 2026?

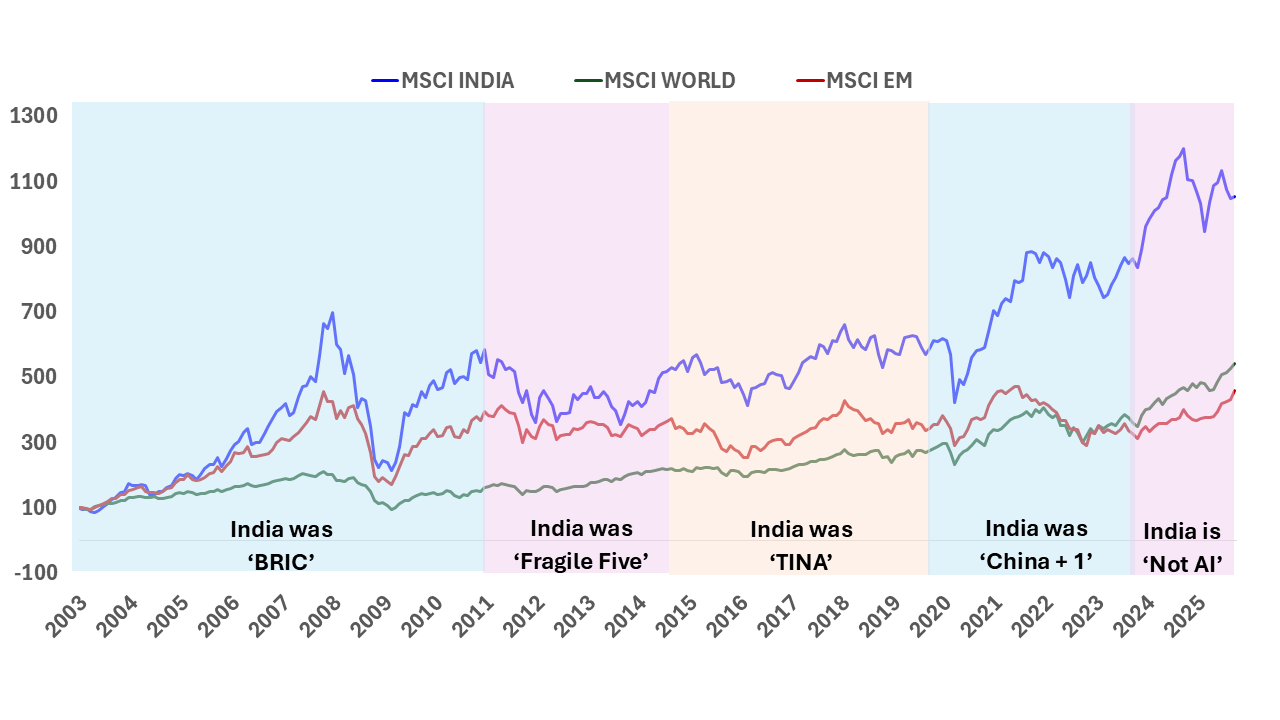

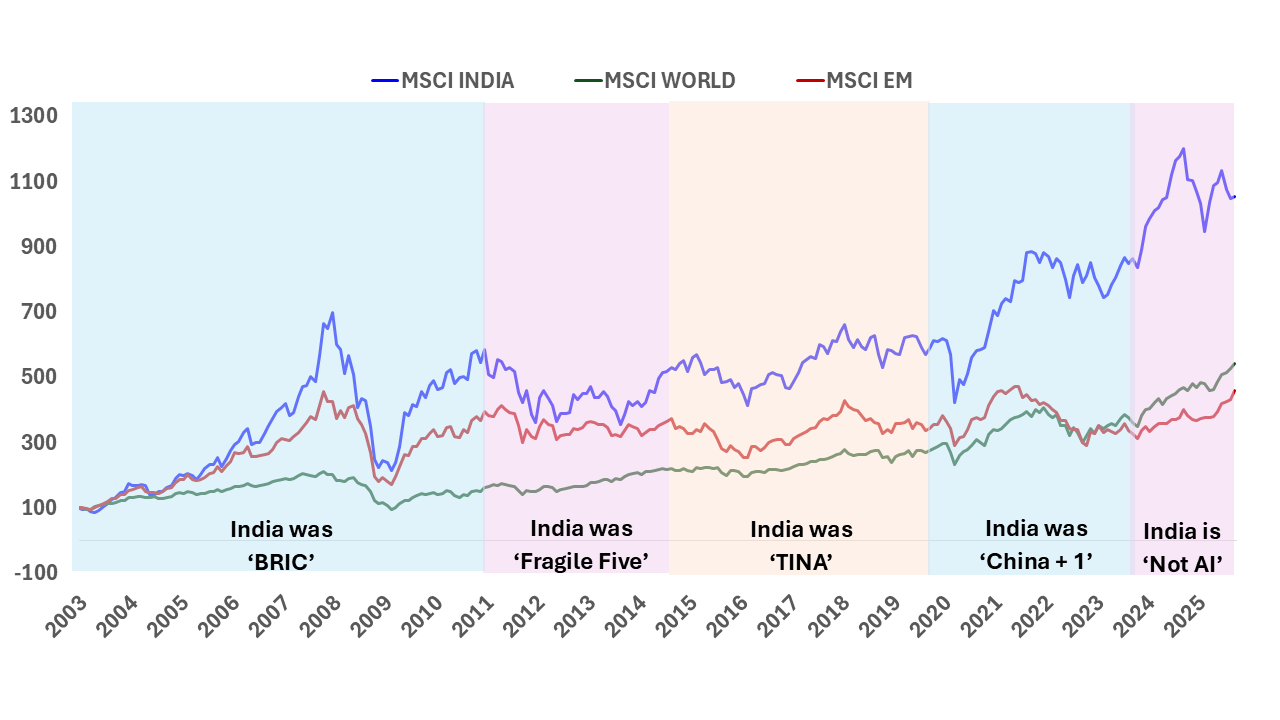

The simple India investing story of double-digit nominal GDP growth reflecting in stock market returns even in dollar terms has faced some headwinds in 2024/2025. Are these headwinds structural? What should investors expect in 2026?

India Investing Under Global Mood Swings

India Investing Under Global Mood Swings

The narrative around global investing is often built around stories. Investors weave these stories around cycles, themes, and opportunities to justify and support their investment rationale.

The Great India Under-Allocation

The Great India Under-Allocation

The most common response to our reach outs to prospective Global Investors to get them interested in Indian Equities is ‘NO’ response.

A Permanent Headache

A Permanent Headache

Look at the map of India. History and Geography haven’t been kind to India.

On its North-East border, it shares a ~3,400 km (2,111 mile) border with China.

On its North-West border, India shares an almost similar ~3,200 km border with Pakistan.

India Outlook: Growth and Valuation

India Outlook: Growth and Valuation

India needs sustained long-term growth to pull people out of poverty, create jobs for the young, and boost incomes to widen the consumption base.

India Deserves a Dedicated Investment Mandate

India Deserves a Dedicated Investment Mandate

Global wealth is estimated at over USD 250 trillion. Long term investors like Public Pension Funds and Sovereign Wealth Funds account for over USD 50 trillion in assets. The other [...]

Can India benefit out of US Single country allocation risk

Can India benefit out of US Single country allocation risk

We have been on the road since 1990, singing praises of investing in India’s growing economy via allocations to the Indian stock markets – and citing dangers of bouts of hyperbolic euphoria that seem to periodically rule passionate hearts and override rationality.

India@75, Next25: Will India allocation reflect share in global GDP?

India@75, Next25: Will India allocation reflect share in global GDP?

Over the next decade, India is slated to overtake Germany and Japan to become the third largest economy in nominal terms. It is already the third largest in PPP (Purchasing Power Parity) terms. Of course, on an annual per-capita income basis, India at ~USD 2,600 is well below most Asian countries and a few African economies.

Trump and Tarrifs - From Optimism to Tension

Trump and Tarrifs - From Optimism to Tension

On 30th July, Donald Trump slapped a 25% tariff on Indian exports to US, effective from August 7th, citing unhappiness over the trade negotiations and warned of a penalty rate for India’s continued purchase of Russian crude oil.

Waltz with India Directly, Don’t Dance through GEM

Waltz with India Directly, Don’t Dance through GEM

A recent shift in public equity allocation strategies is driving investors away from China and towards other Emerging Markets, notably...

Global MNCs flourish in India, Their Pension Funds are missing out

Global MNCs flourish in India, Their Pension Funds are missing out

India's engagement with global trade and investment stretches back through various civilizations, marking a significant presence in the world economy. The East India Company, often regarded as the first multinational corporation (MNC), was established for commerce within the Indian Ocean territory, including the East Indies, South Asia, and India itself. This entity eventually extended its influence to colonize extensive regions of present-day India

India’s Economic Growth Fuels Stock Market Returns

India’s Economic Growth Fuels Stock Market Returns

India's soaring GDP growth powers double-digit stock market returns. Broad economy and corporate growth drive markets.

Why Does India Not Grow at 8%?

Why Does India Not Grow at 8%?

What is India’s potential GDP growth rate? The answer to this proverbial question on depends on the period in which the question was asked:

China Tactical, India Strategic

China Tactical, India Strategic

Mesmerized by the Chinese dragon many investors have been comfortable leaving India in a generalist “emerging market” bucket in their...

India: Opportunity, Valuation, and Governance

India: Opportunity, Valuation, and Governance

In a dynamic geopolitical environment, global investor interest in India remains robust. With India’s GDP growth projected to continue at twice the global rate, the country warrants a “GEM + India” allocation strategy.

‘INDIA to TINA’: Private Assets – Is the Over-allocation Justified?

‘INDIA to TINA’: Private Assets – Is the Over-allocation Justified?

An in-depth analysis of foreign investment trends in India's private and public markets over the past two decades highlights the shift in...

India – Hype, Hope, and Reality

India – Hype, Hope, and Reality

In February 1990, our Founder Ajit Dayal wrote an article in the Asian Wall Street Journal ‘Loosen the Reins on India’s Bull Market’....

Are Corporate Pension CIOs heeding their Corporate CEOs?

Are Corporate Pension CIOs heeding their Corporate CEOs?

US corporations are increasingly investing in India, but their corporate pension funds have not followed suit. With over $6 trillion in...

Will Foreign Investors finally ‘Bond with India’ July 2, 2024 Quantum Advisors India

Will Foreign Investors finally ‘Bond with India’ July 2, 2024 Quantum Advisors India

A big milestone for Indian debt markets, opening access for index-tracking foreign capital flows.

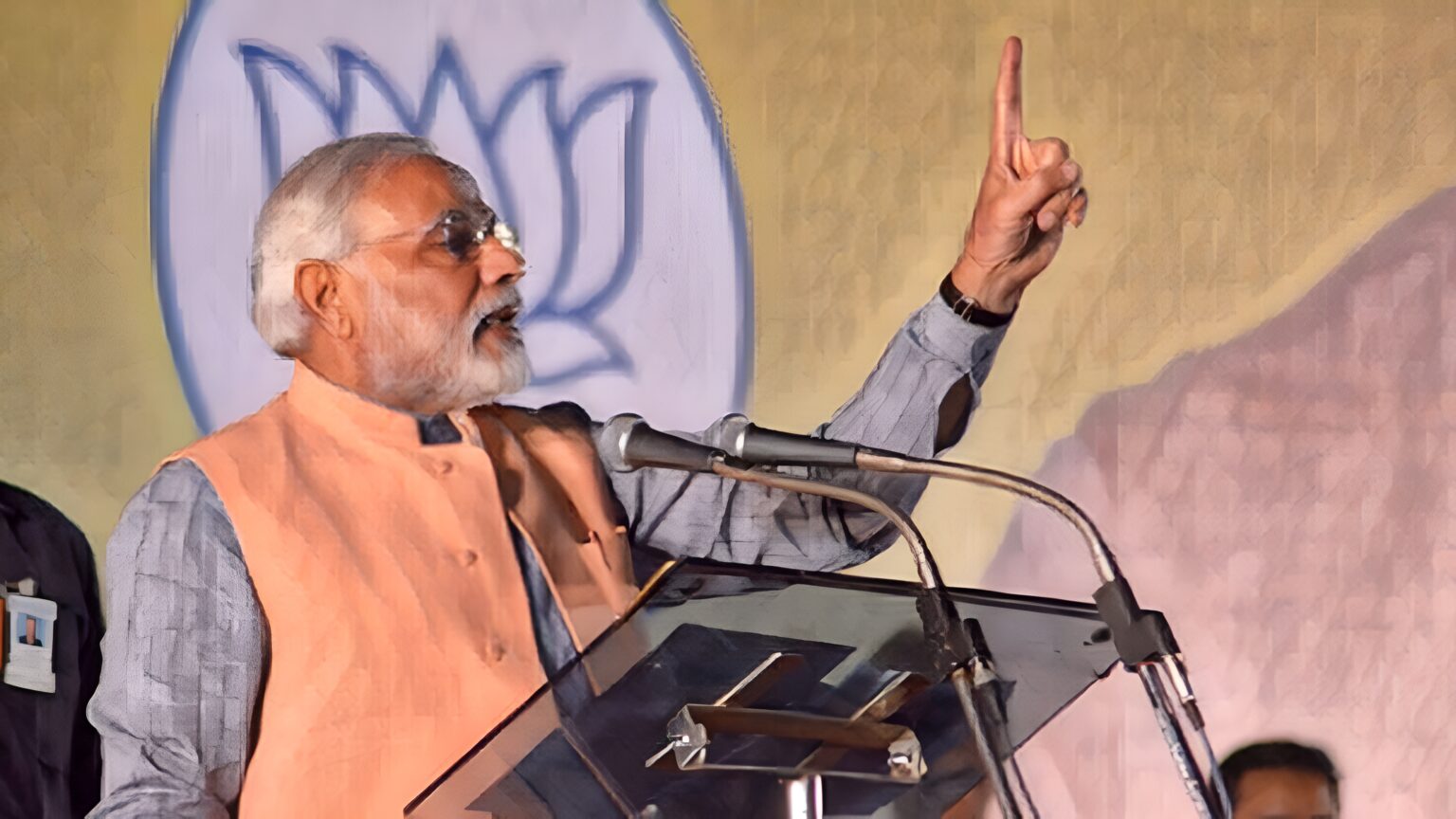

Indian Elections Don't Matter to Long Term Investors

Indian Elections Don't Matter to Long Term Investors

On 17th May, 2004, the Indian stock markets hit its lower circuit, (-20%). The Bombay Stock Exchange (BSE)-30 Index, Sensex, fell by 842 points, its steepest one-day fall ever then.

India – Time for a Reality Check

India – Time for a Reality Check

Amid growing investor optimism about India, it's crucial to reality-check the narrative.

India's Demography: Dividend or Disaster?

India's Demography: Dividend or Disaster?

India can potentially become a billion-plus consumer market over the next 25 years but there are signs job creation is failing to keep up.

Many Apples a Day to Keep Unemployment at Bay

Many Apples a Day to Keep Unemployment at Bay

Tim Cook, the CEO of Apple, is India's newest celebrity. The opening of the first Apple store in India, in Mumbai and Delhi, is all the...

India @ 75 - The Next 25: Will India be Decoupled?

India @ 75 - The Next 25: Will India be Decoupled?

Over the next few months, we will look at the various aspects that we think will shape India in the coming 25 years. From now till 2047. India as a [...]

How Geo-politics Shaped India@75

How Geo-politics Shaped India@75

On 15th August 2022, India celebrated 75 years of being a free country since ending British colonial rule in 1947. Though India boasts a civilization with recorded history of over 5,000 years, India, as a modern nation state, is very young.

India: No Country for a Strong Man

India: No Country for a Strong Man

Should global investors worry about Modi being a ‘Strong Man’? Is India becoming un-democratic?

Modi More Obama Than Regan – April 2014

Modi More Obama Than Regan – April 2014

Convinced that the Congress government with its well-honed brand of crooked playing fields and “stash-the-cash” is soon to be replaced by an angelic BJP government led by Narendra Modi, corporate honchos (many of whom were the givers of cash in exchange for favours from the Congress), the financial services community, and the media are waving the “time-to-buy India” flag. With the market already having had a run up and the INR gaining ground, we are sceptical.

The Emergency: India lost its freedom 40 years ago – June 2015

The Emergency: India lost its freedom 40 years ago – June 2015

On June 25, 1975 Prime Minister Indira Gandhi – without consulting her Cabinet colleagues in the then Congress government – sent a letter to the President of India recommending the suspension of individual rights and freedom. The infamous Emergency was born with this statement: “In exercise of the powers conferred by the Clause 1 of Article 352 of the Constitution, I, Fakhruddin Ali Ahmed, President of India, by this Proclamation declare that a grave emergency exists whereby the security of India is threatened by internal disturbance”.

India Geopolitics – Pakistan & China

India Geopolitics – Pakistan & China

We consider the geopolitical macro view that forms the background to our bottom up value investing approach.

First Adani, now Silicon Valley: India Stirred but not Shaken

First Adani, now Silicon Valley: India Stirred but not Shaken

India's inherent long-term resilience has helped it recover from crises, including self-inflicted ones.

Quantum View: A Rating for 'Growth'

Quantum View: A Rating for 'Growth'

Will India be downgraded to Junk? The key rating sensitivity is whether India will reach its growth potential.

Does Growth Matter? – India Multi Asset Commentary

Does Growth Matter? – India Multi Asset Commentary

The Growth versus Markets conundrum - markets have rallied despite growth slowing and corporate earnings flat. Does growth actually matter?

Is India a Flailing State?

Is India a Flailing State?

The contradiction of a fast growing democracy with a failure to provide support during the recent surge has implications on the economy.