What is India’s potential GDP growth rate?

The answer to this proverbial question on depends on the period in which the question was asked:

- In the 1980s, the hopeful answer would have been 5%.

- In the 90s, post-liberalization, hopes had risen for a sustainable 6% growth rate.

- During the ‘Goldman Sachs - BRIC’ mania of 2004-2011, it was India’s birthright to grow at 9%.1

- Morgan Stanley’s ‘Fragile Five’ in 2013 smothered it down below 8%.2

- ‘Ache Din’ in 2014 raised hopes of 8% again.3

- In ‘Atma-Nirbharta’4 and ‘Amrit Kaal,’ many seem to be settling for ~6%.5

(* - Ache Din was a slogan used in an ad campaign by Bhartiya Janata Party in 2014; ‘Atma-Nirbharta – economic self reliance’ was used by the government during COVID and ‘Amrit Kaal – an era of elixir’ was first used by PM Narendra Modi in Independence Day speech, 2021 for the next 25 years roadmap)

The political desire to deliver macro stability over growth has meant that faster growth aspirations do not seem to be a priority. This is way too conservative, and the current pace of growth may not be enough to achieve India’s aspirations of becoming a middle-income country and creating meaningful jobs for its youth.

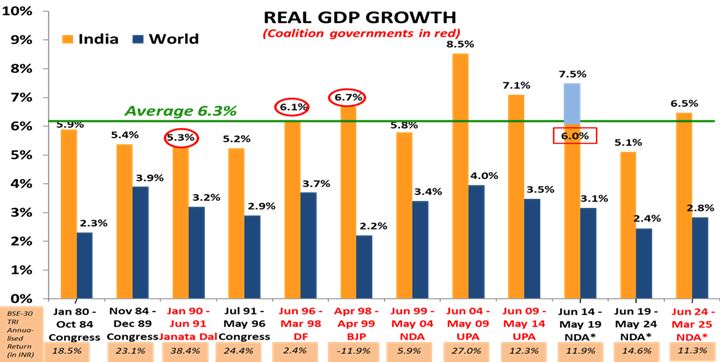

At Quantum, we have long held India’s sustainable real GDP growth rate to be 6.0%-6.5% (6.3% is the average since 1980).

Chart 1: India GDP growth has averaged 6.3% since 1980

Source:Worldbank, RBI and https://sansad.in/ as of March 2025. Note: The number in red rectangle is from a changed data series starting Jan 2015. While a “superior” series, there is no comparable number to equate the “New” with the “Old”. Most economists deduct 0% to 1.5% from the “New” to equate to the “Old”; therefore, under Modi, the GDP has been at 5.9% at best matching the 5.6% under the BJP-led coalition government of Vajpayee that resulted in a rout for the BJP at the time of the next election in 2004. Please note that data used for World GDP for 2021 is a median Estimate since World Bank data is not yet available and India GDP data is governments second advance estimate released at the end of May 2025. The graph is only for representation and understanding purpose and does not assure any promise or guarantee that the historical performance is indicative of future results.

Our long-term assumption of 6.0%-6.5% real GDP growth comes from a very simple analysis. Assuming India’s Gross Domestic Savings (GDS) of ~30% of GDP and the incremental Capital-Output ratio (ICOR - capital required to get a unit of growth) of ~5, the potential growth (GDS/ICOR) gives us 6%. This ~6% gets balanced by the negative aspects of inefficiency in the government sector and household savings, and the positives of attracting excess foreign savings into India.

India’s ICOR has averaged 4.3 in the last 10 years rolling average6. To get an 8% real rate of growth, if the ICOR increases to 5, the Investments ratio needs to increase to ~40% of GDP. That would mean a combination of higher domestic savings rate of ~35% of GDP and ~5% of GDP in foreign capital flows.

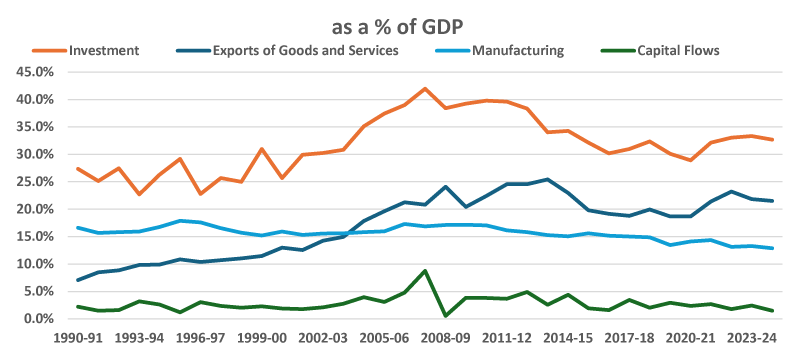

Chart 2: Drivers of Economic Growth – derailed since 2011

(Source: CMIE Economic Outlook; Annual GDP at current market prices; Investment=Gross Capital Formation; Total Capital Flows; Data till March-2025)- There is no assurance or guarantee that the historical result is indicative of future results.

For close to two decades from 1991-2011, India’s growth was also in a high trajectory, when investments rose due to an increase in domestic capacity creation, a rise in export share, and an increase in global capital flows.

However, as the chart depicts, the drivers of high economic growth have slowed down and have yet to reach its peak levels of 2011.

Evidently, India industry invested in large capacities in the previous 2002-2012 boom as seen in the rising share of investments/GDP. Some of these leveraged investments got impacted due to various reasons – regulatory uncertainty, corruption, currency weakening and lower commodity prices.

The economy was not supported by exports sector. Goods exports in nominal terms has grown from USD 276 billion to USD 437 billion in the last decade, a mere 4.7% CAGR growth7. It is services growth which is now almost as large as goods trade which provided some support. Given global geopolitical environment and the changed trade policy, India, we believe, seems to have missed out on the export value chain as a growth driver.

Although, we have seen some general increase in Foreign Direct Investment (FDI) flows including some from corporations like Apple for its iphone assembly8, however, as a share of GDP, it remains underwhelming.

The Indian government and the policy ecosystem know what it takes to try and drive growth above potential. Since the 1980s. it was a combination of receding government control, simplification of taxation, freer goods and services trade, and a recognition of treating risk capital in a fair, transparent, and consistent manner which lifted India’s potential growth from 5% to >6%. However, we seem to have reversed some of those trends and failed to increase the trend growth.

Table 1: Forget 8%, India GDP growth has been below 6.5% 10+ years

| % yoy | Post ‘Fragile Five’ | Demonetization, GST, RERA, Credit Crisis | Covid Period | Post Covid | Since Modi as PM |

|---|---|---|---|---|---|

| Average for the period | For QE Sept-2014 to Sept-2016 | For QE Dec-2016 to Dec -2019 | For QE Mar-2020 to Sept-2022 | For QE Dec-2022 to Mar-2025 | For QE Sept-2014 to Mar-2025 |

| Real GDP | 7.99 | 6.19 | 3.61 | 6.88 | 6.23 |

| Nominal GDP | 10.77 | 9.87 | 11.06 | 9.32 | 10.50 |

(Source: CMIE Economic Outlook, QE=Quarter Ended; shaded for levels below 6.5%; ‘Fragile Five – refers to period between 2011-2013, when India was bracketed with countries which were vulnerable due to high external current account deficit and inflation in an era of tightening FED policy and strong dollar; Demonetisation, Goods and Service Tax implementation, RERA – Real Estate Regulation Act – caused some distress in the informal and formal economy and and led to growth slowing down. Credit crisis refers to the financial system impact post the collapse of Il&FS, September 2018; Post COVID - we assume the quarter post September 2022 to be period from which y-o-y numbers are not impacted by covid period base effects; Under NDA government with Mr Narendra Modi as PM which started in May 2014, GDP data taken from June-September 2014 quarter)