Climate change is global, solutions need to be too.

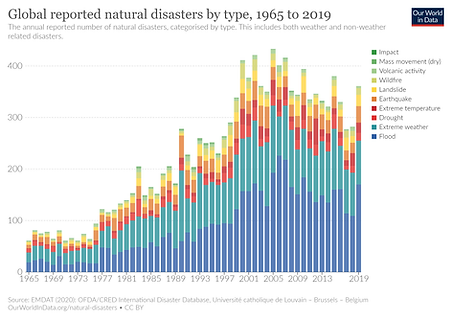

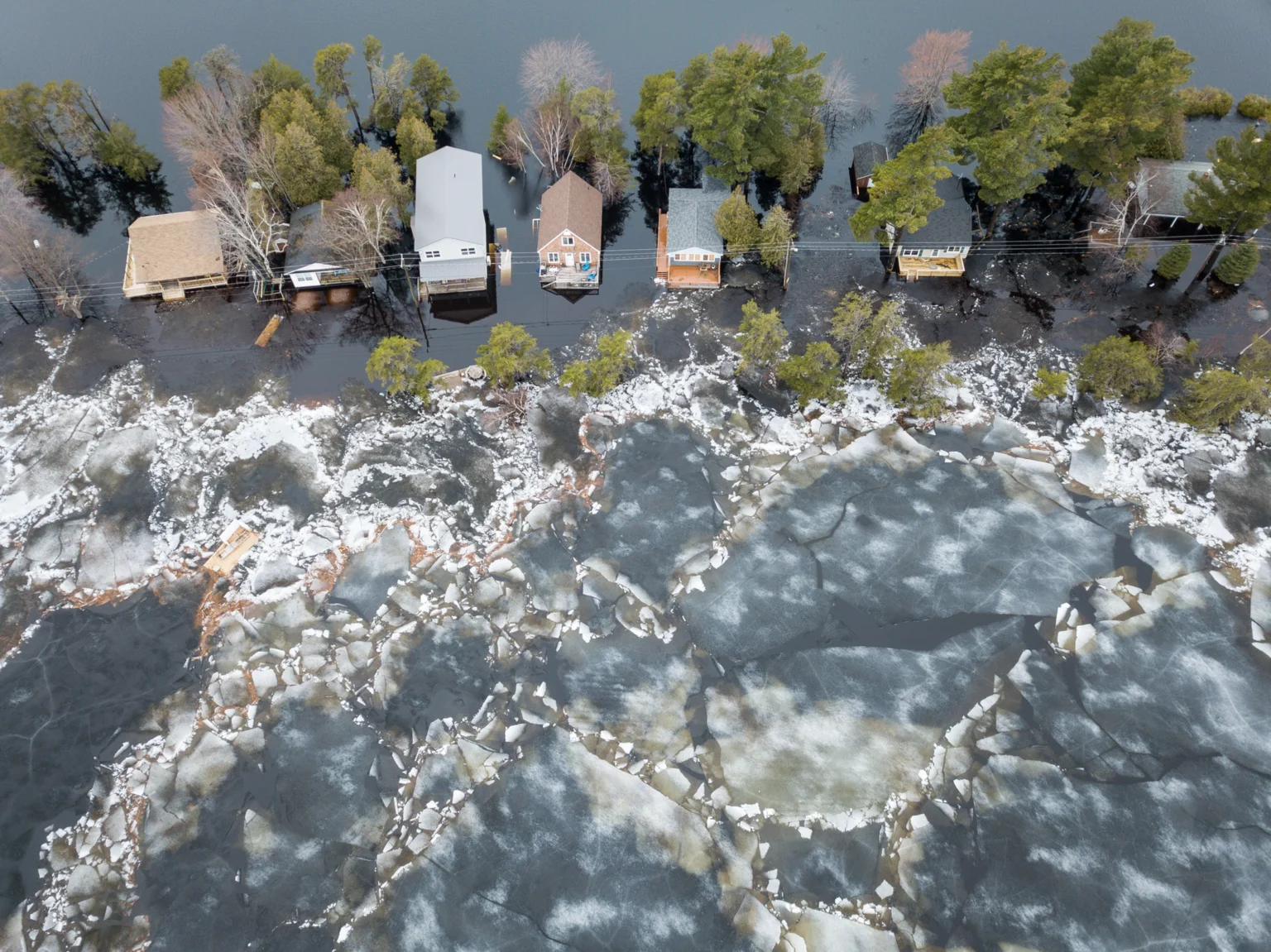

Record breaking temperatures this year as well as historic floods have underlined the urgent need for concerted action by global asset allocators to create a 'Save My World' Bucket in their investment portfolios.

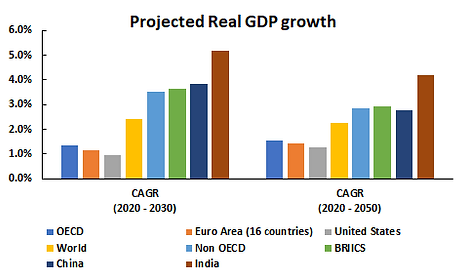

The coal and oil that fuelled growth and security may be being replaced with green energy in the West but the rest of the world will continue to rely on dirty energy. So if developing countries cannot cut back on carbon emissions quickly, gains made in richer countries will be overwhelmed by higher emissions elsewhere. Since poorer but rapidly growing countries do not have the financial resources to keep up the green energy race, climate disasters will continue to devastate the world.

To solve this global problem will require a universal solution too. The huge stock of wealth in richer countries could be tapped to redress the balance

Not just Governments but businesses, pensions, foundations and endowments could commit just 1% of their funds to invest in potential climate solutions for the developing world.

We call it the ‘SaveMyWorld’ investment allocation bucket.