In our increasingly ESG conscious world, merely good intentions aren't enough. Unpacking the complex layers of Diversity, Equity & Inclusion, executive pay,andworkforchealth & safety, this article emphasizes the importance of transparency in business practices. Highlighting the role of self-assessment andproactiveengagement,itshowcases how businesses like Quantum Advisors are leading the way towards a sustainable future, underlining the harmony between 'planet andpeople.'

Good intentions are not enough in today’s increasingly ESG-conscious world. Issuing glossy sustainability reports without enough evidence won’t winoverinvestors.Theintegration and quantification of ESG efforts into strategy and operations is what’s needed to make it more robust and more so to avoid greenwashing traps.

The global pandemic accelerated the discussion on our society’s flaws including vast economic disparities, lack of inclusion and diversity, and compromisedhealthandsafetymeasures. The social scope has certainly broadened and has a direct bearing on the company’s ability to maintain its relationships with its stakeholdersanditsreputation Today, individuals’ decisions to accept an employment offer often take into consideration corporates’ stance on social issues and commonly shared beliefs.

Unlike environmental factors, social issues are more complex and qualitative. The typical criticism is that social issues are interlinked anddifficulttomeasure.Nevertheless, it is important to continue discussing how and what to measure through relevant and impactful metrics and indicators. Getting thisrightwillbetransformational and we are getting there. Entities like ShareAction’s Workforce Disclosure Initiative (WDI) have developed useful metrics and detaileddisclosuresth help assess companies on their work force practices.

Making a positive social impact isn’t just about mitigating risk; it’s also about prosocial behavior. Also, we believe there are many social impacts that canpositivelyaffectacompany’s financial performance through competitive advantage, business growth, market relevance, brand purpose, and securing license to operate.

Among the list of social parameters, the major issues that businesses are focussing on today are:

Diversity, Equity, and Inclusion (DE&I)

A diverse, equitable, and inclusive workplace makes employees feel equally involved and supported resulting in committed employees, greater innovation, and stronger overall performance.

The evolution of workplace diversity has been happening prior to the pandemic, but the shift has accelerated over the last two years. Deloitte’s Women at Work 2022: A Global Outlook makes it clear that the new normal and pandemic-induced disruptions have taken a heavy toll on working women. Compromised mental and physical health has led to many leaving the employer or workforce completely.

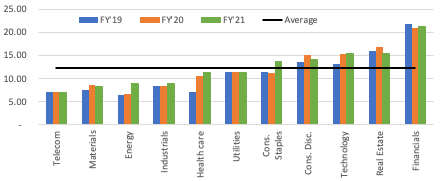

India’s women participation in the workforce is just 21%, which is less than half of the world average. That makes it critical for investors to push companies to improve the gender mix given the plethora of evidence that a better mix helps improve decision making at the organisation level In India, the outward facing sectors like financials, technology, consumer discretionary showcase better gender diversity. Public sector enterprises and manufacturing units have a poor mix.

Chart: Women participation in Indian work force by sector

Data as on the Fiscal Year ending March 31,2021Source: Quantum Advisors

Disclaimer: To represent India, a proxy of the top 250 companies is considered, which are among the best in class.

Real change happens when it is put into effect at the top of the corporate food chain, which is not yet evident. Breaking the glass ceiling is still a challenge. Women representation at the board level has shown a steady increase, but the number of women actually leading boards remain disappointingly low and further, the equal gender representation at board level is rare.

Deloitte report on Women in the boardroom: A global perspective analyzed boardrooms of 49 countries only to find out that a mere 12% of the board seats are held by women and just 4% boards are chaired by women. In spite of the regulatory requirement, the picture in India is not at all encouraging. Only 7.7% of board seats are held by women and 2.7% of boards are chaired by women. There is still a long way to go to match up even the global peers.

A new development in DE & I is the clash between professional and personal responsibilities. The challenge for companies now is to enable the workforce to strike a balance between professional and personal responsibilities through policies like flexible working hours, better facilities, optional relocations, etc.

Executive pay to be linked beyond the usual performance metrics

There is enough evidence that the pandemic has worsened the economic wealth gap. There are substantial discrepancies in the pay of workers and executives, and therefore, companies are under heavy scrutiny by the regulators as well as the public.

The Economic Policy Institute report shows that CEO pay has increased by 1,322% since 1978. This has far outstripped the S&P stock market growth and top 0.1% earnings growth. Contrastingly, the worker’s compensation has increased by just 18% in the same period. As per the recent IPS survey, CEOs were paid 670x more than a typical worker, a further increase from 640x in 2020. On one side the economy is facing a lack of growth opportunities for ordinary workers, rising inflation, and widening income inequality and on the other side, it appears that there is no upper limit on the expansion of incomes of the top 1%.

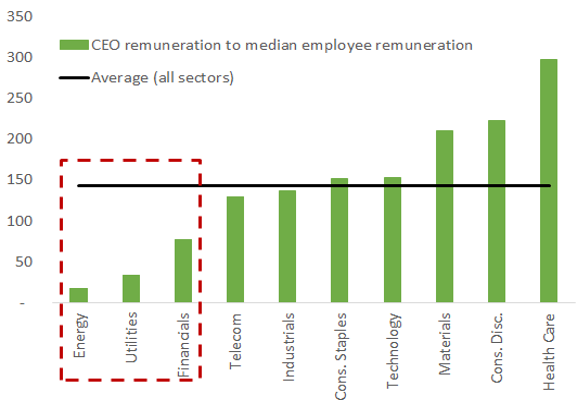

India CEO to Median average for the top 200 companies stands at 143x. While its is better than US, there is a wide variation between sectors in terms of median pay. Sectors like Healthcare, Consumer discretionary, Materials and Technology are higher than the average, much to do with the outward facing nature of these businesses. Lowest deviation is seen in the Energy sector, likely due to government-owned entities.

Chart: CEO Remuneration ratio by sector

Disclaimer: To represent India, a proxy of the 165 companies is considered which are under Quantum’s coverage and are among the best in class.

Many are, hence, advocating for policy changes and mechanisms to regulate the executive compensations through taxation and furthermore, linking the executive pay to ESG targets. Clearly, a step to move beyond the traditional key performance indicators.

As with all things ESG, if you scratch the surface, you will find a range of behaviors from authentic meaningful, genuine actions to blatant greenwashing. To avoid the latter, it is a must that companies should be prepared with transparent, measurable disclosures that are material to the industry and to the investors. Just the intent and public commitment would not be enough, real quantifiable impact is what would prove that ESG goals are actually embedded into the company’s long-term strategy.

Health and Safety

To have a truly resilient company, it must have a resilient workforce. Investing in addressing the critical issues that affect the health, community, economic stability, education and social identity of the people has changed from being “good to have” to “must have”.

Studies have shown that, for every dollar saved in direct health care cost, the employers recovered an extra $2.30 in improved performance and productivity.

The workforce of the future, especially the millennials, are now considering health and safety policy as a key factor in career decisions. Therefore, corporates have to respond to these calls soon to have a resilient and agile workforce that is well positioned for the future.

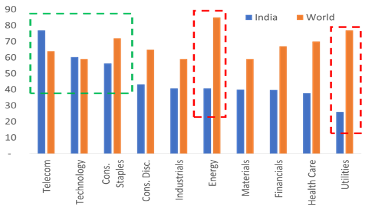

Workforce Disclosures- India vs the World

India has better workforce disclosures than the world in Telecom and Technology sector, again outward facing sectors. Energy and utility sector are largely governed by the government as a result the disclosures are limited. This tells us that companies do respond to external linkages and “Investments” could be that essential external link that could help drive better disclosures and practices. It would thereby be in the interest of investors to engage with companies to nudge a culture that builds trust and fosters innovation to gain from their resulting long-term performance.

Chart: Sector level disclosure in India vs World

Disclaimer: To represent India, a proxy of the 165 companies is considered which are under Quantum’s coverage and are among the best in class.

Evidence – Good Governance drives better E&S

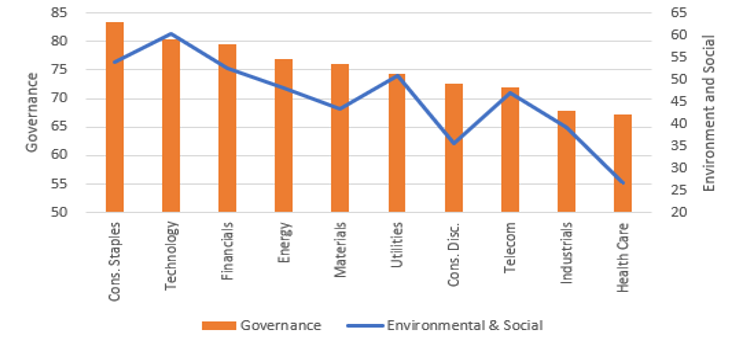

The foundation for ensuring best and fair practices is laid by good governance. In India, a high correlation is observed between governance ranking and E&S practices. As seen in the chart below, sectors with a high governance score also fare better on Environmental and Social assessment as compared to sectors with a low governance ranking.

Chart: Governance profile matters for E&S performance

Disclaimer: To represent India, a proxy of the 165 companies is considered which are under Quantum’s coverage and are among the best in class.

Governance sits at the heart of our analysis. Our experience of using an “Integrity screen”since 1996 to evaluate companies on their treatment of minority shareholders, business ethics and practices combined with our proprietary ESG framework gives us an edge to assess companies on governance and thereby identify companies that can act as long term stewards of capital.

Self-assessment and Engagement

Quantum assesses the social aspect of ESG in the companies under coverage and goes further to incorporate it in our own business strategy. We prefer self-assessment before advocating virtues.

Adhering to the motto of “Walk the talk”, Quantum became the first company from India to enroll with ShareAction’s Workforce Disclosure Initiative (WDI) to shine the light inwards in November 2020. The aim is to improve accountability and responsibility towards Quantum’s own workforce and extend the scope and learnings to the investee companies.

WDI assessment goes beyond the tick the box approach of assessing human capital development, human rights protection, diversity and inclusion, and health and safety policies. Periodic review and quantifiable scores help in identifying hog washing practices. Quantum will continue to march ahead and carry the mantle of adopting best practices on sustainability and hold the investee companies to the highest standards of governance and ESG scrutiny.

Quantum aims to engage with the investee companies by citing their own experience to ensure that companies adopt best practices on workforce-related aspects and thereby, improve on the social aspect of ESG.

In parallel, engagement with the companies on social parameters, especially nudging the companies to quantify the efforts undertaken for social impact and addressing stakeholder concerns on social aspects will certainly have a measurable impact on the company’s ESG assessment and benefit the organizational performance in the long run.

With all the talks about net-zero addressing the concerns on E in ESG, it is crucial to strategize net stakeholder impact alongside. After all, ESG is a sum of both planet and people to result in truly sustainable businesses.