India's macro-economic policy leaders tackle the trilemma dilemma of capital mobility, exchange rate management and monetary autonomy.

In July 2007, I wrote a Quantum Direct piece titled, “Learning to live with the Impossible Trinity”. The then Reserve Bank of India (RBI) governor, Dr. Y.V. Reddy, had admitted:

“Dealing with the impossible trinity of fixed exchange rates, open capital accounts and discretion in monetary policy has become more complex than before”.

The ‘more than before’ is important. Emerging Market Central Bankers are always faced with this dilemma. However, there are times when it becomes challenging enough to impact macro-economic stability. The RBI under Governor Das now, is faced with such a challenge of the Impossible Trinity.

The Impossible Trinity

This issue comes to fore in periods of excess foreign capital inflows. As capital inflows increase, the currency appreciates. If the central bank deems these inflows as excessive, it buys up the supply of dollars from banks and resists the appreciation. The buying of dollars increases its foreign exchange reserves. The resultant printing and sale of rupees increases the liquidity in the banking system. Banks then use this new liquidity to buy bonds and give loans.

If this excess liquidity leads to inflation, the central bank is forced to hike interest rates. The higher interest rates may lead to more foreign inflows into its bonds. The currency continues to appreciate.

The central Bank then has to decide the bigger evil. It cannot manage everything.

If it deems the capital inflows to be short term, hot money, it will prioritize exchange rate management and capital controls over inflation and domestic liquidity (2007).

If it wants to control inflation, it has to stop printing excess money. This means it cannot buy the excess dollar inflows and has to allow the currency to appreciate (we may be entering this scenario).

The ‘BRIC’ Mania (2003-2007): RBI Bulks Up FX Reserves, Fuels Liquidity

The policy path it chooses has short term to medium term impact on the different asset classes. India attracted hot money flows in the global liquidity and the ‘BRIC’ mania boom during 2003-2007. Although the Indian bond market was closed to foreigners and hedge funds were not allowed direct access to Indian Equities, hot money flows came through the opaque Participatory Notes (P-Notes).

RBI's intervention fuels liquidity and a credit boom

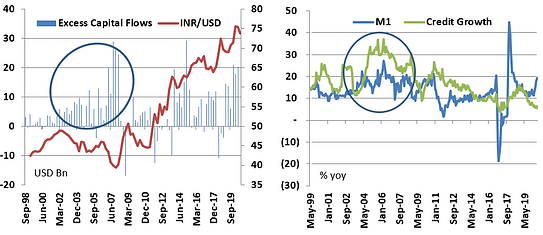

Source: CMIE, RBI, Quantum Research, Quarterly data till June-2020 and monthly data till September 2020; Excess Capital Flows = Capital Flows minus Current Account Deficit; M1= Measure of Money Supply

The RBI bought up the large inflows and built up its forex reserves. However, that led to a sharp increase in money supply. The economy was growing and hence credit demand grew at a faster pace. The RBI mindful of the perils of easy money hiked the Cash Reserve Ratio (CRR) and issued Market Stabilization Bonds (MSS) to suck out the excess liquidity. This led to increase in bond yields and fixed deposit rates.

It wanted to impose capital controls to control the pace of inflows but the finance minister basking in the ‘BRIC’ mania would not allow it. In May 2007, in order to lower the Forward premia, the RBI took overnight rates down to zero. It did not stop the foreign flows and it created havoc in the money markets. This move also went against the rate hiking spree from early 2005 till March 2007.

In 2008, with the global financial system teetering, the RBI prevailed upon the government and banned P-notes and curbed corporate external commercial borrowings (ECBs). It all unraveled soon enough with the collapse of Lehman Brothers. The RBI’s decision to bolster its defenses paid out well and India managed the Great Financial Crisis.

Why are we talking about it now? Are we in a similar situation? Why should there be a dilemma? Isn’t the RBI now an Inflation focused and an Inflation targeting Central Bank?

Inflation Targeting is an Admission to the Realities of the ‘Impossible Trinity’

Inflation Targeting is a policy choice by a central bank. The RBI chose to retain control over managing inflation. India also has a relatively open capital account. If you see Chart I again, the RBI has chosen path (B). This means that the exchange rate should be market determined with no intervention from the RBI.

In reality, this doesn’t happen. Many will say it is not even prudent. The RBI is very active in the Foreign Exchange (FX) markets. This has always been so, but for a brief period in 2010-2011 under Dr. Subbarao when the RBI did not intervene in the FX markets.

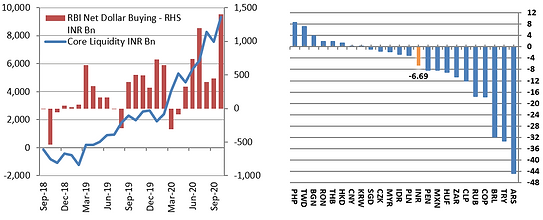

Under Governor Das, we are back to the Reddy era. The RBI has significantly increased its intervention in foreign exchange markets. Since December 2018 till August 2020, the RBI has net bought USD 90 billion. It has thus added ~INR 6.45 trillion of newly printed rupee liquidity into the banking system. As the below chart shows, this has been a major reason for the banking system liquidity to be in a significant surplus.

This has macro-economic costs and benefits:

- The increase in forex reserves bolsters the confidence of investors; but in today’s low global interest rates, the RBI earns much lower on its forex reserves than the cost it pays

- The excessive intervention may delink the INR from macro realities

- The excess liquidity so created and allowed to fester may spawn risk taking and inflation

RBIs buys up the Dollars; resists INR appreciation

Source: Bloomberg Finance L.P, RBI; Chart V = Emerging Market currencies against the USD, April 2020 – October 2020

Will Global Liquidity find its way into India?

The situation seems similar to the post SARS epidemic 2003-2004 period. Global Interest rates are at zero, the central bank balance sheets have expanded beyond imagination and the fiscal deficits are wide. The world is sloshing with liquidity looking for returns. Will India get a large share of the global liquidity?

The world is awash with liquidity and will chase returns

Source: Bloomberg Finance L.P, Morgan Stanley Research, FED Balance sheet size

Can We Absorb USD 100-200 bn Capital Flows Into Our Markets?

The developed world central bankers are likely to create more than USD 10 trillion of new money. Most of it is deployed in the government bond markets earning next to nothing. As the chart on the right shows, when risk falls and things settle, investors move money out of safe assets and look for higher return sources.

Even if 1% of this liquidity finds its way into Indian assets over the next 1-2 years, the RBI will have to deal with the problem of plenty. They will have to allow the INR to appreciate.

The RBI needs to start thinking and developing strategies to accept USD 100 billion into the Indian Equity, Fixed Income and Real Estate markets.

- How will the INR get impacted? If it appreciates, will it impact Atma-Nirbharta?

- If they intervene, how will they manage the resultant liquidity of this large intervention?

- If a large proportion comes in fixed income, what does it do to bond yields?

- If inflation continues to rise, how will the RBI balance the accommodative policy, excess liquidity and interest rates.

Indian Equities: Large Capacity, High Valuations

The BSE-200 Index has a current total market capitalization of ~USD 1.95 trillion and a free float market capitalization of just below ~USD 0.95 trillion. This also indicates that on average promoters own around 50% stake in their companies. Foreign Portfolio Investors (FPIs) share of holding in the BSE-200 as of June-2020 was down to 22.8% from a peak of +25% in 2014.

Foreigners had cut India over-weight on weak growth and high valuations

Source: Kotak Research, Bloomberg Finance L.P, Quantum Research

Source: Kotak Research, Bloomberg Finance L.P, Quantum Research

Is the Love for Emerging Market Back?

We though may have seen the early signs of reversal in this trend. From October 2020 till November 18th, foreigners have bought ~USD 8bn of Indian Equities. This pace of inflows is staggering. Compare this to the ~USD 10bn in Net Inflows which India received in four calendar years from CY 2014-CY 2018.

We see a similar trend in the broader EM and EM Asia flows as well. The pace has picked up post the US presidential elections. Few broad things underline this trend and we believe it has legs:

- There is near consensus on Dollar weakness; which is always EM positive

- The global reflation trade on the coordinated global monetary and fiscal policy response will have positive demand spill-overs for Emerging Markets

- Asia has managed COVID better than US and Europe. The recovery seems sustainable

Reasonable flows can be absorbed as a combination of redemptions in domestic equity mutual funds, share sales by companies to shore up capital and the government privatization drive will counter the foreign inflows. However, flows at current record pace will put upward pressure on stocks and increase the RBIs headache on the appreciation bias in the Indian Rupee.

India Residential Real Estate - Recovering

Overall sentiment remains weak but there are some bright spots. Sales have picked up in completed projects as well as a handful of new projects launched by established players. The large listed players are benefitting more from this increased activity: on a year-on-year basis, average residential sales volume for large listed players fell by 43% versus an 80% drop for the sector as whole. Depending on the city, enquiries were back to 50% to 70% of pre-COVID levels. Property registration data shows that some of those enquiries have turned into sales.

Low home loan rates, cut in stamp duty rates (in certain cities), consolidation of real estate developers and completion of existing projects are seen to be major reasons for why enquiries and sales have picked up.

Lowest Interest Rates in two decades – will this spur demand?

Source: CMIE, HDFC, Quantum Research, Monthly Data till October 2020

With sales picking up, the inventory overhang in cities like Mumbai, Delhi (NCR) seems to be reducing. Interest rates have never been this low and should drive demand for house buying.

- With alternate fixed income investments yielding such low rates, investor demand for residential real estate should pick up

- Foreign investments have increased in high yield real estate debt of bankrupt developers and struggling projects

- Low interest rates should also drive demand for commercial Real Estate Investment Trusts (REITs) as foreigners chase high yields.

Will Foreigners ‘Bond with India’ Again?

In this world awash with liquidity and earning negative yields, why has more money not flown into Indian bonds? In fact, as the chart below shows, foreigners have withdrawn money from the Indian bond markets over the last 3 years.

Will Foreigners Bond with India with again? India has opened up limits

Source: Bloomberg Finance L.P, NSDL, Data till September 2020; FAR= Fully Accessible Route

In the absence of strong foreign flows, local banks and the RBI have had to pick up and support the growing borrowing of the government. The government would be well served if some of the bond supply is picked up by the foreigners.

The government has increased limits. They have also devised a way out to try and get into global bond indices. Prior to 2013, foreigners used to complain about lack of limits to investing in Indian bonds. Today, foreigners have only utilized ~18% of the available limits. If they indeed wanted to show their love for Indian bonds, they can potentially invest USD 180 billion into Indian government and corporate bonds.

Imagine, if India indeed attracts USD 200 bn over the next 3-4 years into Indian bonds. All the market worries on fiscal supplies, RBIs worries about the yield curve, banks ability to sell bonds and lend will dissipate.

It will of course invite problems of INR appreciation, the liquidity impact of sterilizing those flows, the bulging forex reserves. But if the world remains awash in liquidity and negative rates, India should think, act and prepare to receive and manage these flows.

Investor Conundrum: How to Play the Low Growth but High Liquidity Environment

As we wrote in our earlier insight why Growth matters to markets, if growth remains weak; 6% real GDP growth/10% nominal GDP growth, investors will have to re-calibrate the long term returns for various asset classes. Long term returns from equities, real estate and infrastructure depends a lot on the base level of growth. In our October insight piece, What Drives Growth, we had explained why we believe India’s long term growth potential may have fallen below 6%.

For assets which are sensitive to interest rates, an initial period of low growth leads to low interest rates. Thus fixed income investments, Real Estate Investment Trusts (REITs), long term infrastructure assets appreciate in value.

But a prolonged growth slowdown, will keep interest rates low and hence diminish the value of fixed income. Look at the low to negative yielding interest rates in much of the developed world today. Thus investors would need to lower their return expectations from fixed income and yield instruments.

Equities and Credit, if the slowdown is viewed temporary, will fund support with the low interest rates and excess liquidity that the central bank has created.

The global liquidity and capital flow boom can overwhelm these short term worries. We may be entering a scenario where capital flows precede actual growth and recovery. The RBI may be forced to prioritize external management over inflation and growth.

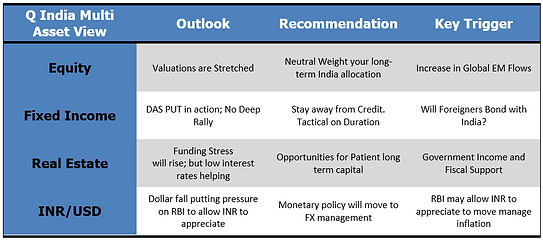

Q India Multi Asset Summary

For more information, and if you wish to discuss the details in the newsletter or if you wish to know more about our investment strategies, the investment philosophy and investment opportunities, please contact:

Arvind Chari – [email protected]

Arvind Chari is the Chief Investment Officer (CIO) at Quantum Advisors. Arvind’s vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 18 years of experience in tracking domestic and global economy he is Quantum’s thought leader and is the author of this Q-India Insight edition.