When you tune in to a new FM station, you hope to hear a different song. The new FM offers little change.

Predictably, when you tune in to a new FM station, you hope to hear a different song.

So far, tuning in to what Finance Minister Jaitley of the BJP has said – sadly – makes us feel we are hearing the same old songs and tunes sung by the previous FM (Chidambaram from Congress). It is probably a reflection of the power of business lobbies that such warring individuals and polarised political personalities should have common views on so many varied topics.

Whether it is on getting black money back to India - or on the right of a sovereign nation to tax its citizens retrospectively – not much seems to have changed. This FM is singing the same ragas as the previous FM.

Even the promises of “reforms are around the corner” or “I wish I could do more for the middle class” or whines that “the Opposition is blocking my reforms” are dull notes and static repeated by previous Finance Ministers.

The constant badgering of the RBI to provide liquidity to quench the thirst of excessive government spending is a fashionable trend in economic prescriptions globally. Fixing underlying economic problems is not the focus of most Finance Ministers and governments.

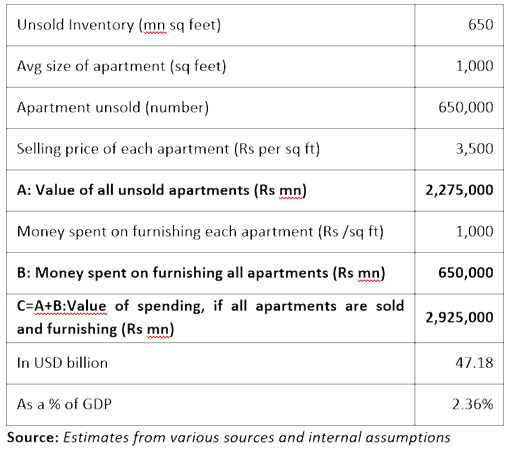

Dialing back to our 2-step, easy solution to get India’s GDP going, let’s take the case of real estate and the mafia like behavior of an industry keen on supra-normal profits. The inventory levels in key cities like Bombay, Pune, the capital region of New Delhi is in the range of 24 months to 36 months with an estimated 650 million square feet of unsold apartments across India.

Many of these projects are funded by bank loans. In any sensible, free-market, the Finance Minister would be asking the question: Why are real estate developers not slashing prices to move product and clear the unsold inventory? To encourage that line of thinking, the Finance Minister (who freely lecture the government-owned banks on controlling NPAs) should ensure that no bank rolls over loans due from real estate developers. If a real estate developer does not repay a loan, the bank should seize the property and auction it. With latent demand far outstripping supply, inventory would clear pretty quickly – at a market determined price.

Will the Finance Minister really reform?

The Indian economy would get a boost in consumption of 2.4% of GDP. Furthermore, this clearing would act as a catalyst for subsequent investment in real estate. If there are an estimated 650,000 homes in residential projects across India which can find buyers, there is a need for furnishings, consumer white goods - and cars and 2-wheelers to fill up the parking spaces! With inventory clearing everywhere, companies will be ready to start their natural capex cycles – even those in real estate development. Of course, for this momentum to occur, real estate developers need to slash their asking prices by maybe 20% to 25%. The super-normal profits of real estate developers may be wiped out. Some real estate projects may not even make money!

That, it seems, is not an option for this or any previous FM. Rumours suggest every real estate developer has a sugar-daddy political connection or, conversely, many politicians are in the business of real estate. Hence, Finance Ministers find it easier to tell the RBI to reduce interest rates. Reforms are of the monetary printing kind – not of the curtailing expenditure, the traditional fiscal or the structural “open-markets” kind.