We are not India bears. We are India bulls. So what will the true economic growth be like during 5 years of Modi’s rule?

A reminder: We are not India bears. We are India bulls.

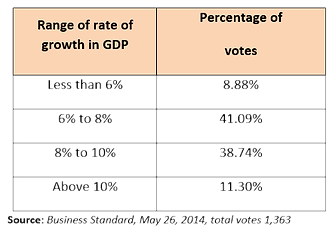

In a “normal” environment, a fund manager who takes a view that the GDP of an economy will surge from sub-5% levels to 6.5% levels would be asked the rational question of “Why are you so optimistic?” However, in an environment when people expect India’s GDP to be 8% p.a. and above (see Table), the question being lobbed at us is: “Why are you so pessimistic?”

Table:What will the GDP growth rate be during 5 years of Modi’s rule?

The answer is obvious: GDP is not a function of hope and magic wands, but a response to real action. The belief during the NASDAQ bubble (1999/2000) that economic cycles are dead was proved wrong. The blind faith that, by being part of an acronym called BRIC, India will surge to some magical economic path ended with a thud. There is still nothing out there for us to believe that Prime Minister Modi will magically push the Indian economy to a higher orbit. A break out to an 8% p.a. rate of growth requires “magic” while a return to 6.5% requires the economic cycle to run its course.

But, we confess, we are beginning to see some signs of what we have often called “true economic growth”: the process by which Indian entrepreneurs are encouraged to create rather than allowing many of the established business houses to steal. Stealing is the transfer of wealth from one pocket to another by fixing the rules of the game. Creating relies on smarts and ingenuity to build something that never existed – and is generally done by those who (generally) never had.

Sophie’s Choice

The stock market may be sensing a turning point in this battle of creativity over theft.

For the first time in decades, companies like Reliance – and their founder – are not being portrayed in a positive light. And the Modi government does not seem to be coming to their rescue. The Economist, a magazine, could open a fully staffed office in India to cover a bunch of characters who have dominated the “transfer of wealth” industry in India. With a follow-up series on how that wealth is stashed in far-away places with the help of the usual suspects in the financial world.

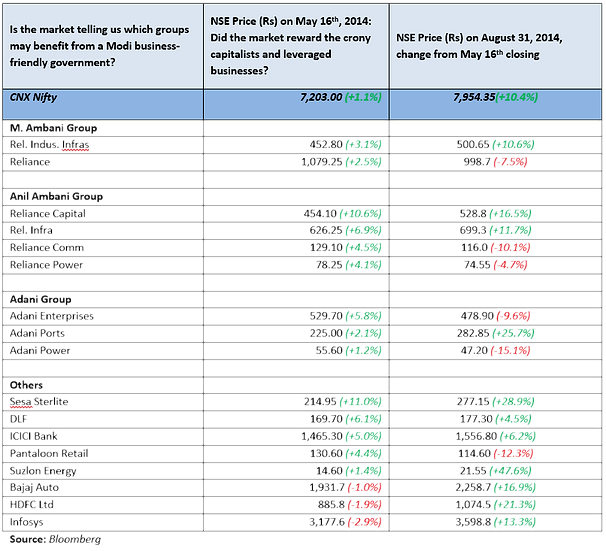

On May 16th – the day the historical election results were announced – the shares that went up in price were, alas, those that belonged to crony capitalists or to leveraged firms. Since May 17th, there has been a significant change (Table) in share price movements. The shares of many suspect companies have been lagging the overall rise in the market by wide margins. Those shares that did not see any “Modi-boost” on May 16th seem to be back in favor. Was the market wrong on May 16th when it assumed that Modi would be a puppet of the crony capitalists? Is the market now wrong in assuming that the glory days of the crony capitalists are over? Is there a pattern, or is this some random movement not linked to the Sophie’s Choice moment that Modi faces: to pay back the few industrial groups that paid for his election victory, or please the 250 million who voted for him? In a society where wealth has historically been transferred – and not created – Modi cannot please both groups of backers. He needs to leave one group behind at the gate, at the hands of the guards of the concentration camp. Could he be turning his back on his corporate backers?

Table: Now I buy you, now I can’t?