2020 has been a year of facing, learning and adapting to the unknown. We look to the year ahead and what is to come.

Nothing that anyone writes about the year 2020 will do justice to what the year actually was. Any adjective you use to describe your experience is likely to be true. It has been a year of facing, learning and adapting to the unknown.

Fund Manager Interview

In this fund manager interview, Arvind Chari, Chief Investment Officer, talks to the value investing team, I.V. Subramaniam “Subbu” & Nilesh Shetty, on their learnings for the year that passed and their insights on what the future holds for value investing strategies.

In investing as well, there have been similar experiences. The markets faced with an Unknown in February and March reacted as was expected. Then as countries announced lockdowns and policy makers laid out plans to deal with the pandemic, the markets learnt and adapted.

The reality that today’s market price is a reflection of expected future outcome was very apparent this year. Every asset class reacted to the threat of coronavirus, well before the spread of the virus.

Global Equity markets bottomed on March 23rd, 2020. As the year ends, many indices are at/or near all-time highs. The cumulative global reported coronavirus as on March 23rd, 2020 was 322,930. On December 31st 2020, the reported cases stood at 83,839,200. There have been more than 300,000 deaths in the United States alone.

Of course on March 23rd, 2020 no one could have said that this is the bottom of the market. However, the market movements since would be a lesson on what drives investor behavior.

Table 1: Markets recovered as COVID-19 soared

(Source: Refinitiv Eikon, Worldometer, WHO; Global Bond ETF – I-Shares US Aggregate Bond ETF; EM Bond ETF = I-Shares Local Currency EM Bond ETF)

The extent of the rebound in the markets has been astonishing. However, those who have seen the power of central banking in the last 10 years would not be surprised. Global Central Bankers coordinated their rate cuts and liquidity actions as the WHO deemed COVID-19 to be a pandemic. It was indeed the US FED’s assurance to support the bond markets given again on March 23rd which seemed to have turned the tide for the equity markets.

The economic rebound seen over the last 6 months is even more pleasing. Economic indicators have improved at a faster pace than predicted. The fact that this has also been a global trend has given confidence in the sustainability of the recovery.

The roaring 20s or the post SARS credit fueled recovery or the post GFC greenshoots Advertisers use ‘stories’ to sell their brands. Investors like to use investing ‘themes’ in their pitch.

Roaring 20s: The decade long economic recovery in the 1920s post World War-I as countries rebuilt their infrastructure. Many believe that the conditions and the fiscal and monetary support are similar now and will thus lead to a similar period of a decade of high growth.

2003-2007: Although SARS was a pandemic with a higher fatality rate, but it did not spread as much as COVID-19. Many compare the post SARS recovery and believe that the global economy could be entering a period of a short but synchronized growth trend powered by cheap money and fiscal action.

2009 post GFC: Multi speed, multi-faceted, fractured economic and market recovery post the collapse of the global financial system.

The Alphabet Soup: There is also the Alphabet Soup on the shape of the recovery. Will the recovery be a ‘V’, a ‘W’ or a ‘K’.

To a top-down macro investor, these aspects are important to understand and ascertain its impact on their portfolio. They position their portfolio based on their outlook on the likely economic and market trajectory.

To a bottom up investor, be it in equities, credit or real estate, they are concerned about the valuation and the margin of safety in their investments. However, even the bottom up investor has to be mindful of the macro and investing environment in which they operate.

To a retail investor, all this is needless confusion. All they need to do is to follow a simple but disciplined asset allocation containing Equities, Fixed Income, Gold and Real Estate.

However, the two indicators that determine long term trends are the US Dollar and the US 10 year Treasury Yield. Most themes are shaped by the movement of these two assets.

Chart 1 and 2: The Price and the Value of Money

index.webp)

The US Dollar is the global reserve currency and the US interest rates thus become a benchmark for the world. The US government bond market is the largest and the most liquid asset class and hence draws in investments by all types of investors. As of June-2019, foreigners owned a total of USD 20 trillion of US assets (Equity ~USD 8.6 trillion) and (Bonds ~USD 11.4 trillion). Although, a significant chunk of that is dedicated to the US markets but there would yet be a substantial sum which is opportunistic depending on the relative appeal of US interest rates, US equities and the US Dollar.

Generally,

- A (forecasted) weaker Dollar would make US investors to invest incrementally more in non-US assets

- A (forecasted) weaker Dollar would make non-US investors to reduce their US investments assets

- Lower US interest rates relative to other countries can drive money away from US into other geographies.

Most Investment themes and trends for 2021 and beyond are premised on the following:

- Developed world Central Banks will keep rates low and liquidity high

- Governments will continue to provide fiscal stimulus

- US interest rates will remain low for long. Real yields will remain negative

- Dollar will weaken against global and thus EM currencies

Chart 3 and 4: Monetary and Fiscal co-ordination to drive global growth

.webp)

I do not know enough about the 1920s to juxtapose today’s conditions and look out over the next decade. The situation today though seems to be similar to the post SARS epidemic 2003-2007 and the post GFC coordinated global action. Global Interest rates are at zero, the central bank balance sheets have expanded beyond imagination and the fiscal deficits are wide. The world is sloshing with liquidity looking for returns. Will India get a large share of the global liquidity?

Chart 5 and 6: A weak dollar and low US real rates should drive flows to Emerging Markets (Source: Chart 6: CitiResearch)

If that premise is true, what does that mean for an India asset allocation for investors, domestic and global?

An internal scenario exercise on what happens even if India attracts an excess of only USD 100 billion per year of the global stash of trillions of dollars was revealing.

Despite the size and depth of the Indian Bonds, Equity and Real Estate markets, excess inflows of such order will have its impact on market valuations. We may have seen the first wave of such flows in the Indian equity markets over the past 4 months. If India is indeed able to attract such large excess inflows over the year, we expect the Indian rupee to remain strong, interest rates to remain low, liquidity to remain comfortable and equity valuations to remain high.

This is not a prediction but is an ‘If so, then what’ kind of scenario analysis. It may or may not happen, however portfolio managers will bear this in mind while investing.

Table 2: Q India Multi Asset Summary

Indian Equities: Large Capacity, high valuations

The BSE-200 Index has a current total market capitalization of ~USD 2.1 trillion and a free float market capitalization of just above ~USD 1.0 trillion. This also indicates that on average promoters own around 50% stake in their companies. Foreign Portfolio Investors (FPIs) share of holding in the BSE-200 as of June-2020 was down to 22.8% from a peak of +25% in 2014. So there is absorptive capacity.

Chart 7 and 8: Are foreigners increasing their India active Equity allocations?

(Source: Kotak Research, International Institute of Finance, Data till November 2020)

Low growth in earnings and slower GDP growth had led foreigners to cut their India over-allocation. Given the background and the recent non-ETF flows, we may be seeing foreigners increasing their active India allocations. So despite selling by domestic investors and the relative over-valuation from an historical perspective, Indian equity markets have climbed towards all-time highs on the back of foreign flows.

Indian Equities despite being at record highs have still underperformed some of their other EM peers. That is due to the fall in economic growth and stagnant earnings. If these large inflow keeps cost of capital low, boosts demand and triggers a private capex recovery, we will see earnings estimates upgraded. The valuations then might not look as rich as they seem now.

India Residential Real Estate – Can absorb large flows – key to economic recovery

Despite the Covid-induced disruptions and income shrinkages in the economy, demand for fresh home mortgage was robust in the last few months. Leading home loan providers, such as State Bank of India, ICICI Bank and HDFC have witnessed double-digit growth in home loan advances. The recovery in residential markets since end-August across the country has surprised everyone. The bounce back has been more pronounced in Mumbai and Mumbai Metropolitan Area (MMR).

Low home loan rates, cut in stamp duty rates (in certain cities), consolidation of real estate developers and completion of existing projects are seen to be major reasons for why enquiries and sales have picked up. Registrations jumped by 66% Y-o-Y, boosted by a stamp duty cut and the festive mood of Navratri and Dussehra.

Chart 9 and 10: Lowest Interest Rates in two decades – will this spur house demand?

(Source: Propstack, Data for Mumbai. HDFC Ltd, Monthly Data till October 2020)

With sales picking up, the inventory overhang in cities like Mumbai, Delhi (NCR) seems to be reducing.

- With alternate fixed income investments yielding such low rates, investor demand for residential real estate should pick up.

- Foreign investments have increased in high yield real estate debt of bankrupt developers and struggling projects.

- Low interest rates should also drive demand for commercial Real Estate Investment Trusts (REITs) as foreigners chase high yields.

- High Net worth Investors may also be booking profits as the stock markets have recovered and ploughing their money into Real Estate.

Will Foreigners ‘Bond with India’ again?: ~USD 180 billion of unutilized limits

In this world awash with liquidity and earning negative yields, why has more money not flown into Indian bonds? In fact, as the chart below shows, foreigners have withdrawn money from the Indian bond markets over the last 3 years.

Chart 11 and Table 3: Will Foreigners Bond with India with again? India has opened up limits

Source – Bloomberg Finance L.P, NSDL, Data till November 2020; FAR= Fully Accessible Route

In the absence of strong foreign flows, local banks and the RBI have had to pick up and support the growing borrowing of the government. The government would be well served if some of the bond supply is picked up by the foreigners.

The government has increased limits. They have also devised a way out to try and get into global bond indices. Prior to 2013, foreigners used to complain about lack of limits to investing in Indian bonds. Today, foreigners have only utilized ~18% of the available limits. If they indeed wanted to show their love for Indian bonds, they can potentially invest USD 180 billion into Indian government and corporate bonds.

Imagine if India indeed attracts USD 200 bn over the next 3-4 years into Indian bonds. All the market worries on fiscal supplies, RBIs worries about the yield curve, banks’ ability to sell bonds and lend will dissipate.

Death of the Dollar: We have heard that many times, it trades in a long cycle

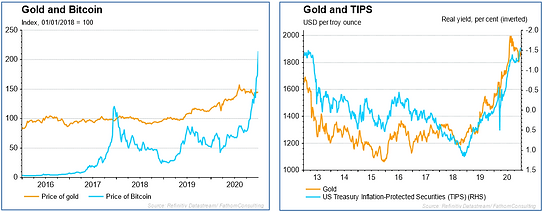

This has been talked about every time the dollar depreciates. However, as we have seen with those long-term charts, the US dollar trades in a long strong/weak cycle. The ‘death of the dollar’ play gets emphasized through the price of Gold. In recent times, Bitcoin has caught investor’s fancy. Bitcoin has had a great year but as the indexed chart shows, Bitcoin is way more volatile than Gold. I think the jury is still out on whether Bitcoin can also be regarded as a currency: as a medium of exchange and a Store of Value.

Chart 12 and 13: Gold will remain the safe haven against dollar debasement

Source – Bloomberg Finance L.P, NSDL, Data till November 2020; FAR= Fully Accessible Route

As chart 13 shows, Gold priced in USD does well when US real interest rates fall. The US Federal Reserve pledging to tolerate higher inflation in keeping rates low as long as growth recovers. The RBI governor has also allowed real interest rates to be negative in to support growth. Negative real rates will continue to drive demand for real assets.

Gold did, what it was supposed to this year. It gained in prices in all currencies living up to its function of a store of value. Gold priced in Indian Rupees touched all-time highs this year.

Large institutional Dollar Investors tend to be more comfortable in investing into hard assets like real estate and infrastructure as a hedge against inflation. Gold has been an anathema. However, for the first time, we are hearing certain large global pension fund CIOs talking about internal discussions on making allocations to Gold. Some have already begun the process. Some are considering. This is indeed a big development towards assets like Gold and possibly Bitcoin.

Climate Change and ESG Investments in India will gain ground

India is Ground Zero for climate change. Any action on climate change without considering the actions taken by India is futile. If India follows the growth and development path of the developed world or even China, the global Paris accord of curbing carbon emissions will not be met.

If the world is serious about tackling climate change, they need to focus on India. Countries like Japan, Switzerland, Sweden can do all they want to tackle climate change. However, it is countries like China, India, Indonesia, Nigeria etc which will determine the outcome of the global climate action. India needs the technology and the investments from the western world so as to continue to meet its developmental goals and at the same time meets it carbon emissions targets.

The Indian renewables story has seen rapid pace of action and development. A good share of that is funded by foreign companies, global pension funds and global private equity funds.

Chart 14 and 15: India is ground zero for climate change

Over the last 5 years, we have also seen increased focus from global investors in adopting ESG (Environment, Social and Governance) methodologies in their investing. Some pension funds are part of the Zero-Net alliance, pledging to move their portfolio outcomes to Net Zero carbon emissions.

We see great synergy in the desire of the western investor world to adopt ESG and India offering large scalable investment opportunities across Equity, Fixed Income, Real Estate and Infrastructure to fulfill those desires.

For more information and if you wish to discuss the details in the article or if you wish to know more about our investment strategies, the investment philosophy and investment opportunities, please contact:

Arvind Chari – [email protected]

Arvind Chari is the Chief Investment Officer (CIO) at Quantum Advisors. Arvind’s vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 18 years of experience in tracking domestic and global economy he is Quantum’s thought leader and is the author of this Q-India Insight edition.

*While we shall comply with all applicable regulations and it is our endeavor to follow industry best practices for the benefit of all our clients, non-US persons and investors in our non-US funds should take note that registration of QAPL as an investment adviser with SEC does not imply any level of skill or training. that our non-US clients are entitled to the full benefit of all substantive provisions of the Investment Advisers Act 1940 (Advisers Act) or that we are required to comply with all the provisions of the Advisers Act in our dealings with our non-US clients, including non-US funds. We will thus have responsibilities under the Advisers Act that differ from client to client, based on whether or not the client is a non-US client”.

This article is strictly for information purposes only and should not be considered as an offer to sell, or solicitation of an offer to buy interests in the account. Investments in the equity and fixed income instruments are not guaranteed or insured and are subject to investments risks, including the possible loss of the principal amount invested. The value of the securities and the income from them may fall as well as rise. Past performance does not guarantee future results and future performance may be lower or higher than the data quoted, including the possibility of the loss. Quantum Advisors reserves the right to make the changes and corrections to its opinions expressed in the document at any time, without notice. Information sourced from third parties cannot be guaranteed or was not independently verified. Comments made herein are not necessarily indicative of future or likely performance of the account and are based on information and developments as at 31/12/2020 unless otherwise stated.

All of the forward-looking statements made in this communication are inherently uncertain and Quantum Advisors (QAPL) cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “should”, “can”, “may”, “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume”, “target”, “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities law.