As investor interest in India grows, it's important to take a reality check on the optimism surrounding India's economic prospects. While there are positives driving the India story, a closer look at some key data points suggests there may be causes for concern, things to ponder, reasons to worry, and matters to delve into further.

It seems that investors have moved from terming ‘India – I will Never Do It Again’ to being ‘TINA’ – There is no other Alternative’.

From being the eternal opportunity, to becoming the ‘Darling within the ‘BRIC’ and then to be a ‘falling angel’ as part of ‘fragile five’; to now being goaded as ‘China + 1’ and ‘America’s best friend’.

Everyone seems to want to have a piece of the pie. There is genuinely a lot going for India. Especially in the investment world.

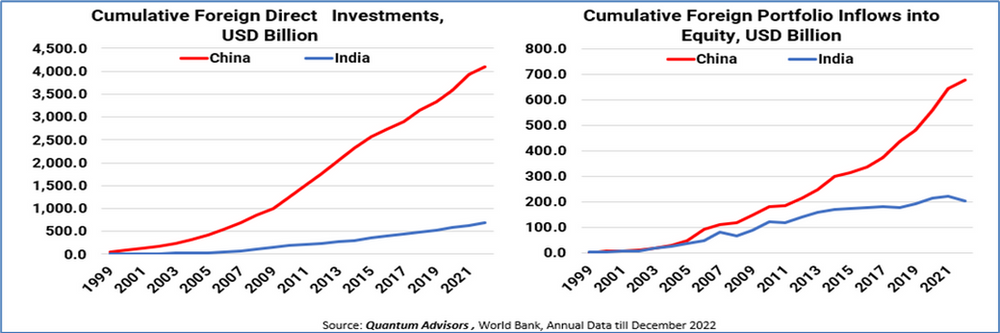

Is China Investable? – As more and more investors and corporations ask and ponder over this question in their investment committee and board rooms, the more the discussion veers towards India.

Given how much under invested and under allocated India has been in comparison to China, it is no surprise that India is the talk of the town.

We can see that ourselves in our growing discussions with large institutional investors who are looking at having dedicated investments and are researching and studying the Indian market and the economy closely.

Chart 1: India poised to get more Foreign Investment

The euphoria is visible in Investor interest with flows over time across FDI, Equity and Bonds. The number of global corporations looking to enter and/or increase the presence in India is rising. That India got to be the host for the G-20 in 2023 and the Indian governments management of the event seemed to have increased the spotlight. Contrary to expectations, over the last 10 years, PM Modi’s biggest successes have been in the arena of geo-politics and bilateral relations. The comprehensive US-India statement post PM Modi’s visit in June 2023 was enough for the Economist to put India on the front page as ‘America’s New Best Friend’.

However, India often disappoints the Optimist and Pessimist – so goes the saying. We would add that it pays to have a healthy dose of skepticism on everything you hear about India – as with the other adage, that ‘everything you hear about India, consider that the opposite is also true’.

With that, we look at a few data points, which suggest either: cause of concern; a thing to ponder; a reason to worry; a matter to delve into. A time for a reality check on the otherwise overly positive India story.

A Cause for Concern:

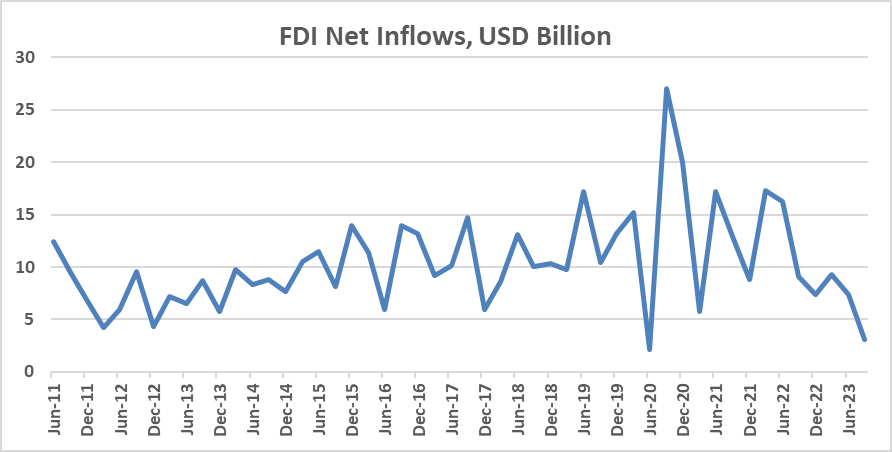

Chart 2: Global Corporations don’t seem to be walking the talk

(Source: Quantum Advisors, CMIE, Quarterly Data till September 2023)

A large proportion of India’s Foreign Direct Investment (FDI) flows were driven by financial investments by global Private Equity (PE), Venture Capital (VC) funds. As the US rate cycle turned and valuations peaked out, we seem to be seeing a similar drop in fund flows from these financial investors into India. The net inflows also seem lower as we are seeing some old vintage PE/VC firms taking their exits given the exuberance in the public markets. However, if we strip exits out, even on a gross inflow basis the amounts have halved from ~USD 30 billion per quarter to ~USD 15 billion per quarter now1.

This is a concern as India is still not seeing large investments by global corporations to set up their manufacturing, sourcing and/or global centres. So much for India’s sweet spot in current geo-politics and the growing drive of China+1.

We have to watch this closely. Has India muffed its chances, again? Or Do these things have a long lead time, and will India’s effort in moving electronics manufacturing with the likes of Apple and its capital subsidy program to build a semi-conductor ecosystem pave way to crowd in large global corporate investments.

A thing to Ponder:

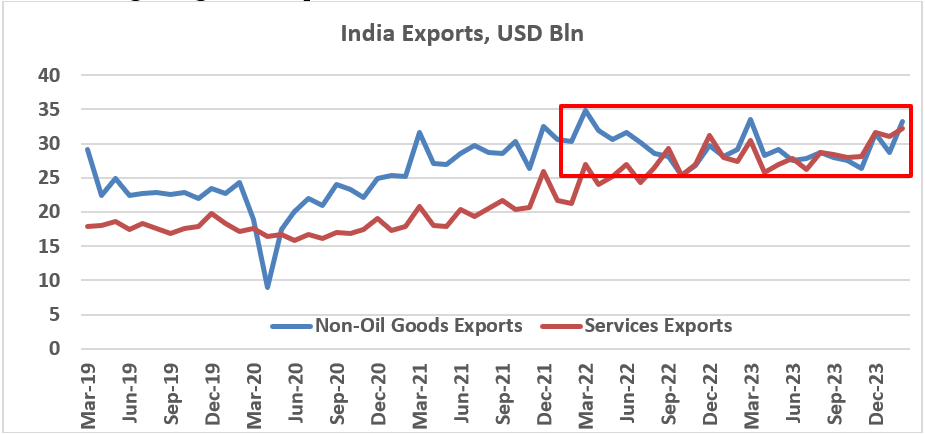

Chart 3: Stagnating Good Exports

(Source: Quantum Advisors, CMIE, Monthly Data till February 2024)

In the post COVID world, as global government stimulus boosted demand, we saw an encouraging increase in India’s non-oil goods exports. It built hope, that maybe India is scaling up and is entering global supply chains. But since then, with a combination a price and volume impact, the export numbers have almost flatlined.

Is India’s reluctance to join any multi-lateral trade agreement impairing its exports? Is the decision to hike import tariffs across a range of industries to incentivise ‘Make in India’ making India’s re-exports costlier and hence getting priced out in a competitive global market.

India is more focussed for now on import substitution related policies. Most of its production incentives are geared towards that as compared to using them for large global export opportunity.

The silver lining though remains India’s strength in Services – especially in IT services and global capability centres. Almost, all of it, is despite any major government efforts apart from tax breaks and SEZs in the initial years.

Given, India’s apparent strength, it may be prudent for the government to may be ask for more bilateral opening up of Services exports with the developed nations. Raghuram Rajan, ex-RBI governor, is the more vocal votary of this going as far as to say that ‘don’t treat services as a step child’2

A Reason to Worry:

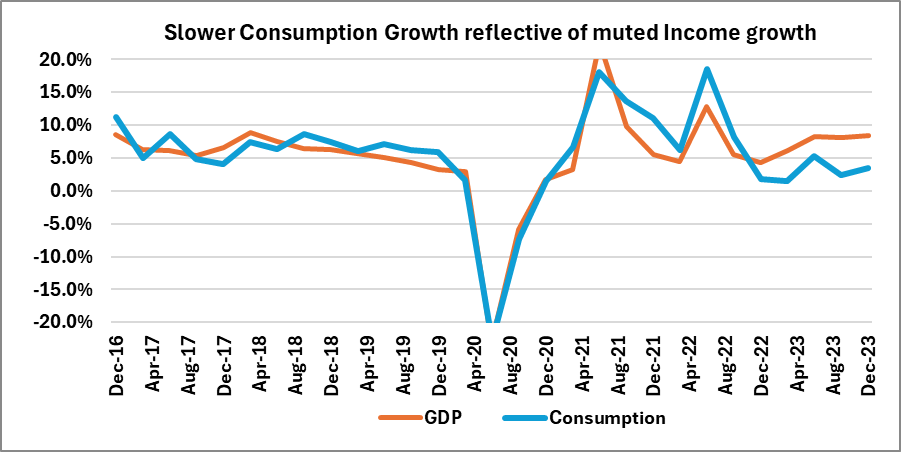

Chart 4: Lack of Income Growth impacting consumer demand

(Source: Quantum Advisors, CMIE, Quarterly Data till December 2023; % yoy; both data in real terms – after inflation; consumption = private final consumption expenditure)

We continue to believe that the income growth of vulnerable sections – daily wage, casual labour, self-employed small business owners – remains much lower than the urban salaried / professional / business persons.

We saw this trend post the demonetisation (November 2016). It got further impacted during GST (mid 2017), credit crisis (late 2018) and then during COVID. Governments lack of direct income support spending and its tight leash on consumption spending has meant that incomes and hence consumption have lagged broader economic growth.

Consumption expenditure is ~55% of GDP3. Slower consumption growth is thus dragging overall GDP growth lower. Given the strong state of balance sheets of the government, corporates and banks, investment led growth should have been a lot higher. Given that demand remains constrained due to lower income growth, the economy seems to be unable to grow faster.

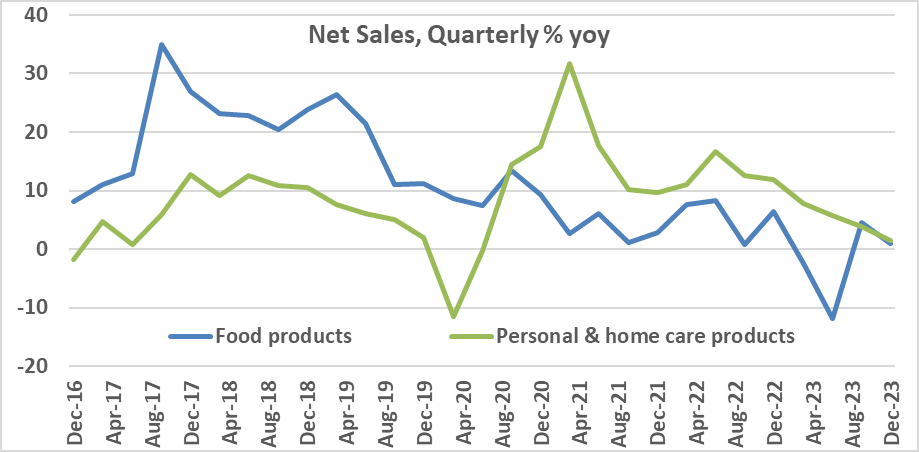

The same trend is visible in the corporate activity as well. The net sales of consumer oriented companies have generally seen a slowdown and/or slower growth as compared to other sectors.

Infact, in the equity markets, consumer staples and durable companies have generally underperformed the broader market.

Chart 5: Lack of Income Growth impacting consumer demand

(Source: Quantum Advisors, CMIE, Quarterly Data till December 2023; Data for aggregate as per CMIE classification and as per interim financials)

A Matter to Delve into:

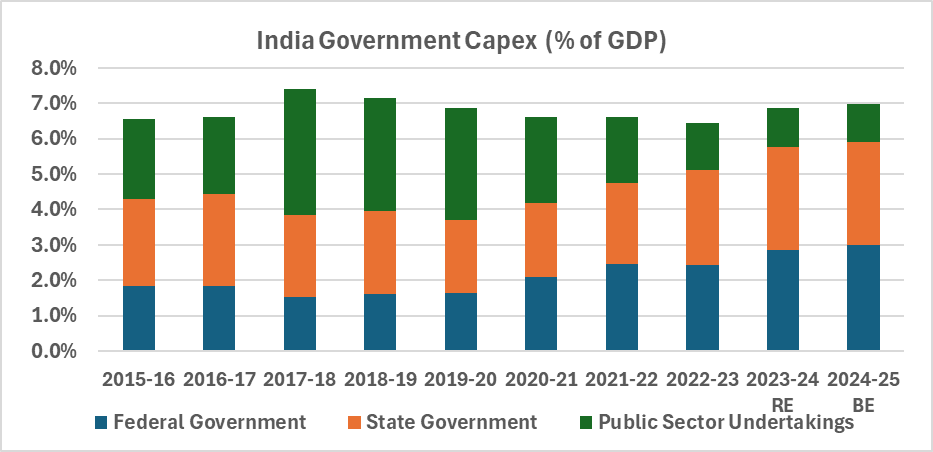

Chart 6: Is this enough to grow at 8%?

(Source: Quantum Advisors, Indiabudget.nic.in; RE= Revised Estimates; BE=Budget Estimates; State government capex for 2023-24 and 2024-25 is assumed; adjusted for centre loan to states for capex)

The Economist wrote a good piece on India’s eye-watering transport upgrade on the investments in roads and railways by the Modi government. Apart from the national and state highways, every major city you visit, you would see metro’s being built and flyovers criss-crossing major intersections. India’s glitzy airports today are a envy of the western world.

A big reason for the poor air quality in major cities would be this hectic pace of transport construction.

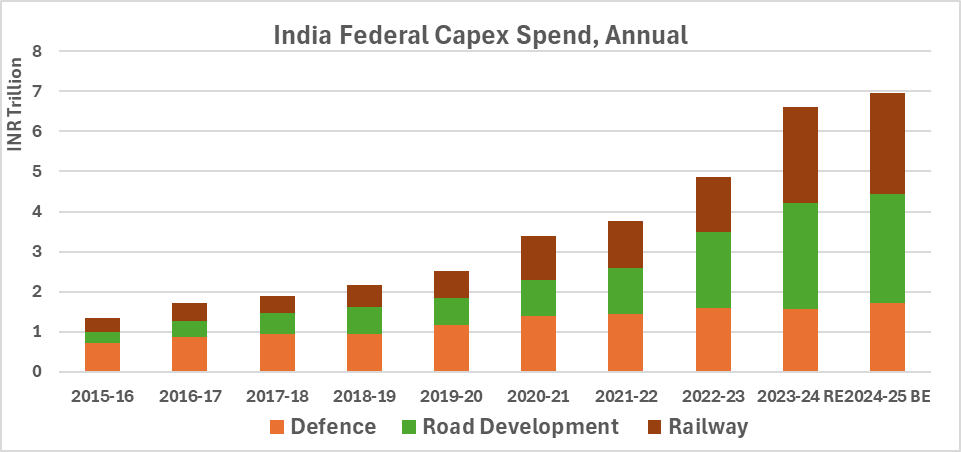

Chart 7: India’s eye-watering transport spending

(Source: Quantum Advisors, Indiabudget.nic.in; RE= Revised Estimates; BE=Budget Estimates; State government capex for 2023-24 and 2024-25 is assumed)

Impressive as this chart is, but as the chart above that (Chart no.6) shows, the overall public spending across federal, state and public sector undertakings (PSUs) has barely increased from its levels of around 7% of GDP. The federal capex number looks to have increased but there has been a similar drop in PSU capex.

This government had done its best given the fiscal constraints. However, the question to ask remains : can this amount of public capex spending drive growth above the 6.0%-6.5% range? In the absence of broad private sector capex, the medium term GDP seems unlikely to grow and sustain beyond 7%.

Now the 6.0%-6.5% GDP growth is respectable number, however, we are uncertain if that is what pockets of the markets have priced. If we look at valuations of certain sectors, it seems to be pricing a lot higher macro growth as compared to what we seem to be generating. If I look at some corporate and investor commentary, the euphoria and expectations on the economy, investor flows, seems a lot higher than the actual reality.

We would like to be realist and our experience over the last 30+ years has taught us to be realist about our expectations from politics, economy and hence from market returns.