"Is India a flailing state?"asked Lant Prittchet of the Harvard University in a brilliant research piece in May 2009. The contradiction of a booming economy with elite institutions and democracy unable to provide a few basic services to its population. He provided examples from varied sectors like education, health, transfer programs where the primary failure was the failure of administration.

This should not be a surprise to our clients who have read our monthly newsletters. A scroll down through Quantum Insights lists down several thought pieces explaining why India is not a ‘macro efficient’ planned economy like China but is a ‘micro chaotic’ outcome of actions of million ‘invisible hands’. We have bemoaned over years on the state of infrastructure, administration, and politics as a hindrance to growth and welfare.

From what we have seen over the last 2 months, the Indian administration has yet again failed to provide reasonable care, support, and facilities to its population.

The moving visuals of patients lying on the pavements outside the hospitals waiting to get admissions; social media being inundated with ‘SOS’ calls; the macabre sights of mass cremations and the painful realization that many are dying, not due to COVID, but due to lack of timely intervention and treatment for COVID.

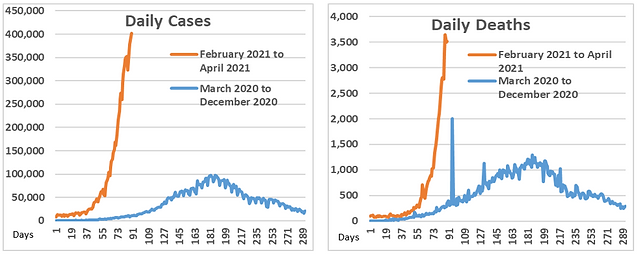

An overwhelming second wave & A staggering humanitarian toll

Source: www.ourworldindata.org

India’s ‘second wave’ began in mid-February 2021 with cases rising in Maharashtra and Kerala. Open borders, State and district level elections, political rallies, protests, religious mass gatherings, cricket stadiums teeming with audience and covid-fatigue travel spread it across the country. People are bound to let their guard down. However, it is the policy makers, across state and the central governments, who have dropped the ball.

On February 21st, the Bhartiya Janata Party (BJP), passed a resolution celebrating the fact that India has won against COVID and eulogizing the prime minister Narendra Modi for his ‘courageous, constructive and far-sighted approach during the COVID pandemic’.

By March, we had a few cities/states announcing ‘soft’ lockdowns to contain local/community spread. In April, the governments task force on COVID-19 apparently advised a strict national lockdown.Ignoring their advise, in a televised address to the nation on 20th April, PM Modi bewilderingly cautioned "States have to try to avoid lockdowns as much as possible".

PM Modi seems scarred by the memories of the 2020 lockdown which led to a steep drop in GDP and the migrant crisis which was for him a PR disaster.

He does not want a visible repeat of that. A national lockdown would also force the central government to provide income and jobs support. The government was stingy in its income support last year. They seem reluctant this year as well. We have argued and continue to argue that India has the resources and it needs to provide income support. A shift in short-term economic policy priority is what is needed.

A policy blunder to not enforce an early lockdown?

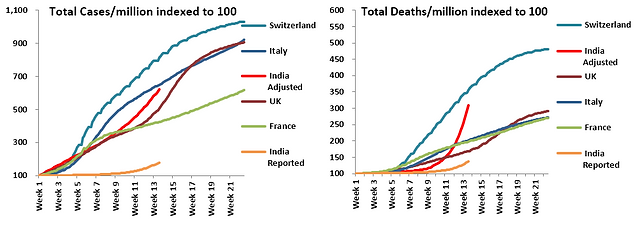

It may be too late to announce a national level lockdown. State level lockdowns may also be a good approach for decentralized decision making. However, by not enforcing a strict ‘mobility’ lockdown, India is going against the standard practice followed by other countries to control the pandemic. As we show in the charts below, India’s second wave trajectory (when adjusted for actual reporting) is very similar to what Europe /UK faced. This explains why India’s already precarious health system under-developed as compared to Europe has been found wanting. However, it also tells you that the situation is manageable, as certain India cities and districts have shown.

Graph 3 and 4: India second wave tracking similarly to Europe, when adjusted for under-reporting

Source: Ourworldindata.org; Quantum Advisors Estimates Note: The chart above is an indexed chart of cumulative cases per million in each country’s second wave. For European countries the data is October 1, 2020 to February 28, 2021, while for India the data is from February 1, 2021 to April 30 2021. The calculation of India adjusted figures is Quantum’s own calculation using internal estimate and assumption based on various news media reports and studies / research released. These source references can be made available on request.

UK and Europe responded by imposing national lockdowns. Of course, it helped that they had a good vaccination policy, strategy, and rollout.

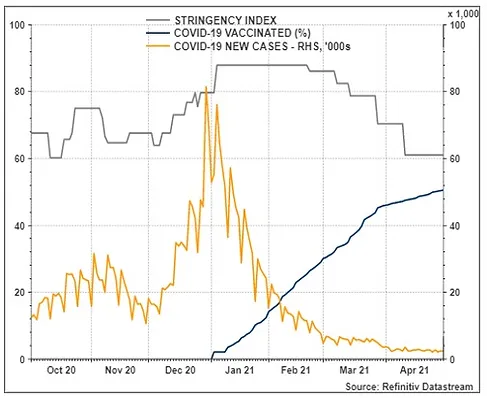

The United Kingdom has seen great success in dealing with its covid crisis. It announced a strict lockdown, supported the economy through income and business support and rolled out a superb vaccination strategy.

The result: the UK economy has rebounded. The Pound has had a stellar run. The Bank of England may be the only developed world central bank talking about rates hikes and removal of emergency measures.

Graph 5: India cannot emulate the UK

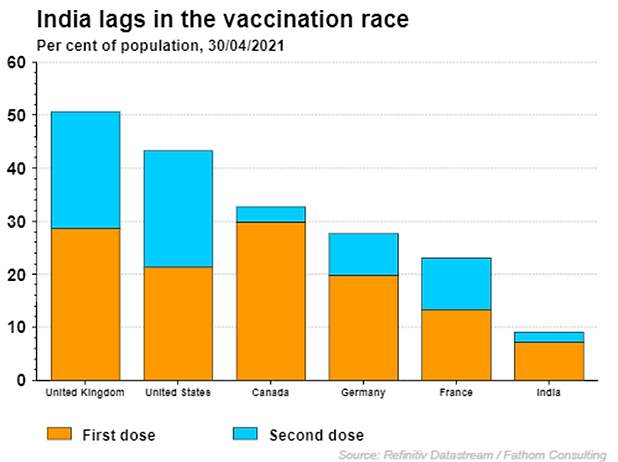

Graph 6: Still much work to be done in India

India cannot emulate the UK; maybe not even other European nations.

No strict Lockdowns: Despite the health system getting over-whelmed and the large increase in deaths, India will not completely lockdown.

No fast-paced vaccination: India, the country with the maximum capacity to produce COVID-19 vaccines is struggling with its own vaccination strategy. The Indian government did not pre-fund the vaccine makers. The Indian government did not pre-order vaccines. The Indian government, we now know, having known the capacity and efficacy of the two vaccines has not given confirmed orders to vaccinate its population. A decentralized procurement now is creating further uncertainties. The Indian government’s vaccination policy is that there is no policy.

No Income and business support: States imposing local lockdowns do not have the financial resources to provide jobs and income support. The effect is a double whammy – curtailed activity, and no income support to cushion that blow.

India seems to have chosen the middle path of soft state specific lockdown to curb the spread and reduce the deaths but at the same time avoiding any large national level income and business support. We expect a drop in FY 22 GDP growth from our earlier estimates of 12.5% to 9.8%.

We must emphasize though that lockdowns without fiscal support could be severe and will impair the economic recovery. The government absolutely must provide that support, whether or not it imposes the full national lockdown. We estimate an income support of INR 2.0-2.5 trillion (~1% of GDP) to be given for the year ending March 2022 and 2023 to support loss of employment and income as well as health costs incurred by the population during the pandemic.

Given India’s dependence on foreign flows, it is incumbent upon the government to convince the world that not only can it contain the virus, but it can emerge stronger on the other side. As it stands, foreign investors are grossly under-allocated to India relative to its economic position and are actively seeking alternatives to China. All they need is sensible, stable, and coherent long-term policies and reforms.

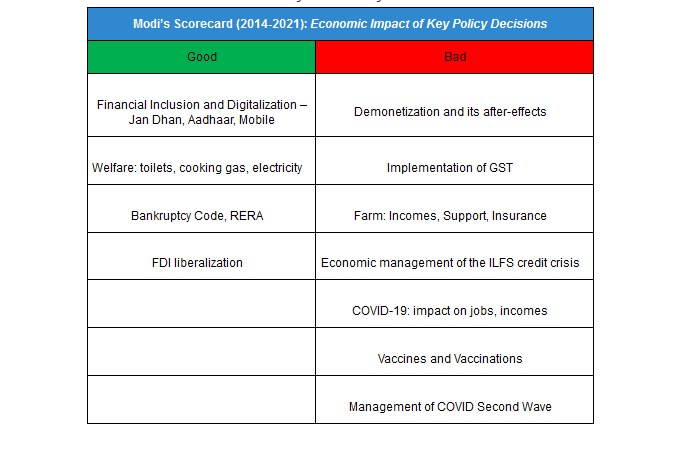

Table 1: More blunders than wins for Modi…so far at least

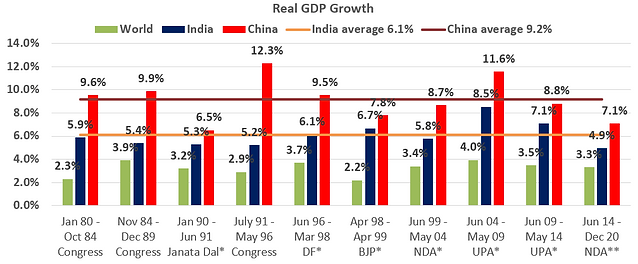

India can yet get back to its 6.0%-6.5% long term growth potential

Due to the slowdown prior to COVID and the hit taken by the economy since the start of the pandemic, we had espoused doubts on the near-term growth. Few earlier measures along with the Union Budget announcement of February 1, 2021, which we believe was the best one presented by this government, had enough policy priorities to get India back on its growth path. Authorities signaled a willingness to let the fiscal deficit widen, knowing they have the central bank’s support in buying bonds to finance that deficit. Further, they indicated an increased desire to privatize and created long-term financing vehicles that ought to solidify economic growth.

Graph 7: India can grow its long-term real GDP at 6.0%-6.5%

Source: Worldbank, RBI and www.parliamentofindia.nic.in as of December 2020

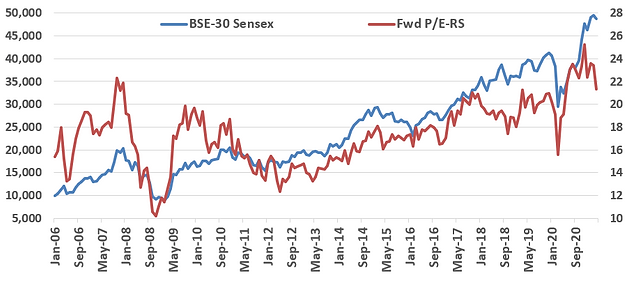

Indian Equity markets continue to hover around its all-time highs. Many seem bewildered by the market’s response. Unlike last year, when the markets collapsed, this time around despite the large increase in cases and deaths, the equity markets for now seem to have tried to put behind any fears.

Knowledge of the virus: Unlike last year, we now know a lot about the virus and the protocols to be followed to bring it under control.

No National Lockdown: India’s stringency index has moved from below 60 in February 2021 to just above 70 in May 2021. Large parts of the economic activities are yet operational.

Listed Corporate India is better placed: They know the procedures to operate in a lockdown, they have cut costs, they have streamlined operations, they are gaining market share and many have raised capital.

Vaccination: Although delayed, India should be able to vaccinate 50% of the eligible population with the first dose in the next six months.

RBI accommodation: Markets have assumed the RBI to remain accommodative, retain surplus liquidity and manage bond yields. Low and negative real rates remain a big support to the economic recovery. The RBI is also likely to allow restructuring of loans and support stressed sectors.

Top 200 million Indians: We may have a billion people, but we do not have a billion consumers. For listed corporate India, how the top 200 million Indians fare makes a big difference. As savings data shows, the rich and the middle class were able to keep their jobs and also boost their savings in the last year. It is reasonable to expect the continuation of the same.

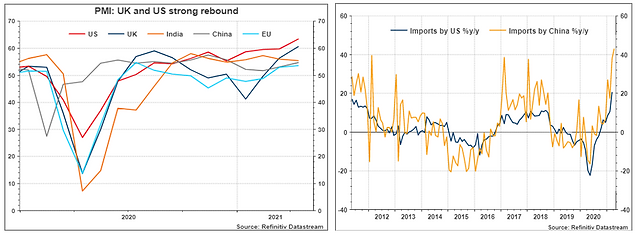

Global Recovery: As shown below, many parts of the global economy have recovered well buoyed by monetary and fiscal support and faster pace of vaccinations. India Inc is likely to benefit from an increase in exports.

The expansion of fiscal deficits globally is expected to drive global growth. The fact that leading economies like the US, UK and China have also been able to vaccinate its population will allow for further opening up of their economies. The strong recovery in global trade and activity levels is positive for India Inc.

Graph 8 and 9: Global growth will aid India’s recovery.

Short-term caution for the markets: Sentiment – of the consumer and the investor

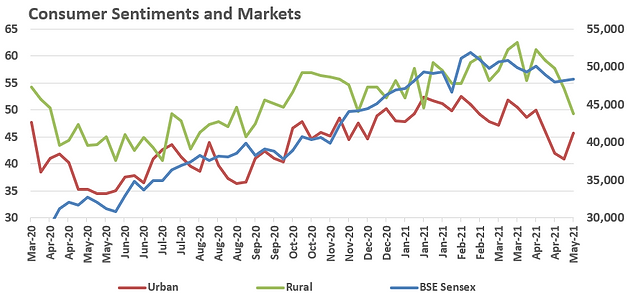

The markets are the sum-total of the expectations and sentiments around all the companies. As the chart on the right shows, consumer sentiments as measured by CMIE have indeed taken a dip over the last month. Loss of jobs and deaths in family could be causing the fall in sentiment.

Graph 10: will the high earnings estimates be downgraded?

Graph 11: Consumer sentiment drops as COVID rages

Source: CMIE, Bloomberg finance L.P.

It was rural India which sparked off the recovery during the first wave. Rural India which was spared the impact of the virus in the first wave, is reeling under the second wave. For now, the markets are yet to factor in any major demand and consumption drop from rural India.

Agricultural income which is a big part of rural India has done well over the last 4 seasons. The monsoon forecast for this year as well is positive. During the last lockdown, agricultural activity was not impacted much. We will hope that this trend continues. The overall rural demand and consumption though is a different story. Job losses exacerbated by lockdown, a stop/start economy and no major income support has dented incomes.

We estimate an income support of INR 2.0-2.5 trillion (~1% of GDP) to be given for the year ending March 2022 and 2023 to support loss of employment and income as well as health costs incurred by the population during the pandemic.

The investor sentiment is driven for now by the foreigners. Foreign investors ploughed in money into Indian public equities last year. Foreigners have been net-sellers over the last 2 months. If the news from rural india continues to remain grim, we may see investors re-evaluating some of their India allocations.

Earnings estimates for companies in the index were increased quite substantially as the economy rebounded post the first lockdown. That may be under threat as input commodity prices rise.

The other issue is the raging issue of inflation. We wrote in detail about how an inflation tantrum can impact Indian equities and bonds. However, it depends on whether the view on India is short-term or long-term.

The Inflation Question depends on the investment timeframe

India will hope for a goldilocks scenario: Higher than average growth and manageable inflation. The initial government stimulus improves incomes and confidence. Private sector investment activity picks up to meet that demand and creates fresh capacities. If the cycle sustains, the Government stimulus fades out with growth remaining high, interest rates normalized, and inflation controlled. This is the best case for Emerging Markets.

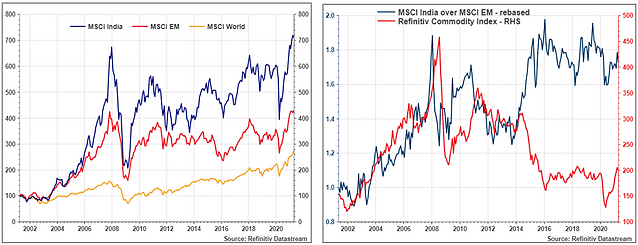

Graph 12 and 13:: Indian Equities thrive during global growth; ‘Good’ Inflation helps emerging markets

(Source: Refinitiv, Chart 6: All data rebased to 100 in January 2002; Chart 7: MSCI India, MSCI EM, Commodity index rebased to 100; Data till April 2021)

The chart on the left is a testament to why global long-term investors need to have a dedicated India equity allocation. Over the last 20 years, Indian equities have delivered significant returns in dollar terms albeit with some volatility. The chart on the right depicts Indian equity outperformance against EM equities using MSCI indices. The outperformance of India over MSCI world in the 2002-2007 period reflects the impact of high growth. However, as global growth stuttered post the US and EU sovereign debt problems of 2011-12, you can notice the Indian outperformance drops significantly.

In our view, only when inflation becomes a serious problem (for eg. Oil prices above $100/brl), do we expect Indian equities to underperform global equities. Growth combined with a measured real economy inflation is good for India and emerging markets.

If the post COVID world indeed resembles the post SARS global growth recovery, Indian equities seem promising. The Inflation tantrum playing out now could lead to an equity market sell-off, which in our opinion will be a great opportunity to increase your long-term India allocation.

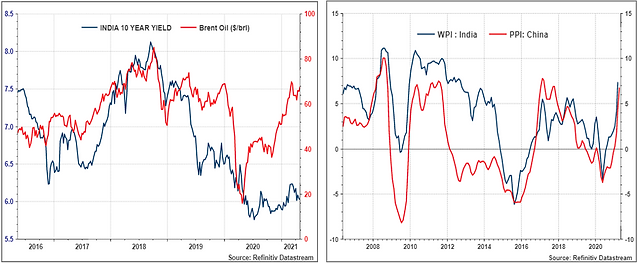

Indian Bonds though face a tougher challenge

Indian Bond yields had moved up sharply on: a) fears of normalization; b) increase in fiscal supplies; c) doubt on RBIs commitment; d) global reflation leading to high global commodity prices and e) Indian bond yields moving in sync with global bond yields.

However, the RBI increased its commitment to announce a US FED type non-discretionary bond purchase program. Since then, the 10-year bond yields moved down from around 6.25% to trade around the 6% level.

Governments bonds will continue see a stronger hand of the RBI. The severity of the second wave has surely pushed back any normalization of liquidity and rates. The RBI will support to manage bond yields and fund any increase in fiscal deficit. Although, we do not see any large drop in yields, but the Indian yield curve remains steep and is attractive at certain maturity points.

Graph 14 and 15 :: Best of the Bond markets are behind us. Wholesale inflation rising at a fast pace.

(Source: Refinitiv, Chart 9: Bloomberg Finance L.P)

In the backdrop of rising commodity prices and increasing global bond yields, Indian bond yields will feel the pressure. We are closely watching the wholesale/producer price inflation as input prices rise due to the rise in global hard and commodity prices. China PPI, we believe remains a key barometer for global inflation fears.

Although, the RBI is managing the bond yields, it may be forced to allow Indian bonds yields to rise in lone with global world. India will hope that the global inflation tantrum is only a short-term issue and that as long term supply responses kick in, commodity prices subside.

Low and negative real interest rates remain the bedrock of the Indian economic recovery. In the near-term, the RBI will be challenged to retain this support.

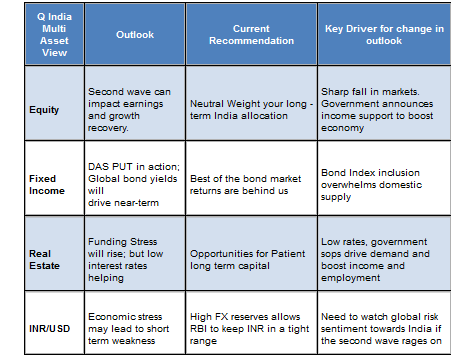

Table 2: : Q India Multi Asset Summary

For more information and if you wish to discuss the details in the article or if you wish to know more about our investment strategies, the investment philosophy and investment opportunities, please contact:

Arvind Chari – [email protected]Arvind Chari is the Chief Investment Officer (CIO) at Quantum Advisors. Arvind’s vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 21 years of experience in tracking domestic and global economy he is Quantum’s thought leader and is the author of this Q-India Insight edition.

*While we shall comply with all applicable regulations and it is our endeavor to follow industry best practices for the benefit of all our clients, non-US persons and investors in our non-US funds should take note that registration of QAPL as an investment adviser with SEC does not imply any level of skill or training. that our non-US clients are entitled to the full benefit of all substantive provisions of the Investment Advisers Act 1940 (Advisers Act) or that we are required to comply with all the provisions of the Advisers Act in our dealings with our non-US clients, including non-US funds. We will thus have responsibilities under the Advisers Act that differ from client to client, based on whether or not the client is a non-US client.

This article is strictly for information purposes only and should not be considered as an offer to sell, or solicitation of an offer to buy interests in the account. Investments in the equity and fixed income instruments are not guaranteed or insured and are subject to investment risks, including the possible loss of the principal amount invested. The value of the securities and the income from them may fall as well as rise. Past performance does not guarantee future results and future performance may be lower or higher than the data quoted, including the possibility of the loss. Quantum Advisors reserves the right to make changes and corrections to its opinions expressed in the document at any time, without notice. Information sourced from third parties cannot be guaranteed or was not independently verified. Comments made herein are not necessarily indicative of future or likely performance of the account and are based on information and developments as at 14/05/2021 unless otherwise stated.

All of the forward-looking statements made in this communication are inherently uncertain and Quantum Advisors (QAPL) cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “should,” “can,” “may,” “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume,” “target,” “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities law.