India was a large part of the Global Economy

India's engagement with global trade and investment stretches back through various civilizations, marking a significant presence in the world economy. The East India Company, often regarded as the first multinational corporation (MNC), was established for commerce within the Indian Ocean territory, including the East Indies, South Asia, and India itself. This entity eventually extended its influence to colonize extensive regions of present-day India. 1

For over a hundred years, numerous international corporations and brands have maintained operations in India. However, during its early years as a sovereign nation, India was wary of foreign enterprises due to prevailing nationalist and socialist sentiments. India’s relationship with the United States deteriorated sharply during the Nixon-Kissinger years when the United States supported Pakistan during the war for the liberation of Bangladesh in 1971 and sent the Fifth Fleet to threaten India, which was supporting Bangladesh. In response, a mandate was introduced in the 1970s limiting foreign ownership in Indian subsidiaries to 40%. This led to the departure of several companies from India, including IBM and Coca-Cola. 2

India’s socialist turn had an impact on investment by foreign corporations in India

Those that remained had to adapt by going public, thereby reducing their stakes and listing new shares on Indian stock exchanges. This move significantly enriched India's stock market culture, allowing Indian citizens to invest in and own parts of the companies whose products they patronized daily -such as Unilever, P&G, Nestle - which have been publicly traded since the 1970s and 1980s.

In a pivotal shift in 1991, India liberalized its economy, embracing foreign investment and capital. Companies like IBM and Coca-Cola re-entered the Indian market in the 1990s and have continued to invest. Presently, nearly 90% of Foreign Direct Investment (FDI) is processed through an automatic route, bypassing the need for direct federal government or central bank approvals.3

Indian entities of Global MNCs have created enormous returns for their shareholders

Over the years, many international corporations, whether publicly traded or not, have found success by building businesses in India. The Indian stock market has a history of valuing well-managed companies with robust brand identities, as evidenced by the stock market performance of Indian franchises of McDonald's, Dominos, Jockey International.

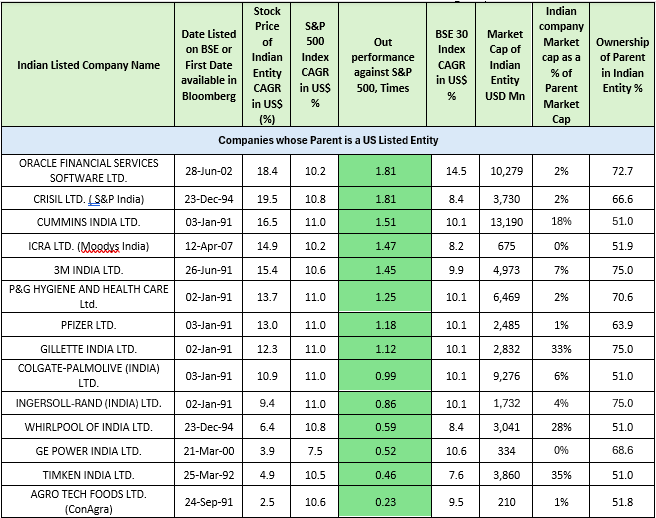

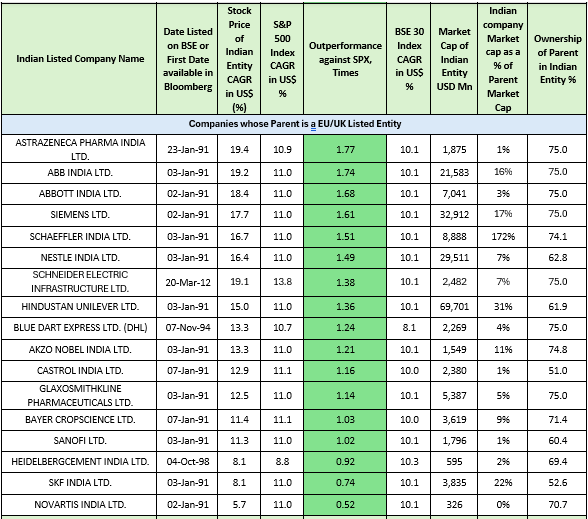

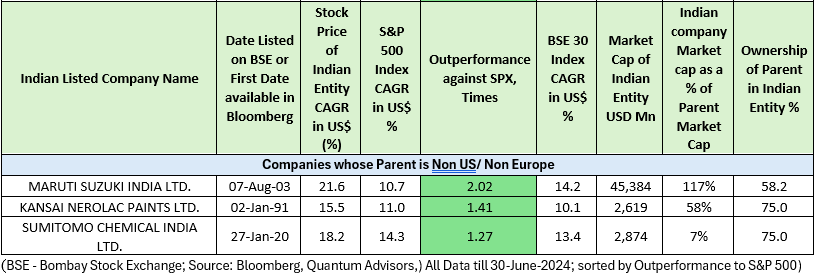

Our analysis of 34 MNCs with businesses in India and with local shares listed on the Indian stock exchange (see table below) shows that:

- all the 34 businesses have done well in India;

- not only did the parent MNC make money doing business in India and earning royalties, selling raw materials, products and know-how, etc but - on average - the parent MNC witnessed a 13.6% CAGR in US$ from their investment in the Indian listed entity, compared to a 11% return in the S&P 500 over the same time period. This suggests an outperformance of ~20% against the S&P 500 Index;

- 26 of the 34 stocks of listed Indian affiliates of the MNC companies in the analysis outperformed the local India BSE-30 Index;

- Boards, CEOs, shareholders of these MNCs have reaped the benefits of investing in India.

Table: Global MNCs Invest and Flourish in India; Their Pension Funds are missing out

The above representation is purely for Illustration purpose. This is not a recommendation to buy or sell any particular security(ies). The security(ies) may or may not form the part of our portfolio. Past performance is not an indicator of future results.

As the data shows, few Indian entities are large enough as a market and as shareholder value to the global parent. This will be the case eventually for most organisations as India grows in size.

There are of course, many MNCs who have exited India for various reasons – predominantly due to trying to force fit their global way of doing business in India, and/or having unreasonable growth and profitability expectations from the India company. However, the table above is also a testament to companies who have made long-term local dedicated commitments to its India businesses and have seen them succeed.

Intel, which re-entered India in the 1990s, recently announced that they will now treat India as a standalone region 4 . Apple has made a dedicated switch to India as a move away from China. This is the best way forward for success in India.

We have been long arguing that financial investors should also consider India as a standalone destination.

India is now ~4% of Global GDP; ~4% of global market capitalization. Bracketing India as part of EM, Asia, Asia ex Japan, Asia ex China and Japan, BRIC etc. is lazy and detrimental to long-term outcomes.

These MNCs are large, global corporations. They have recognized the long-term India opportunity and allocated dedicated capital and resources to their India businesses. These corporations run their own large pension funds for their employees. We have a simple question to the Corporate Pension Fund CIOs, to the management and the Board: Why are the Pension fund assets not allocated in a dedicated manner to India?

We see very few ‘INTEL’s’ in the long-term institutional investor community.

For instance, based on P&I data5, the Top 1000 US pension funds (State, University and Corporate) total to about USD 12 trillion in Assets Under Management (AuM). If we consider only US Corporate pension plans, as per our data analysis, just above 750 of them with assets of ~USD 6 trillion. The ECB puts the EU Pension Fund size at EUR 3.2 trillion.6 and including the UK, the IPE puts it at EUR 6.7 trillion7

India requires investors who want to invest in public accounts on their own account to register as Foreign Portfolio Investor (FPI)8. Investors who invest in India through global/EM/Asia funds or India Dedicated funds either in public and/or private markets need not have their own license.

Less than 100 of the 1,000 US entities have a direct registration to invest in Indian markets. For US Corporate Pension Plans, only a handful would have registrations. The pattern of EU and UK pensions is the same: very few of the pension funds have India registrations.

from those who have the India registration, it is likely that it would be to invest as part of a Global or Emerging Market bucket which happens to have an India allocation. We do not see large India dedicated allocations by these pension plans.

This is in sharp contrast to what the corporations, their CEOs and their management boards are likely to do as they seize the India opportunity. As we have shown, many MNCs focused on good governance have found a way to make profitable direct investments in India for years and many are likely to come on board as they pivot away from China and participate in the India opportunity.

The logical aspect would be to see corporate pension CIOs following the path of their corporate CEOs in making dedicated long-term India investment allocation.

India Public Equities is the most sensible way to participate in the long-term India story.

Foreign investors have allocated 2X more capital to India private assets like Private Equity, Venture Capital, Infrastructure and Real Estate than in Public Equities. Again, a large part of is driven by investments by US domiciled global Private asset managers.

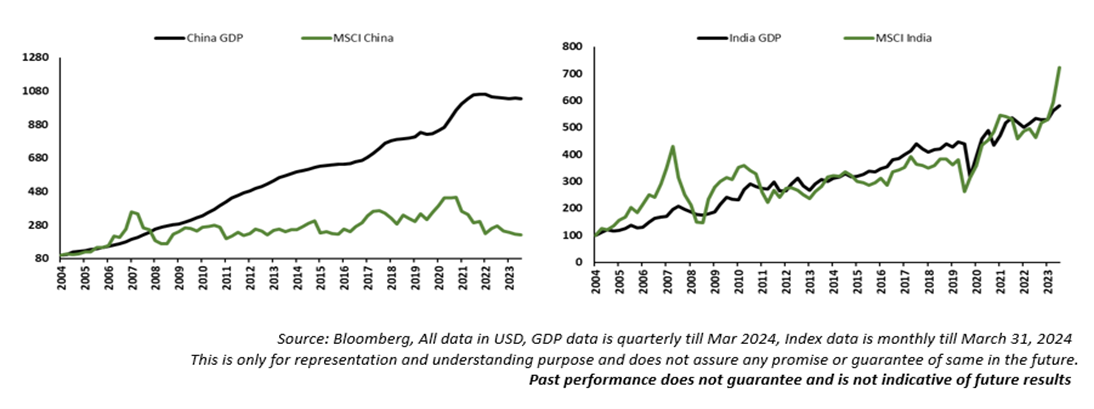

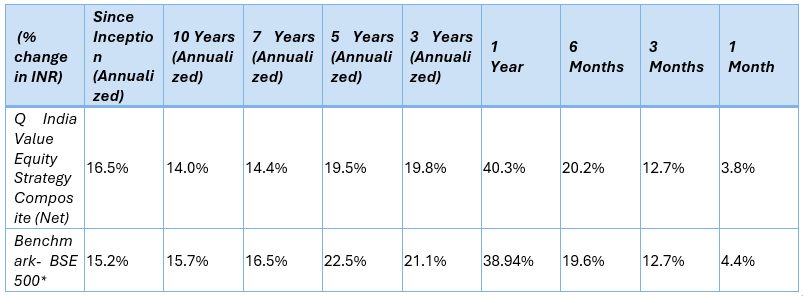

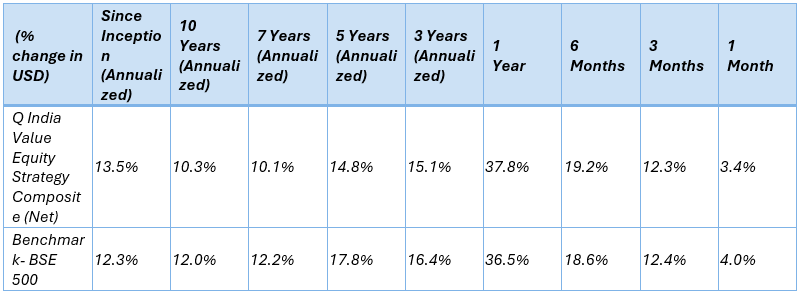

However, as this chart below and as the long term returns in the table shows, India Public Equity is the best way to play the India long-term story.

Chart 1 and 2: India GDP Growth Reflected In Equity Markets

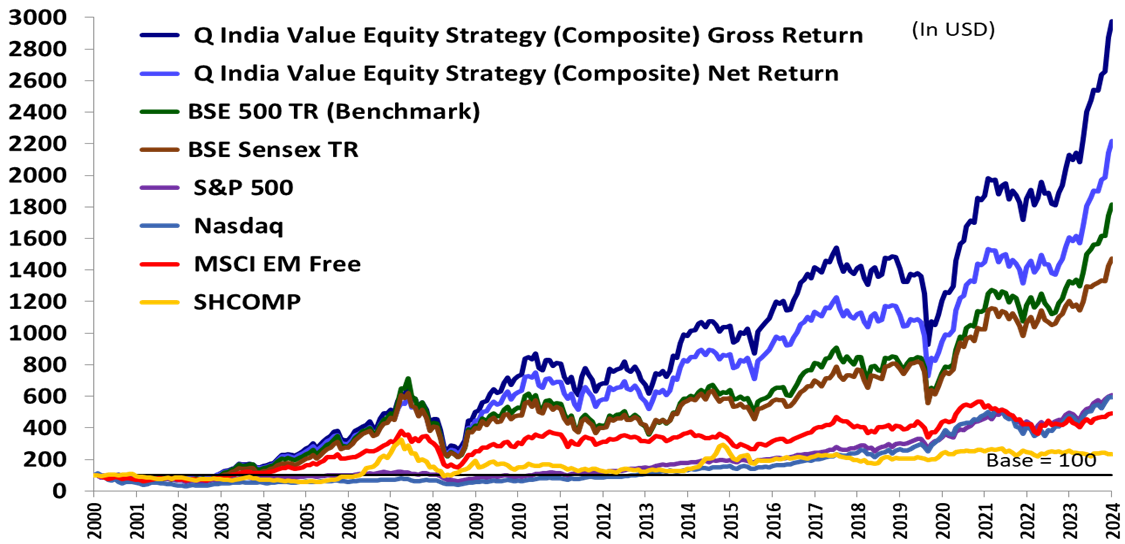

Chart 3: Global Investors are under-invested in India and are missing out on India’s stellar returns Across 23 Years Of Mood Swings, Quantum India Returns 1.8x > S&P 500

In 2005 – India was “BRIC” ; In 2013 India Was “Fragile Five” ; In 2015 India Was “TINA” Since 2021 India is “China + 1”

Source: Quantum Advisors, Bloomberg Finance L.P.; As of July 31, 2024

The performance shown above does not guarantee future results and future performance may be lower or higher than the data quoted. Please refer Disclosure Statement for important performance related disclosures and disclaimers. The Quantum India Value Equity Composite’s (QIVEC) inception date is considered as August 01, 2000 as per our internal performance computation policy and procedures. * Effective April 1, 2023, the Benchmark for QIVEC has been changed to S&P BSE 500 TRI as prescribed by SEBI, India. Note- The return shown above are computed as per Quantum’s internal policy and procedure on performance computation. The returns of QIVEC computed in accordance with SEBI guidelines, as applicable from time to time and the computation methodology prescribed in the SEBI guidelines are given in Annexure 1 at the end of this document."

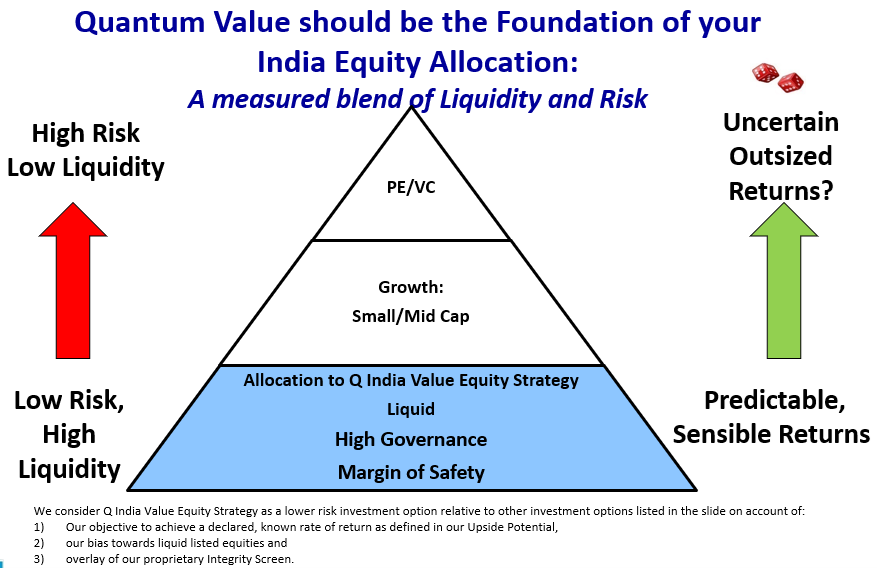

The Quantum India Value Equity Strategy has a track record going back to the year 2000. Its goal is to generate sensible returns in a liquid, scalable, high-governance portfolio, which is built with a margin of safety.

So investors who want to roll the dice and are not bothered about governance and valuations can of course buy the Indian indices and other growth managers. However, If you are looking for a long-only, India portfolio which is liquid, avoids the 'crony capitalists', is built on sound principles of value investing, and delivers a predictable outcome, speak to us.

Footnotes:

- The world’s most powerful corporation - BBC Worklife

- choudhury,khanna_charting-dynamic-trajectories.pdf (harvard.edu)

- Press Release Ifrma Page: Press Information Bureau (pib.gov.in)

- Intel designates India as a separate geography - The Hindu BusinessLine

- P&I 1,000 Largest Retirement Plans 2023 - Full List | Pensions & Investments (pionline.com)

- Euro area pension fund statistics: first quarter of 2023 (europa.eu)

- IPE Top 1000: European pension assets grow by 9% | Special Report | IPE

- SEBI | FPIs / Deemed FPIs (Erstwhile FIIs/QFIs)

Recipients should exercise due care and caution and if necessary, obtain the professional advice prior to taking any decision based on this information. Click here to read all important disclosures and disclaimers.

Annexure 1

Performance of the Q India Value Equity Composite (QIVEC) computed as per methodology prescribed under SEBI guidelines

Inception Date: June 27, 2000; data as of July 31, 2024

Disclosure Statements:

-

Composite inception date is taken as the date on which the Portfolio Account is funded by the Client and accrual of Management fees commences.

-

All INR to USD conversion has been done based on RBI FX Rates till May 2010, and WM Reuters Closing Spot Rates (4pm UK time) from June 2010 onwards.

-

The performance shown above does not guarantee future results and future performance may be lower or higher than the data quoted.

-

Recipients may check the relative performance of investment approach offered by other Portfolio Managers under the same strategy by clicking here.

Brief note on performance computation methodology under SEBI guidelines:

SEBI has prescribed specific guidelines on computation and disclosure of performance by portfolio managers to their clients and in marketing materials. A summary of these guidelines is give as below.

-

The performance of a discretionary portfolio management mandate shall be calculated using Time Weighted Rate of Return (“TWRR”) method.

-

Cash holdings and investments in cash equivalent are considered for calculation of performance.

-

Performance computed and reported shall be net of all fees and all expenses (including taxes/statutory levies thereon).

Statutory Disclosures:

-

The performance reported above is not verified by SEBI.

-

Quantum Advisors provides a direct on-boarding option to clients who wish to avail our services, without intermediation of persons engaged in distribution services.

-

For detailed description of Q India Value Equity Strategy such as investment objective, assets allocation pattern, investment strategy and philosophy, associated risk factors and other details please refer to the Disclosure Document available at www.qasl.com.

Important Disclosures & Disclaimers

Any information contained in this material shall not be deemed to constitute an advice or an offer to sell/purchase or as an invitation or solicitation to invest in any security and further Quantum Advisors Private Limited and its employees/directors shall not be liable for any direct or indirect loss, damage, liability whatsoever arising from the use of this information.

Recipients should exercise due care and caution and if necessary, obtain the professional advice prior to taking any decision based on this information.

-