Tim Cook, the CEO of Apple, is India's newest celebrity. The opening of the first Apple store in India, in Mumbai and Delhi, is all the rage. Tim's face is all over print, online and social media. Apple users and lovers have waited in queues for the store launch. The allure of the Apple store experience and India's penchant for shopping would mean footfalls will remain high.

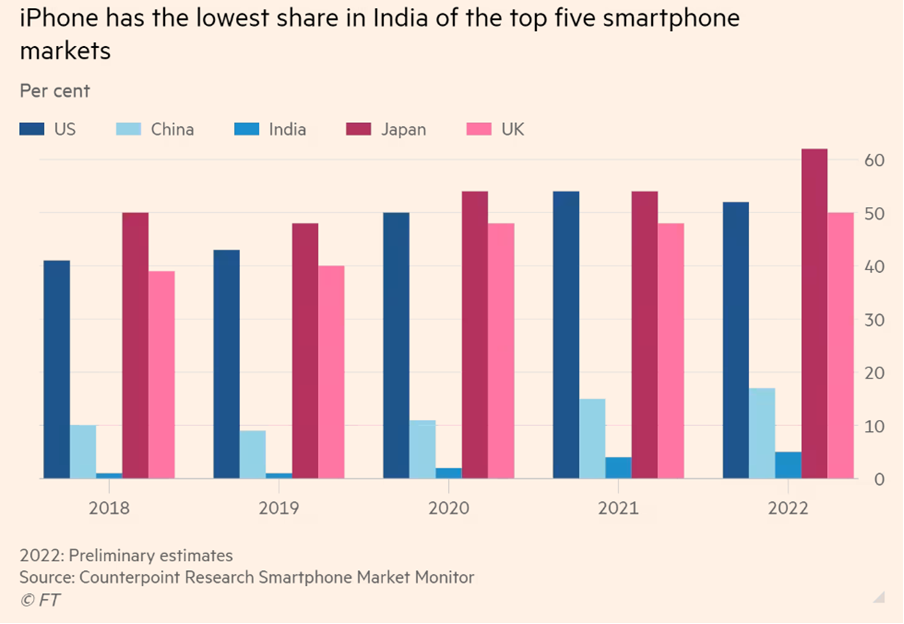

The question though is how many Indians can afford an Apple product. Among the countries which have an Apple Store, India has the lowest per-capita income.

However, what India has is size. Even with average per capita income below USD 3,000; India has ~70 million households (~300 million people) who can afford an i-phone or an apple product. That is indeed a large market. Apple is playing in India on the proverbial hope of the rising Indian consumer class.

However, what is getting us excited is not Apple opening its store. It is Apple producing its products in India and exporting to the world.

Apple's suppliers, Foxconn, Pegatron and Wistron began assembling the i-phone in India in 2021. From 1% of global production, reports suggest that as of March 2023, India is producing ~7% of global i-phone production. An earlier Bloomberg report had suggested that Apple is looking to increase it to 25% by 2025-2026.

Apple sold ~USD 200 billion worth of i-phones in 2022. Assuming it has a 50% margin, that would mean, Apple's suppliers make i-phones worth ~USD 100 billion. 25% of that would mean the Indian assembly would be about USD 25 billion by 2026. assuming 80% of that is exported, that would mean USD 20 billion of gross exports.

An operation of that size would spawn an eco-system of companies, technologies and skill levels which would be helpful in other aspects of electronics and consumer durables production.

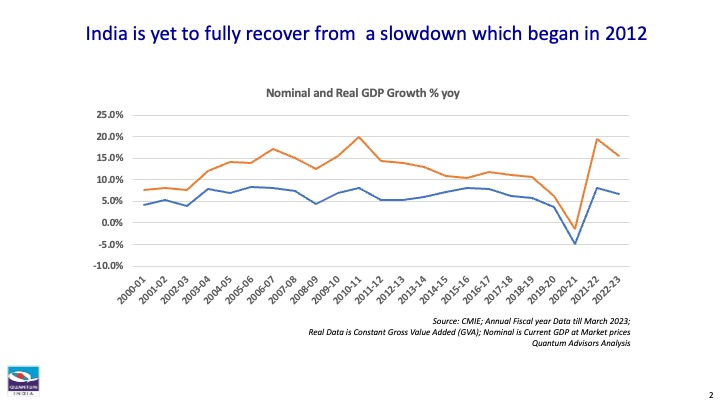

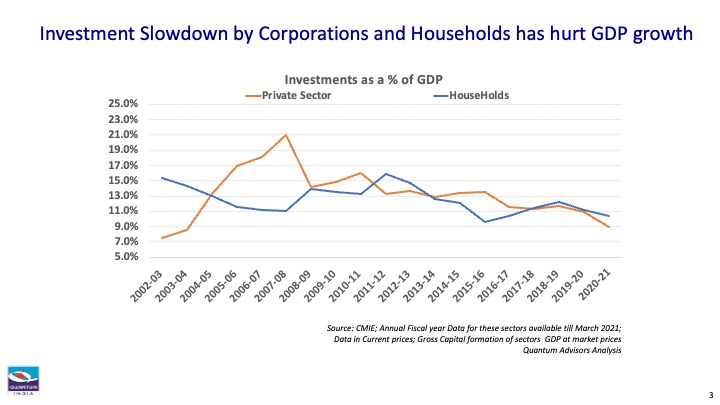

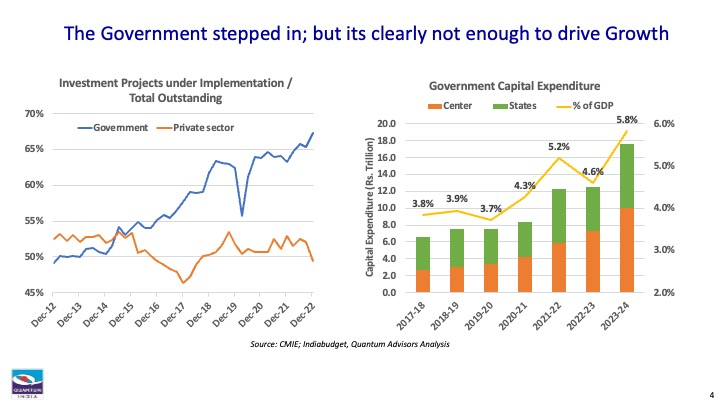

India needs many more such investments from global producers. It is imperative that Apple succeeds and crowds in other fortune 500 global corporations to look at India as a production, assembly, outsourcing base.

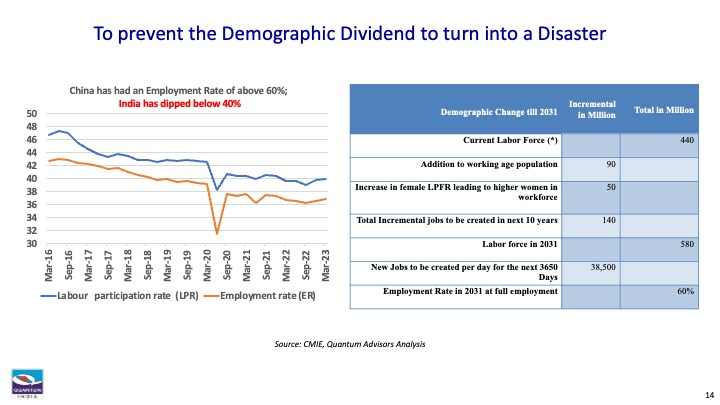

India not only needs the investments, but it needs these investments to create jobs for its young population.

Apple's suppliers have created 100,000 direct jobs in the last 2 years. As they scale capacity, they will create more jobs. The pleasing aspect is that 70% of these jobs have gone to women.

India needs to create ~>27,000 jobs per day for the next 10 years to absorb its growing young workforce. It will need to add more, to absorb movements away from agriculture. India's dismal female labor force participation will also rise as salaries rise enough to motivate women to seek work outside the homes leading to more job demands.

Getting Apple into India is indeed a success. The Government's Production Linked Incentive (PLI) which is applicable to Apple's suppliers as well is ambitious. The government will dole out incentives worth USD 25 billion in a 5 year period and estimates production value of ~USD 400 billion and new job creation of 6,000,000. That is ~3,750 jobs per day over the next 5 years.

For India's demography to remain a Dividend and not turn into a disaster, India needs Many Apples a Day to keep unemployment and social tensions at Bay!