In February 1990, our Founder Ajit Dayal wrote an article in the Asian Wall Street Journal ‘Loosen the Reins on India’s Bull Market’.

Over the past 4 decades, India has received over USD 400 billion in Foreign Portfolio Flows and India has been part of the BRIC mania, then shunned as a ‘Fragile Five’ when Ben Bernanke was readying for his ‘twist’ in 2013, and has since evolved into TINA and China+1.

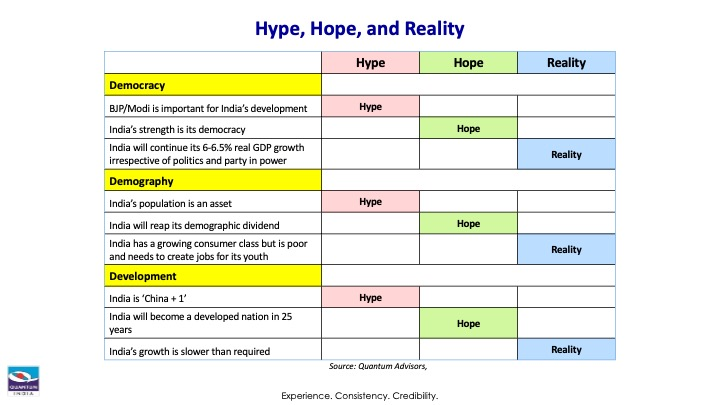

As 970 million Indians cast their votes over the next two months and as international allocators assess the India investment opportunity and the ‘Hopes’ hanging on India’s demography, democracy, and development, listen in to Ajit Dayal, Founder, Quantum Advisors and Arvind Chari, CIO, Q India UK as they dissect the Hype, Hope, and Reality of the India Opportunity.

India Investing: Perspectives on Long Term Asset Allocation

Interview with Ajit Dayal, Founder of Quantum Advisors and Arvind Chari, CIO

Interview Summary Slides

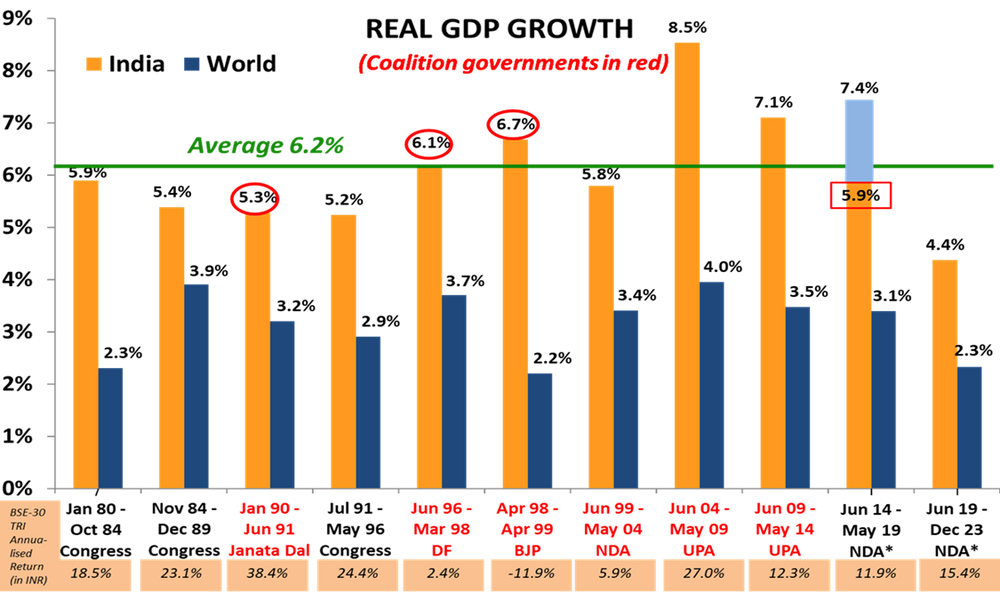

Since then, the Indian stock markets have surged over 200x while India’s average annual real rate of growth in GDP has been +6% per annum.

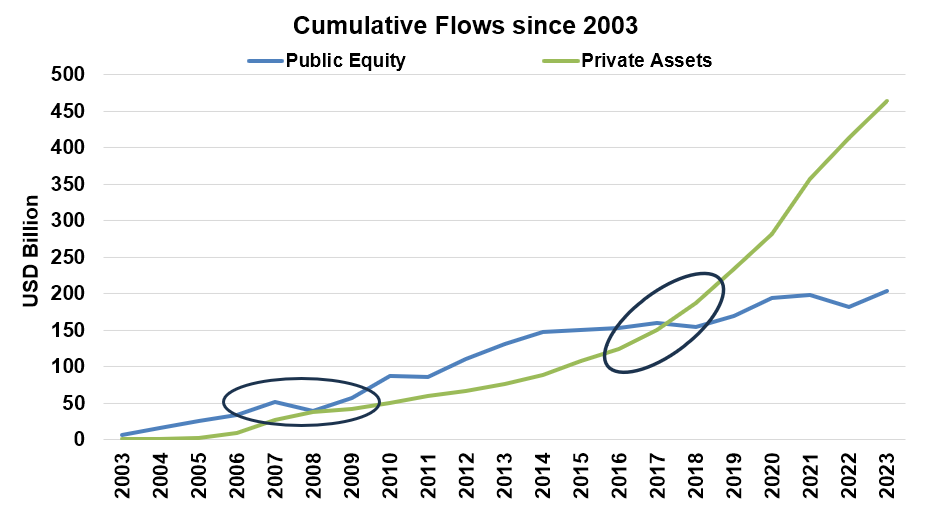

Over the past 4 decades, India has received over USD 500 billion in Foreign Portfolio Flows into Public and Private Equity (see chart 2 below).

Big Bang Reforms of 1991 saw India emerge as part of the ‘BRIC’ mania, then shunned as a ‘Fragile Five’ (when Ben Bernanke was readying for his ‘twist’ in 2013) and has since evolved into ‘TINA’ and ‘China+1’.

Investors need themes and stories to invest. However, investing in the hype of a theme without being realistic about expectations can lead to bad allocation decisions.

We saw that during the ‘BRIC’ mania. Driven by the expectations of 9% GDP growth and an appreciating currency to continue forever, we saw large foreign flows into small cap and private equities; tier 2/3 real estate and risky greenfield infrastructure.

India benefitted from the flows and capital as things got build out. However, the General and Limited Partners (GP/LP) who made and backed some of these investments had horrible outcomes. So much so, to eventually lead one investor to remark that ‘INDIA – I will Never Do It Again’.

As global corporations and investors ponder over ‘Is China Investable’? – the more the discussion veers towards India.

how much under invested and under allocated India has been in comparison to China, it is no surprise that India is the talk of the town.

The euphoria is visible in Investor interest with flows over time across FDI, Equity and Bonds. The number of global corporations looking to enter and/or increase the presence in India is rising.

We can see that ourselves in our growing discussions with large institutional investors who are looking at having dedicated investments and are researching and studying the Indian market and the economy closely.

However, India often disappoints the Optimist and Pessimist – so goes the saying. We would add that it pays to have a healthy dose of scepticism on everything you hear about India – as with the adage, ‘everything you hear about India, consider that the opposite is also true’.

Politics – Hype, Hope, and Reality

India’s economic rise; its place in geo-politics; and Prime Minister Modi’s global outreach has definitely raised India’s profile. The comprehensive US-India statement post PM Modi’s visit in June 2023 was enough for the Economist to put India on the front page as ‘America’s New Best Friend’.

We see domestic and global corporations and investors pinning lot of hopes on the leadership of Mr. Modi and his party the Bhartiya Janta Party (BJP) for India’s economic outcomes. There has been marked improvement in delivery of welfare and services, creation of infrastructure and investor sentiment. They have also embarked on some tough institutional reforms.

However, we would caution on the aspect that India’s outcomes are dependent on one person or one party. For instance, see this recent comment by Jamie Dimon. While true, but it seems to be construing that one person is driving all the change. This positioning also wrongly tends to bracket India with the ‘strong man’ syndrome which has plagued the other BRICs – Brazil, Russia, China.

As 970 million Indians cast their votes, international allocators are assessing the India investment opportunity with their ‘Hopes’ hanging on India’s demography, democracy, and development.

However, as we have noted, Elections and the party in power, be it of the left or the right, single party or coalition, weak man or strong man, has not altered India’s economic trajectory of growing at 6.0%-6.5% real GDP. All parties in power follow a steady blue print of broad reforms.

Chart 1: Election results have not mattered to long-term GDP growth

(Source: Worldbank, RBI and www.parliamentofindia.nic.in as of December 2023. Note: The number in red rectangle is from a changed data series starting Jan 2015. While a “superior” series, there is no comparable number to equate the “New” with the “Old”. Most economists deduct 0% to 1.5% from the “New” to equate to the “Old”; World bank data is annual estimate)

Demography and Income – Hype, Hope, and Reality

India is a young country. The average age is ~28. India has recently entered the demographic dividend phase of more than 50% of the population as working age. As economic growth picks up and more labor force rises, household incomes, saving and consumption will swell. This is of course well known and is the India long term opportunity.

India is still poor. On a rough guesstimate, The top 30-40 million Households tend to be the discretionary consuming class. The next ~200-220 million households are subsistence and the last ~30-40 million households are poor. The size of the market opportunity, hence needs to be calibrated accordingly.

Also, India is not investing fast enough to be able to provide meaningful jobs to all its citizens. India’s employed population is below 50% of work force much below China’s in its growth phase. Jobs for its educated, aspirational and aware youth is an ever present social challenge.

Make in India/China + 1: Hype, Hope, and Reality

Japan, Korea China grew in double digits for close to two decades. We do not expect to see that in India. India missed out on the global manufacturing value chain. Initiatives like Make in India and production linked incentives and capital subsidies (~USD 40 billion) are trying to spur manufacturing. The success thus far has been in electronics and now seemingly in semi-conductor chip assembly and packaging.

However, as an investment play for financial investors, we do not yet see significant scope. Government choosing winners in sectors is concerning with respect to policy, corruption etc. and uncomfortable for us as fiduciary, minority investors. Also, we find that the valuation on offer on some aspects is not very encouraging. As the opportunity broadens, we should expect to see more options, however, it would pay to have realistic expectations.

Foreign Allocation: Hype, Hope, and Reality

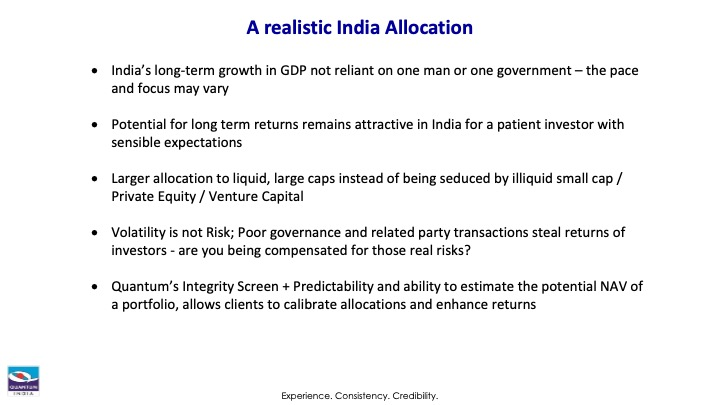

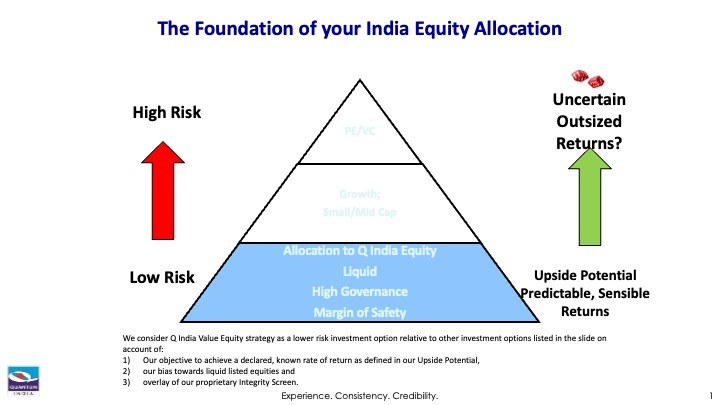

India has seen more than USD 500 billion in flows into public and private markets. However, we have seen 2x flows in Private assets over public equities. The first phase of over allocation was in the BRIC era which as we noted didn’t go all that well. Post the Chinese crackdown on technology sectors, we saw a surge of flows into Indian Private equity, venture capital space. We are almost certain that many of these investments will not deliver expected returns.

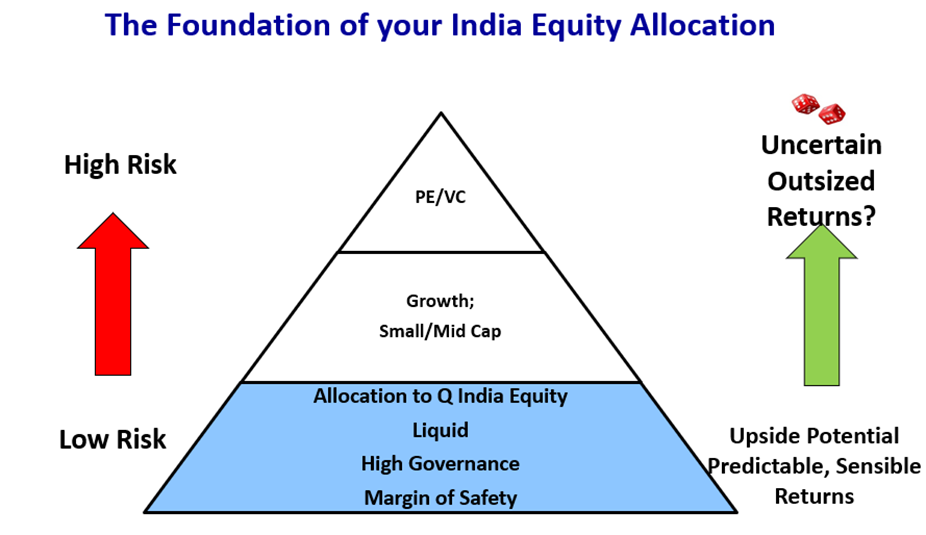

Even in public markets, we are increasingly seeing flows driven by passive ETF allocations. India’s weight in the MSCI EM Index has increased. We note that passive investing is like ‘rolling the dice’ and ignoring the risks of governance, valuation and tracking error due to rebalancing and capital gains.

Chart 2: India poised to get more Foreign Investment flows, however investors need to allocate correctly

Source: Quantum Advisors NSDL, IVCA, Private Assets includes Private Equity, Venture, Infrastructure, Real Estate, Private Flows are Gross and does not include exits; Annual Calendar year data till 2023)

Our experience over the last 30+ years has taught us to be realist about our expectations from politics, economy and hence from market returns. We believe that a realistic long-term India allocation should be overly biased and allocated to a strategy which offers sensible, risk adjusted and predictable outcomes.

For detailed description of Q India Value Equity Strategy such as investment objective, assets allocation pattern, investment strategy and philosophy, associated risk factors and other details please refer to the Disclosure Document available at www.qasl.com.