Over the next few months, we will look at the various aspects that we think will shape India in the coming 25 years.From now till 2047. India as a nation state would be 100 years old.

In February 1990, our Founder Ajit Dayal wrote an article in the Asian Wall Street Journal 'Loosen the Reins on India's Bull Market'....

In our last insight piece, we looked at India@75- How Geo-politics shaped India - a crucial aspect which does not get as much importance as it deserves in explaining India's trajectory as a nation. In an interview, Ajit Dayal, founder Quantum Advisors, looked at the social, political and economic decisions India made in its 75 year journey and argues that those were all shaped by global events and circumstances - be it the independence post World War 2; the idea of non-alignment; India's pivot to Russia as Nixon embraced China in the 70s and the fall of the Berlin wall which made India look to the west unleashing market-economy reforms.

For this piece, I look at this notion of 'Decoupling'. Time and again, when Indian market performance looks invincible, commentators forward this concept of India having 'decoupled' from the rest of the world. 2007/8, was one such occasion that I remember, when India's growth and Indian markets were on a tear. India was a shining star amongst the chosen 'BRICS'. We know how that ended. Within five years, India was a 'fallen angel' and part of fragile five'.

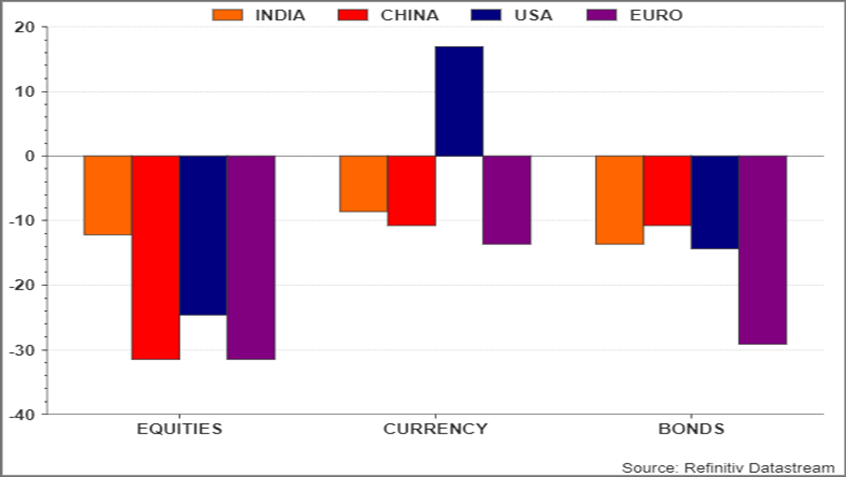

India's relative market performance this year across asset classes has got the market talk going on India decoupling again. As the chart shows, that hope is justified and not without reason.

Chart 1: India Markets ''De-coupled'?

(Source: Equities - MSCI Indices in USD; Bonds - respective government bond ETFs in USD; currency - USA - dollar Index); (Data is YTD % change till September 29th, 2022)

Today, given a higher share of domestic consumption and lower share of global supply chain, India is less dependent on global world for its growth. However, if we look at the next 20-30 years, as India grows and takes up a larger share of the global economy, India will be more integrated into the world, instead of decoupling.

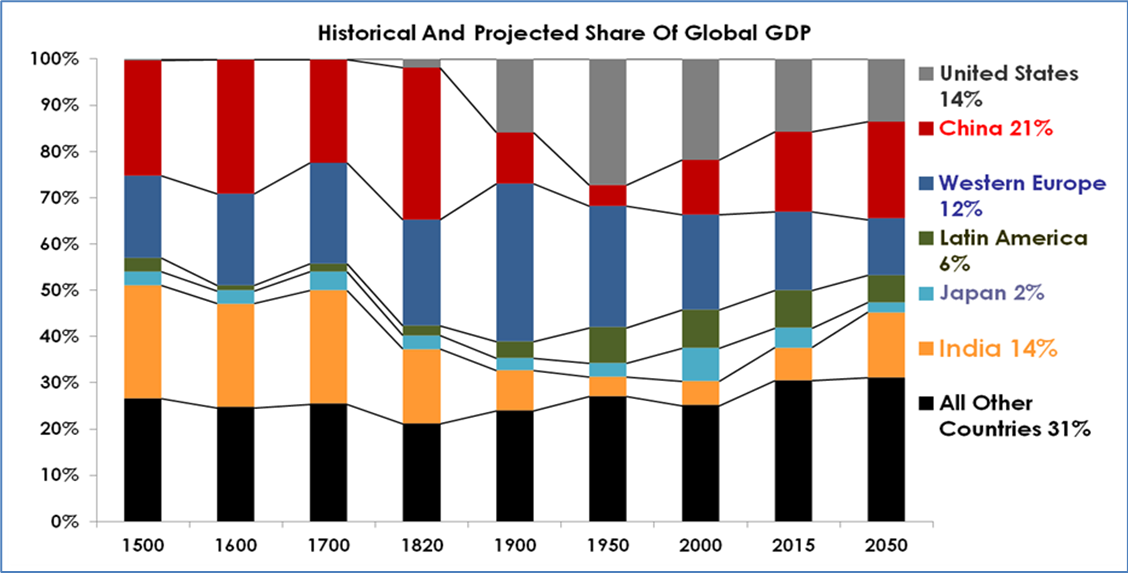

We can lay to rest the decoupling argument in the long-term. India will have a large share of global GDP, an increased share of global trade, will be linked into global supply chains and will access a larger share of global capital. India's dependency on the global world and more so vice versa will increase.

Chart 2: India will take its rightful place and will get more integrated into the global economy

(Source: Angus Maddison, University of Groningen, Quantum Advisors)

That being said, in the short-term though, with all that has been going around the world, India does seem to be in a sweet spot.

India's 'non-aligned' position with respect to the Russia-Ukraine war stood out. India was able to explain its position to the western world.

Apart from the delta scare that ravaged India in the summer of 2021, India managed COVID and the vaccinations better than most expected. India's use of vaccine supply as a tool of global diplomacy earned it accolades and global recognition.

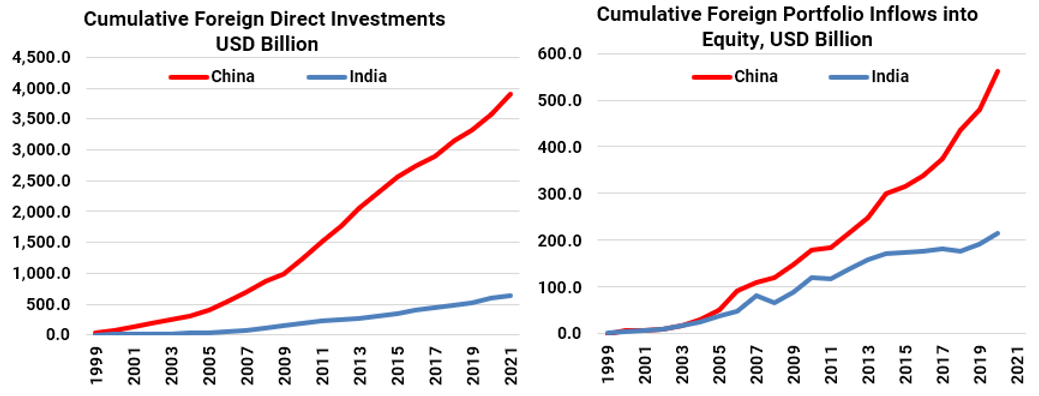

China's decision to target sectors which have large external investments with regulatory diktats has meant that capital will look for other destinations. There is a growing recognition that India is the next big market after China where global corporations and investors can deploy large sums of capital.

Chart 3 and 4: Will Global Corporations and Investors pour out their love for India as well?

Source: World Bank, Annual Data till December 2021

India: Democracy, Non-aligned, Political Stability, Rule of Law, Open for Business - if India remains true to this, it can chart a path of its own

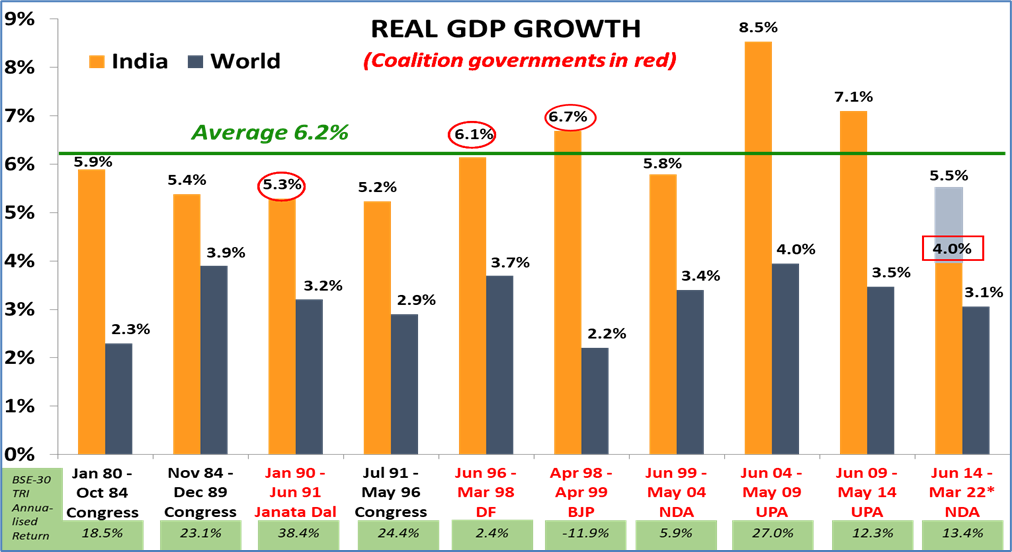

Democracy provides checks and balances. India is not a geo-political or strategic threat to any other nation. India has had a steady blueprint of reforms carried out by various governments over the last 40 years. It does not matter which government is in power.

India’s judicial system may be slow, many compliance and legal rules are archaic, but its institutions, be it the courts, its regulators and its markets follow a stated and somewhat predictable ‘rule of law’.

Chart 5: India has seen steady reforms across governments which has led to an increase in GDP growth

(source; loksabha.nic.in; worldbank, BSE)

India is welcoming to foreign investors – be it in direct investments or portfolio investors. Public Equity, Private Equity, Venture capital, Infrastructure, Real estate and now even the Bond market is open, investable and are large enough to absorb long-term capital from global corporations and investors

The regulator needs to ensure that market structure and governance is upheld to ensure that retail investors are not hit with financial scams. The Indian regulation has come a long way in that regard. It has improved regulation, risk management. More importantly, it has vastly improved market and product access for retail investors. As we have seen, especially over the last six years, there has been steady increase in retail investing in direct equities and mutual funds.

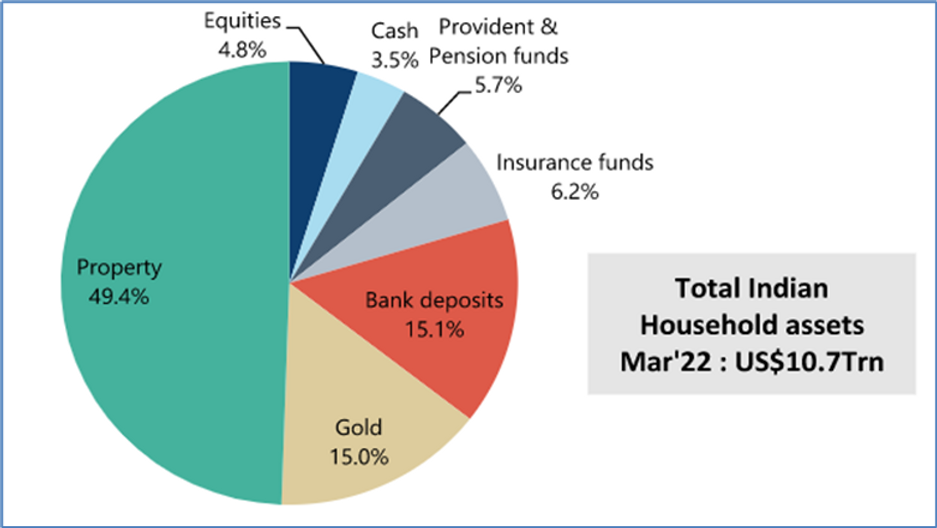

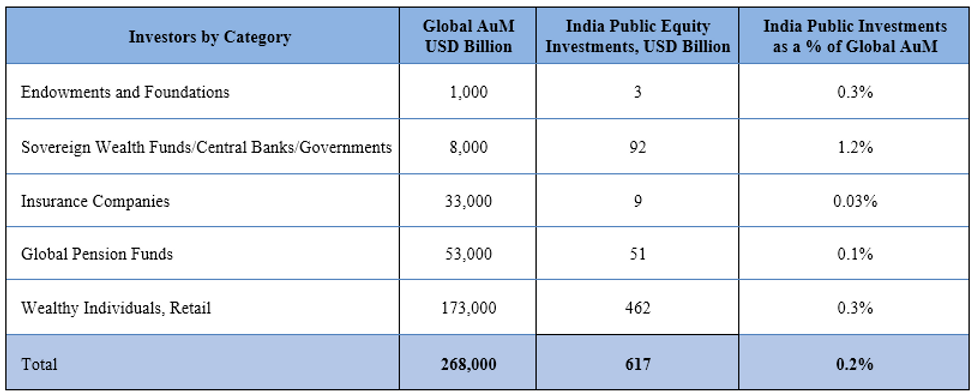

However, foreign investors and resident and non-resident Indians are under invested in Equities. India can show resilience and uncorrelated, if it can ensure long term flows from foreign and domestic investors into its capital markets.

Chart 6 and Table 1: Domestic and Foreign Investors are under-allocated to Indian Equities

(Source: Chart 6: Jefferies Research; Table 2: NSDL Data as of March 2022, Towers Watson, PWC, OECD, Quantum Estimates)

Investors don't need decoupling; Investors look for predictability

The India story always had its dose of opportunity and risk, most of them will remain true over the next decade as well. Over time though, the nation has taken more right steps instead of wrong ones. India may have missed the East Asian growth miracle. India, as we have shown is not China as well, in growth, as well as in geo-political and strategic terms.

However, in today’s risky geo-political environment, reminiscent of the cold war days, India may well be that destination which provides any strategic partner – be it a country, an MNC or a global investor – a framework which runs on a democratic principle, with rule of law and provides the stability in actions necessary in a long-term relationship.