India faced some flak from western geo-political commentators on its decision to abstain at the UN General Assembly voting against Russia’s actions in Ukraine. India was measured in its response and asked for complete cessation of hostiles and violence and reminded Russia, as a UN member of its obligation to respect territorial sovereignty of nations. However, it chose to abstain on the voting alongside other countries like China, Pakistan, Iran, Iraq - a not so popular grouping to be a part of.

As the world largest sovereign democracy, India was expected to condemn Russia’s seemingly autocratic aggressions against Ukraine. India, which is now part of QUAD – a strategic security dialogue between the US, Japan, Australia and India – was expected to vote alongside the western power alliance in such matters.

India’s reluctance to fall in line harked back to India’s position of non-alignment with any military alliance followed since India’s independence in 1947. Jawaharlal Nehru, the first prime minister of India, told the Indian constituent assembly in 1949,

“We have stated repeatedly that our foreign policy is one of keeping aloof from the big blocs [….] being friendly to all countries... not becoming entangled in any alliances… that may drag us into any possible conflict. That does not, on the other hand, involve any lack of close relationships with other countries..”

India, over all these years, across various governments and ruling parties, with differing economic and strategic ideologies, has followed this doctrine of non-alignment, at least in letter, if not in spirit.

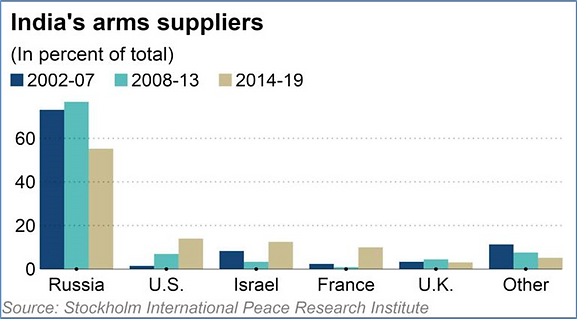

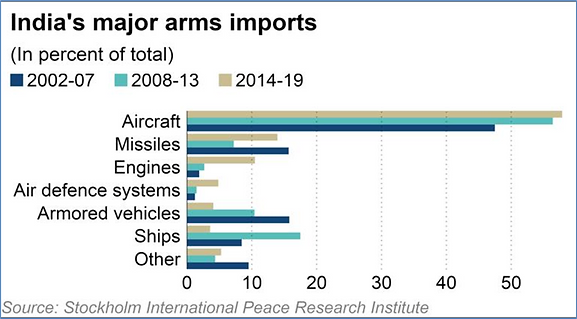

Chart 1 and 2: India has always had strategic dependence on Russia

Why has India chosen to be Non-Aligned?

India’s non-aligned stance needs to be seen in the context of its own (non-violent) independence struggle, its fight against colonialism and the emergence of the bipolar world leading to the cold war.

India abstention can also be understood from two other motivations. The chart above depicts India’s dependence on Russia for key military inputs. Over the years, other countries like France and US have stepped up in supplying fighter jets and helicopters. However, India’s existing fleet of fighter planes and missiles are Russian and requires its support.

The Soviet Union came to India’s rescue during the 1971 east Pakistan war thwarting the US and UK marine fleets in the Bay of Bengal. Indian foreign policy has placed more trust historically on the Soviet/Russians over the Americans.

India’s strategic pivot to the US though has been steady and determined over the years. The signing of the historic nuclear supply deal in 2008 was one such. Under Prime Minister Modi, India entered into QUAD, in what is termed as a strategic security dialogue, but has now expanded into joint military drill in the Indian ocean and south China sea and is seen as a counter to China.

A Multipolar World

The world is no longer bipolar. Many view todays geo-politics as being multipolar with no clear hegemon and a world which is more adrift than ever before.

S. Jaishankar, India’s foreign minister, summarized this multipolarity in his recent book,

“this is a time for us to engage America, manage China, cultivate Europe, reassure Russia, bring Japan into play, draw neighbors in, extend the neighborhood, and expand traditional constituencies of support..” ¹

This stance I believe underscores the desire of India to keep all its options at play and not to antagonize anyone by taking sides.

Consequences of being non-aligned

By choosing to remain non-committal and non-aligned in the Russia/Ukraine conflict also suggests that India does not deem any major geo-political impact or strategic impact from it. Abstaining is unlikely to impact its relations with the US and Europe. Also, India is indicating that if and when they face a military issue with China at its borders, India will deal with it on its own and not look for western support.

India may face US sanctions on its arms and military purchases from Russia depending on how Russia is treated post this conflict. India will happily reduce its dependence on Russia if it gets access to the most advanced US military equipment. It is thus in the western nations interest to work with India to help reduce its strategic relations with Russia.

Non-Aligned but NOT De-Coupled

India may not expect any strategic issues in the near-term. However, India is most exposed to this conflict from an economic perspective.

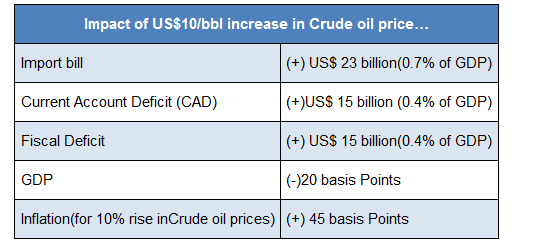

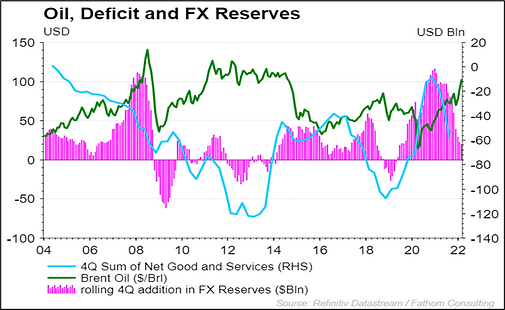

Oil Prices are India’s biggest short term macro risk. India imports more than 85% of its oil requirement. A spike in Oil prices increases the trade deficit, leads to domestic inflation and widens the fiscal deficit due to the increase in the subsidy burden.

Table 1: India’s bugbear – High Oil Prices

(Source, RBI working paper, Quantum Analysis)

Russia plays an outsized role in the global oil market. It is one of the largest producers of oil in the world accounting for more than 10% of total world production of crude oil. A fear of supply disruption has pushed the crude oil prices surging above US$ 110 /barrel first time since 2011.

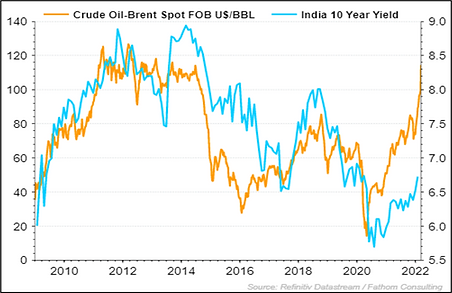

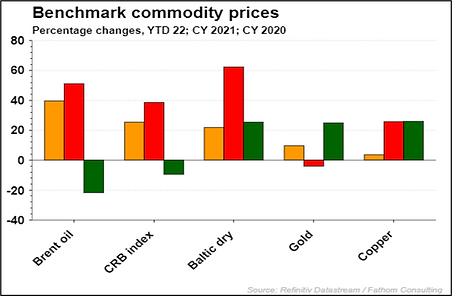

Chart 3 and 4: RBI has a serious inflation challenge on hands

(Source, Refinitiv DataStream, YTD till 10th March 2022, orange=YTD22, Red=CY21; Green=CY20)

India Vulnerable to Oil Price Shock

For the Indian economy, it gives a feeling of déjà vu.

India faced its worst economic crisis in the aftermath of Gulf war following Iraqi invasion of Kuwait in 1990. Precipitated by the consequent spike in oil prices, India's oil import bill swelled, exports slumped, credit dried up, and investors took their money out leading to a balance of payment crisis.

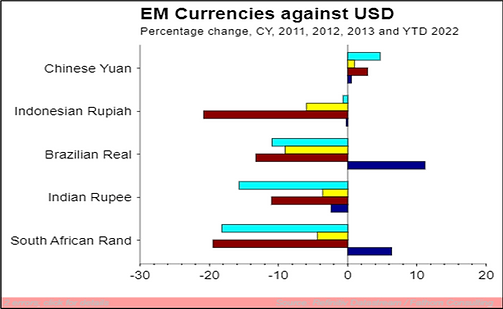

It also reminds us of the India’s ‘fragile five’ movement between 2011-2013. As the Arab spring took hold of much of the middle east, oil prices shot up leading to widening of current account deficit and high inflation.

This ended with ~20% fall in Indian Rupee against US dollar and ~150 basis points jump in bond yields between July-September 2013 during the taper tantrum.

Chart 5 and 6: High FX Reserves buffering the impact of higher Oil prices for now

(Source: Refintiv Datastream; Teal=CY 2011; Yellow=CY 2012; Brown=CY 2013, Blue=YTD 2022; till March 10)

The bond and the currency markets will hope that the current conflict eases out and does not drag on for long. In that case, given the deep backwardation in the Oil Futures market, Oil prices will fall sharply towards it pre-conflict levels.

Given India’s increase in goods and services exports, India can manage an oil price level of up to USD 100/brl.

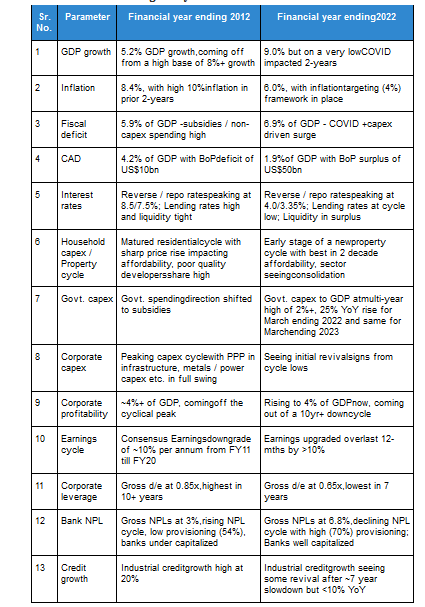

India is not as Fragile as it was in 2012. We do not expect any major rupee depreciation or bond yield increases in a scenario of Oil prices below 100$/brl. (See Table 2)

Table 2: India NOT Fragile anymore?

(Source: Quantum Analysis, Jefferies Research)

The markets will eventually move into focusing on the commentary by global central banks. Given the fact that, the geo-political scenario has only increased price pressures and inflation expectations, we would expect global central bankers to remain steadfast on their path to normalize monetary policy.

We have always maintained that the US politics is very sensitive to inflation. Given the tight labor markets, the increase in commodity prices and the general inflation readings, there is growing pressure on the US administration and on the US FED. President Biden’s approval ratings are at its lowest and we can sense democrat party members wanting the US FED to be seen as doing something to curb inflation.

Indian Equities: Braving the storm

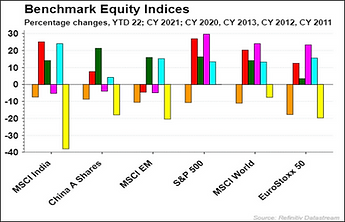

Indian equities have shown remarkable strength up until now. As the chart below shows, YTD 2022 (till March10), Indian equity markets in (USD terms) had outperformed, the developed markets and emerging markets. It has fallen lesser than Chinese equities and the US S&P 500.

This is a bit surprising given the macro concerns that India faces from high oil and commodity prices. Historically, during such times as seen from the equity chart below and the currency return chart above, Indian equities and the currency does tend to have relative underperformance.

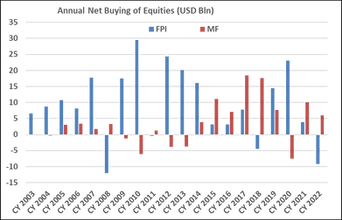

Chart 7 and 8: Domestic Buying shores up Indian Equities despite foreigner’s exodus

(Source: Refintiv Datastream; Orange=CYTD’22 (till 10th March 2022); Red = CY’21, Green=CY’20, Pink=CY’13, Teal=CY’12, Yellow=CY 2011; SEBI, NSDL)

One reason for India’s relative outperformance is the strength of the domestic retail buying, directly and through mutual funds. Till about 2014, foreigners used to dictate market movements. They still do, but in 5 out of the last 7 years, domestic mutual funds on the back of strong retail flows, have net invested more than the foreign investors. This is a significant development and one that is a structural long-term story given how under-allocated Indians are to equities.

In the short-term also, given the strong performance of Indian equities in 2020 and 2021, domestic investors are sitting on gains and are unlikely to panic sell or turn net sellers. Indian mutual funds now get close to USD 1.4 billion inflows through monthly systematic investment plans (SIP) up from less than half a billion few years ago.

The other aspect could be the expectation of the strong underlying recovery in earnings and corporate profitability. There will be near term impact on corporate earnings as companies battle rising input costs. Assuming that the war is not prolonged, we think the medium term economic outlook for India remains robust given the recovery in business activity and the strong macro economic tail winds. We believe that the Indian economy is at the cusp of a multiyear upcycle with real GDP getting back to its long term growth trend of 6 to 6.5%. Investors are hopeful that over the medium term, corporate earnings will continue to remain stronger and thus support equity markets and valuations.

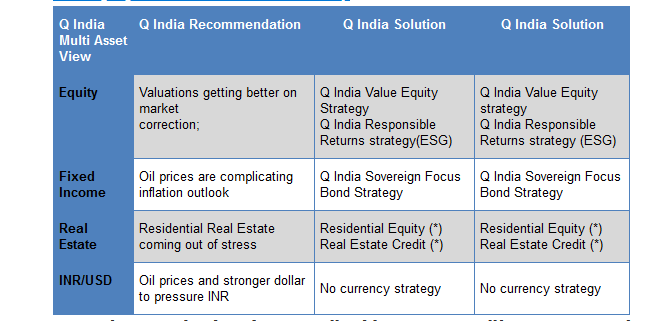

The Quantum Value Equity team is taking advantage of the market fall to add on its cyclical tilted value portfolio. As the market corrects further, the portfolio valuations are getting more palatable. The potential portfolio upsides are now better than it’s long-term historical averages. On further market correction, we are likely to recommend an increase in the India weightage for a long-term investor.

Table 3: Q India Multi Asset Summary

(* - Real Estate related products are offered by Quantum’s affiliate Primary Real Estate Advisors)

For more information and if you wish to discuss the details in the article or if you wish to know more about our investment strategies, the investment philosophy and investment opportunities, please contact:

Arvind Chari – [email protected]

Arvind Chari is the Chief Investment Officer (CIO) at Quantum Advisors. Arvind’s vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 18 years of experience in tracking domestic and global economy he is Quantum’s thought leader and is the author of this Q-India Insight edition.

Important Disclosures & Disclaimers:

1. Quantum Advisors Private Limited (QAPL) is registered in India and holds a Portfolio Management License from Securities and Exchange Board of India (SEBI), India. It is also registered with the Securities Exchange Commission, USA as an Investment Adviser and a Restricted Portfolio Manager with the Canadian Provinces of British Columbia (BCSC), Ontario (OSC), and Quebec (AMF). It is currently not registered with any other regulator. Registration with above regulators does not imply any level of skill or training

2. This summary is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fee and investment strategies of QAPL.

3. This article is strictly for information purposes only and should not be considered as an offer to sell, or solicitation of an offer to buy interests in the account. Investments in the equity and fixed income instruments are not guaranteed or insured and are subject to investments risks, including the possible loss of the principal amount invested. The value of the securities and the income from them may fall as well as rise. Past performance does not guarantee future results and future performance may be lower or higher than the data quoted, including the possibility of the loss. Quantum Advisors reserves the right to make the changes and corrections to its opinions expressed in the document at any time, without notice. Information sourced from third parties cannot be guaranteed or was not independently verified. Comments made herein are not necessarily indicative of future or likely performance of the account and are based on information and developments as at 10/03/2022 unless otherwise stated.

4. All of the forward-looking statements made in this communication are inherently uncertain and Quantum Advisors (QAPL) cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “should”, “can”, “may”, “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume”, “target”, “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities law

UK related important disclosures

• The content of this newsletter has not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000 (“FSMA 2000”). Reliance on this newsletter for the purpose of engaging in any investment activity may expose you to a significant risk of losing all of the property or other assets you invest or of incurring additional liability. This newsletter is exempt from section 21 FSMA 2000 on the grounds that it is directed only to certified sophisticated investors, high net worth companies, unincorporated associations, trusts and/or investment professionals within the meaning of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (“FPO”). The investment activity described in this newsletter is only available to these persons or entities and no other person or entity should rely on the contents of this document.

• The protections conferred by or under the Financial Services and Markets Act (FSMA) will not apply to this newsletter and any investment activity that may be engaged in as a result of this newsletter The applicability of any dispute resolution scheme or compensation scheme and its jurisdiction (if and where applicable) pertaining to a transaction resulting from this newsletter would be as specified in the respective client agreements.