India has faced many tough situations. However, its inherent long-term resilience due to a structural micro story; low-hanging macro policy reform opportunities; and the improving standards of regulatory governance; have ensured that India has always recovered from a crisis. In fact, as the ex-RBI Governor, Raghuram Rajan, remarked in his maiden speech as RBI governor, the words, 'India' and 'Crisis' should never be used together in a sentence.

Be it a situation driven by India's self-goals: 1991, 2000, 2013, 2016-2018 or driven by external events: 1998, 2008, 2020; India has always been, much to James Bonds' chagrin, 'Stirred but not Shaken'.

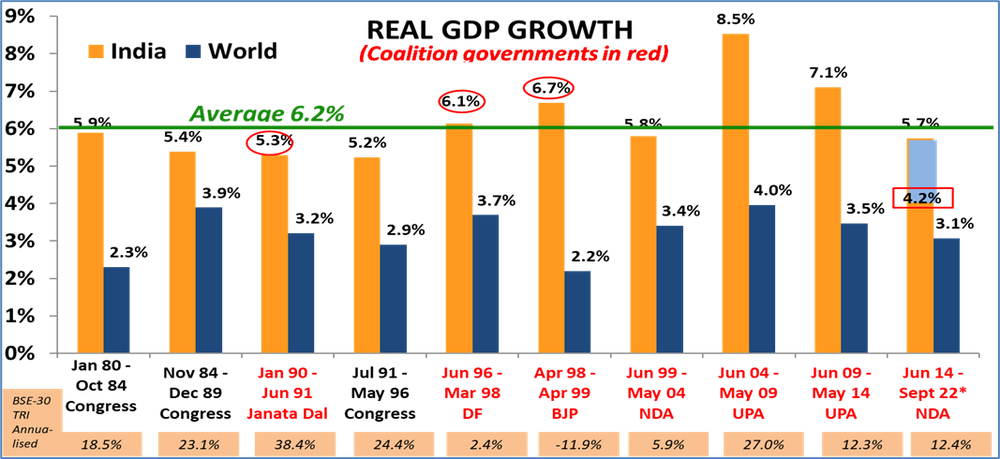

India Real GDP has averaged above 6% for the last 40 years

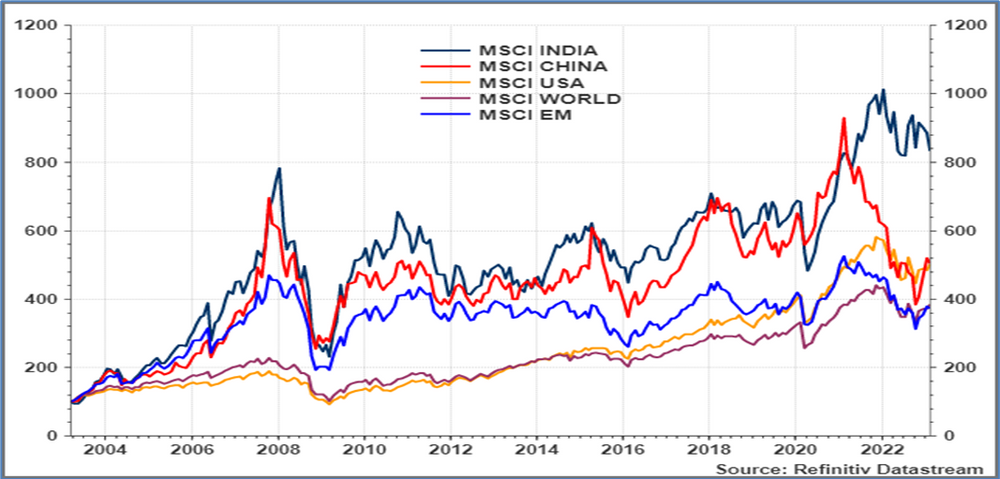

The fact that during the last 40 years, the Indian Real GDP growth has averaged above 6% is a testament to this. In the last 20 years, India's Stock indices have returned 2x over the US and grown much more over EM, and China to the dismay of the many who have remained under-allocated to India.

Under Allocation to India has hurt Investors

India has seen relative underperformance in 2023

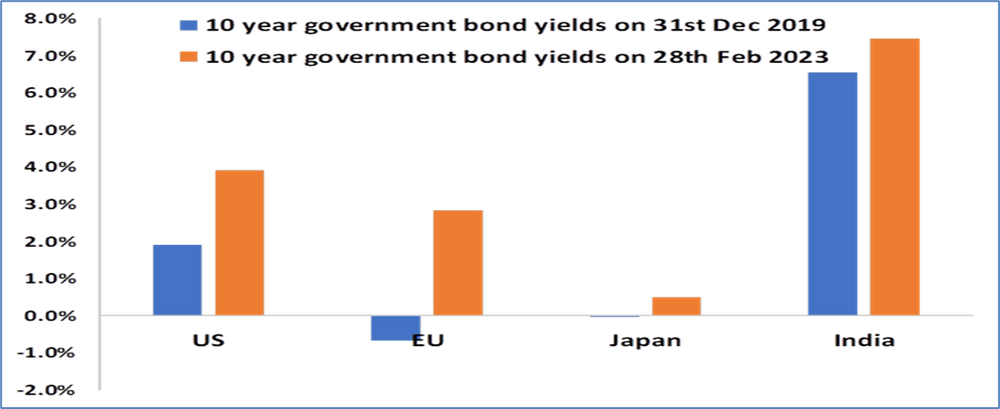

India is also at about its long-term average interest rates. Indian companies, financial firms, households and investor are used to dealing and managing with interest rates around the 7%-8% level. This is different in the western world. Current interest rates are so much higher than levels seen in the last 15 years.

Indian bond yields are back at its 20-year long-term average

Yes, India is chaotic; it is a democracy; has corruption weeded in its governance; and has underachieved. However, in the chaos is the opportunity; in its democracy is the checks and balances; in its corruption is the clean-up; and India thus continues to disappoint the optimist and the pessimist.

India suffered from the stock market scams of Harshad Mehta (1992), and Ketan Parekh (2000) and lost the trust if retail investors. Retail shareholding fell from 11% in 90's to below 5% in early 2000s. However, India learnt enough to eventually build a truly world-class stock and bond market trading and settlement system.

The mutual fund busts in CRB (1996) and UTI (2003); the rampant mis-selling in the early 2000s; the liquidity and credit episodes of (2008, 2013, and 2018); has meant that regulations are now better than the best leading to retail investors returning in droves.

Indian Retail Investors are allocating to Mutual Funds as foreigners sell

The recent Adani issue, given its size and scale, in an earlier world should have had an impact on the entire market. However, given the maturity of institutions and regulations, it caused a ripple but there were no system-wide issues. The issues raised on the Adani group were well known and the regulator should have acted earlier. However, I am sure, SEBI will tighten the regulations to maintain the sanctity of the capital market with expected corporate governance standards.

The Indian insurance and pension industry though given the relative lack of investor-oriented reform has had continued issues with mis-selling; higher costs and a lack of professional investment philosophy. It is clearly losing out to other forms of investment.

The RBI having suffered the shame of having to pledge its Gold in 1991 managed the 1998 and the 2008 external crises with prudent regulations. They seemed to have lost control when India was part of the fragile five in 2013, but with external and monetary policy reforms has regained its credibility.

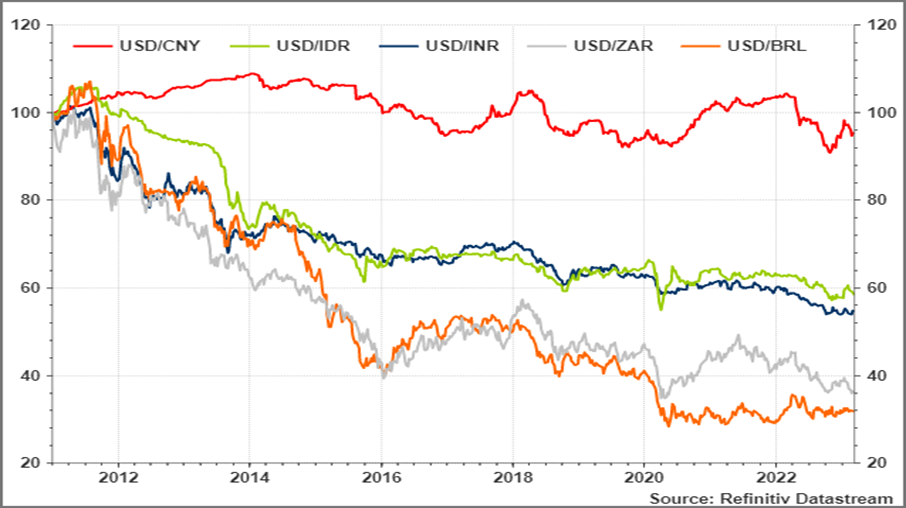

India was part of 'Fragile Five' in 2013, Will it be now be 'TINA'

(Source: Datastream, rebased in 2011)

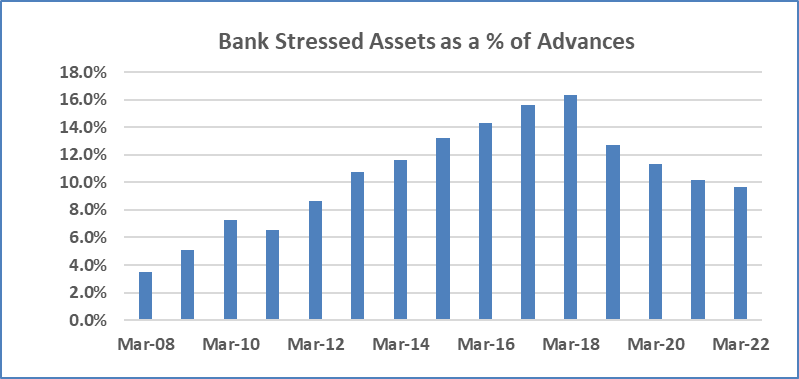

India went through a bad asset quality cycle between 2014-2020 impacting the financial sector and culminating in a credit crisis that accounted for a few banks, shadow banks, and mutual funds.

The 2018 IL&FS solvency issue was India's 'SVB' bank event. India initially dilly-dallied on the resolution of these firms but with the threat of contagion, it moved to either re-capitalize, shut down, sell, or resolve the impacted entities.

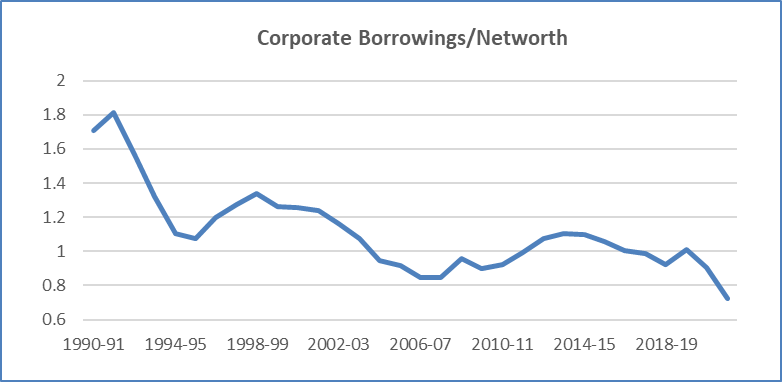

Bank and Corporate Balance Sheets are mending

The RBI's macro-prudential regulation now is almost similar for a bank or non-banking financial firm; large or small. Indian banks also have limits on wholesale funded deposits to prevent consolidated bank runs. India follows Basel-3 norms on capital adequacy. Learning from the 2013-dollar funding crisis, it now requires all external corporate loans to be hedged or provided for with capital buffers. The RBI sensing the impact of rising interest rates on bank profitability allowed the banks a higher HTM limit for a 2-year period to absorb the increase in fiscal borrowing. SVBs major issue stemmed from the impact of higher rates on its balance sheet.

India's financial system held up well during the COVID crisis as well. One particular reason is the large presence of Public Sector Banks (PSBs). Though it has impacted credit creation and they were also responsible for bad lending and poor asset quality, the PSBs go a long way in restoring depositor confidence and aiding in financial stability. As we saw, the government re-capitalized many PSBs over the last 5 years. It was also always a PSB that has come forward to rescue a failed private sector bank.

India should improve their quality but should always ensure that a third or more of the banking system belongs to PSBs.

The lesson to learn from the SVB crisis though is the speed of the resolution. India now has a bankruptcy code to deal with corporate failures. It needs a financial resolution code to quickly deal with financial firm failures.

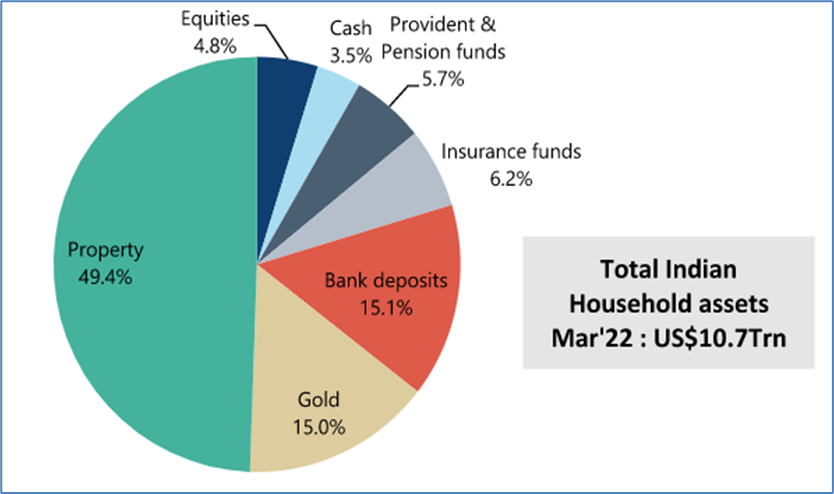

Finally, the main resilience comes from the Indian households(HHs). Household debt though rising is well below global averages. Also, the Indian household is a smart asset allocator. About 50% of the HHs is land/property; about 30% is cash, deposits, and insurance; another 15% is in Gold. These are stable long-term assets as compared to volatile stocks and mutual funds.

India Households are smart Asset Allocators!

This is of course not a complete picture, as the bulk of the HHs does not have any disposable incomes to save in this manner. But for those who do, this represents a decent balance between their income and spending.

These very HHs and small businesses have also prevailed despite severe shocks in recent years starting with the disastrous decision to demonetize 86% of the currency; they have adapted to the cumbersome GST compliance; withstood the credit shock and survived the Covid-19 pandemic.

India has its frailties and its share of disappointments. But in a world of uncertainty, India does its own thing and provides a predictable outcome for those willing to use a sensible approach.

Important Disclosures & Disclaimers:

1. Quantum Advisors Private Limited (QAPL) is registered in India and holds a Portfolio Management License from Securities and Exchange Board of India (SEBI), India. It is also registered with the Securities Exchange Commission, USA as an Investment Adviser and a Restricted Portfolio Manager with the Canadian Provinces of British Columbia (BCSC), Ontario (OSC), and Quebec (AMF). It is currently not registered with any other regulator. Registration with above regulators does not imply any level of skill or training

2. This summary is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fee and investment strategies of QAPL.

3. This article is strictly for information purposes only and should not be considered as an offer to sell, or solicitation of an offer to buy interests in the account. Investments in the equity and fixed income instruments are not guaranteed or insured and are subject to investments risks, including the possible loss of the principal amount invested. The value of the securities and the income from them may fall as well as rise. Past performance does not guarantee future results and future performance may be lower or higher than the data quoted, including the possibility of the loss. Quantum Advisors reserves the right to make the changes and corrections to its opinions expressed in the document at any time, without notice. Information sourced from third parties cannot be guaranteed or was not independently verified. Comments made herein are not necessarily indicative of future or likely performance of the account and are based on information and developments as at 14/03/2023 unless otherwise stated.

4. All of the forward-looking statements made in this communication are inherently uncertain and Quantum Advisors (QAPL) cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words "will," "should", "can", "may", "believe," "expect," "anticipate," "intend," "contemplate," "estimate," "assume", "target", "targeted" or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities law

UK related important disclosures

. The content of this newsletter has not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000 ("FSMA 2000"). Reliance on this newsletter for the purpose of engaging in any investment activity may expose you to a significant risk of losing all of the property or other assets you invest or of incurring additional liability. This newsletter is exempt from section 21 FSMA 2000 on the grounds that it is directed only to certified sophisticated investors, high net worth companies, unincorporated associations, trusts and/or investment professionals within the meaning of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 ("FPO"). The investment activity described in this newsletter is only available to these persons or entities and no other person or entity should rely on the contents of this document.

. The protections conferred by or under the Financial Services and Markets Act (FSMA) will not apply to this newsletter and any investment activity that may be engaged in as a result of this newsletter

The applicability of any dispute resolution scheme or compensation scheme and its jurisdiction (if and where applicable) pertaining to a transaction resulting from this newsletter would be as specified in the respective client agreements.