In a dynamic geopolitical environment, global investor interest in India remains robust. With India’s GDP growth projected to continue at twice the global rate, the country warrants a “Global Emerging Markets (GEM) + India” allocation strategy.

Despite India’s status as TINA (There Is No Alternative), are investors overlooking the risks?

As we approach the end of 2024, the Indian public equity markets have sustained their bull run. However, recent headlines have highlighted governance issues at one of India’s largest conglomerates and growing concerns that stocks may be overvalued amid slowing economic growth.

Listen in as Ajit Dayal, Founder of Quantum Advisors, and Arvind Chari, CIO of Q India UK, as they discuss the ‘Hype, Hope, and Reality’ of the Indian market and examine the often-overlooked risks related to valuation and governance in Indian investments.

Investing tends to yield the best results when kept simple. However, when investing becomes driven by themes the outcomes are often less favorable. Thematic investing can sometimes lead investors to abandon rational expectations. When return expectations diverge from the associated risks, investor outcomes can suffer.

In the US, the NIFTY-501 stocks of the 1970s and 1980s exemplified a thematic-driven boom and bust cycle. Similarly, the Dot-com bubble2 was another instance where investing, detached from valuation logic, led to a massive bull run followed by a crash and a prolonged bearish phase.

In India, the stock market scams involving Harshad Mehta3 (1992) and Ketan Parekh (1999)4 among others, significantly reduced retail investors participation in the Indian equity markets for many years.

Investor interest towards India though surged during the ‘BRIC’ mania, with the Goldman Sachs report of 2003 asking us to ‘Dream onto 2050’, envisioning Brazil, Russia, India and China as the four countries to re-shape the world economy.5 Less than a decade later, S&P warned that India might be the first ‘fallen angel’ amongst the ‘BRIC’ nations6. In 2013, Morgan Stanley another investment bank, labelled India as part of the ‘Fragile Five’7 countries.

Many foreign investors captivated by the ‘BRIC’ hype poured money into risky, illiquid investments like small cap equities, Tier 2/3 real estate, green field infrastructure. In 2015, at a private event, I heard one of those investors who had lost capital say, ‘INDIA – I will Never Do It Again’.

In recent years, especially after China became ‘Uninvestable’, India is seen as ‘TINA – There is No Alternative’ and ‘China+1’. This has led to a surge in private equity and venture capital flows into India as global financial capital moves away from China.

The rising interest in the India opportunity is evident through increased global investor flows across FDI, public equity, and bonds. More global corporations are looking to enter or expand their presence in India.

This trend is reflected in our growing discussions with large institutional investors who are dedicating resources to researching and studying the Indian market and economy closely.

However, as the saying goes, India often disappoints both optimists and pessimists. It’s wise to maintain a healthy dose of scepticism about everything you hear regarding India, keeping in mind the adage that ‘everything you hear about India, consider that the opposite is also true.’

The Hype, Hope and Reality of India Investing

(Source: Quantum Advisors)

Apart from the hype on the opportunity, Investors need to carefully calibrate the risks of valuation and governance. While valuations in the public markets are transparent, we often observe bubble-like valuations in private equity and venture capital when hype overshadows reality.

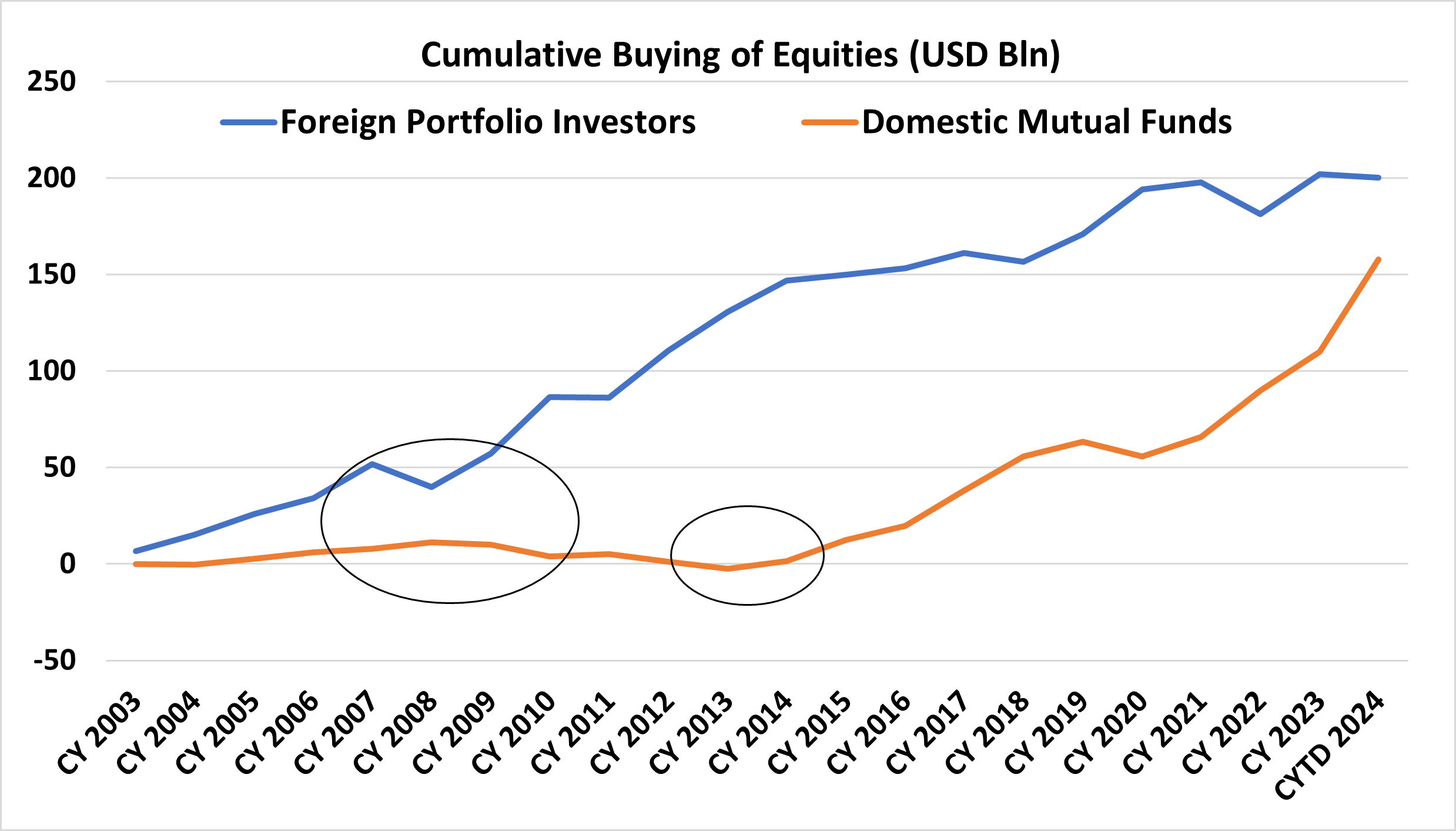

In public markets, the risk-taking exuberance has shifted to Indian retail investors. In recent years, it has been encouraging to see individuals outpacing foreign investors in equity markets. Indian investors have poured more than USD 150 billion into equities through mutual funds. It’s heartening to witness Indians placing their faith in the opportunities and increasingly allocating to public equities.

Flows have been strong: The Modi Effect

(Source: NSDL, SEBI, Annual Calendar year data till November 2024)

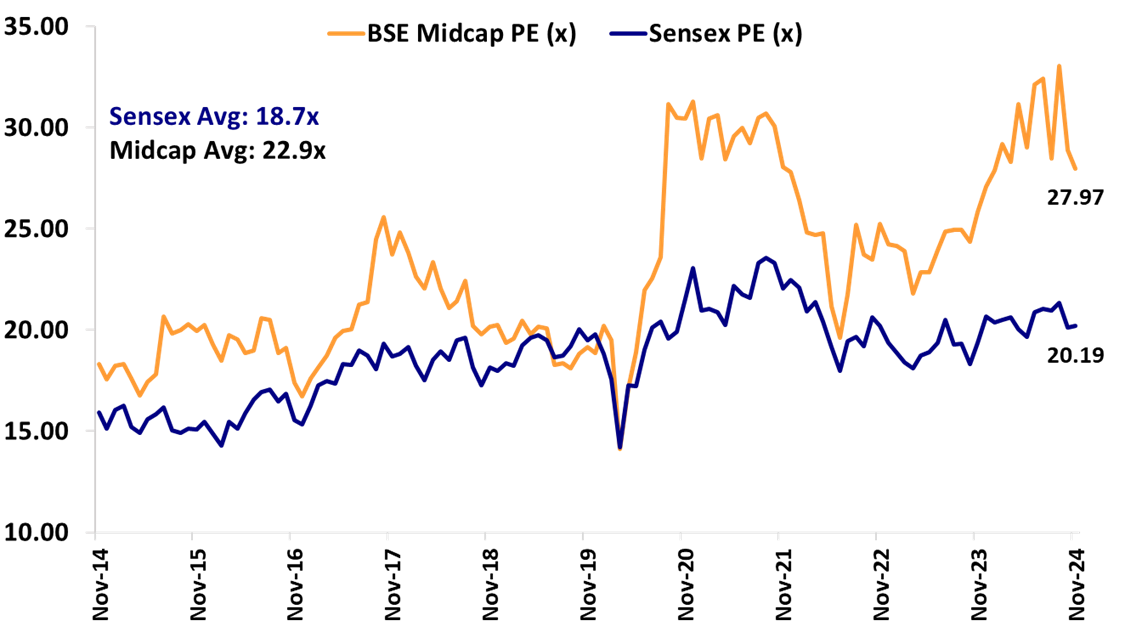

However, it so seems from the valuations of different market segments, Indians seem to be over-allocating to mid and small cap equities. Post the global financial crisis (GFC) crash, it was foreign investors who took a major hit due to their allocations to illiquid, small cap stocks. We heard of many off-shore India funds imposing redemption gates to return capital. Domestic mutual funds did see redemptions for the next four calendar years, however the extent of investments was not widespread.

The scenario is different today. Mutual Fund investors have increased allocation to mid and small cap mutual funds. Earlier in the year, the regulator introduced stress and liquidity test for these mutual fund schemes to protect investors8. The sustained flows has resulted in mid-cap equities being valued at a significant premium to large-cap equities. Valuations remain a big risk to your potential returns from Indian equities.

Midcap PE at ~39% premium to Large cap

(Note: BSE Midcap Index and Sensex 1Y Forward PE. Source: Bloomberg Finance L.P.; As of November 30, 2024 Past performance does not guarantee and is not indicative of future results. )

The other ever-present risk is of course of Governance. While, macro risks and market risks can be priced and managed over the long term, governance risks can seldom be priced and the reputational costs of backing ‘bad actors’9 can be severe.

The recent bribery allegations against an Indian conglomerate, its founder and employees of institutional investors, illustrates the governance challenges of investing in illiquid private assets in India.

In this recent piece, Ignore Governance at your own reputational risk, we examined the governance risks of India investing highlighting key messages:

- Volatility is not the only risk

- Passive Index Investing comes with significant governance risks

- Investments in illiquid, private and real assets needs to have a clear ‘Integrity Screen’. The recent episode is likely to slow down investments by global institutional investors into Indian private equity, infrastructure and real estate.

- While India’s regulation and rule of law have evolved, the responsibility for managing governance risks remains with the investor.

We have demonstrated through ‘Governance in Action’ how public markets consistently signal which companies are perceived as ‘bad actors’ and which are accorded a good governance premium. It is up to investors to maintain the discipline to avoid certain groups, businesses, and possibly even sectors as a risk management strategy.

Investing in India, when approached with a clear understanding of liquidity, governance, and valuation risks, remains a sensible way to capitalize on the long-term opportunities the country offers.

Source:

1,2,3,4: Wikipedia pages of events and persons mentioned

5: Goldman Sachs Investment research ‘ Dream onto 2050’, 2003

6: Indian Express news article referring to the S&P ratings report on India fallen angel, 2012

7: BBC news article on Fragile Five, 2013

8: Mint News article on Indian regulators action for investor protection in mid and small cap mutual funds, 2024

9: Bad actors is referred to companies considered to be poor on Governance/ESG parameters as per Quantum’s internal research and investment process.

Important Disclosures & Disclaimers

The views expressed herein shall constitute only the opinions and any information contained in this material shall not be deemed to constitute an advice or an offer to sell/purchase or as an invitation or solicitation to invest in any security and further Quantum Advisors Private Limited (QAPL) and its employees/directors shall not be liable for any direct or indirect loss, damage, liability whatsoever arising from the use of this information.

Information sourced from third parties cannot be guaranteed or was not independently verified. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate, and the views given are fair and reasonable as on date. All the forward-looking statements made in this communication are inherently uncertain and we cannot assure the reader that the results or developments anticipated will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations.

Recipients should exercise due care and caution and if necessary, obtain the professional advice prior to taking any decision based on this information

Important Notice:

This newsletter contains hyperlinks to websites operated by third parties. These linked websites are not under the control of QAPL and are provided for your convenience only. Clicking on those links or enabling those connections may allow third parties to collect or share data about you. When you click on these links, we encourage you to read the privacy notice of the website you visit. QAPL does not endorse or guarantee products, services or advice offered by these websites.

UK related important disclosures:

• The content of this newsletter has not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000 (“FSMA 2000”). Reliance on this newsletter for the purpose of engaging in any investment activity may expose you to a significant risk of losing all of the property or other assets you invest or of incurring additional liability. This newsletter is exempt from section 21 FSMA 2000 on the grounds that it is directed only to certified sophisticated investors, high net worth companies, unincorporated associations, trusts and/or investment professionals within the meaning of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (“FPO”). The investment activity described in this newsletter is only available to these persons or entities and no other person or entity should rely on the contents of this document.

• The protections conferred by or under the Financial Services and Markets Act (FSMA) will not apply to this newsletter and any investment activity that may be engaged in as a result of this newsletter. The applicability of any dispute resolution scheme or compensation scheme and its jurisdiction (if and where applicable) pertaining to a transaction resulting from this newsletter would be as specified in the respective client agreements.