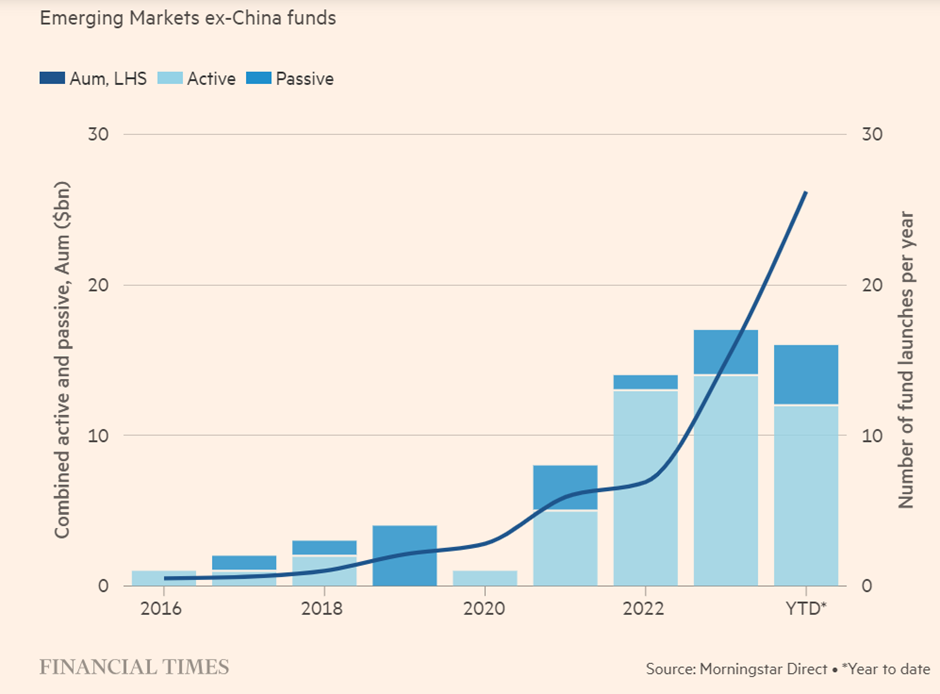

A recent article in the Financial Times notes that investors are piling into Emerging Market (EM) funds which exclude China on the belief that an “EM ex-China” allocation will give them sufficient exposure to India and, simultaneously, deal with the China geo-political risk

Watch as Ajit Dayal - Founder, Quantum Advisors; Nilesh Shetty - Portfolio Manager - Quantum Advisors; and Arvind Chari - CIO, Q India UK discuss why allocators are likely to be disappointed with this approach and why a dedicated allocation to India combined with a “EM ex-India and ex-China” allocation could be a winner.

The Asset Allocators conundrum

We understand the asset allocators and risk managers conundrum. This conundrum is especially true in public equities allocation.

The MSCI Equity indices are no longer used only for performance measurement. The weights of the regions and countries in the MSCI index is also used as a guide for country/region allocations.

This is convenient but may not be ideal.

| Weight in % | World GDP |

MSCI World ACWI |

MSCI EM | MSCI EM ex-China |

|---|---|---|---|---|

| China | 16.88 | 2.86 | 27.45 | 0.00 |

| Taiwan | 0.72 | 1.97 | 18.98 | 26.21 |

| India | 3.37 | 1.92 | 18.59 | 25.61 |

| South Korea | 1.62 | 1.06 | 10.11 | 13.89 |

| Brazil | 2.06 | 0.51 | 4.81 | 6.63 |

| Saudi Arabia | 1.01 | 0.39 | 3.84 | 5.30 |

| South Africa | 0.36 | 0.33 | 3.18 | 4.39 |

| Mexico | 1.70 | 0.20 | 1.87 | 2.58 |

| Indonesia | 1.30 | 0.17 | 1.63 | 2.25 |

| Thailand | 0.49 | 0.14 | 1.46 | 2.02 |

| Malaysia | 0.38 | 0.14 | 1.43 | 1.99 |

| UAE | 0.48 | 0.12 | 1.18 | 1.62 |

| Poland | 0.77 | 0.09 | 0.83 | 1.13 |

(Source: For MSCI Indices weights – respective iShares MSCI Index ETF holdings data as of October 28,2024; For GDP, $Annual GDP at Current Prices/World GDP; WorldBank, Data as at 2023) ACWI – All Country World Index; EM-Emerging Markets

As the returns of Emerging Market indices have underperformed over the last decade or so, many have started questioning the rationale of investing in EM as a block. Over the last 5 years, investors moved to carve out China, worried about its geo-political risk and as a major reason for EM underperformance given its large weight. This led to EM ex-China Index which has now seen substantial flows including from the larger institutions.

Source: FT Article, https://www.ft.com/content/d0631629-568e-4fe6-adb2-b7b8395c91f4, dated October 23, 2024

This brings out the same questions as before on the rationale of investing in a block of countries. The table above on GDP and MSCI Index Country weights details one of the issues that potential allocators face. For instance, how do you manage geo-political risks of investing in an EM ex-China allocation? What does a >25% weight in Taiwan and India mean to the risk and return profile of the index?

We may not have all the answers, however we pose these questions and discuss potential solutions.

Watch as Ajit Dayal - Founder, Quantum Advisors; Nilesh Shetty - Portfolio Manager - Quantum Advisors; and Arvind Chari - CIO, Q India UK discuss why allocators are likely to be disappointed with this approach and why a dedicated allocation to India combined with a “EM ex-India and ex-China” allocation could be a winner.

Disclaimer: The views expressed herein shall constitute only the opinions and do not constitute any investment advice or recommendation on any course of action to be followed. The viewer must consult their own investment professional/advisor before taking any action.