Workplace diversity contributes to better management outcomes. How has India progressed in female employee participation?

Greater management diversity is more likely to contribute to better decisions, innovation and better governance, which is essential for the longevity of the company. Are Indian corporates doing enough?

It is no secret that across the globe, including the most developed nations, gender disparity exists in both skilled and unskilled sectors. With all that we have seen in 2020 with migrant issues and rising female unemployment, a greater push towards gender parity is need of the hour than mere hollow promises.

Merely being labelled as an “equal opportunity employer” is not enough; rather the company should aim should be to be without this label.

A crucial aspect to consider when researching for companies for investment is the assessment of gender diversity. A diverse approach in hiring and promoting, fair compensation and equal opportunity are the key attributes that are increasingly becoming indicators of company's financial strength and sustainability.

Diversity in the management team is more likely to contribute to better decisions, innovation and better governance, which is essential for the longevity of the company.

A quick glance at the sample of Indian companies shows promising efforts to reduce the gap between male and female employees.

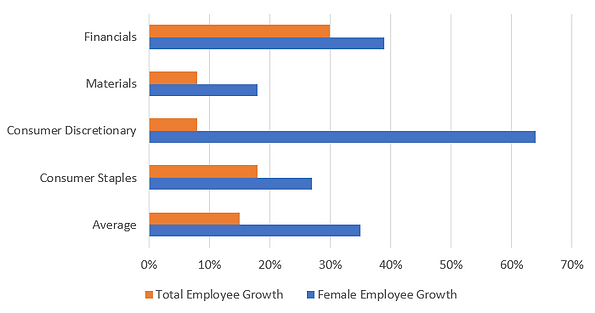

Female Employee Growth Outpaces Total Employee Growth

Source: Quantum Proprietary ESG Research, 2020

The efforts are certainly visible in terms of growth of female employees in the workforce. However, the women employment in proportion to the total employed continues to be abysmal.

The female participation in the workforce has been low due to myriad of factors including unequal compensation. The underrepresentation in the manufacturing sector is strikingly higher.

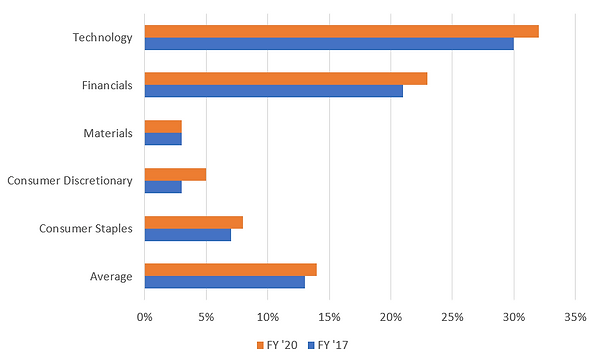

The priorities of the C-suite are changing, minding the huge gender gap, especially in the non-service sectors, needed to be linked to the performance of the company to materialise the goal of being an gender equal company.

Service-oriented Sector Moving Faster Towards Gender Equality

Source: Quantum Proprietary ESG Research, 2020

There is a long way ahead. Many countries have laid out directives for the company comply with the diversity policy. It is a matter of time that this will become a norm across the globe, including the developing countries like India.

It is vital for asset managers to consider the aspect of gender parity while investing in the company by rewarding those who are consistently progressing towards striking a balance in gender pay and parity and by penalising those who are reluctant to accept and minimised the gender gap.

Regulator, asset managers, investors, employer and employees, let's collaborate to close the gender gap and stop paying lip service to gender equality.