Through this cycle of expectations and disappointment, opportunities exist for those tempted by near-term events.

Through this cycle of expectations and disappointment, there will be pickings to be made for those tempted by the near-term events and their impact on share prices.

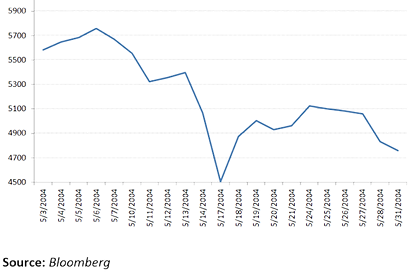

While election outcomes tend to matter less over longer periods of time, the few who are positioned “correctly” can make a fat profit. When the incumbent BJP lost the election in May 2004, the stock markets tumbled by -20% in a week (see Graph 3). But things changed quickly. The return during the Congress-led coalition over the next 5 years was a breath-taking +207% in INR (+197% in USD).

In May 2004, the incumbent BJP lost the election to the Congress-led coalition and stocks nose-dived

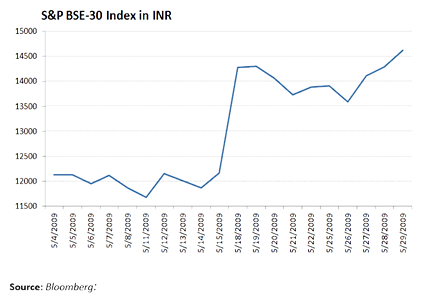

For the elections in May 2009, the market was expecting the incumbent Congress-led coalition to win fewer seats. They fared better. The stock market went ballistic and gained +17.2% in 36 seconds of trading, punctuated by 3 circuit-breakers. But that buoyancy did not continue. So far, this government has delivered a stock market return of +44% in INR (+10% in USD). An investment in fixed deposits over the past 5 years may have been better!

In May 2009, the incumbent Congress-led coalition did better than expected and stocks surged by +17.2% in 36 seconds of trading on May 18

As these longer term stock market return numbers suggest, despite all the fanfare and focus on elections, elections matter less in the long run. Barring an extremely unlikely victory by a combination of regional parties (affectionately called the Third Front), a victory by the BJP-led or Congress-led coalition will see a sharp movement - and then a return to “normalcy” as policy-making takes over. The trends in the current account deficit, inflation, and interest rates - and policy changes - will be back in focus.

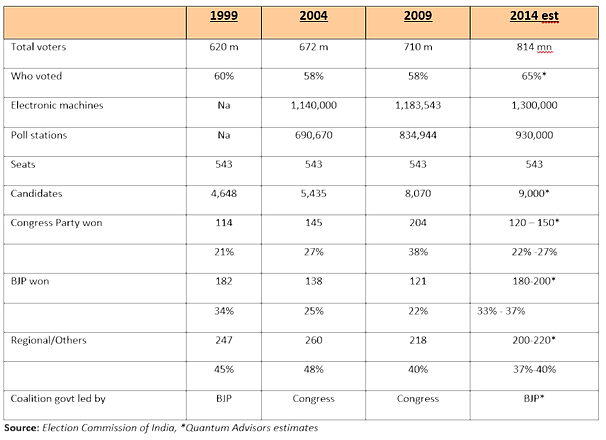

In 2009, the 2 National parties won a majority of votes for the first time since 1991

While the Indian stock market is still rooting for a win by a BJP-led coalition with Narendra Modi as Prime Minister the trends will be clearer once the names of individual candidates will be announced. While there may be a “Modi wave” of sorts and an anti-Congress sentiment, the voters will be swayed to vote for (or against) specific individuals.

A tepid outcome?

Not being pollsters, we take a valiant attempt at deciphering the level of the current decibels, put our finger in the air, check the wind, and “predict”:

- BJP will be the largest party but far short of a majority of 272, it will need allies to form a government,

- The power play will be more brutal than that being played out in the Ukraine and Crimea with cabinet seats up for grabs and horse-trading over various cabinet berths,

- A motley crew will make up the cabinet and the BJP will have to teach Mr. Modi how to share his power - something he has apparently never done in his 9 years as Chief Minister of Gujarat,

- After some angst, policies will be announced that will please industry and also upset them: the captains of industry will be mostly disappointed but, since they cannot disown a government they rooted for, they will go on TV and say how “balanced” the BJP-led coalition is,

- By mid-June the captains of Indian industry will focus on the World Cup in Brazil, even though the Indian football team is ranked 154 out of 207 football playing nations by FIFA, Brazil is where the real samba will take place and it is a good time to leave the messy Indian monsoon,

- The evergreen “ignore the long term impact of elections” GDP chart (see Chart 1 below) will be back in focus.