The government has shocked the bond markets and cheered the equity markets with its new budget - will increased spending spur growth?

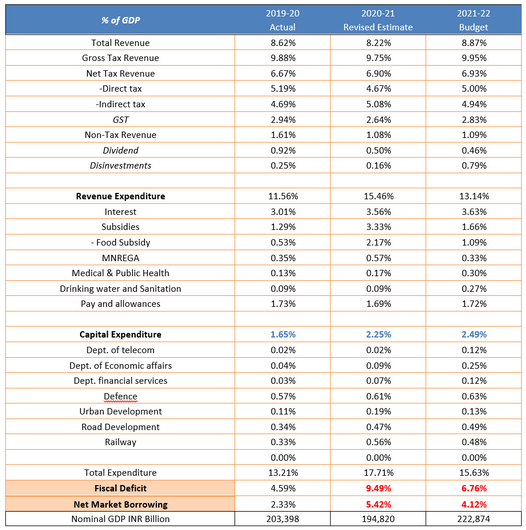

The government shocked the bond markets by pegging the fiscal deficit at a much higher number than expected. The fiscal deficit for Fiscal year 2022 is slated to be at 6.8% of GDP. Market estimates were around 5.0%-5.5% of GDP.

The other shocker was that the government has postponed fiscal consolidation for the ever future. The government now expects fiscal deficit to GDP to be at 4.8% by Fiscal year 2026. This is a big departure from the 3.0% target first slated to be reached by this government in Fiscal year 2018.

3.0% was always way too ambitious for a populous low-middle income country like India. Many ascribed the growth slump pre-COVID to government’s reluctance to increase its spending. The shocks of demonetization, GST, IL&FS overwhelmed the households and the SMEs. The government did not spend (as much) even in 2020, the year of COVID, despite even the fiscal hawks exhorting the government to support the economy.

My view has been that the reluctance to spend was due to the Prime Minister’s own fiscal conservatism.

In my naive view, I have held that PM Modi believes in two macro data points: Inflation and Fiscal Deficit. The BJP won in 2014 against the ruling UPA-2 government on the back of high inflation and a falling currency brought about by higher fiscal deficit in the years post the Lehman crisis (2009-2012).

Mania over Inflation and Deficit

In the 2019 re-election, PM Modi used to proudly mention that this would be the first election in India where inflation will not be an issue. They delivered on that.

The CPI target was 4%. Minimum Support Prices (MSPs) used to increase by 3.8%/3.9%.

The first press release of the introduction of GST was on its impact on CPI inflation. The Prime Minister’s Office (PMO) ensured that a multi-generational tax regime’s rates were determined by its impact on the next one year’s inflation. Such was their mania over inflation.

This government has also somehow met the stated fiscal deficit target. Between 2014-2019, they have managed to show a lower headline number every year.

Ruthless cut in spending. Shoving off expenses below the line. Palming off one government company to another. Taking on the RBI to part away with their capital. You name it, they have done it to meet their numbers.

Growth concerns forces change in PM Modi’s stance?

If so, that is good.

India needs to get real GDP growth back to the 7% level. India needs its nominal growth to grow at a much higher rate than its cost of interest.

India is a growth story.

However, Growth slumped below 4% pre-COVID.

Many, including us, worried about whether India’s long-term potential growth has been impaired. It is thus important to get investors to believe in the 6.5%-7.0% long term real GDP growth potential.

High and sustainable growth in the long-term can take care of inflation and deficits.

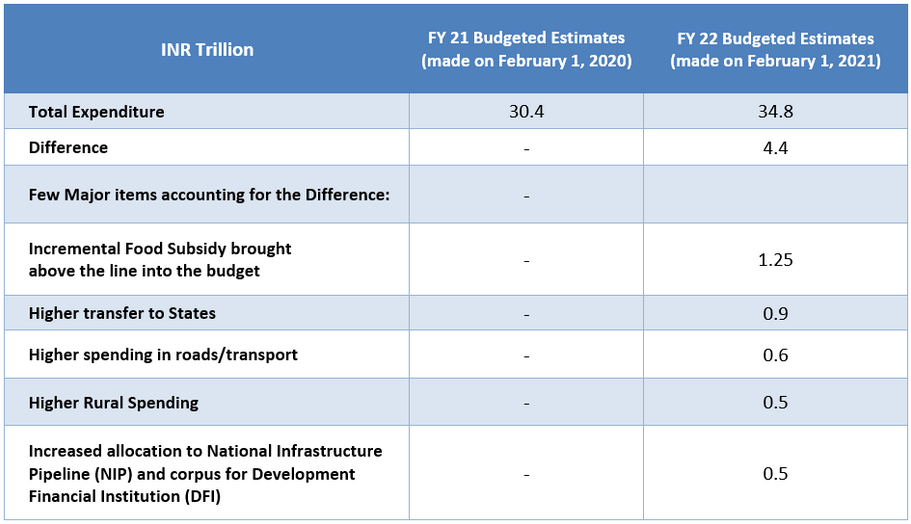

Table 1: Will the increase in spending spur growth?

Source: Budget Documents, all are approximate numbers

Equity Markets will remain excited

The revised FY 21 estimates also pegs the total expenditure at INR 34.5 trillion. However, a larger increase in spending is re-apportionment. It is existing food subsidy spending now correctly reflecting in the budget numbers. This increase in food subsidy helped buffer India’s lockdown and COVID shock. However, it was already accounted for.

As the table shows, when we compare FY 21 budgeted before COVID to FY 22 presented today, we do see some growth and spending impulse. This augurs well for the growth recovery to sustain.

There is enough in the budget to keep the equity markets interested. Slower fiscal consolidation would mean that the government can continue its infra spending. The Production linked Incentives (PLI) can be provided and paid out in time. The move to disinvest, privatise and monetise is great and if it draws in the foreign investors it will be better. It though needs to be backed in action. The government needs to be bang-on in its execution.

Great day for the equity market. Horrible day for the bond market. The bond markets carried the same naïve view of PM Modi into the budget: this government will not rock the bond markets.

However, there were multiple shockers:

- The government will borrow more in FY 2021 as against the expectations of carrying surplus cash into the next fiscal.

- FY 22 Fiscal Deficit pegged at 6.8% of GDP as against market expectations of 5.0%-5.5% of GDP.

- State governments allowed to borrow more than anticipated.

- Fiscal consolidation on a long path: 4.8% FD/GDP till FY 26.

Bond Markets will hope it’s not Pranab Re-Dux?

Bond markets have rightly sold off (yields have increased). The best of the bond market is behind us. We would need to hope that the increase in yields is gradual.

The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) meeting will be crucial in determining this trajectory of the bond market. We expect them to try and remain accommodative and supportive of the government bond borrowing programme for a while. However, I do not see them changing the direction of interest rates. Interest rates are headed higher, across the curve.

The conditions are eerily like the post Lehman crisis government response. Pranab Mukherjee increased the fiscal deficit in March 2009 budget. The RBIs repo and reverse repo rates were at similar levels as now. Bond yields began to increase on the higher fiscal deficit. The RBI was slow to respond to the inflation challenge. In 2012, bond yields had climbed to 8.5% from 5% in December 2008. Eventually the Indian rupee started weakening as growth fell. We of course ended up as fragile five in the 2013 taper tantrum. UPA lost power.

PM Modi having shed his fiscal conservatism to get back growth will well and truly hope and pray that this is not repeated.

Table 2: Will the increase in spending spur growth?

Source: budget documents

For more information and if you wish to discuss the details in the article or if you wish to know more about our investment strategies, the investment philosophy and investment opportunities, please contact:

Arvind Chari – [email protected]

Arvind Chari is the Chief Investment Officer (CIO) at Quantum Advisors. Arvind’s vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 18 years of experience in tracking domestic and global economy he is Quantum’s thought leader and is the author of this Q-India Insight edition.

Disclosure Statement

The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument for the recipient. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Recipient should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. This is neither an offer to sell securities of any investment fund nor a solicitation of an offer to buy any securities. All of the forward-looking statements made in this communication are inherently uncertain and we cannot assure the reader that the results or developments anticipated will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations.