India was hit hard by the second wave of Covid. Lack of Governments’ preparedness accompanied by the sheer number of people impacted, further aggravated the crisis as there was dearth of supplies on many fronts. Many corporates selflessly chipped in with whatever help they could, be it oxygen supplies, facilities for more hospital beds, medicines or be it donations. At last, we saw some applaud for corporates for weaving the social fabric. Environmental improvement has always been appreciated by the stakeholders and has been a good branding for the corporates unlike any efforts on the social front that doesn’t seem to add immediate “ROI” to build a business case, sadly so!

The ‘S’ in ESG has certainly been highlighted by the pandemic. Even while business resilience was under threat, the world took a closer at how businesses handle human capital and related issues. Stakeholders were keenly watching the priorities of the corporate and their efforts to retain staff, policies on pay cuts, caring for employees impacted by the virus, meaningfully compensating families of the deceased employee, etc. This scrutiny by businesses has also compelled them to realize the importance and work towards increasing the focus to prioritize Diversity, Equity and Inclusion in the workplace.

The dialogue around equality and equal rights has been there for quite a while now and businesses have now begun to evaluate their practices with regards to these issues.

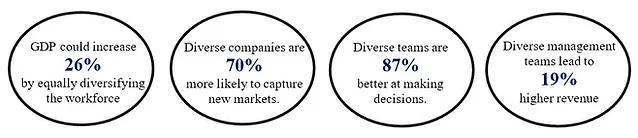

A series of influential studies by McKinsey also highlighted a strong correlation between diversity and financial performance. Companies with greater ethnic and racial diversity performed 33% better than average. Moreover, greater gender diversity aided companies to perform 21% better than the national average.

As the businesses matured, the need for diversity has been inclined more towards socially conscious practices for some, while others continued to push diversity in order to comply with the regulation.

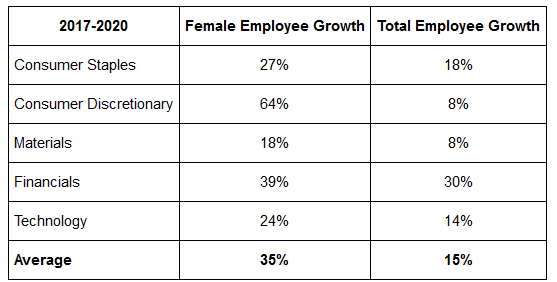

On average, female employment doubled in 3 years in India inc.

Source: Quantum Proprietary ESG Research, 2020

Yet, women are still struggling to break through the glass ceilings that keep them out of the boardroom. A deeper analysis shows that most of the companies (~60% in Nifty 500 Index) have only one woman in the board of directors.

Data Source: IiAS Research, NSE info base (Corporate Information Database, nseinfobase.com), Quantum Research, 2021

It would appear that the companies are making progress in the right direction with many making public statements while it is important to deal with issues of biases, prejudices and inequity internally. Many companies may proclaim to be progressive in their culture and values, however, how many of them are forthcoming about disclosing the workforce related issues no matter the intensity and severity – being pertinent questions.

India has a poor record of inclusion, Women just account of about 20% of the workforce whereas they constitute ~48% of the population. 3 key reasons for lower inclusion emanate from patriarchal society, caste and cultural norms and safety and flexibility issues; which are rapidly changing. Even in corporate India, only 3.7% of CEOs & MDs of listed companies were women as on 2019 and just 8.9% of firms have women in top management positions. It is abundantly clear that it will require a continuous engagement with investee companies to improve inclusiveness, equity and diversity even if they stand relatively better than the averages.

While we can start mandating certain minimums and take the bar higher periodically, this “stick” method lacks empathy. In order to better engage with companies and to see to it that they meaningfully improve over years, it was important that we understand the quest first. Therefore, we signed up with one of the best work force standards available today WDI – WDI – Workforce Disclosure Initiative. The idea is to not to start mandating disclosures from our investee companies immediately. The idea was to shine a torch on Quantum’s own workforce disclosures and practices, learn where we lack, work on the quick fixes, put an action plan to improve on other areas, understand the challenges to improve. These iterations will help us take our experience to the companies and not only mandate but meaningfully engage to make them better.

WDI aims to improve corporate transparency and accountability on workforce issues, provide companies and investors with comprehensive and comparable data. Many stakeholders including employees feel that the public commitments by the company to provide equal opportunity and inclusion is not necessarily matched by internal corporate policies and culture. WDI is a framework to bridge this gap between public statements and ground reality through its comprehensive disclosures.

Quantum Advisors is the first in India to partner with WDI and the 51st in the world. Aine Clarke of WDI recently talked to Quantum Advisor's founder, Ajit Dayal for their Leadership Podcast Series.

Quantum’s long term track record of asset management and corporate engagements in India and WDI’s direction towards global standards on workforce disclosures will certainly serve as a nudge to have better and wider disclosures.

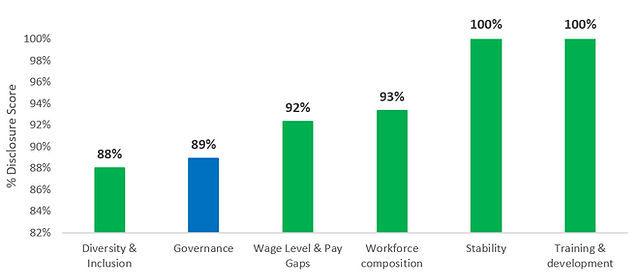

In the first disclosure evaluation, Quantum scored 101 out of 175 points across 13 sections ranging from supply chain management to health and well-being policies to compensation structures to diversity and inclusion policies and so on. On subsequent discussions with WDI, we learnt that many of the areas where we haven’t scored aren’t applicable to us from a materiality perspective; hence our score in itself is much better which will be rerated higher in next evaluation. Almost 25 years ago, Quantum introduced Governance screening in its investment research process and complementing to that, the WDI scores highlight that Quantum’s internal policies are in tune with good governance practices.

Quantum Score - Top 6 areas based on WDI disclosure scores

Source: ShareAction Work Force Disclosure Initiative, Quantum Research

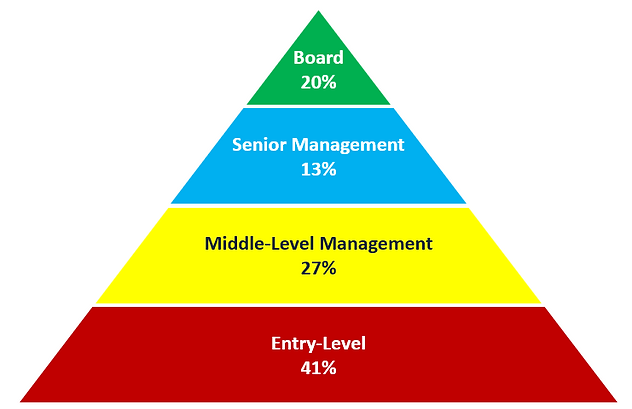

Quantum’s gender mix may not be equitable at all levels of hierarchy even though it is much better than average; it relates more to the societal challenges in India and not due to any inherent biases on diversity. We don’t ask the conventional caste-based questions generally demanded when applying for ‘government’ jobs in India (directly and indirectly, India’s biggest employment generator).

Quantum’s Gender Mix

The major areas where Quantum lags is disclosures on supply chain and adoption of certain policies. While Quantum does not have a big list of suppliers it generally includes IT vendors, stationary suppliers and the maintenance providers. Quantum does have an open and equitable vendor policy.

The other is adoption of human rights related policies. Quantum does practically follow inherent principles of such policies but just needs to formally adopt these policies at the board level and ensure its implementation. We are working towards it and will ensure we have the requisite in place and fare much better at our upcoming evaluation.

An important takeaway here is that Quantum and WDI’s joint efforts are focused on engagement with companies under coverage/portfolio companies by penetrating into the hard wired mindset of the corporates to bring about systemic change. A step towards extensive quality disclosures backed by consistent and on-going efforts towards diversity, equity and inclusion by Indian companies is the only way forward.