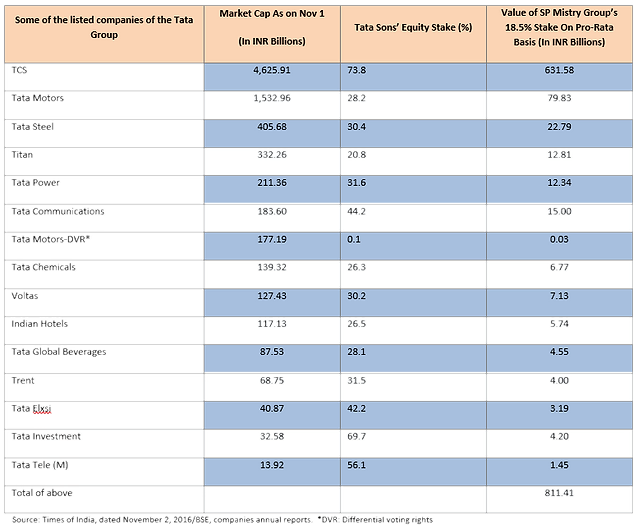

While the US was going through the trauma of its succession plan, India is seeing a dog-fight in the Tata boardroom. The veritable Tata Sons, a private company controlled by the various Tata Trusts (65%), the Shapoorji Pallonji family (18.5%), and where members of the Tata family have insignificant individual percentage shareholdings had an eruption that would put most volcanic activity to shame.

Tata Sons is not a listed company but it has significant majority and minority stakes in many Tata companies (some of which are portfolio companies which we own on your behalf). In December 2012, after an exhaustive 14-month search to appoint a successor to Ratan Tata (Chairman of Tata Sons since 1991), Cyrus Mistry (then aged 45 years) was anointed as the Chairman.

Make no mistake about it: Cyrus Mistry is an “insider”. His family owns an 18.5% equity stake in Tata Sons; his sister is married to Noel Tata, the step-brother of Ratan Tata; he was on the Board of a few Tata companies before he was made Chairman of Tata Sons. Frankly, we did not like the choice of Cyrus Mistry as Chairman of Tata Sons. However, we noted the fact that Tata Sons is not a listed company and we did not expect any change in the overall businesses of the listed companies, each run by professional managements, headed by a CEO, and with Independent Members of the Board. We did recognize that any change of business ethics, business ethos or business focus would clearly have an impact on the underlying operating companies which we may own in your portfolio. There was no reason to believe that Mr. Mistry could do much singlehandedly given the representation of the Tata Trusts on the Board of Tata Sons.

Corporate Philosophy vs. Corporate Governance

The unexpected and curt announcement on that Monday, October 24th that “the Board of Directors of Tata Sons has, in its meeting today, replaced Mr. Cyrus P. Mistry as Chairman, with immediate effect” was signed by Ratan N. Tata in his capacity as Interim Chairman.

But Cyrus Mistry is not slipping into the sunset silently. On Tuesday, October 25th his “camp” leaked an earlier confidential letter addressed to the Members of the Board of Tata Sons alleging that the Tata group had made some big – and wrong – bets on the acquisition of Corus by Tata Steel and the continuing production of the failed Nano small car project within Tata Motors, to name a few. These failed investments needed to be shut down and “emotional” reasons to own these businesses needed to end. The impairment, the internal note from Cyrus Mistry alleged, to the Tata group from these decisions would be nearly USD 18 billion. Furthermore, though Cyrus Mistry was the Chairman, Ratan Tata was still effectively interfering with the business decisions, including the decision to partner Singapore Airlines for the aviation business.

This revelation got the corporate governance watchdogs howling. Armed with their tick-the-box rules for corporate governance standards, they mushroomed on the media channels to push their recipe of fixing the world. Sadly, not one “expert commentator on corporate governance” made the obvious points:

Any analyst worth her or his salt, tracking the Tata companies, knew these “facts” of the numbers due to the bad decisions,

Any analyst – and owner of a Tata company – knows that the Tata family does not have the gene pool of a Gordon Gekko. The Tatas (and a few other businesses) run their businesses not to maximize near term profits but to build businesses that can benefit their employees and the communities around them. When we research a Tata company v/s a Gekko-like company we know that the Tata entity will take “softer” decisions and not fire people but allow headcount to reduce through natural retirement. The classic case of over-staffed cement manufacturer ACC or the long drawn out decline of Tata Finlay and Tata Textiles in the 1990’s may be forgotten by those with no memory. The dismissal of the money-oriented chieftains like Darbari Seth and Ajit Kelkar after Ratan Tata came to power in 1991 is also a case study of governance v/s profits. Every analyst expects a typical Tata company to have “waste” and “excess” from their “socialist” stance and builds that into their valuation models. If they don’t, it is because the analysts have not read up on their history. Here is a quote from Jamsetji Tata (1839 – 1904), the founder of the Tata group: “In a free enterprise, the community is not just another stakeholder in the business but is, in fact, the very purpose of its existence.”

Sure, all this lofty idealism stuff can potentially destroy shareholder value – for a quarter, a year, or longer. As data shows, though, this approach to worrying about “community” has built value of the Tata brand and its businesses over the long run. The group did not get to be India’s largest business house by Gekko-ing its way or bribing the system for favors.

We don’t know what happened in the Ratan/Cyrus spat – and the leaks of past communication from both the camps overshadowed the interest in the Clinton emails. But there is a feeling that Cyrus Mistry – and his coterie of advisors – was looking to shift this underlying corporate philosophy of focus on all stakeholders towards a RoE shareholder bias. And Ratan Tata’s response – along with the Directors representing the Trusts that control 65% of Tata Sons equity stock was: “over our dead body”.

What lends credence to this view (though dismissed by the Mistry camp) is the filing of a law suit by NTT DoCoMo against Tata Sons for failing to honor a share repurchase contract for their struggling telecom joint venture. An arbitration proceeding had ruled against Tata Sons and awarded DoCoMo USD 1.2 billion in damages. Tata Sons was apparently not paying and was sheltering behind a legal fact that, when the Agreement was signed, that repurchase clause was not allowed by the then prevailing Indian law. DoCoMo went to court on October 5th to have that award honored. Two questions to support this thesis for the ouster of Mistry:

When was the last time that a Tata company has been sued by a joint-venture partner? Never! When was the last time you heard of a Japanese company going to court against anyone??? Given their respectful culture and a management style that looks down on conflict, it probably took a lot for a Japanese firm to head to court – and that too against the venerable Tata group!

What next for Tata?

Over 100 years of Corporate Philosophy was shaken and stirred. The Mistry camp has stated that Tata Sons was aware of the evolution of the DoCoMo dispute and has denied the allegations of breaking ground with Tata’s tradition. As the days unfold, the situation will get murkier before it gets clearer. Cyrus Mistry is still Chairman or Director of some of the underlying portfolio companies of Tata Sons and is still a Director of the “parent” Tata Sons. Meanwhile, a committee has been formed to select a new Chairman for Tata Sons in four months. This time we hope they do a lot better and get a true professional in.

But whoever is selected to be the new Chairman of Tata Sons, the unlisted “parent” company will have had sufficient warning of the dangers of taking over the rein of an enterprise which is steeped in tradition and not focused on pure RoE as desired by most shareholders today.

The impact of these boardroom battles will dampen share prices of listed Tata companies for a while. However, they are unlikely to change the underlying outlook for the varied businesses and impact their intrinsic valuations. Our valuation models for some Tata companies are similar to that of the government owned banks: limited benefit of agility (but smart folks at the helm and in the depths of the management team); a diluted focus on near-term RoE but a believer in long term wealth and value creation; a bit fuddy-duddy on costs due to a constant focus on benefits to staff…you get the picture. Most analysts and portfolio managers probably have these characteristics built into their models when evaluating most Tata companies v/s other peers. Meanwhile, the portfolio will be constantly monitored and new information analyzed before decisions are taken.