Gender diversity is crucial to profitability and value creation. As India ESG investors, we demand far better disclosures from companies.

Equality for women "remains the great unfinished business of the 21st century"

The quote by former United State Secretary of State Hillary Clinton did really press the nerve in 2014 United Nations event. The reality has, however, been slow and swampy.

Gender is a crucial aspect that is intertwined with Environment, Social and Governance (ESG). As per the International Labour Organization Database, the world average for percentage of total women employed is ~39% in 2020. Strikingly, the average women participation in India is barely close to 19%.

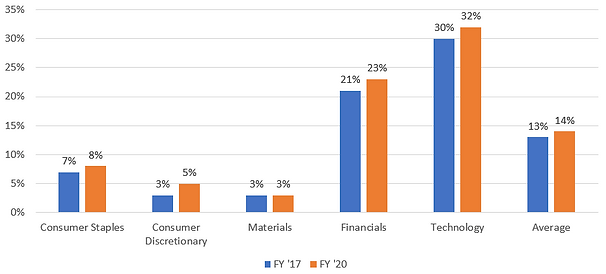

A quick glance at the sample of Indian companies shows the women employment in proportion to the total employed across different sectors continues to be well below global average.

Source: Quantum Proprietary ESG Research, 2020

A mere 1% increase in the percentage of women employed from 2017 to 2020 strongly indicates the need to address the issue of gender parity on a high priority basis. If this trend continues, it would take India approximately 80 years to be at par with the global average!

Historically, the financial sector absorbs more female workers given the fixed nature of the job and security of employment. In case of India, the share of women employed is yet far off from the global average. On the other hand, Technology sector has certainly emerged as a female friendly sector and manages to employ up to 30% plus females. The gender pay parity is something that needs a further investigation.

Traditionally, sectors like materials, industrials, manufacturing, and mining were male dominated as the jobs demanded extensive physical demands and commitment of long working hours. The social aspect was another hurdle in increasing the participation of women in these sectors.

In the current scenario, the share of women in sectors like consumer staples, consumer discretionary and materials continue to be disappointing. These sectors have been revolutionised by automation and technology that can enable the management to increase women representation.

The data continues to be supported by stereotypes and biases even in 2020. It is crystal clear that the pandemic has further affected women disproportionately and the need for a greater push towards making gender parity a priority is being felt more than ever.

How does this affect investors?

The latest McKinsey & Company report on “Diversity wins” shows that women contribute positively to the company's decision making, innovation capacity, financial strength and good governance. Gender diversity is crucial for profitability and value creation. Gender equality, thus, becomes an important essential for the longevity of the company.

As investors, it is in our best interest to demand more disclosures and improvement on gender diversity. One of the crucial aspects to consider while investing in a company is to assessment of gender diversity.

- Women representation at the management and board level

- Equal and fair compensation to men and women

- Diverse approach to hiring and promotions

The new disclosures by top 100 listed companies about health care benefits to women, composition of women employees as per skill set, percentage of women employees earning less than median wage will nudge the companies to assess their business from a different perspective.

At Quantum Advisors, while 32% of our employee base are women, at the senior management level, it is lower at 18%. Quantum Advisors recently became a member of Workforce Disclosure Initiative (WDI), UK with an aim to “Walk the Talk” first, demonstrate improvement in gender issues internally starting 2021. We then, hope to engage with Indian companies, including our portfolio companies, to showcase our own journey and guide them for an inclusive workforce.