The fact that the union government has outlined a wider fiscal deficit going out 5 years upto 2026 should give some comfort to the RBI on the growth recovery. The economy will have fiscal support of ~8% of GDP on average over the next 5 years, higher than historical average.

India’s history though suggests a period of high deficits leads to high inflation and subsequently a weakening currency. Although, the global world now seems more forgiving of high deficits, but an emerging market country like India can quickly lose credibility if the high deficits lead to high inflation.

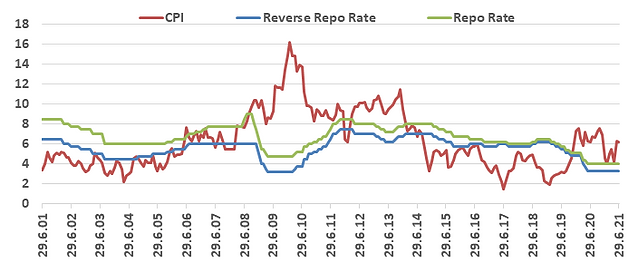

The RBI, given that it isn’t focusing on the 4% CPI target, has borrowed some leeway out of a deficit fueled inflation. They have also taken comfort on government spending being more capex than revenue. Also, for now they seem to have placed a rather high trust on the ability of this government to yet again control food prices and hence the overall CPI inflation.

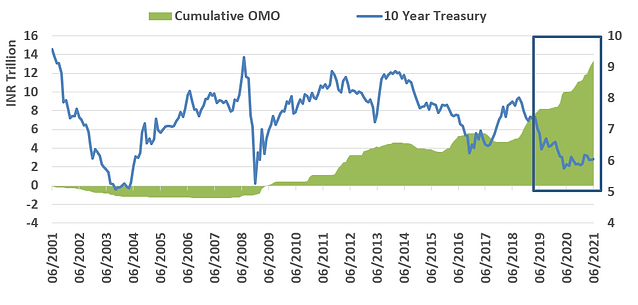

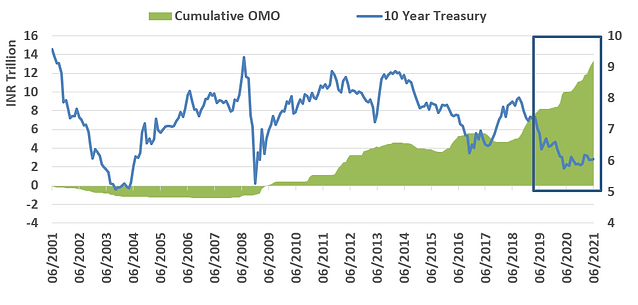

Under Das, this RBI has also become more zealous in its role as a debt manager. They may be cognizant of the inflation risks of higher deficits, however they seem to be more sensitive on ensuring a lower cost for the government borrowing.

The ‘orderly yield curve being a public good’ is also indicative of the fact that even when policy rates eventually rise, the RBI will continue its market interventions and keep a firm control on the government bond yields.

(Source: RBI, OMO= open market operations, Government bond purchases by RBI, QE=Quantitative Easing)

All Signs Thus Point to a Lower ‘Normal’

A final fact to consider is that the RBI and MPC do not even talk about real interest rates anymore. This suggests that India will continue to have low or negative real interest rates. India’s large Asian neighbours, China and Indonesia, also hit by the same pandemic, have managed to keep short term real interest rates positive despite the growth challenge.

This does not bode well for India’s intention to attract foreign money in the bond markets. For now though, given the excess capital inflows into the Equity markets, RBI will weigh its policy balance favouring equity investors over debt and keep real rates low or negative.

This is a big change from the previous regime. The RBI can now potentially hold its policy rate at or below the level of inflation.

We estimate India’s long-term CPI inflation in the 5.0%-5.5% range. If that be so, the RBI can try and hold the Repo rate at say 5.0% to achieve its growth objective.

As we look out over the next year, we do see rates higher as mentioned. However, we think the RBI will be slow to act and try and indicate to the markets that a policy rate of 5.0% in itself may be the ‘new normal’.

Of course, it all depends on global commodity prices and India’s fiscal spending policies, to see if growth can sustain above 6% and inflation can remain in the 5.0%-5.5%.

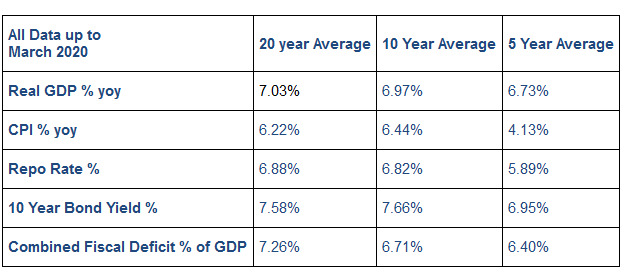

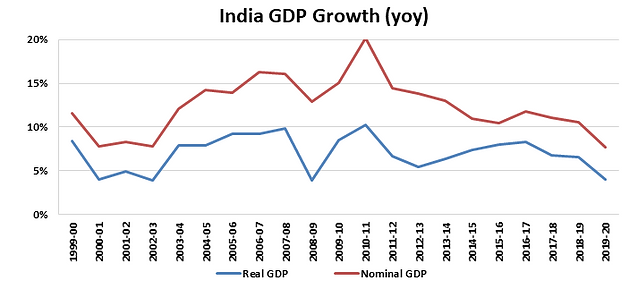

However, it so seems, we may have to ignore the weight of historical long-term averages and adapt to a scenario of Indian rates trying to be held at a lower level than usual.

Will this growth supportive monetary and fiscal stance take us back to a time when Governor Subbarao had to face the wrath of the global financial markets as inflation soared?

Back then, the RBI response to a challenging inflation, foreign exchange scenario was slow. However within a year of the start of the normalisation, the RBI had hiked rates by 300 bps by March 2011 and despite that India made it to the ‘fragile five’ list in 2013.

Das, who is sure to continue for another two years as Governor, would hope and pray that global conditions remain benign to allow him to operate Indian rates in a ‘new normal’.

In a following piece, we will look at what would it mean for bond markets and for fixed income investments, if Indian rates indeed are held at a lower level than normal.

For more information and if you wish to discuss the details in the article or if you wish to know more about our investment strategies, the investment philosophy and investment opportunities, please contact:

Arvind Chari – [email protected]

https://www.qasl.com/insights/categories/india-macro

Arvind Chari is the Chief Investment Officer (CIO) at Quantum Advisors. Arvind’s vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 18 years of experience in tracking domestic and global economy he is Quantum’s thought leader and is the author of this Q-India Insight edition.

Important Disclosures & Disclaimers:

1. Quantum Advisors Private Limited (QAPL) is registered in India and holds a Portfolio Management License from Securities and Exchange Board of India (SEBI), India. It is also registered with the Securities Exchange Commission, USA as an Investment Adviser and a Restricted Portfolio Manager in the Canadian Provinces of British Columbia (BCSC), Ontario (OSC), and Quebec (AMF). It is currently not registered with any other regulator. Registration with above regulators does not imply any level of skill or training

2. This summary is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fee and investment strategies of QAPL.

3. This article is strictly for information purposes only and should not be considered as an offer to sell, or solicitation of an offer to buy interests in the account. Investments in the equity and fixed income instruments are not guaranteed or insured and are subject to investments risks, including the possible loss of the principal amount invested. The value of the securities and the income from them may fall as well as rise. Past performance does not guarantee future results and future performance may be lower or higher than the data quoted, including the possibility of the loss. Quantum Advisors reserves the right to make the changes and corrections to its opinions expressed in the document at any time, without notice. Information sourced from third parties cannot be guaranteed or was not independently verified. Comments made herein are not necessarily indicative of future or likely performance of the account and are based on information and developments as at 10/08/2021 unless otherwise stated.

4. All of the forward-looking statements made in this communication are inherently uncertain and Quantum Advisors (QAPL) cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “should”, “can”, “may”, “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume”, “target”, “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities law

UK related important disclosures

The protections conferred by or under the Financial Services and Markets Act (FSMA) will not apply to this newsletter and any ESG based investment activity undertaken by us.

The protections conferred by or under the FSMA may not apply to any investment activity that may be engaged in as a result of this newsletter.

The applicability of any dispute resolution scheme or compensation scheme and its jurisdiction (if and where applicable) pertaining to a transaction resulting from this newsletter would be as specified in the respective client agreements.