We take an accounting of the sustainability linked hits and misses in this year's Fiscal Budget.

One of the most noticeable aspects of the Union Budget 2022-23 presented by the Finance Minister on Feb 1st 2022 was the reference towards sustainability. The Budget speech, on more than one occasion, brought attention of the house for the need to grow sustainably. Clean and green energy were the major focus areas, which helps India progress towards the Sustainable Development Goals set. The intention and thrust were evident in the language however it seemed short on its vision. While it did have a slew of great sustainability initiatives, which also appeared at the core of its main agenda i.e. PM Gati Shakti National master plan to bring sustainable economic development, it does not put enough might behind it.

The Government seems to be doing some heavy lifting which may not be enough. Private sector needs to be brought in to make the desirable changes towards the ambitious cleaner, greener India to emphasize sustainable production to begin with. To name a few, Incentives to corporates to increase their share of renewable energy, CSR investments channelised towards sustainability initiatives, incentives for technology and investments towards sustainability seem to be missing. More importantly, this Budget also approved a river-linking project called Ken-Betwa. The project involves transfer of excess water in Ken river, a tributary of Yamuna, to central India with a dam built as a reservoir along the way. There are many NGO reports sighting the threat this project would have on tribal population and one of the pristine tiger reserves in Madhya Pradesh. Potentially, an environmental disaster in the making. This government has a poor track record when it comes to engaging stakeholders that are likely to the most affected when it comes to clearances for projects. It seems like a Hogwash in the name of sustainability!

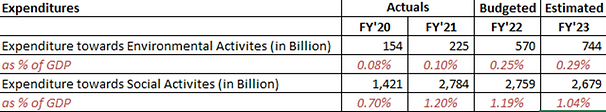

Environment & Social Budget Breakup -

The government has been emphasizing to tackle environmental problems and thus have been committing budgets towards it which needs to at least triple in the next couple of years. Given the government revenues have been increasing, it would have been ideally a good move to front load and channelize more funds towards climate objectives in this budget.

Last financial year expenditure towards Social Activities nearly doubled due to additional spends in Rural Employment Guarantee and Social Assistance Programmes and is likely to remain muted in the coming years.

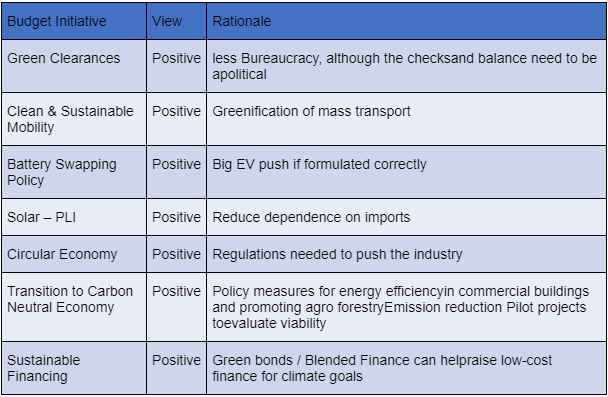

Budget - Hits

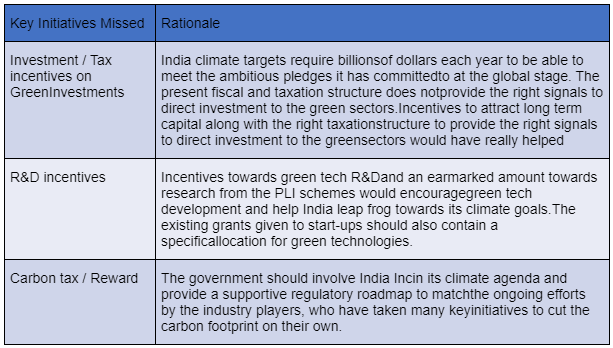

Budget - Misses

Some of the important Sustainability linked announcements made in the budget:

Solar Power - Government has an ambitious goal of 280 GW of installed solar capacity by 2030. As of 31st December 2021, India's total Renewable Energy capacity is 104 GW of which solar power capacity installation is 49GW solar power capacity in the country. An additional allocation of INR 195 billion for Production Linked Incentive (PLI) for manufacturing of high-efficiency modules, with priority to fully integrated manufacturing units from polysilicon to solar PV modules. This will help reduce reliance on the import-dependent supply chain for green technologies. Such measures will be crucial to ensure that the green transition does not increase our dependence on a small set of countries that control the technology and raw materials at present.

Circular Economy - The majority of India's recycling has been traditionally managed by the informal sector. The government has laid down action plans for ten sectors such as electronic waste, end-of-life vehicles, used oil waste, and toxic & hazardous industrial waste. The government has also been providing Carbon Credits in certain sectors as a measure to fast-track and formalize waste recycling. This will provide the much needed regulatory push for circular economy initiatives in important sectors.

Coal Substitution in Thermal Energy - 5-7% biomass pellets will be substituted with coal in thermal power plants resulting in CO2 savings of 38 million tons nearly ~2.5% of emissions contributed by India's Thermal Power Plants. This will also provide extra income to farmers and job opportunities to locals and help avoid stubble burning in agriculture fields. This is an important measure but execution is the key as many biomass projects have failed to procure the necessary bio mass raw material from farmers.

Energy Service Companies - Government will be promoting energy efficiency and savings measures in large commercial buildings through the Energy Service Company (ESCO) business model. It will facilitate capacity building and awareness for energy audits, performance contracts, and common measurement & verification protocols. Currently, 149 ESCOs are empaneled by the Bureau of Energy Efficiency (BEE). The energy efficiency market in India is estimated to be worth INR 1500 billion, out of which only 5% potential has been tapped by ESCOs so far.

Environmental Clearances - India ranks 63/192 countries in ease of doing business (142/185 in 2014). The Government has been promoting Make in India since 2014 and launched PLI schemes in 2020 to push manufacturing practices. The government will be expanding the scope of their existing environmental clearance portal, PARIVESH, by reducing inefficiencies and combining all approvals under one application. This will make it easier as it introduces a single window for all environmental clearances, provides location-specific information, and more importantly, reduces bureaucracy involved with getting approvals.

Battery Swapping Policy - With the government introducing FAME policy in the past to subsidize the purchase of EVs, the market is yet at a nascent stage due to lack of charging infrastructure, range anxiety, and high charging time. To improve efficiency in the EV ecosystem, the Government will be introducing Battery Swapping Policy to give impetus to innovative business models like 'Battery or Energy as a Service'. If Battery as a Service model is commercialized, it can bring down the cost of an electric vehicle by ~50%. Such policies if executed well can provide a big push to EVs in India.

Climate Financing - Climate Finance is one of the key drivers to the implementation of National Targets related to sustainability.

Green Bonds - As a part of the government's overall market borrowings in 2022-23, sovereign Green Bonds will be issued for mobilizing resources for green infrastructure. The proceeds will be deployed in public sector projects which help in reducing the carbon intensity of the economy.

Blended Finance - For encouraging important sunrise sectors such as Climate Action, Deep-Tech, Digital Economy, Pharma, and Agri-Tech, the government will promote thematic funds for blended finance with the government share being limited to 20 percent and the funds being managed by private fund managers.

India's climate targets require billions of dollars each year to be able to meet the ambitious pledges, it has committed to on the global stage. Incentives to attract long term capital along with the right taxation structure to provide the right signals to direct investment to the green sectors would have really helped. Additional incentives towards green tech R&D and an earmarked amount towards research from the PLI schemes would help India leapfrog towards its climate goals. Allocating funding to set up Centres of Excellence or government-funded incubators for start-ups could also spur innovation. The existing grants given to start-ups should also contain a specific allocation for green technologies.

Corporate India a Great Force in the Fight Against Climate Change

Prime Minister Narendra Modi has set his country a target of net zero greenhouse gas emissions by 2070, a significantly later deadline than many other countries. By 2030, the Prime Minister said India will reduce its emission intensity by 45% by 2030 (from 2005 level) as opposed to 35% set earlier. The country also aims to achieve net-zero by 2070. Ignoring the fact that the country's targeted 175 GW of renewable power capacity by FY22 is already behind schedule, this emission intensity reduction targets cannot be achieved by grandiose statements. It is estimated that India needs US$ 10 trillion by 2070 to meets its CO2 emission targets, according to CEEW-Centre for Energy Finance (CEF), a think tank based in New Delhi. Of this, US$ 8.4 trillion is needed for its renewable energy targets, including distribution and transmission infrastructure. One wonders if there is a road map exists at all keeping these long term targets in mind.

There is a greater thrust on climate action following the announcement of India's target of becoming Net-Zero by 2070. Climate finance will remain critical to successful climate action. The government should involve India Inc in its climate agenda and provide a supportive regulatory roadmap to match the ongoing efforts by the industry players, who have taken many key initiatives to cut the carbon footprint on their own. Though there was a clear thrust on intention to grow sustainably, it has clearly missed on some important measures that could have fast tracked climate efforts.

Given the fact that most Green / Clean projects are long gestation projects, it is imperative to act early and fast. We are probably losing time to meet our ambitious climate goals by 2030. This delay will in turn increase the urgency at some point to put in aggressive measures and thereby lead to the haphazard implementation of regulatory mandates to meet the climate commitments. India Inc. may have to bear the brunt and Corporates who are ahead of the curve with respect to their ESG practices will benefit as they would be prepared for the eventuality.