In the month of November 2020, year Quantum Advisors was the first company in India to partner with the Workforce Disclosure Initiative (WDI) and the 51st in the world. The idea was:

- to shine a torch on Quantum’s own workforce disclosures and practices,

- learn about our weaknesses,

- implement what can be quickly corrected, and

- put an action plan to improve on other areas and understand the challenges to improve.

These learnings help us take our experience to the portfolio companies who can meaningfully engage with WDI to improve their own workforce practices.

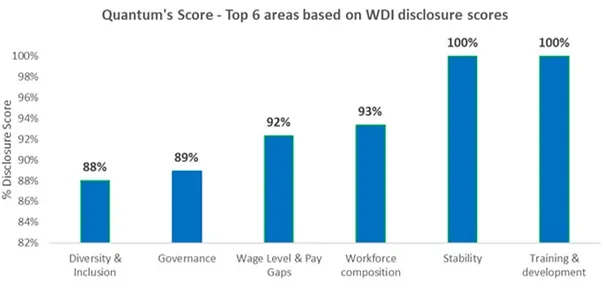

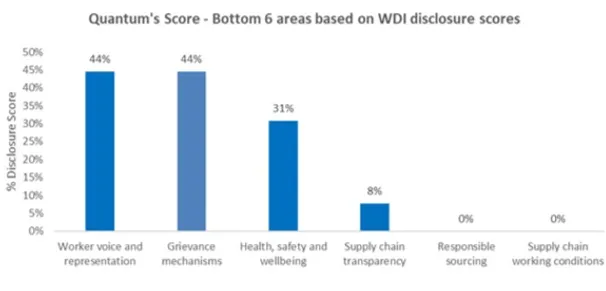

We submitted our workforce disclosure to WDI in December 2020. Quantum had a score of 101 out of 175 points across 13 sections ranging from supply chain management to health and well-being policies to compensation structures to diversity and inclusion policies.

The two charts below showcase areas where Quantum Advisors rates well in relation to our disclosures over our workforce - and areas where we need to disclose more data.

For a financial services company like Quantum Advisors, supply-chain and responsible sourcing are less-relevant compared to a manufacturing firm. Also, in our interactions with WDI, we have learnt the importance of adopting formal policies at the Board level for worker representation, well-being, and grievance mechanisms. We are in the process of adopting such policies in the quarter ended December 31, 2021.