A macro look at global investor allocation to Indian asset markets as the world frets over Inflation.

Milton Friedman is credited to have said ‘Inflation is always and everywhere a monetary phenomenon’. In the post 1970s inflationary world, this theory gained prominence. Central bankers moved to inflation targeting. They also built in the quantity theory of money models into its rate and liquidity setting mechanisms.

Over the years, the monetary world was convinced that as and when central bankers increase money supply, it will be followed by inflation. However, the evidence of the last 20 years has been the complete opposite.

Central bankers around the world have expanded money supply and its own balance sheets to get inflation. Forget worrying about inflation. The developed world has just about managed to beat deflation.

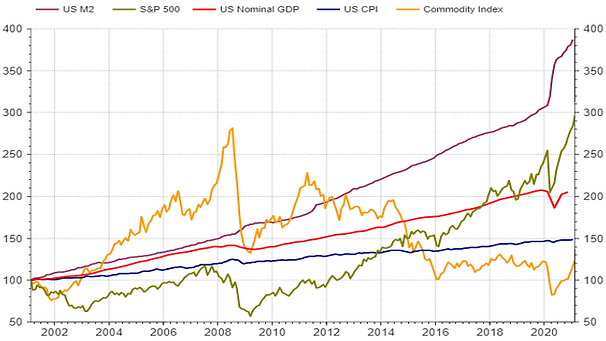

Chart 1: Hey look, do you see Inflation?

(Source: Refinitiv, All data rebased to 100 in January 2002; M2= US Money Supply, Commodity-Reuters Commodity Index in USD)

As the chart above shows, the US, the global currency, has seen a significant increase in money supply (purple line). The blue line indexed to 100, the US Consumer Price Index (CPI), has managed to inch up to 150 in 20 years, a ~2% per year increase. The US Money supply measure (M2) in the same period has grown by ~7% a year. If you look at the commodity price index, in dollar terms, it has been in deflation over the last 10 years.

These are long enough periods for many to start questioning the inflation as a monetary phenomenon thesis. Developed world central bankers have printed significant money especially since the global financial crisis of 2008. We have seen asset price inflation, however, there has been no resultant inflation in goods and services.

‘Is Inflation then always and everywhere a fiscal phenomenon’?

No one is credited in saying this. However, over the last 20 years, it so seems many are getting convinced that so is the case. If monetary policy has been unable to drive inflation, the answer may well lie with fiscal policy.

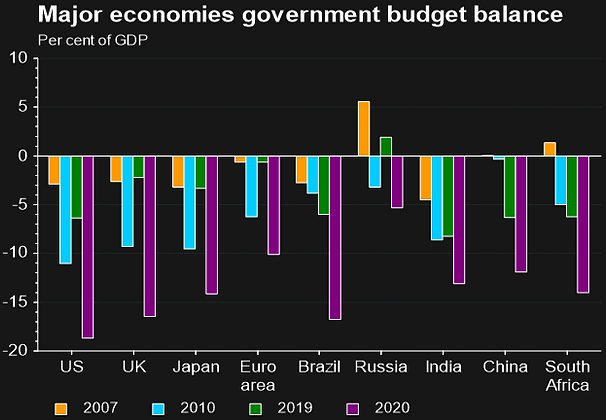

Chart 2 and 3: Global monetary and fiscal policy in sync!

(Source: Refinitiv, for chart 3: Macquarie research)

As the chart on the left shows, almost all countries tightened their fiscal deficits between 2010 and 2020. The US credit rating downgrade of 2011 and the European sovereign debt crisis triggered a global move to fiscal austerity. The 2013 Taper-Tantrum episode was brutal on many emerging markets forcing them to tighten their fiscal and monetary policies.

This de-leveraging and belt tightening seems to have dampened demand, slowed down growth and lowered inflation leading many to term it new normal or secular stagnation. The Modern Monetary Theorists on the other hand have been vehemently arguing for increased fiscal response to get back growth, income, and employment.

COVID Has Made Policy Makers Bolder

COVID handed over the much-needed license to governments to increase their spending. Governments all over the world have pledged to increase the government spending not only in 2020-2021 but even beyond.

Under the new president Joe Biden, the US passed its US$1.9 trillon stimulus and pledged to do more. The EU passed through its EU 700bn package and has contemplated to spend EU 2.2 trillon over the next 3 – 5 years.

The Indian federal government has decided to keep the fiscal deficit to GDP around 4.5% till march 2026, almost 2% points higher on an average than its fiscal consolidation target of 3% of GDP.

The fiscal stimulus of such amounts in sync with the monetary policy response triggered a rally. A rally not only in risk assets but also in real economy variables.

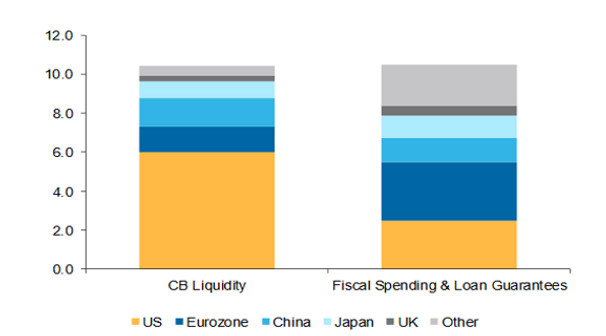

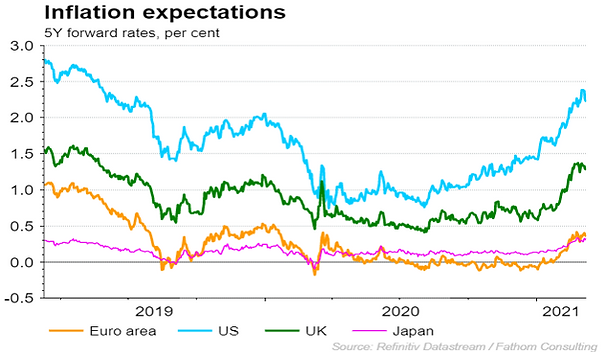

Chart 4 and 5: Deflation to Reflation to Inflation?

The recent brouhaha in the global markets are signals that the markets expect inflation to be higher. For now, it seems it views this in the short term. A burst of fiscal spending in the next two years is feared to spike inflation more than growth. The worry then is that global central bankers may have to begin increasing interest rates faster than earlier anticipated. The edifice of the asset market recovery is based on interest rates being low.

The Inflation Question Is One of Time: Short-Term

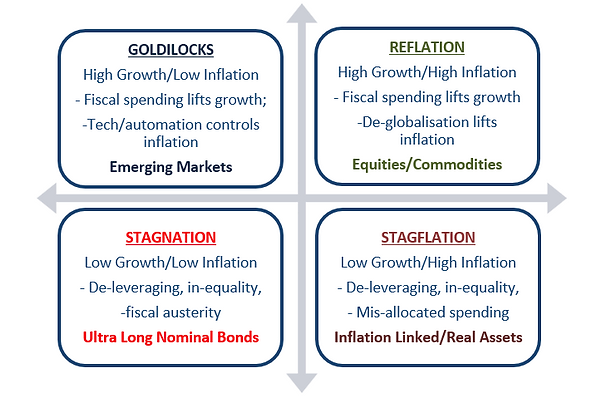

Markets tend to think short-term. We may see that over this year itself. The global markets at different points in time may price all the above scenarios depending on data releases of GDP, CPI, PMI and employment.

Risk assets will fear stagflation and reflation. Both scenarios require the central banks to move away from the ‘low for long’ thesis. As inflation picks up, markets will price higher interest rates and tighter liquidity. A case for normalization of monetary policy will be made. Although desirable over the long-term, the market in the short-term will juxtapose to the two recent episodes of monetary policy normalization by the US FED; 2013 and 2018.

Emerging Market politicians, policy makers and investors will particularly fear the 2013: Taper Tantrum episode. India got bracketed as ‘Fragile Five’ and required higher interest rates, tighter fiscal policy to stem the brutal depreciation. The incumbent UPA government lost power in 2014 to Narendra Modi led NDA coalition.

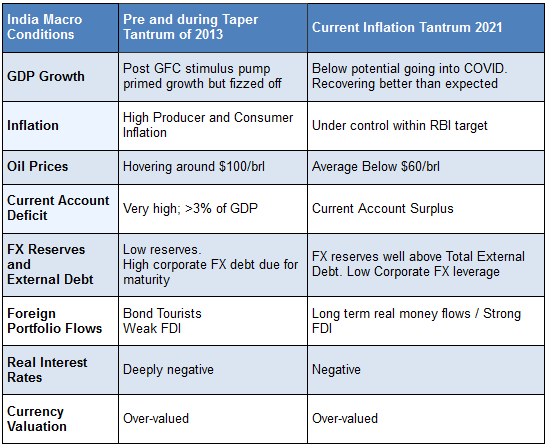

Table 1: India not ‘Fragile’ anymore?

(Source: Quantum Research)

As the table depicts, in the short run, India is in a good position to manage a ‘tantrum’. This is not to say Indian assets won’t take a hit. Indian equity markets, bond yields and currency cannot be immune to a broader emerging market sell-off. However, the pace and the magnitude of the sell-off will be manageable.

India’s biggest short-term macro risk remains oil prices. Since 2013, India has had it good with oil prices averaging below the US$ 60 level. In a reflationary world, where global commodity prices rise, India will find it tough. If oil boils, Indian assets will cool off. Bond yields will be higher, INR will be weaker.

The Inflation Question Is One of Time: Medium to Long-Term

India will hope for a goldilocks scenario: Higher than average growth and manageable inflation. The initial government stimulus improves incomes and confidence. Private sector investment activity picks up to meet that demand and creates fresh capacities. If the cycle sustains, the Government stimulus fades out with growth remaining high, interest rates normalized, and inflation controlled. This is the best case for Emerging Markets.

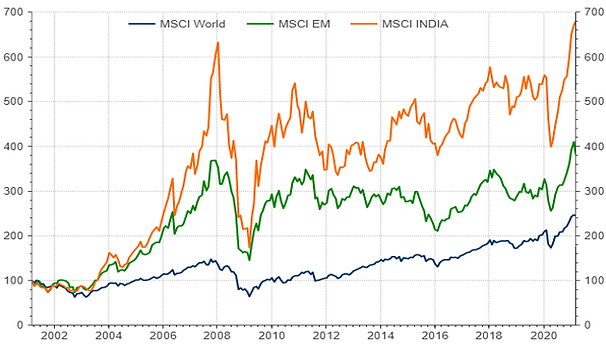

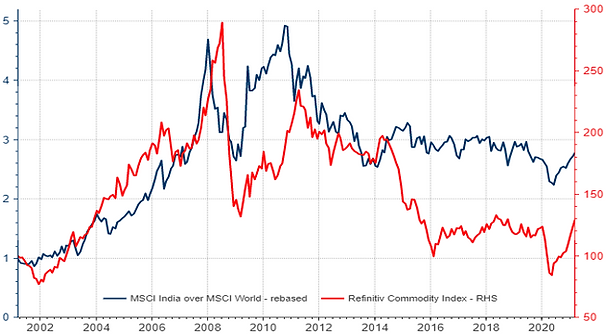

Chart 6 and 7: Indian Equities thrive during global growth; ‘Good’ Inflation helps emerging markets

(Source: Refinitiv, Chart 6: All data rebased to 100 in January 2002; Chart 7: MSCI India, MSCI World, Commodity index rebased to 100)

The chart on the left is a testament to why global long-term investors need to have a dedicated India equity allocation. Over the last 20 years, Indian equities have delivered significant returns in dollar terms albeit with some volatility.

The chart on the right depicts Indian equity outperformance against world equities using MSCI indices. The outperformance of India over MSCI world in the 2002-2007 period reflects the impact of high growth. However, as global growth stuttered post the US and EU sovereign debt problems of 2011-12, you can notice the Indian outperformance drops significantly.

Also, in the medium term, only when inflation becomes a serious problem (for eg. Oil prices above $100/brl), does Indian equities underperform global equities. Growth combined with measured real economy inflation is good for India and emerging markets.

If the post COVID world indeed resembles the post SARS global growth recovery, Indian equities seem promising. The steep valuations are a bit of hindrance; however, the Quantum Value Equity Team does note the increased earnings estimates and positive management commentary. They are also enthused by the government’s decision to focus on growth over deficits over the medium term.

The Inflation tantrum playing out now should lead to an equity market sell-off, which in our opinion will be a great opportunity to increase your long-term India allocation.

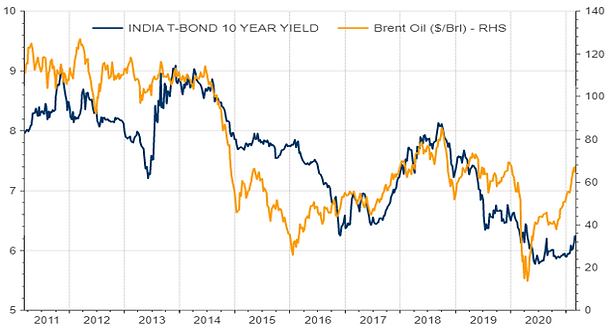

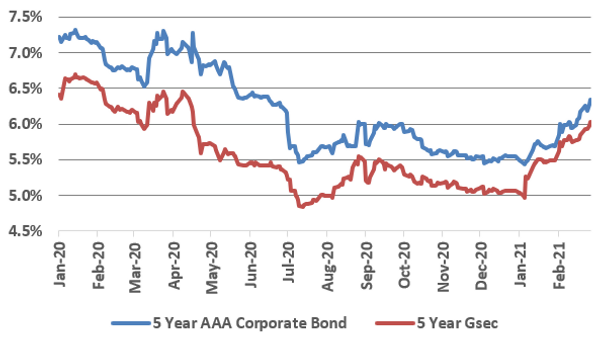

Indian Bonds Though Face a Tougher Challenge

Indian Bond yields have moved up sharply on: a) fears of normalization; b) increase in fiscal supplies; c) doubt on RBIs commitment; d) global reflation leading to high global commodity prices and e) Indian bond yields moving in sync with global bond yields.

We have believed over the last 3 months that rates have seen their bottom and will move upwards. However, the pace of the reversal has been surprising. The shorter end, 2-5 years where the corporates borrow, have seen almost 100 bps increase in yields. Bond markets are no long pricing in only liquidity normalization, they are already pricing in significant rate hikes. The increase in global bond yields and the sharp gain in oil prices is adding to the pressure.

Chart 8 and 9: Best of the Bond markets are behind us. India will hoping for ‘No Tantrum’

(Source: Refinitiv, Chart 9: Bloomberg Finance L.P)

It just shows the extent to which the central bankers have managed the bond market. Any release in pressure and markets start fretting about. In the last decade, few central banks mainly the US Federal reserve made many attempts to roll back the easy money policy but every time it ended up causing turmoil in the financial markets and slowing down the economy. Memories of the disastrous 2013 taper tantrum and the market sell off 2018 are still fresh in everybody’s mind.

However, can economies sustain high interest rates given we are sitting on an unprecedented level of debt? Can central banks prioritize inflation over growth at such times? These questions remain unanswered at this point. Also, how much inflation is inflation. If the developed world gets to 2% inflation, it may actually be a good thing.

For now, I do think central bankers will have more patience than the markets. We don’t see any central banker in a hurry to normalize. They may allow markets a bit more freedom to determine long-term bond yields. However, if yields rise too fast too high, we may see some form of yield curve control to manage long term interest rates.

At a recent global pensions conference, the number of times ‘inflation’ was discussed was revealing. The on-going ‘reflation; trade may well morph into an ‘inflation’ scare. In 2011-2013, the world was worried about debt, deficits and inflation. That episode didn’t end well for emerging markets.

As we have highlighted above, India is in a much better macro situation that it found itself in 2013. An inflation tantrum driven sell off in global bond markets and currencies, will impact Indian markets.

For Indian equities though, a sell-off due to worries on inflation, may be a good opportunity to add/allocate to your long-term India allocations.

The trigger for India bonds remains the potential entry into a global bond index. Foreigners for now continue to shy away from local currency Indian debt. The yield curve is steep and the RBI will need to carefully manage the normalization. The Indian residential housing recovery is dependent on low home loan interest rates apart from government tax sops.

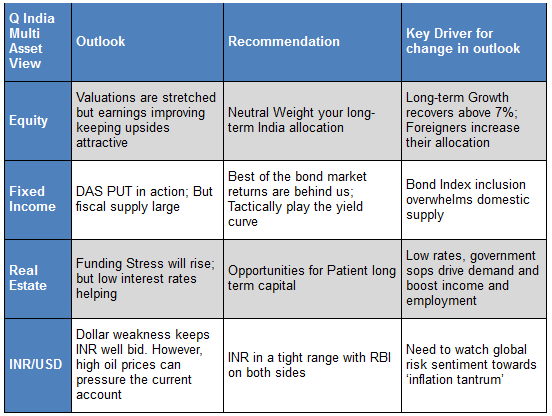

Table 2: Q India Multi Asset Summary

For more information and if you wish to discuss the details in the article or if you wish to know more about our investment strategies, the investment philosophy and investment opportunities, please contact:

Arvind Chari – [email protected]

Arvind Chari is the Chief Investment Officer (CIO) at Quantum Advisors. Arvind’s vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 18 years of experience in tracking domestic and global economy he is Quantum’s thought leader and is the author of this Q-India Insight edition.

About Quantum Advisors Private Limited (QAPL)Investing with principles.

To build an India-focused investment management institution, that can consistently make money for our clients without taking undue risks over longer time horizons and chart a controlled growth in our AuM across the major asset classes: equity, fixed income, real estate, infrastructure

*While we shall comply with all applicable regulations and it is our endeavor to follow industry best practices for the benefit of all our clients, non-US persons and investors in our non-US funds should take note that registration of QAPL as an investment adviser with SEC does not imply any level of skill or training. that our non-US clients are entitled to the full benefit of all substantive provisions of the Investment Advisers Act 1940 (Advisers Act) or that we are required to comply with all the provisions of the Advisers Act in our dealings with our non-US clients, including non-US funds. We will thus have responsibilities under the Advisers Act that differ from client to client, based on whether or not the client is a non-US client”.

This article is strictly for information purposes only and should not be considered as an offer to sell, or solicitation of an offer to buy interests in the account. Investments in the equity and fixed income instruments are not guaranteed or insured and are subject to investments risks, including the possible loss of the principal amount invested. The value of the securities and the income from them may fall as well as rise. Past performance does not guarantee future results and future performance may be lower or higher than the data quoted, including the possibility of the loss. Quantum Advisors reserves the right to make the changes and corrections to its opinions expressed in the document at any time, without notice. Information sourced from third parties cannot be guaranteed or was not independently verified. Comments made herein are not necessarily indicative of future or likely performance of the account and are based on information and developments as at 10/03/2021 unless otherwise stated.

All of the forward-looking statements made in this communication are inherently uncertain and Quantum Advisors (QAPL) cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “should”, “can”, “may”, “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume”, “target”, “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities law