Recurring climate crises adversely impact economic, food and healthcare systems and heat waves are the clearest symptom of global warming.

While heatwaves are common in India, this year’s summer began early witnessing the maximum temperature ever in the last 122 years. The hottest March was followed by even more severe heatwaves in April. It indicates a recurring pattern of intense hot spells, which could be a sign of climate change and global warming. The number of heatwave days in India over the decades have increased from 413 during 1981-90 to 575 in 2001-10 and further to 600 in 2010-20, a study by IMD and Kottayam-based Institute for Climate Change Studies (ICCS) said, highlighting the impact of the climate crisis on the maximum temperatures.

Experts predict that before climate change, such intensity of heat would have only been seen about once in every 50 years in India. However, it is now expected to occur once every four years. As per India’s Ministry of Earth Sciences, the frequency of warm extremes over India has increased during 1951–2015, with accelerated warming trends during the recent 30-year period.

India, which is reeling through a heatwave right now, is also expected to suffer through more frequent and intense hot spells, extreme rainfall, and erratic monsoons in the coming decades as the planet becomes warm, said United Nations’ Intergovernmental Panel on Climate Change (IPCC). It also has led to cascading impacts not just on human health, but also on ecosystems such as agriculture, water, and energy supplies. Power demand has spiked and coal inventories have dropped, leaving the country with its worst power shortage in more than six years.

The heat wave will also have an economic cost—one that will ripple beyond the subcontinent.

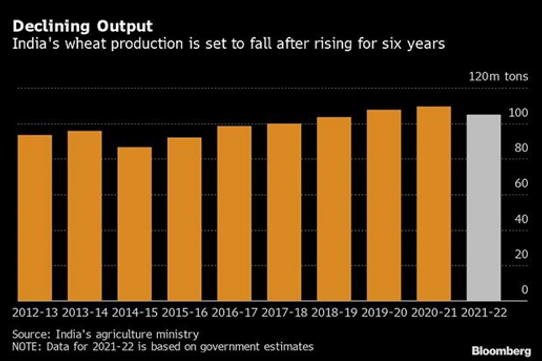

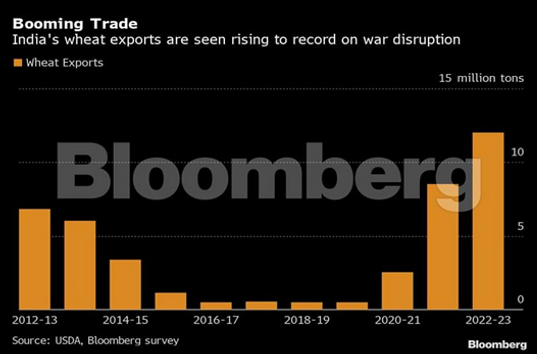

India tried filling in the wheat void created by disruption from Russia and Ukraine, two countries account for nearly a third of all global wheat exports. India, which has enjoyed five straight years of record wheat crops, jumped in and offered to export more than usual. The food and commerce minister predicted that India will export as much as 15 million tons of wheat this fiscal year, a record high and double of what it shipped last year. The scorching heat has thrown that into doubt. Some Indian farmers have estimated that 10 to 15 percent of their crop has died, according to Monika Tothova, an economist at the Food and Agriculture Organization.

The Lancet countdown report shows that India reported the highest loss in working hours or productivity in the world, that is, 118 billion work hours in 2019 due to heat stress! For this year, one can only imagine how many days or years that calculates to. McKinsey estimates that work hours lost to heat waves could cause losses of as much as $250 billion, or 4.5% of gross domestic product, by the end of the decade.

Heat waves are the clearest and most easily identifiable symptom of global warming. Researchers, policymakers, and climate activists have been advocating the need for a long-term vision while planning the future. However, making money at the cost of deforestation, excessive use of fossil fuels, unduly exploiting strained natural resources, and conveniently and disproportionately passing on the burden of these extremities to the poor has been a norm!

It is time to integrate climate change impact including new risks like heatwaves into the risk and strategy models. The temperatures spiking around the world have already started to show their ugly impacts on health, crops, power usage, water supplies, etc. Consequently, these impacts are going to percolate down to affecting the company’s operations, supply chains, employees, customers, and all possible stakeholders.

On one side, the governments across the world are urging fossil fuel companies to drill for more oil and gas to make up for the sanctions on Russia, on the other side, the United Nations’ IPCC report is urging immediate action for rapid and deep emission reduction to limit global warming.

Indian Companies Can Derail Climate Progress

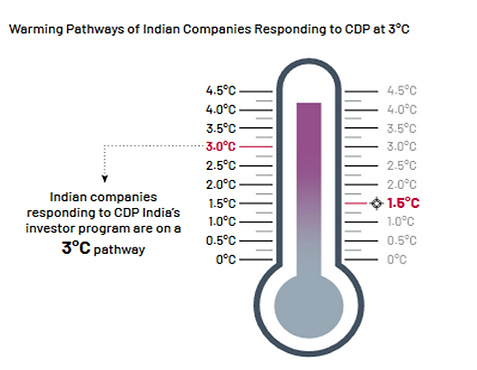

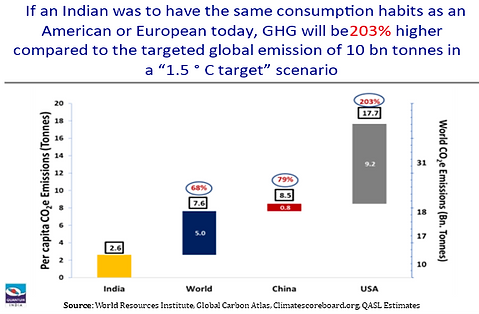

This is the state of companies who are conscious, measuring and reporting their emissions. A large set of companies aren’t even aware of how they are degrading the environment. This makes India ground zero if the world were serious about tackling the climate change menace. If India were to contribute towards achieving 1.5/2 degree targets, it will involve a substantial reduction in fossil fuel use, widespread electrification, improved energy efficiency, and use of alternative fuels.

With such an interconnected world that we live in, any crisis would have consequences ricochet around its economy; society and generations for decades will face the impacts. Alignment and embracing sustainable capitalism will not only fulfill the genuine need for preservation and conservation but also avert future climate emergencies. It is a win-win for all!

As asset managers, it is pertinent to identify whether our investee companies are addressing the climate related risks and opportunities and examine the strategies adopted by them to mitigate their carbon footprint. Generally, most companies first adopt an internal carbon price, establish reporting systems to capture their emissions and then set long term targets on reducing their emissions. These long-term targets can be based on internal aspirations or can be aligned with best practices such as the Science Based Targets Initiative (SBTi) which verifies compliance to the 1.5 ° C or 2.0 ° C pathway, as may be the case. More than 1600 companies globally have their targets approved by SBTi.

In India, most companies are currently in the first stage of establishing an internal carbon price. However, many have also demonstrated an intent to align their emission targets with the SBTi.

Since there is a major emphasis on transitioning to a low carbon future, we have mapped our investee companies on their commitments to various carbon reduction initiatives.

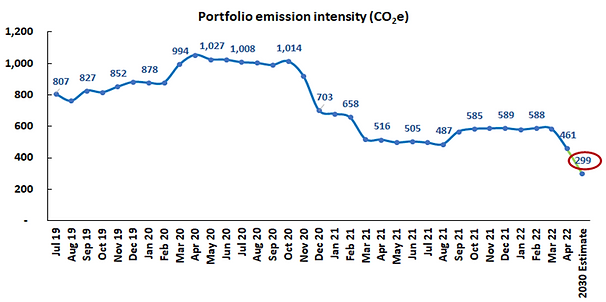

Currently our portfolio carbon intensity stands at ~ 485 tonnes per $ mn of revenues. We assume our investee companies to grow at a real rate of 6% and nominal rate of 10%. Assuming our investee companies reduce their emission intensity in line with their declared targets, we estimate portfolio emission intensity to decline by 1.7% CAGR. At this rate our portfolio emission intensity by 2030 will decline to ~ 299 tonnes per $ mn of revenues.

Snapshot of Portfolio Carbon Characteristics

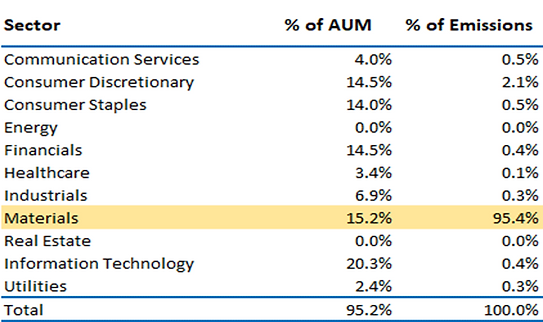

Majority of the emissions are currently contributed by the materials sector.

We are reasonably confident that the emission intensity will decline in the medium and long-term. Most of our investee companies and particularly those that belong to the “hard to abate” sectors have aligned themselves to the SBTi (Science Based Targets Initiative) and have set internal carbon prices.

- 31% of portfolio AUM contributing 86% of total portfolio carbon emissions have established an internal carbon price.

While the methodology used may differ, it provides some comfort that these companies are seriously taking into account the negative externalities associated with their operations.

- 31% of portfolio AUM contributing 94% of total portfolio carbon emissions have either 1) committed to setting SBTi approved targets or 2) have got their targets approved based on 2 °C pathway or 3) have got their targets approved based on 1.5 °C pathway.

The Way Forward

Nearly 93% of the portfolio’s current emissions are attributed to our holding in 2 cement manufacturers and 1 chemical manufacturer. The future course of the portfolio emissions intensity will depend to a great extent on how these companies are managing the GHG risks and opportunities related to the low-carbon transition. In our research process, we also pay a lot of attention to management intent. If there is a clear communication of targets, alignment with best practices and a demonstrable intent to improve, we will be willing to stay invested in such companies. Having said that, the 2 cement and 1 chemical company in our portfolio, have aligned with the 2 °C scenario.

Conclusion

For a developing country like India, the transition to a low carbon future is challenging. Absolute emissions are likely to increase for the foreseeable future despite improvements in emission intensity. While our portfolio emission intensity is expected to decline to 299 tonnes per $ mn of revenue, absolute emissions are still expected to increase by ~50%. It is for this reason that developed countries need to provide technological and financial support to assist developing nations to transition to a sustainable future. As shown above, many Indian corporates are gearing themselves to transition to a low carbon future and as stewards of long-term capital, we continue to nudge all our investee companies to align themselves with best practices and are confident of our investee companies meeting their long term emission targets.

Important Disclosures & Disclaimers:

- Quantum Advisors Private Limited (QAPL) is registered in India and holds a Portfolio Management License from Securities and Exchange Board of India (SEBI), India. It is also registered with the Securities Exchange Commission, USA as an Investment Adviser and a Restricted Portfolio Manager with the Canadian Provinces of British Columbia (BCSC), Ontario (OSC), and Quebec (AMF). It is currently not registered with any other regulator. Registration with above regulators does not imply any level of skill or training

- This summary is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fee and investment strategies of QAPL.

- This article is strictly for information purposes only and should not be considered as an offer to sell, or solicitation of an offer to buy interests in the account. Investments in the equity and fixed income instruments are not guaranteed or insured and are subject to investments risks, including the possible loss of the principal amount invested. The value of the securities and the income from them may fall as well as rise. Past performance does not guarantee future results and future performance may be lower or higher than the data quoted, including the possibility of the loss. Quantum Advisors reserves the right to make the changes and corrections to its opinions expressed in the document at any time, without notice. Information sourced from third parties cannot be guaranteed or was not independently verified. Comments made herein are not necessarily indicative of future or likely performance of the account and are based on information and developments as at 20/04/2022 unless otherwise stated.

- All of the forward-looking statements made in this communication are inherently uncertain and Quantum Advisors (QAPL) cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “should”, “can”, “may”, “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume”, “target”, “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities law

UK related important disclosures

- The content of this newsletter has not been approved by an authorised person within the meaning of the Financial Services and Markets Act 2000 (“FSMA 2000”). Reliance on this newsletter for the purpose of engaging in any investment activity may expose you to a significant risk of losing all of the property or other assets you invest or of incurring additional liability. This newsletter is exempt from section 21 FSMA 2000 on the grounds that it is directed only to certified sophisticated investors, high net worth companies, unincorporated associations, trusts and/or investment professionals within the meaning of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (“FPO”). The investment activity described in this newsletter is only available to these persons or entities and no other person or entity should rely on the contents of this document.

- The protections conferred by or under the Financial Services and Markets Act (FSMA) will not apply to this newsletter and any investment activity that may be engaged in as a result of this newsletter

The applicability of any dispute resolution scheme or compensation scheme and its jurisdiction (if and where applicable) pertaining to a transaction resulting from this newsletter would be as specified in the respective client agreements.