Who will fund the world's needed response to Climate Change? An allocation of just 1% by pension funds and SWF would avert a global crisis.

A proverb from the Native American Cree tribe states bluntly:

Only when the last tree has died

And the last river been poisoned

And the last fish been caught

Will we realise we cannot eat money

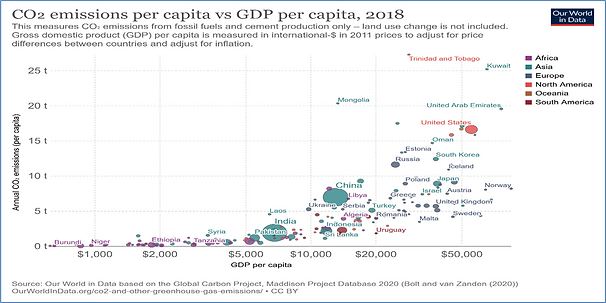

While many scientists have long worried about the impact of a world driven by consumption on the limited resources available on - and within - our planet to satisfy this growth in demand, the rapid globalisation of the world economy over the past 20 years has taken this worry to a new level of heightened alarm. Globalisation and trade agreements like WTO have resulted in the rise of China as an economic powerhouse while the restless stirrings of “we, too” consumption patterns in India, Bangladesh, Cambodia, Indonesia, Vietnam and Africa - which account for nearly 50% of the world population - has led to a fundamental question of the accelerated strain on our planet to meet this anticipated demand. The IPCC warnings, the COP meetings, the Paris commitment have all increased awareness, but the rhetoric has only shifted to a 'Green Growth'. The desire and aspirations to grow and become wealthy remain.

Chart 1: Green Growth - Is That Even Possible?

Climate economists like William Nordhaus, who won a Nobel prize for his work, worked out the impact on economic growth under various scenarios of increase in global temperatures. Many have argued that those economic scenarios do not consider the impact of tipping points. Scientists have argued that once we pass the tipping points, the impact of climate change on economic activity will be manifold.

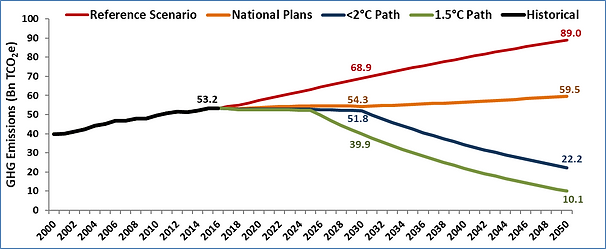

Climate mitigation to achieve the Paris Agreement goals — remaining within 1.5°C from pre-industrial levels — requires staying within a carbon budget of ~420-580 GtCO2e. This means today's GHG emissions of ~53 GtCO2e on net need to be cut in half by the 2030s, and reach net zero by mid-century. Net negative emissions would further help as part of ongoing climate restoration.

Chart 2: Transitioning To a Low Carbon Future

Source: climatepolicyinteractive.org, Quantum Advisors

Net-Zero Pledges Have Picked Up

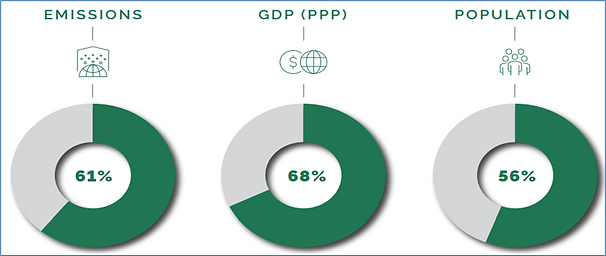

For now, the consensus seems to be on maintaining the growth path but trying to grow with a lower emission intensity. The Nationally Determined Contributions (NDCs) which was the outcome of the Paris Accord has seen pledges being updated and now covers ~60% of global emissions and ~50% of global population.

The Net-Zero pledges have become pervasive. Net zero is likely to be the main theme at COP26- Glasgow. We can now find evidence of Net Zero targets in government's economic plans, city/regional plans, corporate responsibilities, investor portfolios.

Chart 3: Net Zero Is All Pervasive Now

Source: ECIU, TakingStock report; % share with Net Zero pledges

Show Me the Money

Despite the recent movement towards signing up for climate targets and framework, the work and the impact on the ground leaves much to be desired.

The developed world has failed to transfer to the developing world its committed share of USD 100 billion which was agreed upon in the Paris accord.

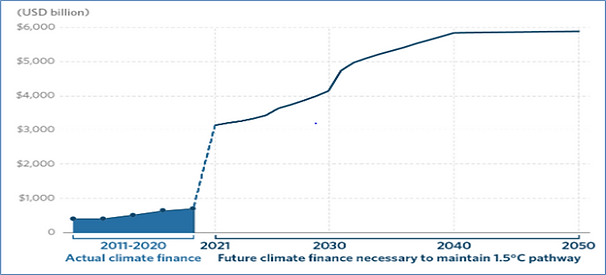

There is a massive financing need to meet these climate targets. The IPCC studies forecast forecast an annual investment of US$ 1.6 - $3.8 trillion. A report by BCG-GFMA details the total investment to be US$100-$150 trillion over the next three decades to achieve a scenario to limit temperature rise to 1.5°C.

A study by climate policy initiative over 2017-2020 showed that annual actual climate related finance investments has been rising but was only ~USD 600 billion, well below the actual investment required of ~USD 1.6-3.5 trillion per annum. (see chart below).

Chart 4: Show me the money! - climate finance is falling woefully short of target

Source: climatepolivcyintiative.org, 2021

Majority of the investments required is in Asia and the emerging world. Channelizing investments of such scale into economies with weaker financial markets, transparency and reporting standards will take some doing.

Vaccine Equity to Climate Justice

The emerging economies are right in demanding that since the developed world has caused a major share of the emissions it is only fair that the developed world also bear a cost of funding the climate transitions investments required in the now emerging economies.

At one level, we do empathize with the concern that a Net-Zero approach by the developed world may be inimical to the growth aspirations of the developing world. Going into COP26, the developing world has seen the behavior and policies of the developed world with respect to managing COVID and the accessibility to vaccinations.

Governments may stop a virus from entering your country - but can they prevent Greenhouse Gases from reaching your backyard?

The World Has the Financial Resources

Global central banks and governments created USD 20 trillion of stimulus post COVID.

Global wealth as per credit Suisse is estimated at USD 400 trillion. The top 1% (~52 million people) account for USD 173 trillion (43%) of the total wealth.

Global financial assets, as per OECD (The Organisation of Economic Co-operation and Development) report, are estimated to be USD 380 trillion. This includes Banks (146 trn), financial institutions (132 trn), Central banks (30 trn), sovereign wealth funds (8 trn), pension (35 trn) and insurance funds (32 trn). Global Asset management companies manage over USD 90 trillion in assets. Some of these financial assets will lead to double counting, however the basic premise is that world has the financial resources to fund a sustainable future.

A #SAVEMYWORLD ALLOCATION

The annual requirement of ~USD 2.5 trillion to meet the IPCC targets is less than 1% of the stock of global financial assets. Even on a flow basis, if global wealth increases annually at the conservative nominal GDP growth estimate of 4%, there is enough to sustain the annual ~USD 2.5 trillion for the next three decades.

Table 1: The word has enough financial resources

There are several good things from this simple '#SAVEMYWORLD' allocation

- It is simple to allocate. Every institution creates a 1% allocation from its existing stock and an incrementally higher share of its annual assets.

- It does away with the issues that institutional investors have on asset allocation buckets, asset class, public v/s private, Developed Markets v/s Emerging Markets.

- The allocation will be made across Equities, Loans, Bonds. It will be done through Public equities, private equity, infrastructure, real estate.

- These investments are predominantly held by the private sector. The spending by the governments out of their budgets will be incremental.

The less developed counties do not have the capital to invest the estimated annual ~USD 2.5 trillion required to get the planet on a more balanced path to economic development.

India is ground Zero for climate change: Needs higher global investment allocation

The world will not meet any of its climate targets, net zero targets, 1.5°C targets if it focusses only on the developed, high income, less populated world. It is countries like China, India, Indonesia, Nigeria which hold the potential for altering the climate realities – positively or negatively.

Chart 5: India is ground zero for climate change

Source: Quantum Advisors Analysis, India per-capita emissions when calculated at current Chinese and US emissions levels

The global pools of capital thus must ensure that they build capabilities to allocate money into climate transition projects in these countries.

The policy world needs to hasten the adoption of global standards of reporting climate data. Alongside, a near standard template to finance climate mitigation projects across the world will help asset allocators in making investment decisions from its #SAVEMYWORLD allocation towards low to middle income countries.

Table 2: India needs financial resources if the world needs to fight climate change

Source: IEA Report

India's pledge to take renewable energy (RE) upto 450 GW by 2030 is very ambitious. (RE capacity - 147 GW; ~38% of total installed capacity; Sep-21).

To meets its target of 450 GW of RE power by 2030, India needs to install capacity at 40 GW per year as compared to the existing average of ~8 GW per year.

According to IEA report, India's energy usage has doubled since 2000 with 80% of it being met by Coal, Oil and solid biomass. India still depends on Coal thermal power for ~50% of its energy needs.

India's move to EV is estimated to reach ~30% of passenger vehicles by 2040 as compared to ~+60% for China and the developed world. India is likely to be a large share of global Solar PV, storage battery over the next 20 years however it will require large investments.

Estimates based on India's NDCs put India's total investments from 2015 till 2030 at ~USD 2.5 trillion, USD 170 billion per year for climate action.

As per a study, climate finance in India, over 2017 and 2018, averaged only USD 38 billion. Only 15% of that was from international sources. The world needs to find a way to allocate more to India.

As the world grapples with their India allocation, we believe that a large part of the allocation should be made through large and mid Indian corporates and especially those in the public listed markets.

Important Disclosures & Disclaimers:

- Quantum Advisors Private Limited (QAPL) is registered in India and holds a Portfolio Management License from Securities and Exchange Board of India (SEBI), India. It is also registered with the Securities Exchange Commission, USA as an Investment Adviser and a Restricted Portfolio Manager with the Canadian Provinces of British Columbia (BCSC), Ontario (OSC), and Quebec (AMF). It is currently not registered with any other regulator. Registration with above regulators does not imply any level of skill or training

- This summary is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fee and investment strategies of QAPL.

- This article is strictly for information purposes only and should not be considered as an offer to sell, or solicitation of an offer to buy interests in the account. Investments in the equity and fixed income instruments are not guaranteed or insured and are subject to investments risks, including the possible loss of the principal amount invested. The value of the securities and the income from them may fall as well as rise. Past performance does not guarantee future results and future performance may be lower or higher than the data quoted, including the possibility of the loss. Quantum Advisors reserves the right to make the changes and corrections to its opinions expressed in the document at any time, without notice. Information sourced from third parties cannot be guaranteed or was not independently verified. Comments made herein are not necessarily indicative of future or likely performance of the account and are based on information and developments as at 23/10/2021 unless otherwise stated.

- All of the forward-looking statements made in this communication are inherently uncertain and Quantum Advisors (QAPL) cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “should”, “can”, “may”, “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume”, “target”, “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities law

Important disclosure relating to Quantum India ESG Equity Fund

Quantum Asset Management Company Related Disclaimer:

Quantum India ESG Equity Fund (QIESG) is a fund launched in July 2019 under the Quantum Mutual Fund (QMF), a Indian domiciled public retail mutual fund. QMF is registered with Securities and Exchange Board of India (SEBI). Quantum Asset Management Company Pvt Ltd (QAMC), 100% subsidiary of Quantum Advisors, is the Investment Manager of QMF.

QAMC provides research/advisory service to Quantum Advisors (QAPL). The information on QIESG is provided for illustration and information purpose only, as QAMC follows a similar investment strategy, process and philosophy for this fund as that offered by QAPL. We receive non-binding and non-discretionary research/advisory services from our 100% subsidiary, QAMC (our “Affiliated Adviser”) with respect to investments by our Private Account clients (including Fund clients). Our evaluation of our Affiliated Advisers' qualifications, suitability and performance as research/advisory services providers involve inherent conflicts of interest that would not be present if we were instead evaluating independent. This is neither an offer to sell securities of any investment fund nor a solicitation of an offer to buy any securities of the funds.

UK related important disclosures

- The protections conferred by or under the Financial Services and Markets Act (FSMA) will not apply to this newsletter and any ESG based investment activity undertaken by us.

- The protections conferred by or under the FSMA may not apply to any investment activity that may be engaged in as a result of this newsletter.

- The applicability of any dispute resolution scheme or compensation scheme and its jurisdiction (if and where applicable) pertaining to a transaction resulting from this newsletter would be as specified in the respective client agreements.