Climate mitigation to achieve Paris Agreement goals requires concerted action by global asset allocators and policy makers alike.

In December 2015, the Eiffel Tower was illuminated with green lights '“Accord de Paris c'est fait!” (“the Paris agreement is done!”). That the world leaders could come together and flesh out an agreement was indeed a great step after the disastrous 2009 Copenhagen summit.

“As the leader of the world's largest economy and the second largest (greenhouse gas) emitter … the United States of America not only recognises our role in creating this problem, we embrace our responsibility to do something about it.”

Barack Obama, President of USA (December 2015)

Emerging Countries like India also pledged to “To keep global temperatures "well below" 2.0C (3.6F) above pre-industrial times and "endeavour to limit" them even more, to 1.5C” and agreed to a high 'nationally determined contributions (NDC's) but were cautious of their resources and growth ambitions.

“Climate justice demands that the little carbon space we still have, developing countries should have enough room to grow,”

Narendra Modi, Prime Minister of India (December 2015)

However, all of this based on what climate scientists say, may yet be too late and too little.

“The world is reaching the tipping point beyond which climate change may become irreversible. If this happens, we risk denying present and future generations the right to a healthy and sustainable planet - the whole of humanity stands to lose.”

Kofi Annan, Former Secretary-General of UN (December 2015)

Tipping Point Reached?

The world Metrological organization warned in May 2021 that there is about a 40% chance of the annual average global temperature temporarily reaching 1.5 degrees Celsius (1.5°C above the pre-industrial level in at least one of the next five years.

This 1.5°C above the pre-industrial level is crucial as it is the baseline lower target of the Paris Agreement on Climate Change.

That the world will reach its warmest year between 2021-2025 is yet another reminder to move faster towards achieving the commitments made and to improve upon them to move to Net-Zero.

An expedition led by scientist Markus Rex to study the artic summer ice came back with very despondent news. He claimed in an interview on June 15,2021 “The disappearance of summer sea ice in the Arctic is one of the first landmines in this minefield, one of the tipping points that we set off first when we push warming too far,"

Climate economists like William Nordhaus, who won a Nobel prize for his work, worked out the impact on economic growth under various scenarios of increase in global temperatures. Many have argued that those economic scenarios do not consider the impact of tipping points. Scientists have argued that once we pass the tipping points, the impact of climate change on economic activity will be manifold.

Bittu Sahgal, a well-known Indian ecologist warned us in an interview on the disastrous economic and business impact of climate change.

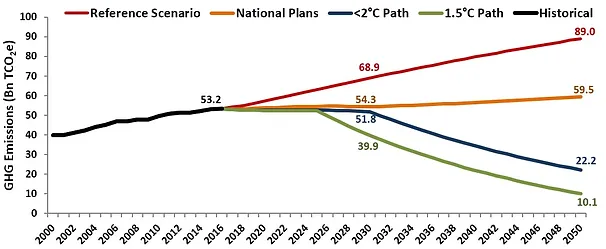

Climate mitigation to achieve the Paris Agreement goals — remaining within 1.5°C from pre-industrial levels — requires staying within a carbon budget of ~420-580 GtCO2e. This means today's GHG emissions of ~53 GtCO2e on net need to be cut in half by the 2030s, and reach net zero by mid-century.

Net negative emissions would further help as part of ongoing climate restoration.

Chart 1: Transitioning to a low carbon future

Source: climatepolicyinteractive.org, Quantum Advisors

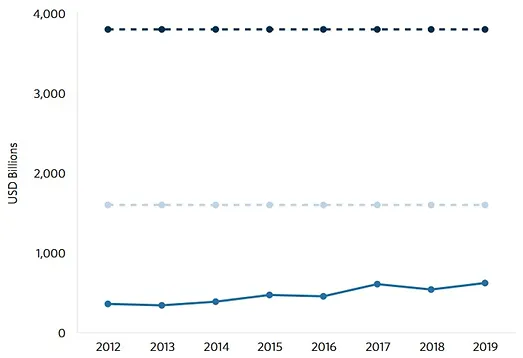

There is a massive financing need to meet these climate targets. The IPCC studies forecast forecast an annual investment of US$ 1.6 - $3.8 trillion. A report by BCG-GFMA details the total investment to be US$100-$150 trillion over the next three decades to achieve a scenario to limit temperature rise to 1.5°C.

A study by climate policy initiative over 2017-2019 showed that annual actual climate related finance investments has been rising but was only ~USD 600 billion, well below the actual investment required of ~USD 2.5 trillion per annum. (see chart 2 below)

Chart 2: Lack of Money or Lack of Commitment? Climate Finance vs. Investment Needs

Source: climatepolicyinitiative.org; lower line = actual investment, middle line = lower range of investment required; upper line = upper range of investment each year to stay under the 1.5°C based on IPCC estimates

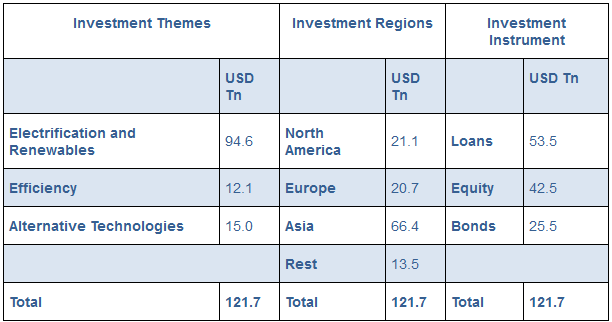

A majority of the investments required is in Asia and the emerging world. Channelizing investments of such scale into these markets into emerging markets with weaker financial markets, transparency and reporting standards will take some doing.

Table 1: Does the world have the financial resources?

Source: GFMA-BCG Report

Some projects may be too risky for private capital to implement alone. The ongoing experience with COVID where governments funded the development of the vaccines to fight the pandemic, suggest that - when there is a will, the governments and markets will find a way for a mutually beneficial partnership.

The World Has The Financial Resources

Global central banks and governments created USD 20 trillion of stimulus post COVID.

Global wealth as per credit Suisse is estimated at USD 400 trillion. The top 1% (~52 million people) account for USD 173 trillion (43%) of the total wealth.

Global financial assets, as per OECD (The Organisation of Economic Co-operation and Development) report, are estimated to be USD 380 trillion. This includes Banks (146 trn), financial institutions (132 trn), Central banks (30 trn), sovereign wealth funds (8 trn), pension (35 trn) and insurance funds (32 trn). Global Asset management companies manage over USD 90 trillion in assets. Some of these financial assets will lead to double counting, however the basic premise is that world has the financial resources to fund a sustainable future.

'SAVE THE WORLD' ALLOCATION

The annual requirement of ~USD 2.5 trillion to meet the IPCC targets is less than 1% of the stock of global financial assets. Even on a flow basis, if global wealth increases annually at the conservative nominal GDP growth estimate of 4%, there is enough to sustain the annual ~USD 2.5 trillion for the next three decades.

There are several good things from this simple 'SAVE THE WORLD' allocation

- It is simple to allocate. Every institution creates a 1% allocation from its existing stock and an incrementally higher share of its annual assets.

- It does away with the issues that institutional investors have on asset allocation buckets, asset class, public v/s private, Developed Markets v/s Emerging Markets.

- The allocation will be made across Equities, Loans, Bonds. It will be done through Public equities, private equity, infrastructure, real estate.

- These investments are predominantly held by the private sector. The spending by the governments out of their budgets will be incremental.

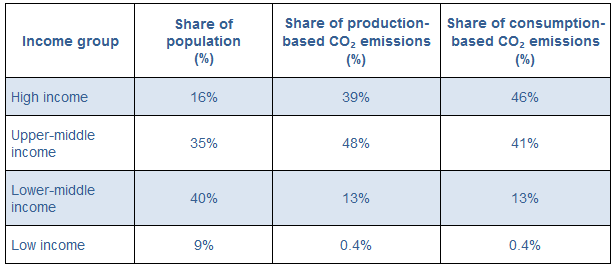

Who will pay?

One cannot deny the desire of every individual in the less developed world to have a higher standard of living - goods that people in the West consume (from microwave ovens to dishwashers to washing machines to air-conditioners) are now the aspirational goals for material success.

Having enjoyed an unprecedented boom in “convenience appliances” since World War 2, policy makers in the West cannot expect austerity from the aspiring consumers in Asia, Africa and South America. That would be blatantly unfair and not acceptable.

The solution to this challenge of “wants v/s needs” will be to allow the consumption to become a reality - but by using new technologies: whether for power (renewable energy v/s coal and gas), transportation (electric vehicles v/s petroleum; public transport v/s private cars), or housing material (concrete v/s sustainable materials).

Older manufacturing facilities which may be energy inefficient or produce harmful effluents will need to be retooled with new technology while new factories will need to be set up to meet future, anticipated demand.

As Table 1 above showed, the invention of new technologies and their adaptation and conversion into the production processes for the use of consumers will cost trillions of dollars.

Table 2: Who should bear the cost of fighting climate change?

Source: ourworldindata; 2019 data

The less developed counties do not have the capital to invest the estimated annual ~USD 2.5 trillion required to get the planet on a more balanced path to economic development.

India is ground Zero for climate change: Needs a higher allocation of global investment

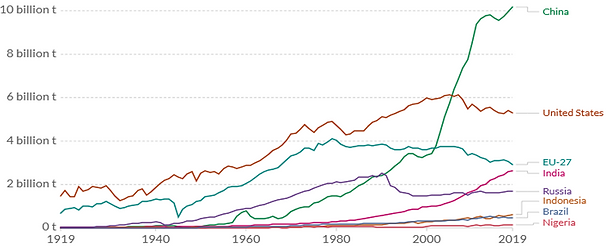

The world will not meet any of its climate targets, net zero targets, 1.5°C targets if it focusses only on the developed, high income, less populated world. It is countries like China, India, Indonesia, Nigeria which hold the potential for altering the climate realities - positively or negatively.

The global pools of capital thus must ensure that they build capabilities to allocate money into climate transition projects in these countries.

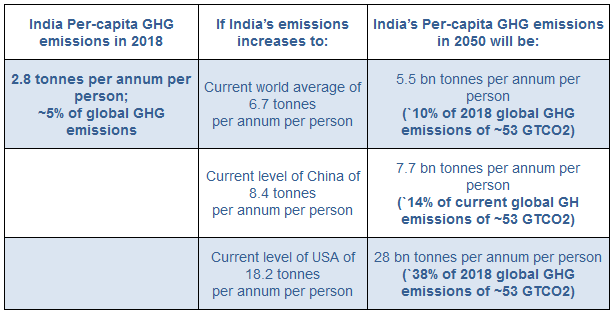

Table 3: India is ground zero for climate change

Source: Quantum Advisors Estimates

Work out these calculations for the other low and middle income, populated countries and you would know that the world will never meet its climate goals if these countries develop the way the now developed world did.

The policy world needs to hasten the introduction of global standards of reporting climate data. Alongside, a near standard template to finance climate mitigation projects across the world will help asset allocators in making investment decisions from its SAVE THE WORLD allocation towards low to middle income countries.

Chart 3: India needs financial resources if the world needs to fight climate change

Source: ourworldindata; Annual Co2 and GHG emissions

India's pledge to take renewable energy (RE) upto 450 GW by 2030 is very ambitious. (RE capacity - 141 GW; ~37% of total installed capacity; Mar-21). Estimates based on India's NDCs put India's total investments from 2015 till 2030 at ~USD 2.5 trillion, USD 170 billion per year for climate action.

As per a study, climate finance in India, over 2017 and 2018, averaged only USD 38 billion. Only 15% of that was from international sources. The world needs to find a way to allocate more to India.

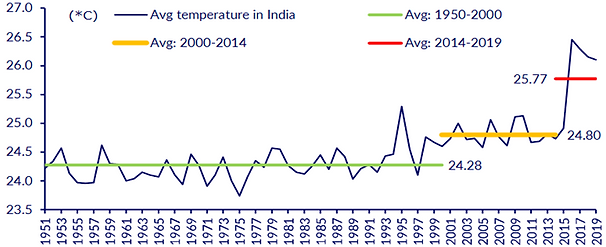

Chart 4: India's average temperatures rising; climate change impacting business activity

Source: CLSA

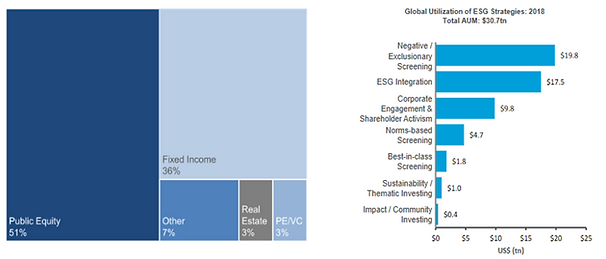

Climate, ESG and Capital Market Integration

The “ESG” theme within climate investments has come a long way in the last 10 years. The principles of responsible investing (PRI) claims to have signatories which account for over US $100 trillion of assets under management. The 2018 Global Sustainable investment alliance (GSIA) said in its 2018 report that US $30 trillion of assets follow some form of sustainable investment strategies. The UN convened Net-Zero asset owner alliance comprises 30 of the world's largest institutional investors with assets under management over US $5 trillion.

This move is not only on the institutional investor front. Many other aspects of the capital markets have also made impressive strides towards climate actions, reporting of climate data and other sustainability reporting.

As per a Macquarie research report of May 2021, over 90% of S&P 500 companies publish sustainability reports. Over 1000 chinese A-share companies had published ESG reports. The Global Reporting Initiative claims over 30,000 global sustainability reports written in line with their standards. The Task Force on Climate Financial Disclosures (TCFD) has grown to exceed 1,500 globally, including 1,340 companies with a combined market capitalization of $12.6 trillion. In 2020, the sales of Green, Social and Sustainable bond (GSS) totaled USD ~550 billion, up 76% over 2019.

Chart 5: ESG AuM by asset class and by investing style but beware of EHG!

Source: GSIA, Citi research

ESG Integration Easier to Implement at Scale in Public Markets

The SAVE THE WORLD bucket which is dedicated to climate change may have a high share of direct and private investments in climate mitigation projects. Alongside, ESG integration investments by institutional investors could be scaled through liquid investments in public equities and fixed income.

Sovereigns and quasi-sovereigns will increasingly issue sustainability linked or SDG (Sustainable Development Goals) linked bonds which when well defined and with transparent reporting can meet investors ESG requirements.

Global large, listed corporations are the likeliest to adopt ESG standards. The main signatories to TCFD are large corporations. As per Macquarie research, Companies with a net zero commitment together represent sales of nearly $14 trillion -33% of total sales across the top 2,000 public companies.

MSCI in a recent study found that companies with high ESG scores tended to enjoy a lower cost of capital than companies with poor ESG scores, and this relationship held in both developed and emerging markets. In the MSCI World Index, the average cost of capital for the quintile with the highest ESG scores was 39 basis points (bps) lower than the bottom quintile.

The key primary stock indices across the Americas, Europe and select Emerging markets have market-capitalization of ~USD 100 trillion. The absorptive capacity of these public markets allows investors to deploy large money at scale and meet their 'ESG' targets.

Indian public equity market capitalization is now ~USD 3 trillion. Foreigners own less than 25% of Indian stock markets. More so, global investors have less than 1% of their overall allocation in India.

We argued that India deserves a dedicated mandate and thus higher allocations from foreign investors. When we look at climate investing or ESG integration, the world needs to make a higher allocation to India and to Indian companies. India's climate transition will be driven by the private sector. For instance, 90% of India's solar power investments are in the private sector.

India's large and listed companies have and will make the required climate transitions, governance changes and social endeavours to meet the global investors increased requirements. We make the case to global institutional investors to look at Indian public equities as well for ESG integration.

With the increased regulatory reporting and hopefully standardized data, we may be able to counter the growing issue of EHG (Eyewash, Hogwash, Greenwash). For firms using proprietary ESG research, it would become easier to rank, grade and score companies on their climate, sustainability and overall ESG disclosures.

Quantum India: We knew the 'G'; we have added the 'E' and 'S'

Since 1990, Quantum Advisors has been a pioneer in India's capital markets and was well positioned for the historic moment when India would open its doors to foreign investments - from portfolio investors and multinationals.

From Integrity screen to E, S, and G:

- In 1996: Introduced the Integrity Screen - “Count your fingers after you shake someone's hands…” + No “sin” stocks.

- In 2014: Initiated the process of converting this qualitative system into a “ESG” framework.

Not a DESK “ESG” research; Not Passive

While we recognize that “scoring” ESG is an evolving science and we are all on a learning curve, one needs to ensure we avoid the path of EHG: Eyewash, Hogwash, and Greenwash!

Given our concerns, we rolled up our sleeves and set out to do what we did in 1990: build our own database of India's publicly listed companies, with a proprietary ESG score. Since 2015, our internal ESG team has built a proprietary ESG research process and we now have an ESG score on a growing number of publicly listed companies.

By 2018, we started running back-tested models of portfolio construction around our ESG databases. By 2019, our 100% subsidiary, Quantum Asset Management Company (QAMC), launched a Daily NAV “Quantum India ESG Equity Fund” which has full disclosures, is highly regulated and allowed us to showcase our track record for thorough scrutiny. The Quantum India ESG Equity Fund, launched in July 2019, has just about a 2-year track record but has already thrived through one cycle given the surge, collapse and recovery of stock markets since its launch.

The identical portfolio process of the Quantum India ESG Equity Fund is being offered to international investors as a Separately Managed Account under the strategy named as the Q India Responsible Returns Strategy.

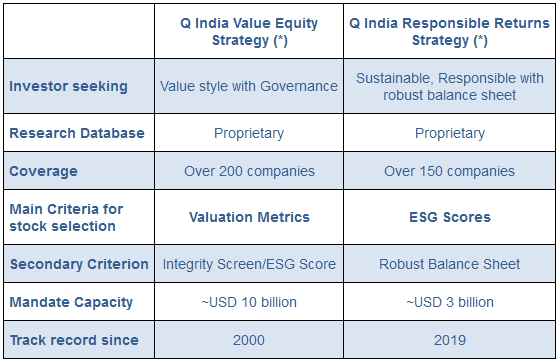

In summary, we offer two approaches to investing in Indian equity markets and reaping the benefits from the expected long-term growth of the Indian economy. Both the equity products are tailored to avoid the risks - monetary and reputational - that concerned institutional investors could face when investing within developing countries like India. Both come with a commitment of being investment managers, not asset gatherers: we will always focus on what is best for our clients.

Annexure A: 'Value' Investing and 'Values' Investing

*For detailed description of Q India Responsible Returns Strategy and Q India Value Equity Strategy such as investment objective, assets allocation pattern, investment strategy and philosophy, associated risk factors and other details please refer to the Disclosure Document available at www.qasl.com # Inception data of Quantum India ESG Equity Fund

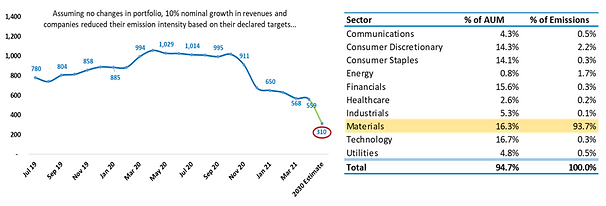

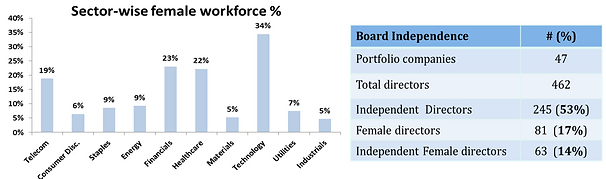

Annexure B: 'Mapping out your “E”, “S” and “G”

Source: Quantum Advisors, Portfolio Characteristics Data as at May 2021 for the Quantum India ESG Equity Fund

For more information and if you wish to discuss the details in the article or if you wish to know more about our investment strategies, the investment philosophy and investment opportunities, please contact:

Arvind Chari - [email protected]

Arvind Chari is the Chief Investment Officer (CIO) at Quantum Advisors. Arvind's vast experience in managing money for global investors and his interactions with leading institutions has exposed him to a world of knowledge. With over 18 years of experience in tracking domestic and global economy he is Quantum's thought leader and is the author of this Q-India Insight edition.

Important Disclosures & Disclaimers:

- Quantum Advisors Private Limited (QAPL) is registered in India and holds a Portfolio Management License from Securities and Exchange Board of India (SEBI), India. It is also registered with the Securities Exchange Commission, USA as an Investment Adviser and a Restricted Portfolio Manager with the Canadian Provinces of British Columbia (BCSC), Ontario (OSC), and Quebec (AMF). It is currently not registered with any other regulator. Registration with above regulators does not imply any level of skill or training

- This summary is subject to a more complete description and does not contain all of the information necessary to make an investment decision, including, but not limited to, the risks, fee and investment strategies of QAPL.

- This article is strictly for information purposes only and should not be considered as an offer to sell, or solicitation of an offer to buy interests in the account. Investments in the equity and fixed income instruments are not guaranteed or insured and are subject to investments risks, including the possible loss of the principal amount invested. The value of the securities and the income from them may fall as well as rise. Past performance does not guarantee future results and future performance may be lower or higher than the data quoted, including the possibility of the loss. Quantum Advisors reserves the right to make the changes and corrections to its opinions expressed in the document at any time, without notice. Information sourced from third parties cannot be guaranteed or was not independently verified. Comments made herein are not necessarily indicative of future or likely performance of the account and are based on information and developments as at 31/05/2021 unless otherwise stated.

- All of the forward-looking statements made in this communication are inherently uncertain and Quantum Advisors (QAPL) cannot assure the reader that the results or developments anticipated by QAPL will be realized or even if realized, will have the expected consequences to or effects on, us or our business prospects, financial condition or results of operations. A prospective investor can generally identify forward-looking statements as statements containing the words “will,” “should”, “can”, “may”, “believe,” “expect,” “anticipate,” “intend,” “contemplate,” “estimate,” “assume”, “target”, “targeted” or other similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this communication apply only as of the date of this communication. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if internal estimates change, unless otherwise required by applicable Securities law

Important disclosure relating to Quantum India ESG Equity Fund

Quantum Asset Management Company Related Disclaimer:

Quantum India ESG Equity Fund (QIESG) is a fund launched in July 2019 under the Quantum Mutual Fund (QMF), a Indian domiciled public retail mutual fund. QMF is registered with Securities and Exchange Board of India (SEBI). Quantum Asset Management Company Pvt Ltd (QAMC), 100% subsidiary of Quantum Advisors, is the Investment Manager of QMF.

QAMC provides research/advisory service to Quantum Advisors (QAPL). The information on QIESG is provided for illustration and information purpose only, as QAMC follows a similar investment strategy, process and philosophy for this fund as that offered by QAPL. We receive non-binding and non-discretionary research/advisory services from our 100% subsidiary, QAMC (our “Affiliated Adviser”) with respect to investments by our Private Account clients (including Fund clients). Our evaluation of our Affiliated Advisers' qualifications, suitability and performance as research/advisory services providers involve inherent conflicts of interest that would not be present if we were instead evaluating independent. This is neither an offer to sell securities of any investment fund nor a solicitation of an offer to buy any securities of the funds.

UK related important disclosures

- The protections conferred by or under the Financial Services and Markets Act (FSMA) will not apply to this newsletter and any ESG based investment activity undertaken by us.

- The protections conferred by or under the FSMA may not apply to any investment activity that may be engaged in as a result of this newsletter.

- The applicability of any dispute resolution scheme or compensation scheme and its jurisdiction (if and where applicable) pertaining to a transaction resulting from this newsletter would be as specified in the respective client agreements.