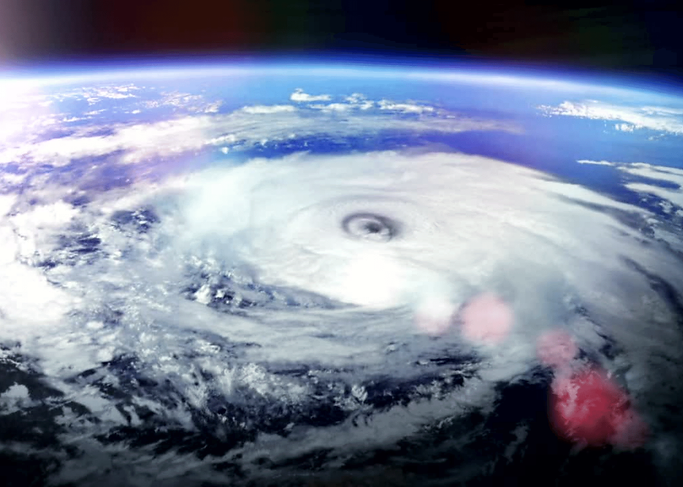

India is Ground Zero for tackling Climate Change. How can we facilitate equitable growth, while limiting greenhouse gas emissions?

Even with America’s restored commitment to the Paris Agreement by the new Biden administration, India’s growing economy will render the Accord’s targets broken by 2030 without sweeping climate targeted investment.

To kickstart a brighter climate future, The Center for Sustainable Enterprise, with generous support from Quantum Advisors, has launched a brand new global competition: the India Impact Challenge powered by Quantum Advisors India. During the spring semester we will challenge student teams representing schools around the world to compete and pitch investment strategies in India to help tackle climate change.

Why India? India is currently the second most populous nation and, according to the United Nations, India is expected to surpass China as the world’s most populous country around 2027. India currently emits 2.7 tonnes per capita but increased economic growth, energy demand and urbanization could lead to major increases in emissions. If India achieves China’s per capita emission levels, world GHG emissions could rise to 63 bn tonnes in 2030; far higher than the targets agreed in the Paris Accords.

However, this also provides enormous opportunity for investment in more climate-friendly growth in India, which will help world-wide efforts to limit global warming to less than 2 degrees Celsius above pre-industrial levels (preferably below 1.5 degrees Celsius).

The Challenge aims to motivate student teams to devise plausible and innovative investment strategies for India that will facilitate equitable growth, while limiting greenhouse gas emissions.

Judges from around the world, including professional investors and more, will debate the most innovative solutions and determine which teams get rewarded.

About Quantum Advisors: Quantum Advisors India is an India-based investment management institution and has been managing money for pensions, endowments, family offices and sovereign wealth funds largely based out of US, Canada and Europe. The company was founded by Ajit Dayal in January 1990 as India’s first equity research house. Our current assets under management is approx.. US$ 2.8 bn as of December 2020.

About The Center for Sustainable Enterprise (CSE): CSE is housed in the University of North Carolina’s Kenan-Flagler Business School and is an affiliate of the Kenan Institute of Private Enterprise. CSE drives responsible thought leadership and inspired action to accelerate progress in social and environmental sustainability through innovative and profitable business solutions. We accomplish this by engaging with and connecting stakeholders to empower students, faculty and businesses to create impactful solutions, strengthen resiliency and identify breakthrough opportunities.