Investors navigating ESG greenwashing need to be aware of practices which we refer to as EHG: Eyewash, Hogwash, and Greenwash.

Greenwashing has now gone mainstream as the UK Government has just launched a new Green Technical Advisory Group to tackle the issue of misleading and sometimes false representations of green credentials in ESG investment products. It is independent of the Government and includes experts from NGOs, Academia and industry bodies interalia.

Quantum Advisors has seen this coming for some time, indeed notwithstanding ESG, we have coined the moniker EHG for ‘Eyewash, Hogwash and Greenwash.’ The Quantum team explored the challenges of greenwashing with Aspida in a recent webinar:

It’s not just Environmental credentials that need closer examination but also Corporate Governance – we have had an integrity screen since 1996 – and Social responsibilities. Investors need to get behind the disclosures, see through the optics and cross check credentials in areas like gender diversity, corporate social responsibility and labour welfare.

In the nascent and evolving approach towards responsible investing, it is already essential to look beyond the tree-hugging logos and see beyond the optics. It is becoming increasingly difficult to tell the difference between companies genuinely dedicated to making a difference and those that are using a green curtain to conceal their darker sides. Even as corporations voluntarily strengthen their record on the environment, they often use multimillion dollar advertising campaigns to exaggerate minor improvements and portray them as major achievements.

While it is true that there is no agreed definition of “Sustainable” or “Responsible” investing – just as there will never be a universal definition of “beauty” – and Quantum as a company still struggles with many inherent conflicts - what can be gauged is intent, sincerity and measurable progress towards a goal of achieving this fluid objective.

In this fluid world of sustainable / responsible investing – symbolized by ESG: Environment, Society, and Governance - investors need to be aware of such practices which we refer to as EHG: Eyewash, Hogwash, and Greenwash.

Greenwash

A wave of eco-consciousness is evident around the world. Since the tides are very obviously turning towards conscious consumerism, some try to leverage the opportunity, claiming that they are helping the planet. In essence, greenwashing involves incorrectly conveying to consumers that a given product, service, or the company cares for the environment.

We have seen green washing attempts across many companies sparing no geography or sector. Right from the famous emission automobile scandal, fast fashion branded as “conscious” line of clothing, the myth of green oil, the bottled water conundrum and to the more common polyester bags, paper cups or cola’s portrayed healthier… it’s all around us.

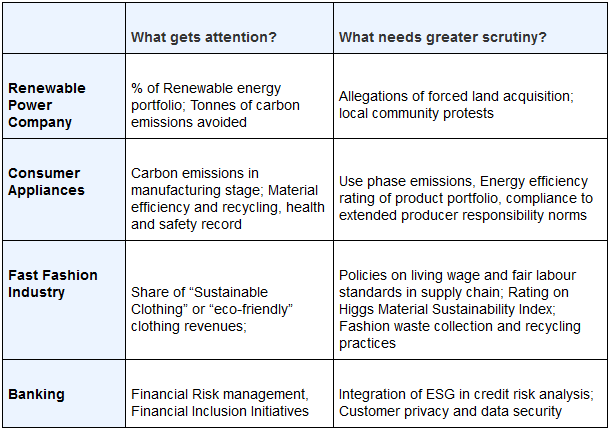

Table 1: Looking beyond optics in India

Source: QASL Research

Hogwash

One may follow the law of the land but not in spirit. An organization may be complying with the applicable laws and regulations on paper but circumventing it through dubious means.

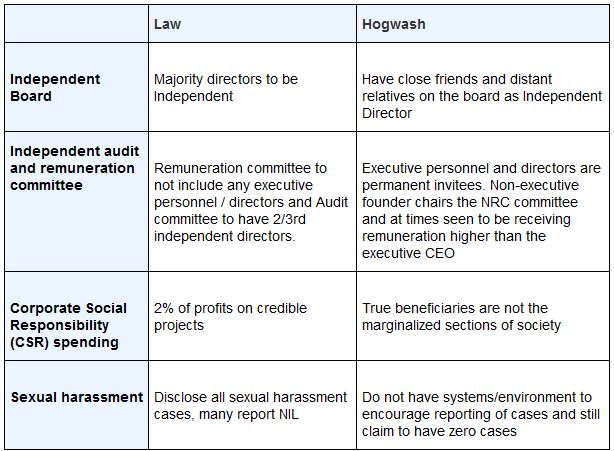

Table 2: Follow the law but not in spirit – Some Indian examples

Source: QASL Research

Eyewash

When it comes to ESG credentials, there is overt reliance on self-disclosure and self-certification. This could lead to exaggerated claims by organizations floating buckling numerous stories and going to great lengths to present themselves on the right side of things.

It is not only restricted to companies, but also true for investment managers and sustainable indices. Investment managers can potentially get themselves the grandest tags that certify them to be responsible managers by a process of self-certification without having to verify their tall claims. Even sustainable stock market indices get recognition without being true to label. They are, at best, sustainable on the margin. The top weight in a stock market index is given to a company that outweighs others on the criterion of market cap, and not on its sustainability credentials. A company may be a relative ESG laggard but if the company is large, it receives a higher weight in the index. So, a poor ESG company gets more of your money and a superior ESG company gets less of your money!

Sustainable Capitalism

Sustainability is fast evolving and as this form of building a corporate image became more rampant over time, so did the movement to counter this practice of conjuring up images. It is investors who will now have to do the heavy lifting to drive responsible behavior.

Consumers and other stakeholders are increasingly becoming conscious about the environment and society. Investors too have realized that they are better off owning businesses that equally prioritize profits, people and the planet. That’s because at the end of the day, successful investments depend on a booming economy, which depends on healthy people, who are ultimately dependent on a sustainable planet. In the long-term, therefore, investors have a clear self-interest in encouraging responsible businesses by choosing them over the irresponsible others.

Globalization has created cross-border alliances paving way for more business and growth opportunities, but this has also put stringent rules and regulations for human and environment protection. Rules set in one country are slowly finding their way across countries where companies or investors operate.

As ESG or environmental, social & governance investing catches investor fancy, companies are upping their game to be a responsible investor’s first choice. Armed with Sustainability Reports and ESG “best-practices”, businesses have started to put their green foot forward. That’s understandable as ESG issues can have a strong impact on a firm’s intangible assets - reputation and brands. Companies that are left out of ESG indices/funds, or receive poor marks from ESG ratings providers, could suffer financial consequences in the stock markets as they are increasingly shunned by investors.

The challenge thus facing consumers and investors is spotting the truth in a world of lies, deceit or EHG.

Most investors seem to be aware of the greenwashing attempts and this could be a deterrent towards further adoption of responsible investing. According to a recent survey by Refinitiv, a global provider of financial market data, around 60% of 250 institutional investors polled with over $10 trillion under management believe companies mislead when it comes to their environmental credentials. And 84% think the practice is becoming more common. Among those being criticized for greenwashing are some of the world's largest banks, including one reported to have financed around $75 billion worth of fracking and other oil and gas exploration since the Paris Agreement.

Source : Greenwashing leaves a stain the world must not tolerate

India Has Its Fair Share of EHG

Investors coming to the Indian shores in search of sustainable stalwarts need to understand that India ranks as a high risk on the ESG front though Indian companies are fast becoming aware of the incentives of appearing environment friendly and sustainable. It becomes even more complicated at a corporate level for it involves the restructuring of entire manufacturing processes, inspecting every bit of waste produced, setting up teams to check on the carbon footprint of the corporation – and extending this to the supply chain. For these reasons, greenwashing in India could be rampant.

Governance Approach to Navigate the Corporate Spin

“Greenwashing” at the end of the day is a matter of ethics; it is a spin of corporate social responsibility in declaring itself as an environmentally friendly company whereas, in reality, the company may not live up to its commitment. Hence, it boils down to “Corporate Governance”. It effectively means assessing the credibility of the Board and the management of the company and analyzing the decisions. How these decisions have impacted different stakeholders gives evidence of the principles they stand for and the value systems they follow.

Quantum has used our proprietary integrity screen to navigate exemplars of bad corporate Governance in India since 1996. In our ESG framework, as with many others, Governance sits at the heart of the analysis. We believe that shortcomings on corporate accountability go hand in hand with poor performance on the social and environmental fronts, making it a good proxy for wider problems.

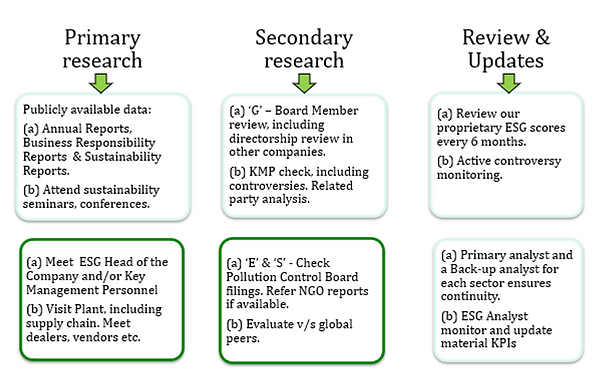

Not “tick the box” Desk Research

Source: QASL Research

Quantum believes that verification of ESG credentials still warrant a detective lens and one cannot and must not rely on self-disclosures. A comparative analysis of a company’s data on various parameters v/s datasets for all companies within a sector can provide reasons for inquiry. Information can also be obtained from many unconventional sources like NGOs, local community, regional / regulatory boards. We aim to meet sustainability officers or key management personnel to understand the ESG strategy of a company and seek answers to our queries.

Many companies create the impression that they are doing the right thing for sustainability, but then fail to produce relevant and tangible information about the action they are taking. Further, we visit plants - including that of supply chains - to get a first-hand verification of the tall claims. (Not green washing our way through, we disclose that such visits have not been possible over the last one year due to Covid-19!) Furthermore, a 360-degree check by interacting with dealers, vendors, employees, customers, and regulators does go a long way in identifying any inflated or absurd claims made by the company.

The following example would serve as evidence of our process:

A power company in India has been providing a sustainability report since the last 10 years with significant disclosures. Incrementally, the company has been moving away from conventional thermal power to renewables portfolio and promising to keep incrementally shifting towards renewables. This would probably convince one on the intent and ESG credentials of the company. However, once we dug deeper, we discovered that one of its largest power projects was plagued with issues like local community protests and noncompliance with ambient air quality norms – and did not find any mention in the sugared sustainability reports. Pollution control board filings showed the company had sought exemptions from complying with emission norms. The company sighted its inability to import coal due to regulations and given that Sox emissions from domestic coal are higher, it be granted exemptions. The glorious sustainability reports did not mention any of this - is and is a good example of how a company would reduce pollution control costs for prioritizing profits over planet and community.

Green is the new black

With “green” fast becoming the new “black,” this tendency to appear sustainable takes the form of “greenwashing.” Such companies believe that it is harder to pursue the sustainability journey than to trick people into believing that you have done so. Greenwashing is a temporary measure that might help organisations for a while but, in the long run, it just does not work. If these companies give these issues some serious consideration, they will realise that the payoff from wholeheartedly adopting sustainability practices is far greater and more satisfying than running a con game. Clearly, all this greenwashing detective work could be easier if investors and the public had a standardized approach and robust set of data to compare. Private ratings systems can be unreliable and corporate reporting is spotty and hard to compare. Thus, till better regulations bring greater transparency, standardization of disclosures and quality ESG actions, investors would have to account for the fact that what you see is often not what you are told it is. ESG sometimes can be EHG. As the fine print at the bottom of every invoice says: Buyer Beware!