If this was a well thought out economic policy with a deep understanding of the Indian economy, then – by the very nature of its stupidity – we should all be frightened about the long term economic prospects under this government and its policy makers. (We have already discussed our shock at the questionable assumptions of an export-led vision of India in an earlier report). If, however, this was a surgical strike on the estimated Rs 8 billion that was collected in cash by the regional political parties to fight elections in UP and Punjab, then it “makes sense”. It does not make the folly of demonetization right, but it protects the IQ levels of many BJP ministers and economic advisors while exposing the level to which the political strategists in the BJP will stoop to win elections.

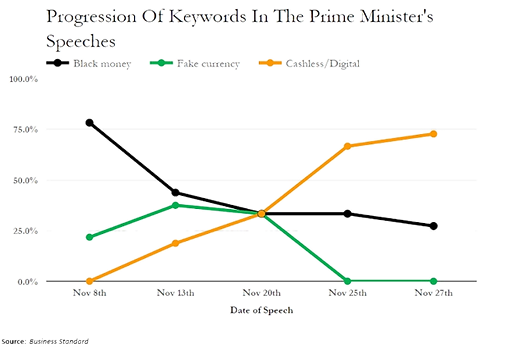

As an article in Business Standard noted, Prime Minister Modi has changed the rationale for the demonetization as the weeks have rolled on (Graph 3). The highly intellectual-sounding “cashless society” has turbo-charged urban Indians and India fans, including Mr Bill Gates. Mr Gates, on a visit to India for his charity work, was initially reported to support demonetization and then accurately clarified that moving to a digital payment economy and demonetization were not related. Await the rollout of fictitious power points to fund ventures to tap into this “boom”! Buyer beware!

On a more fundamental level, the demonetization has not only made people nervous about holding on to what may always be viewed as an unreliable piece of paper, but it has also weakened the role of women in a household. Women, untrusting of their husbands, have always squirreled away a few notes from the monthly household budget. This is insurance for a rainy day. The monthly savings of cash lie in little boxes, tucked under their saris and hidden in places where no male would tend to wander. Prime Minister Modi’s demonetization has destroyed that social fabric. Countless stories – from retired elders to married, practicing, wealthy, women doctors to the less wealthy house staff – suggest that these women have had to come clean and reveal to their husbands the cash hordes they have built up over the years. The husbands are now standing in line to cleanse their already clean money shoveled away by their wives and swap it for the new notes. Now visualize the scene at this household in January, 2017…The wife asks the husband: “May I have Rs 30,000 to run the house?” The response of the imposing husband:

1) Sure, honey, here it is! OR 2) Last time I gave you Rs 30,000 you lied to me and hid money from me. You don’t need Rs 30,000 you need Rs 25,000. Here, take it and don’t lie to me next time or I will send you back to live with your parents!

If Donald Trump expressed his views on how to deal with women off-mike, the BJP has – with the full vocal force of the Prime Minister – exposed its total lack of appreciation of women in India’s rigid society and the impact of the marriage season on family life. As Baba Ramdev, a BJP-supporter and businessman-guru said: “Many in the BJP are bachelors…they didn’t realize it was wedding season.” Moral: don’t ask the BJP to plan your bachelor parties.

Are the BJP that dumb to risk “the India story”? Or were they that selfishly desperate to win UP and Punjab that they came up with this bizarre experiment that would make Josef Mengele blush in embarrassment? This surgical strike has potentially nuked India in the short run.

India at risk in the near term

We could go on and on….but will stop.

The demonetization already has over 30 modifications to it since its announcement on November 8, 2016 – including the changing narrative based on the Prime Minister’s speeches (Graph above). We have no idea what the government will amend or modify next.

1) Share prices are declining and – based on the long term assumptions that we don’t believe need to be changed – we are deploying cash. 2) When foreign investors are unhappy with India, it leads to a self-fulfilling weakness of the Indian Rupee. In August 2013 when India was “stressed” and part of the Fragile Five, the USD Global Index (DXY) was 80 and the INR collapsed to 68. Today DXY is 27% stronger at 102 and – if the INR is under stress – can the INR be beaten down to 87, a loss of 27%. It’s a level that may not be supported by the relatively strong long term fundamentals of India but, in panic, who looks at fundamentals? Our recommendation: buy a 12-month currency hedge for India. Protect your profits.