Assessing companies for financial risk, sustainability and resilience to macro turbulence is key to our proprietary ESG investment process.

Whether it be a taper tantrum, an inflation scare or a Covid blow, any portfolio - particularly in the emerging markets - needs to be prepared for the resulting fallout. However, portfolios that have companies with strong balance sheets, backed by able managements, usually emerge stronger from any crisis. The Covid crisis was one such stress test where quality businesses with robust financials emerged even stronger gaining market share and achieving higher profitability.

Financial sustainability remains an integral part of our ESG assessment in our India Responsible Returns offering. The objective of our financial filters in our proprietary ESG assessment is simple: It does not matter if a company has the best 'green' credentials in India but if has used excessive leverage and taken undue risks to grow the business, our proprietary ESG screen will not allow the bad apple to slip into our database of investable stocks: we will exclude the company from the portfolio. The forward looking financial scrutiny of companies helps mitigate portfolio risk of permanent loss of capital. Limiting your exposure or a complete exclusion of companies with weak financials outlook pays off in turbulent times.

Not that markets seem perturbed by the turbulence. Markets seem sanguine on the recovery, literally shrugging aside many of the lurking risks that could potentially impact the economy and markets. China is rumbling on one side and geopolitical risks have increased on the other - these could have lasting impacts on markets. Similarly, an exit from 'easy-money' can also have an impact on riskier segments of the markets, given that assets are priced to perfection today. Financial sustainability remains an integral part of our ESG assessment. As custodians of investors' capital, we recognize many of these risks and ensure that our portfolios are stress-tested to come out of these event-risks relatively unscathed.

For now, the financial universe is bracing for a soft landing of the potential monetary normalization i.e. the exit from easy monetary policies. The important question remains whether the Federal Reserve will be able to pull back without triggering the kind of “taper tantrum” that roiled markets worldwide in 2013. A lot is at stake, given the mountain of cash awash in the financial system.

But it is important to note that India in 2021, unlike in 2013, is a lot healthier. The EM poster boys, well known as Fragile Five back then, now have current account deficits significantly lower than it was in 2013. The CAD for these five economies averaged around 4.4% of GDP, compared to just 0.4% now. Nor are real exchange rates as overvalued as they were then, which had led to sharp depreciation in currencies amidst weaker fundamentals and accelerated outflows causing a double whammy. In India, the central bank has already bulked up a war chest by accumulating foreign exchange reserves to the tune of $642 billion. The forex reserve kitty stands at ~15 months of import cover as opposed to ~7 months in 2013. India’s forex reserve is enough to continuing paying the import bill and be able to pay its external debt maturity even considering any external shock.

The Evolution of Financial Filters

On Jan 8th 2014, The Guardian in UK published an article and the headline read “Let's be honest: Real sustainability may not make business sense” (1). The author goes on to argue that “…the interest of profit blatantly conflicts with the interest of people and planet”. And very early into our Q Responsible Return Strategy track record, one of the potential investors asked us “Will you invest in a company with say, 3 consecutive years of losses, but has great ESG score or performance?”.

CEOs and the Board of companies, in general in the past, didn't have the scrutiny that they are faced with today when it comes to running their businesses 'sustainably' - not just investors but also customers demanding environmentally conscious products and more inclusive workforce practices. At the same time, the managements must invest in technologies, human talents and generate profits to remain relevant in the long term in an increasingly VUCA world (Volatility, Uncertainty, Complexity, and Ambiguity).

People, Planet, Profit: The Triple Bottom Line

As an investment firm, our mandate is to invest the capital of our clients for sensible long term returns without taking undue risks. It has been over 25 years since Quantum Advisors and its founders have included a "Governance" factor when investing in companies. This is the "G" in "ESG". We have been believers of People, Planet, Profit and not one over the other (watch Ajit Dayal's, Founder of Quantum Advisors, views on triple bottom line).

In our view, any sustainable or responsible investing framework will need to have financial sustainability strongly imbibed in its evaluation process.

Financial Sustainability is Core to Our Proprietary ESG Process

The objective of our financial filters in our proprietary ESG assessment is simple: It does not matter if a company has the best 'green' credentials in India but if it does not generate wealth for shareholders that justifies the cost of capital and/or takes excessive risks to grow businesses i.e., leverage, we will exclude the company from the portfolio.

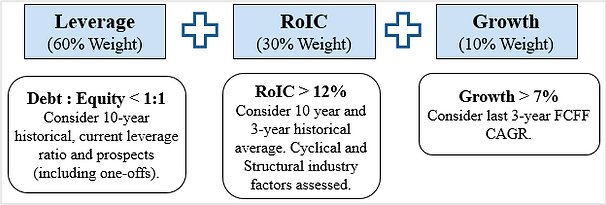

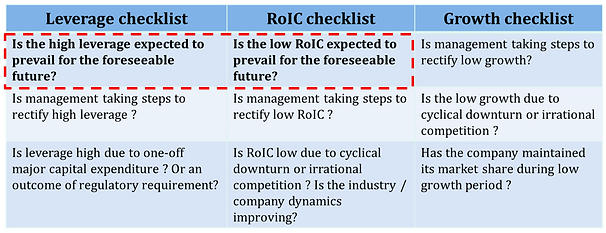

We apply the three quantitative financial filters on our ESG research database of over 150 companies and to its peers i.e. leverage, RoIC and Growth. The objective is to avoid companies within a sector with structurally high leverage and/or poor track record of shareholder wealth creation and/or inferior growth profile.

Financial Assessment is Also Forward Looking

It is quite possible that a company has embarked on a large capital expenditure program that may increase leverage in the short term beyond our comfort of 1 time but leverage is expected to reduce as the new capacity starts contributing to revenues and profit ability. Therefore, companies meeting close to the minimum threshold are assessed on the current and future financial prospects. This exercise helps us to avoid traps where financial soundness meets looks fine today but is about to deteriorate and at the same time capitalize on opportunities where things are expected to improve significantly over the foreseeable future.

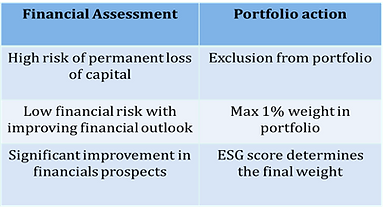

We meet every companies in our ESG database once in six months. We engage with the company to understand the business plan while asking relevant questions on ESG metrics. We also engage and review consensus forecasts, meet competitors and dealers/suppliers. This 'not-a-desk-ESG-research' process helps us make forward looking qualitative assessment of a company's financial prospects. The ESG analyst also draws from the knowledge and experience of over two decades of the equity analyst tracking the company or sector to reach at a more realistic assessment of the company's financial prospects. This, in turn, mitigates portfolio risk of permanent loss of capital by limiting exposure or complete exclusion of companies with weak financials outlook.

Ultimately, the weight of the stock in the portfolio is subject to this financial assessment. We avoid companies with potentially permanent loss of capital while financial stable companies are allocated ESG-score based weight.

As a result of our financial filters, the portfolio is less leveraged compared to the benchmark indices, have better/equal growth prospects and have had a long record of financial stability.

John Elkington in his book suggest the case for “Sustainable Capitalism”, wherein competing entities seek to maintain their relative position by addressing people and planet issues as well as profit maximization”. It is our endeavour to manage not just ESG risks but also ensure Q IRR strategy builds a portfolio that ultimately generates returns for our investors.