As India, and the rest of the world, gear towards a low carbon future we continue to engage portfolio companies in all aspects of E, S & G.

Greta Thunberg has adjudicated COP26 a failure - calling it a Greenwash, PR campaign (Conference of Parties). While on the other hand, scientists' acclaim that the math on emission reduction targets just adds up to keep global emissions below the hard borderline of 2 degree Celsius. Prima facie, this sounds music to ears but as they say the devil lies in the details. The emission reduction targets are ambitious enough but lack a credible plan to back those tall claims. Any delay or failure on those targets will lead to missing the climate threshold and it would be too late when we figure that out.

The obvious path would be to have short-term thresholds mapped out to track the progress, to achieve the desired long-term results. Of course, more needs to be done as the goal is to limit global temperatures at 1.5 degrees, which will require much aggressive commitments. Unless the world drastically cuts greenhouse gas emissions, the planet will suffer even more extreme heat waves, erratic rainfall and destructive storms in coming years, according to the Intergovernmental Panel on Climate Change (IPCC).

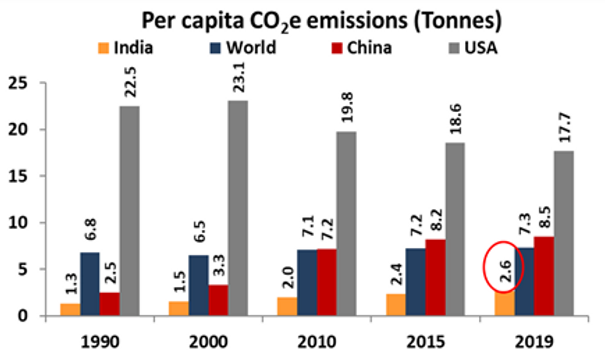

India has not contributed to climate change, yet. But what if we move to Chinese levels?

India @ COP26 - Big statements but will it fructify?

Prime Minister Narendra Modi proposed a five-fold strategy for India to play its part in mitigating climate change. Apart from the long-term commitment to achieve Net-Zero by 2070, the four other medium-term targets to be achieved by 2030 are:

- 50% of power to come from renewable sources

- Reach 500 GW of installed renewable energy capacity

- Reduce carbon intensity by 45%

- Reduce projected total carbon emissions by 1 billion tonnes.

In another nine years, India would increase the share of renewables in its energy mix to 50% from about 38% last year. The target for installed capacity of renewable energy has been raised to 500 GW by 2030 from the previous 450 GW goal. India's current renewable energy capacity stands at 175 GW (2). India will also reduce the carbon intensity of its economy by 45% from 2005 levels, up from the previous commitment of 35%. And lastly, India would reduce its projected total carbon emissions by 1 billion tonnes by the end of the decade. India emitted 2.62 billion tonnes of CO2 in 2019 and it is projected to reach 4.5 billion tonnes in 2030.

India's announcement came as a surprise, as it had rejected calls to announce such a target even a week before COP26. India pledging 'Net Zero' may have turned the math enough to land the global temperature just below the 2-degree Celsius line. That's the nature of international politics and associated pressure tactics making it look like a tipping point. This is apparent in PM Modi's statement “The proper justice would be that the countries which do not live up to their promises made on climate finance, pressure should be put on them” suggesting that I have submitted and now it's on you to help me get there. India's 2070 target seems a convenient combination of managing international relations and diplomacy. India's 2070 date is 20 years later than the 2050 pledged by the UK, US, and other high-income countries, and later than the 2060 chosen by China, Russia and Saudi Arabia.

While the intent to push green energy is clear, the priority should be to ensure that growth is equitable, and the poor should not be unfortunate victims in the transition process. An environmental problem cannot be solved by creating negative externalities on the social side. Wealthy nations have so far failed to deliver on the annual pledge of $100 billion climate finance to developing nations. While justifiably there is great scrutiny on every country's emission pledges, the same yardstick should also be applied to the climate finance pledges made by developed nations.

PM Modi's climate targets have two focus areas: reducing carbon intensity and going big on renewables. Let's look at each of these briefly.

Reducing Carbon Intensity

According to the Global Climate Risk Index 2021 published by the think-tank GermanWatch, India is the seventh-most affected country by extreme weather events. Hence, it is also in India's best interest to ensure sustainable growth.

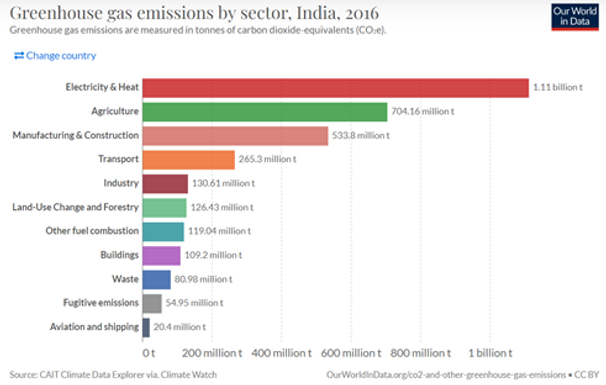

India GHG emissions needs not just a 'solar & wind' solution

To cut carbon intensity by 45%, India will have to go beyond the power sector. This will need an overhaul and cleanup of the industrial processes to squeeze those carbon reductions. The short to medium term target of lowering the carbon footprint along with a ramp up of renewables seen along with the net zero commitment provides the much-needed sense of direction and helps firm up plans for companies to invest in deep decarbonization. This also becomes a blueprint for any future development for India's growing cities to plan for sustainable development in line with the net zero targets.

Thrust On Renewables

Today, India ranks 4th in the world in installed renewable energy capacity. India's non-fossil fuel energy has increased by more than 25% in the last 7 years and now it has reached 40% of its energy mix. However, Modi's pledge to increase the country's non-fossil-fuel energy capacity to 500 gigawatts by 2030 and increase the share of renewables from 40% to 50% by 2030 will require that a large portion approx. 70% of India's installed electricity capacity will be non-fossil-fuel based.

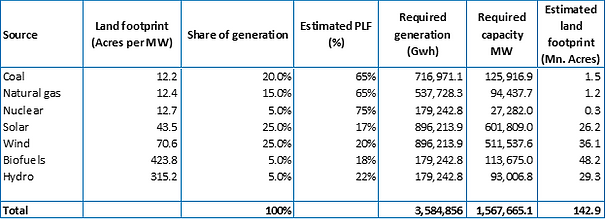

This tripling of the non-fossil fuel energy in nine years is plagued with a lot of challenges. More than half this 500 GW capacity may generate variable power (solar and wind). Thus, given the lower PLF factor, this requires investments in building and strengthening grid infrastructure, building storage and better forecasting, and scheduling to ensure efficiency and reliability of this major dependence on renewables that we are likely to embark on. Countries such as Germany with a very high renewables penetration has witnessed a steep increase in electricity tariffs. This is to be expected since the cost of integrating unreliable sources of power are very high.

Maintaining the 50% share of renewables is a greater challenge

If India's per capita electricity consumption will be closer to world average of 3,300 kwh and if renewables are expected to generate ~50% of total electricity, land requirements are expected to substantially increase to 190 mn acres or ~18% of total available land.

Clean energy is not 'green' - Land acquisition in India has a chequered history

Currently, nearly 51% of India's land is under cultivation, 21.8% under forest and 3.9% under pasture. With ~2% of the World's total land mass, India needs to feed nearly 17% of the world's human population and 17% of the world's cattle population. Even in developed economies such as the US, plans to build large-scale solar plants and wind farms have been opposed for aesthetic and environmental reasons.

Wind farms are coming under increasing scrutiny for their negative impact on wildlife and on rare birds of prey. This is also because while solar power projects are commissioned on contiguous land, wind power projects require scattered land which not only increases the transmission cost but also increases the possibility of interfering and disturbing wildlife habitat.

Not just 'E' in ESG

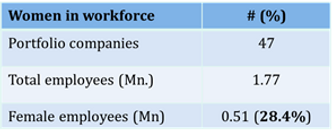

We are concerned that excessive and sole focus on the climate issue is leading to social factors being side-lined. Therefore, to demonstrate our intent to improve our 'S' practices internally, Quantum Advisors became a member of Workforce Disclosure Initiative (WDI) in Nov 2020, the first company to do so in India and 51st in the world. We have filed our internal workforce data with WDI twice so far in a year with an intent to improve our own workforce practices first. Using our experience with WDI, we have started engaging with our portfolio companies actively.

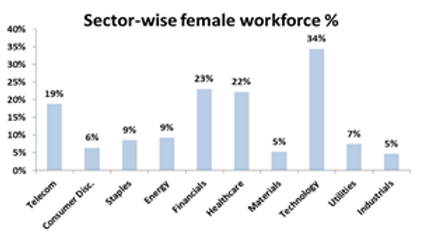

Gender diversity - We engage with our QIRR portfolio companies on gender diversity

Source: * SEBI listing regulations, Annual Reports, Stock Exchange Filings and Quantum research.

Even in companies, carbon reduction projects should not overlook the human capital aspect. Impacts on people and the environment increasingly interact with the creation of enterprise value creation. Climate reduction targets like net zero are big commitments and requires a holistic view across an ecosystem that includes government, businesses, customers and communities. This requires a big transformation which is a more a collaborative between people, technology and capital. And for this collaboration to succeed, you need skills, innovation and trust fostering within the ecosystem to achieve the ambitious climate goals.

We prefer to engage with our investee companies on their Sustainability Goals - strategies that include the 'E' and 'S' & 'G'. We look beyond those glossy sustainability reports and focus on the fact - the pollution control board filings that may hide that plant leakage, carbon abatement technologies, and examine whether a roadmap exists to mitigate their negative environmental impact (if at all it exists). Approx. 92% of our portfolio companies have aligned themselves to either 1.5-degree or 2-degree scenario.

Incrementally, many Indian corporates are gearing themselves to transition to a low carbon future as well as improving their Sustainability disclosures and as stewards of long-term capital, we continue to nudge all our investee companies to align themselves with best practices and are confident of our investee companies meeting their long-term targets.

Be it a COP26 (Conference of Parties) mandate to investors to adopt a “Save My World” allocation or be it the conscious investors who are aware of the many ESG risks those emerging nations face today and thereby their investments, our ESG approach will help address both the needs.

Source :

- The broken $100-billion promise of climate finance — and how to fix it, Nature Magazine, https://www.nature.com/articles/d41586-021-02846-3

- All India Installed Power Capacity (pdf), Central Electricity Authority, https://cea.nic.in/wp-content/uploads/installed/2021/10/installed_capacity.pdf