The US Should Embrace India

The US Should Embrace India

India opened up to the western world in the 1980s and 90s. The US-India relations began to change in the Clinton era, benefitting under...

Are Emerging Markets Dead as an Asset Class?

Are Emerging Markets Dead as an Asset Class?

The case for investing in EM – or in India - rests on more realistic expectations of emerging market governance.

India's INR Crisis

India's INR Crisis

While not in a crisis mode, a fidgety global environment and net imports are not conducive to a stable currency.

A Value Manager in India?

A Value Manager in India?

India's back on investor's radar as a growth story, however our challenge remains to understand and analyze businesses and their leaders.

India Deserves a Dedicated Investment Mandate

India Deserves a Dedicated Investment Mandate

Global wealth is estimated at over USD 250 trillion. Long term investors like Public Pension Funds and Sovereign Wealth Funds account for over USD 50 trillion in assets. The other [...]

Waltz with India Directly, Don’t Dance through GEM

Waltz with India Directly, Don’t Dance through GEM

A recent shift in public equity allocation strategies is driving investors away from China and towards other Emerging Markets, notably...

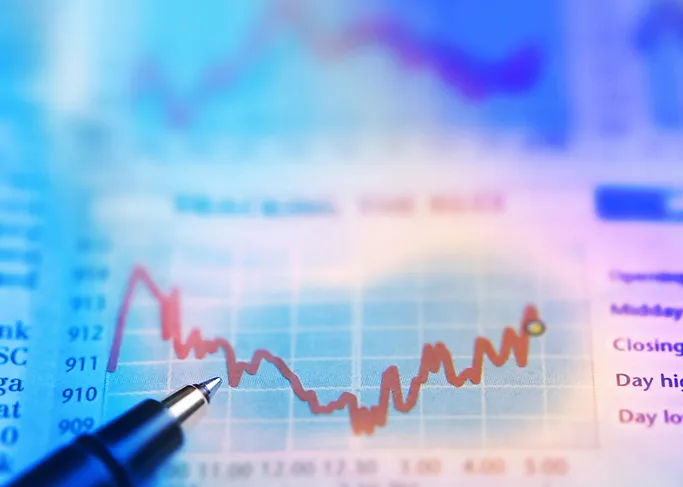

India’s Economic Growth Fuels Stock Market Returns

India’s Economic Growth Fuels Stock Market Returns

India's soaring GDP growth powers double-digit stock market returns. Broad economy and corporate growth drive markets.

China Tactical, India Strategic

China Tactical, India Strategic

Mesmerized by the Chinese dragon many investors have been comfortable leaving India in a generalist “emerging market” bucket in their...

India: Opportunity, Valuation, and Governance

India: Opportunity, Valuation, and Governance

In a dynamic geopolitical environment, global investor interest in India remains robust. With India’s GDP growth projected to continue at twice the global rate, the country warrants a “GEM + India” allocation strategy.

‘INDIA to TINA’: Private Assets – Is the Over-allocation Justified?

‘INDIA to TINA’: Private Assets – Is the Over-allocation Justified?

An in-depth analysis of foreign investment trends in India's private and public markets over the past two decades highlights the shift in...

India – Hype, Hope, and Reality

India – Hype, Hope, and Reality

In February 1990, our Founder Ajit Dayal wrote an article in the Asian Wall Street Journal ‘Loosen the Reins on India’s Bull Market’....

Are Corporate Pension CIOs heeding their Corporate CEOs?

Are Corporate Pension CIOs heeding their Corporate CEOs?

US corporations are increasingly investing in India, but their corporate pension funds have not followed suit. With over $6 trillion in...

Will Foreign Investors finally ‘Bond with India’ July 2, 2024 Quantum Advisors India

Will Foreign Investors finally ‘Bond with India’ July 2, 2024 Quantum Advisors India

A big milestone for Indian debt markets, opening access for index-tracking foreign capital flows.

Shake Hands and Get Five Fingers Back

Shake Hands and Get Five Fingers Back

Good governance protects long-term returns. In India's complex markets, screening for transparency proves crucial.

India – Time for a Reality Check

India – Time for a Reality Check

Amid growing investor optimism about India, it's crucial to reality-check the narrative.

India's Demography: Dividend or Disaster?

India's Demography: Dividend or Disaster?

India can potentially become a billion-plus consumer market over the next 25 years but there are signs job creation is failing to keep up.

Many Apples a Day to Keep Unemployment at Bay

Many Apples a Day to Keep Unemployment at Bay

Tim Cook, the CEO of Apple, is India's newest celebrity. The opening of the first Apple store in India, in Mumbai and Delhi, is all the...

India @ 75 - The Next 25: Will India be Decoupled?

India @ 75 - The Next 25: Will India be Decoupled?

Over the next few months, we will look at the various aspects that we think will shape India in the coming 25 years. From now till 2047. India as a [...]

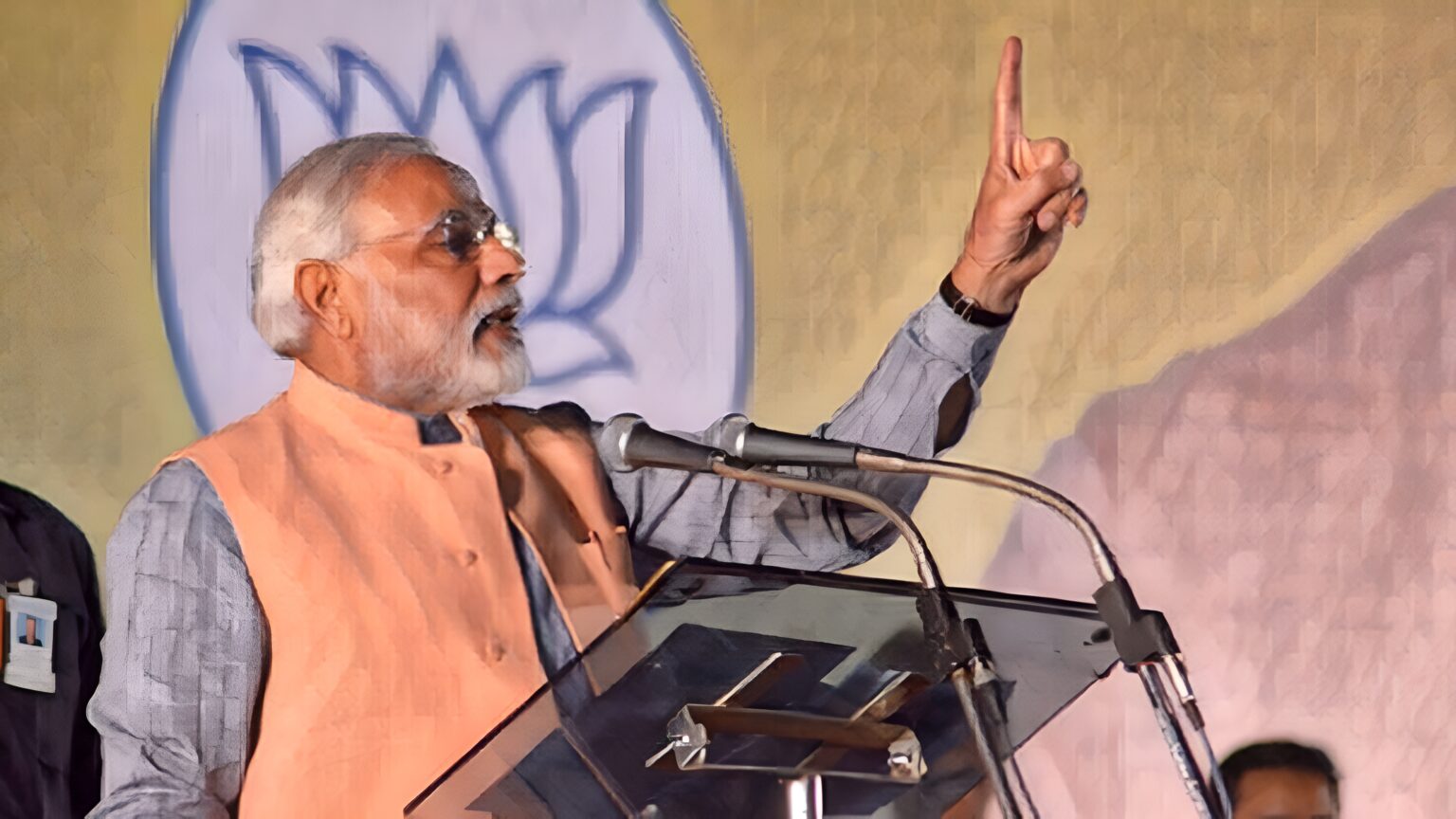

India: No Country for a Strong Man

India: No Country for a Strong Man

Should global investors worry about Modi being a ‘Strong Man’? Is India becoming un-democratic?

First Adani, now Silicon Valley: India Stirred but not Shaken

First Adani, now Silicon Valley: India Stirred but not Shaken

India's inherent long-term resilience has helped it recover from crises, including self-inflicted ones.