India's growing economy is too big to ignore when it comes to meeting the Green House Gas emissions challenge.

During the last couple of centuries, humanity has made enormous progress. Advancements in technology, mass communication (Radio, TV, Internet and Mobile), transportation infrastructure, healthcare facilities and food production have led to improved standards of living across the globe. At the beginning of the 19th century no country in the world had a life expectancy longer than 40 years. Average life expectancy in the world today is close to 73 years (1). World per capita income levels have increased from less than $ 2,000 in the 1870s to more than $ 15,000 today (2). Despite the constant barrage of negative news and geopolitical tensions, fewer people die annually due to violence than due to obesity, car accidents and suicides (3). While as a species, humans have achieved a lot, today there is a growing debate on mankind’s overall impact on the larger ecosystem.

Much of the progress achieved in modern civilization has been created primarily by the combustion of fossil fuels marked by the sequential rise of coal, crude oil and natural gas. It is axiomatic that every unit of GDP growth requires a certain unit of energy. Access to affordable high density energy sources has played a crucial role in uplifting the lives of millions of people. The main drawback associated with fossil fuels is the high carbon emissions emitted during their combustion. There is a growing belief in the world that rising carbon emissions are responsible for environmental problems such as global warming, sea level rise and climate change.

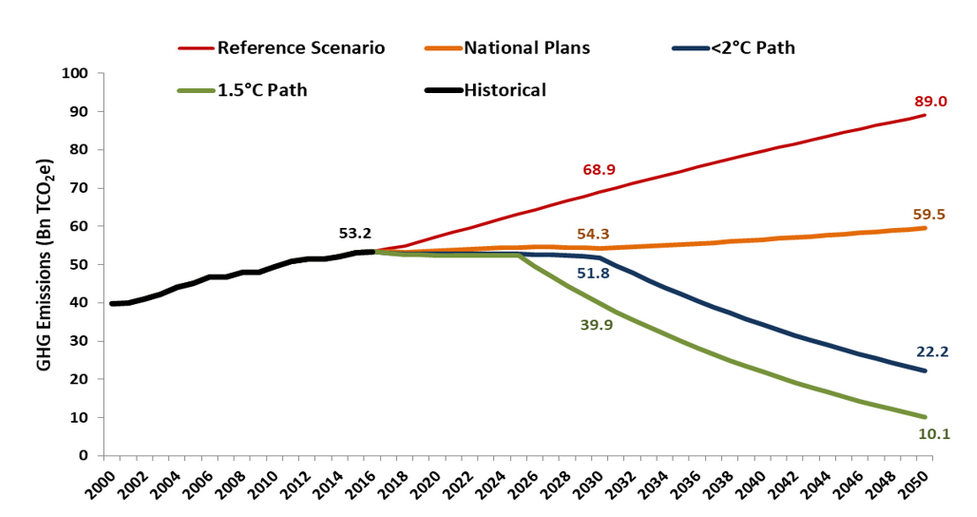

Many countries have undertaken pledges at the global level to mitigate the rise in carbon emissions. In December 2015, under the United Nations Framework Convention on Climate Change (UNFCC), 196 countries adopted the Paris Agreement (4). The Paris Agreement’s long-term goal is to limit global average temperature rise to below 2 ° C (above pre industrial levels) and to pursue efforts to limit the increase to 1.5 ° C.

The European Union, China and 19 other countries have adopted a ‘net-zero’ emissions target (5). The European Union plans to reduce greenhouse gas (GHG) emissions by 55% below 1990 levels by 2030 and become climate neutral by 2050. China, the largest GHG emitter has set a long-term target of carbon neutrality by 2060 and will seek to reach peak emissions by 2030. Based on the analysis of each country’s NDCs (National Plans), global GHG emissions are expected to remain within the 55 billion tonnes to 60 billion tonnes range from 2030 to 2050 (6).

Source: https://img.climateinteractive.org/wp-content/uploads/2020/05/Climate-Scoreboard-Output-120519-to-share.xlsx

However, the more ambitious outcomes that require global warming to be within the 1.5 C to 2 C range require steeper declines in emissions from current levels of ~ 55 gigatons to a maximum of 22 gigatons by 2050. Achieving the above targets will require significant reductions in absolute and per capita GHG emissions from the current levels.

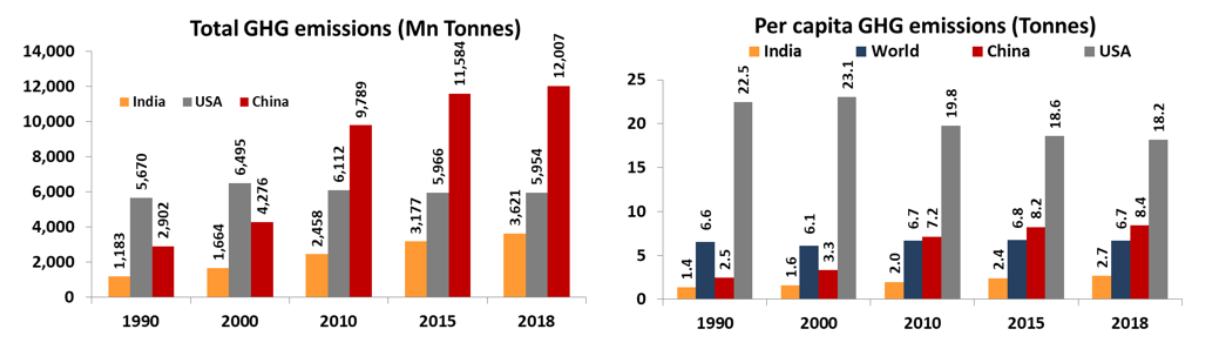

Source: World Resources Institute, Global Carbon Atlas, Climatescoreboard.org, QASL Estimates

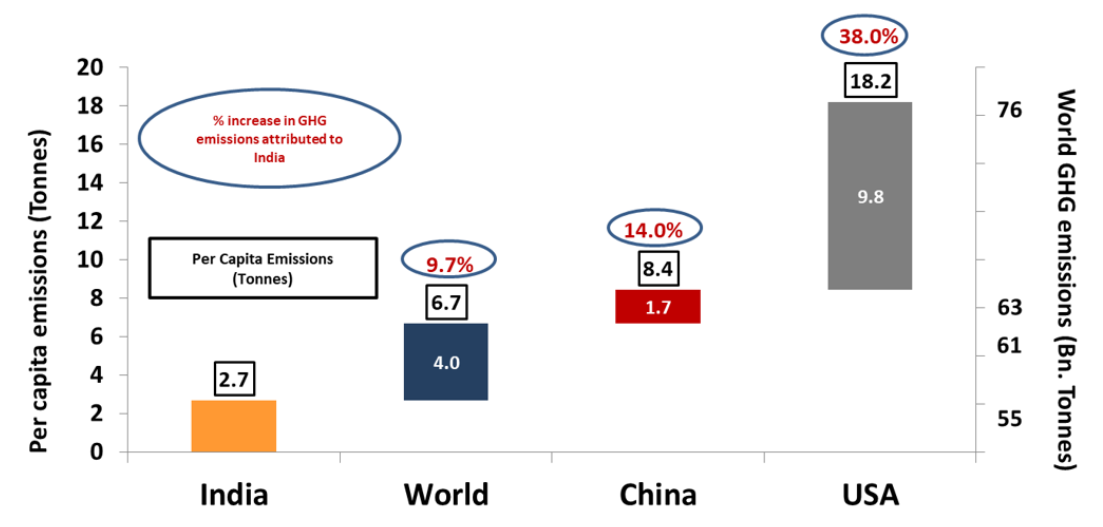

For a country like India, which is still in the developing stage, the challenge is twofold. In addition to providing its large population with access to affordable energy, the focus is also on transitioning to “cleaner” sources of energy. Assuming other countries are able to achieve their NDC’s by the year 2030, the chart below estimates India’s contribution to total GHG emissions at per capita levels equal to that of the World (6.7 tCO2e), China (8.4 tCO2e) and USA (18.2 tCO2e) (6).

Source: World Resources Institute, Global Carbon Atlas, Climatescoreboard.org, QASL Estimates

Clearly, to meet the GHG challenge, India is too big a country to ignore. While India’s share in total emissions is currently less than 7% and its per capita emissions significantly lower at 2.7 tCO2e, to meet the growth aspirations of millions of its citizens, it is likely to consume a lot higher amount of resources such as steel, cement, electricity and various sources of energy. If India achieves China’s per capita emission levels, world GHG emissions are expected to be at 63 bn tCO2e in 2030; nearly 8 bn tCO2e higher than the target specified in the NDCs (6). Without adequate investments in cleaner sources of energy, India is likely to blow a big hole in the 55 billion tons emissions target by 2030.

To win the climate change battle in India, you cannot rely solely on governments and world treaties to do the job. As investors, we need to actively engage with our investee companies, sensitize them to the risks and opportunities associated with climate change and understand the key challenges in the transition to cleaner and efficient sources of energy.

Sources

- https://ourworldindata.org/life-expectancy

- https://ourworldindata.org/economic-growth

- https://economictimes.indiatimes.com/magazines/panache/sugar-is-a-greater-danger-than-gunpowder-says-sapiens-author-yuval-noah-harari/articleshow/63574089.cms?from=mdr

- https://unfccc.int/process-and-meetings/the-paris-agreement/what-is-the-paris-agreement

- https://www.weforum.org/agenda/2020/09/carbon-emissions-net-zero-global-warming-climate-change

- World Resources Institute, Global Carbon Atlas, Climatescoreboard.org, QASL Estimates